Posts

News

Latest

Hot

$NVIDIA (NVDA.US)$ is releasing its Q4 FY24 earnings on Feburary 21, after the U.S. stock market close. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

Rewards

● An equal share of 10,000 points: For mooers who correctly guess the price range of $NVIDIA (NVDA.US)$'s opening price at 9:30 AM ET Feb 22 (e.g., If 50 mooers make a correct guess, each of them will get 200 points!...

152

111

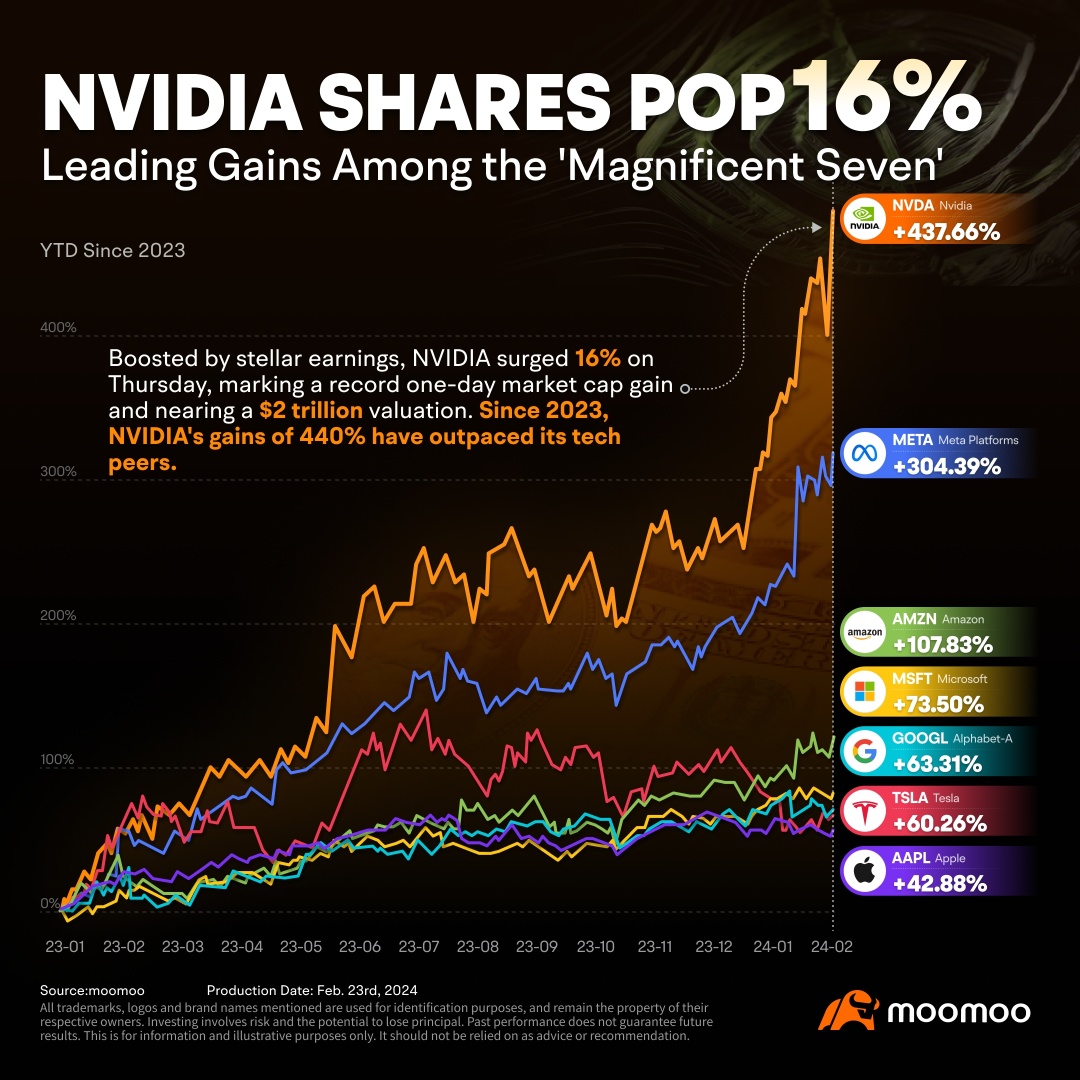

Common logic might suggest that as the stock price climbs, so would the P/E ratio, making the stock more expensive. But NVIDIA's earnings have been growing at a rapid pace, outpacing the stock price increase. Nvidia's Q4 earnings soared beyond top and bottom lines expectations, with revenues and non-GAAP EPS coming in at $22.1B (up +265% y/y) and $5.16 (up +486% y/y), respectively. As a result, the P/E ratio actually...

52

25

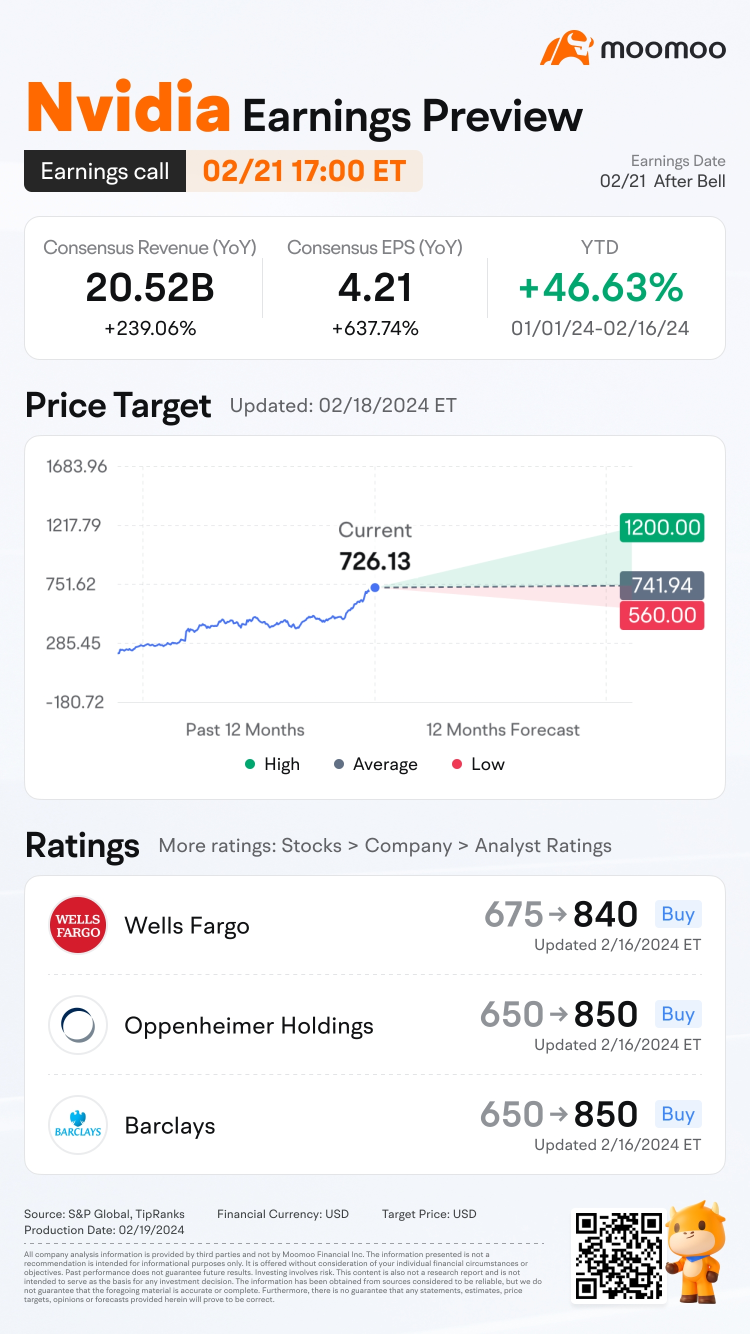

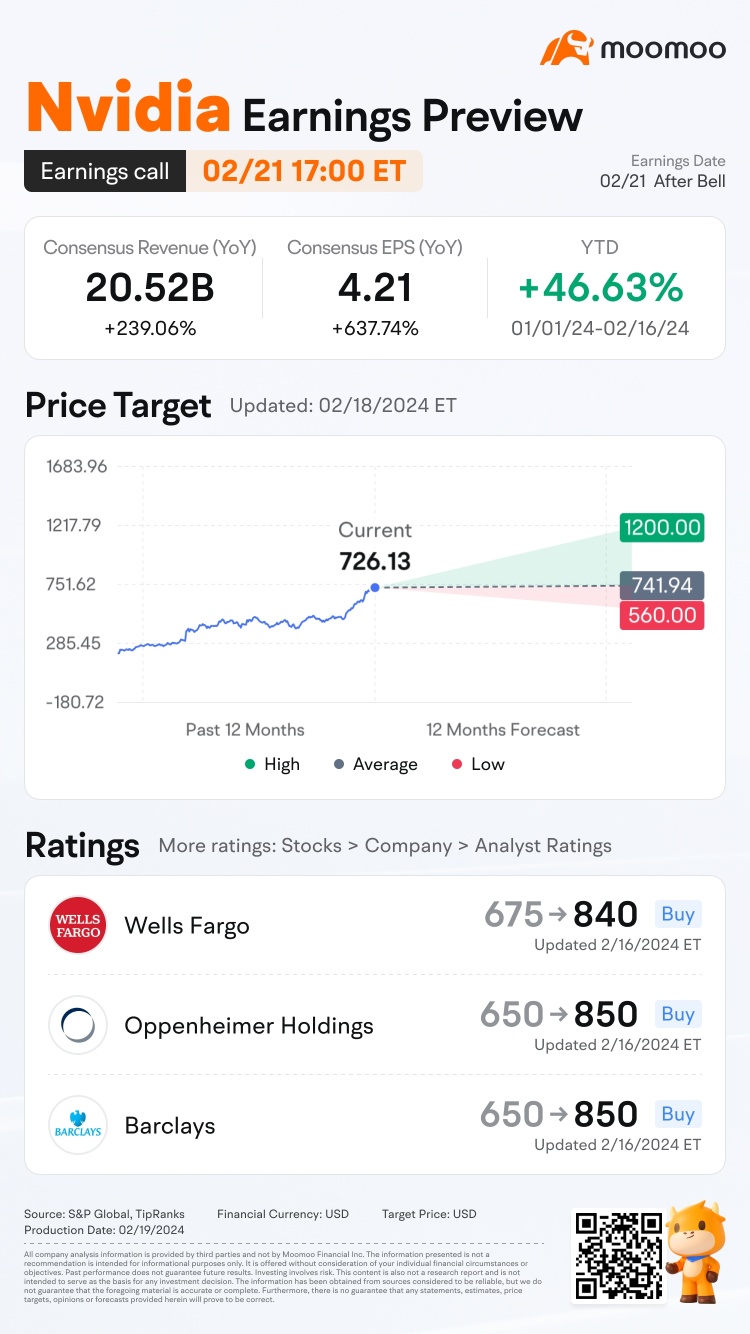

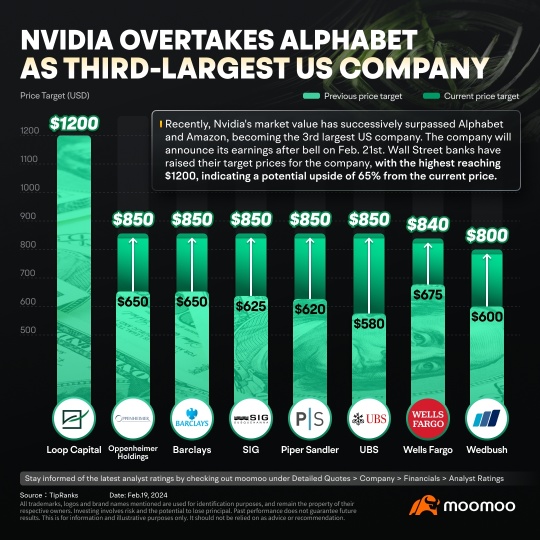

$NVIDIA (NVDA.US)$is set to report earnings for its fiscal fourth quarter of 2024 on Wednesday, Feb. 21, and expectations are high for the chipmaker stock that's already up more than 300% over the past 12 months. Markets also face significant implications. Nvidia, having recently overtaken $Alphabet-A (GOOGL.US)$ in market value, now stands as the third largest publicly traded company in the United States, p...

55

7

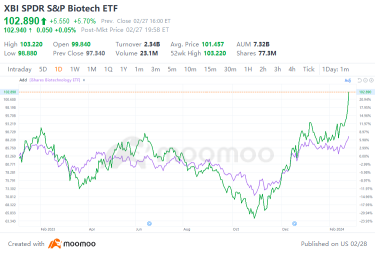

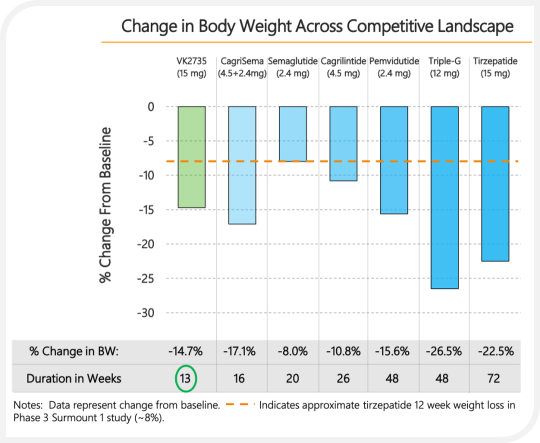

Since the beginning of this year, $NVIDIA (NVDA.US)$ has been leading a group of semiconductor and AI stocks to further rise in response to the breakthroughs in AI technology and a booming industry outlook. However, an increasing number of investors have started to fret over the potential risks behind the high valuations of AI stocks and are scouting for alternative investment opportunities. Some of them have shifted their focus to biotech stocks...

61

3

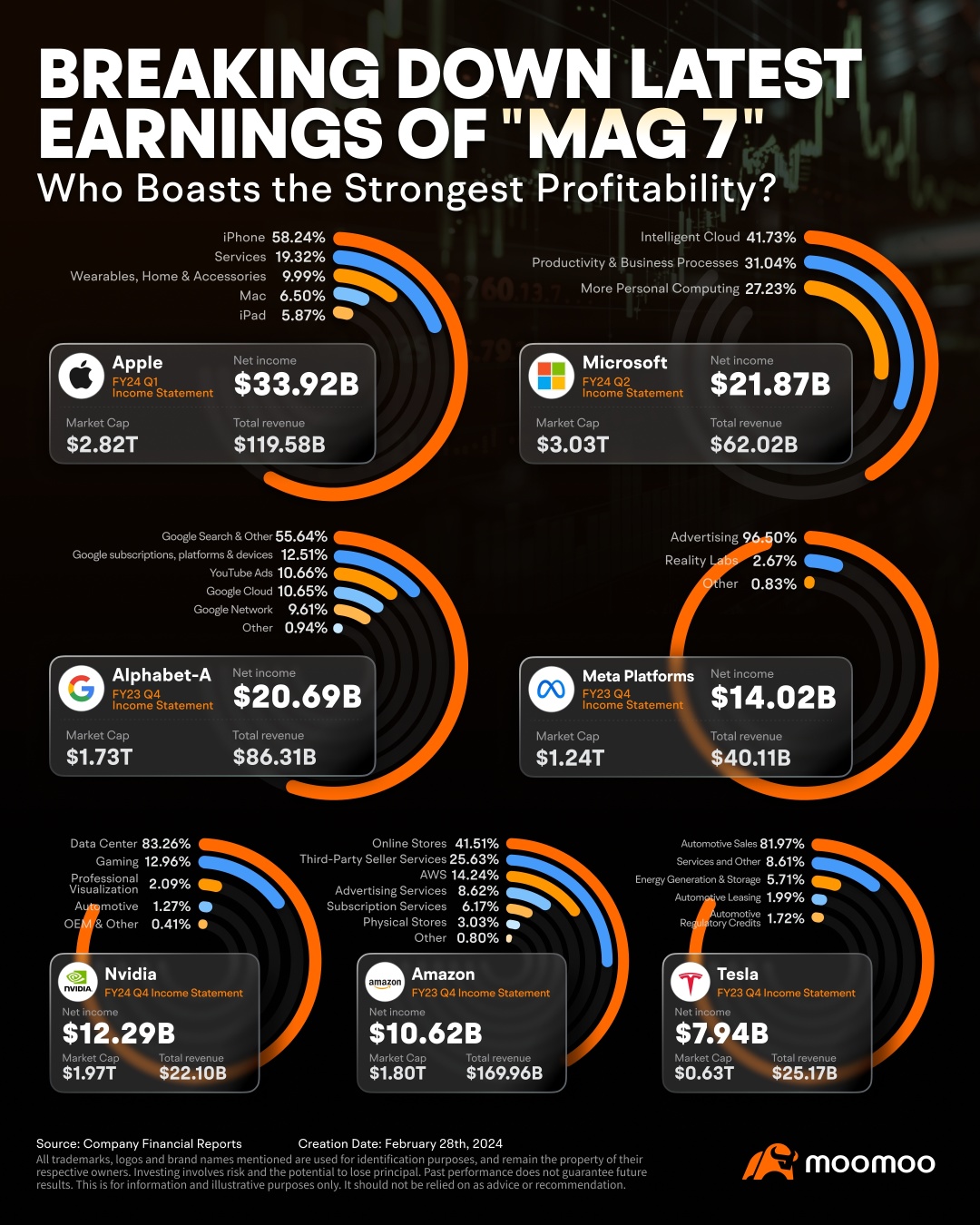

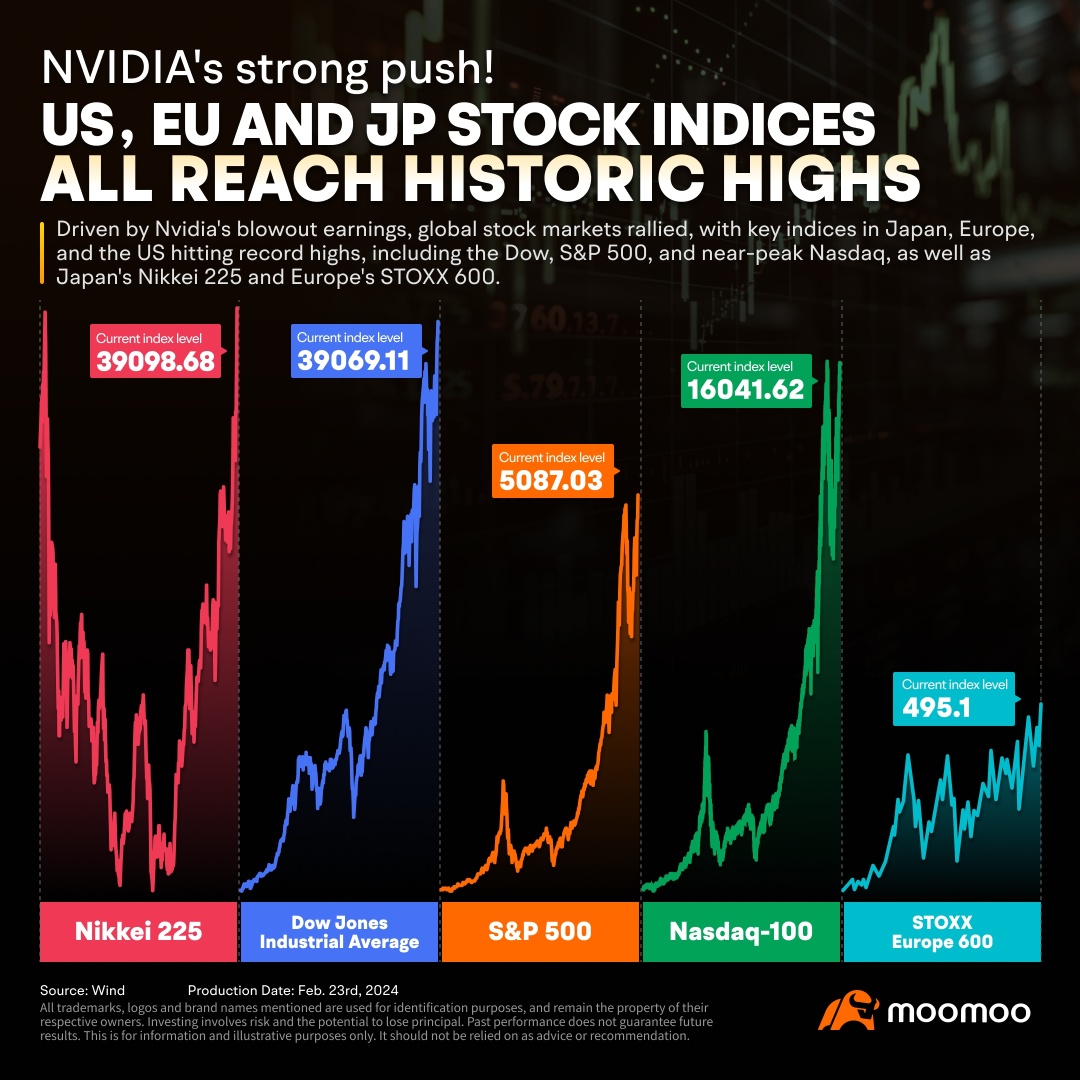

Mega-cap tech stocks continue to lead the U.S. stock market higher this year, driving major indices such as the $S&P 500 Index (.SPX.US)$ and $NASDAQ 100 Index (.NDX.US)$ to record highs. Among the Magnificent 7 this year, the most impressive performer is $NVIDIA (NVDA.US)$, which has risen nearly 60% since the beginning of the year, followed closely by $Meta Platforms (META.US)$ w...

39

5

Can the U.S. market continue its triumph? Some now believe it depends on today's $NVIDIA (NVDA.US)$earnings report. The earnings could potentially result in an impact on market value of about $200 billion, based on options positioning.

According to statistics provided by Bloomberg, the prices of short-term options and puts suggest nearly 11% movement in the chipmaker's shares on Thursday, the day following its ea...

According to statistics provided by Bloomberg, the prices of short-term options and puts suggest nearly 11% movement in the chipmaker's shares on Thursday, the day following its ea...

+1

42

1

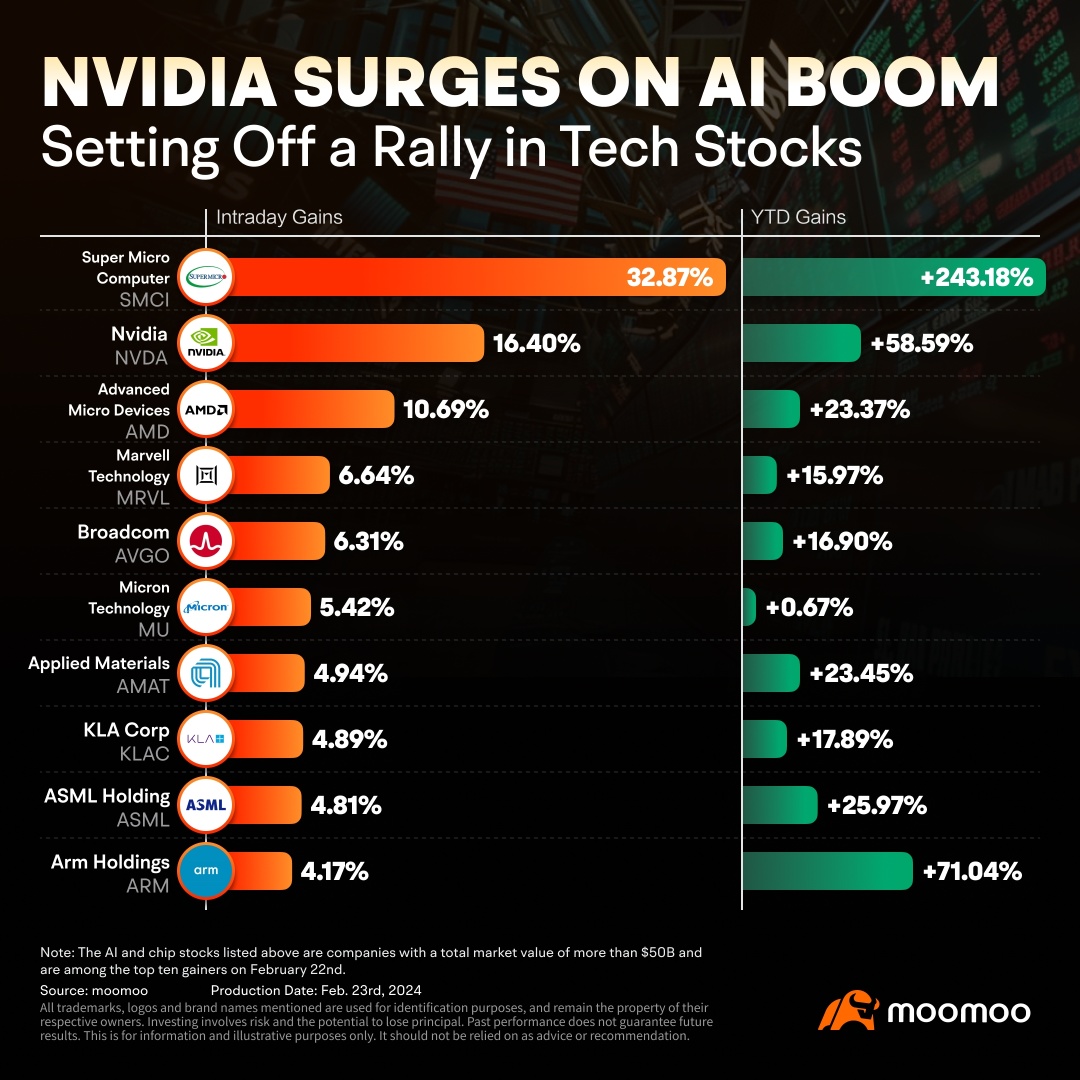

Semiconductor and AI-related tech stocks jumped on Thursday after $NVIDIA (NVDA.US)$, a leader in AI, reported its fourth consecutive earnings beat and raised forecasts. Nvidia's fourth-quarter earnings exceeded analyst expectations with revenue of $22.1 billion resulting in $12.29 billion in earnings.

Read Here: Key Insights You Need to Know About Nvidia's Latest Earnings Report

Enthusiasm over the AI surge, expected to advantage not ...

Read Here: Key Insights You Need to Know About Nvidia's Latest Earnings Report

Enthusiasm over the AI surge, expected to advantage not ...

33

4

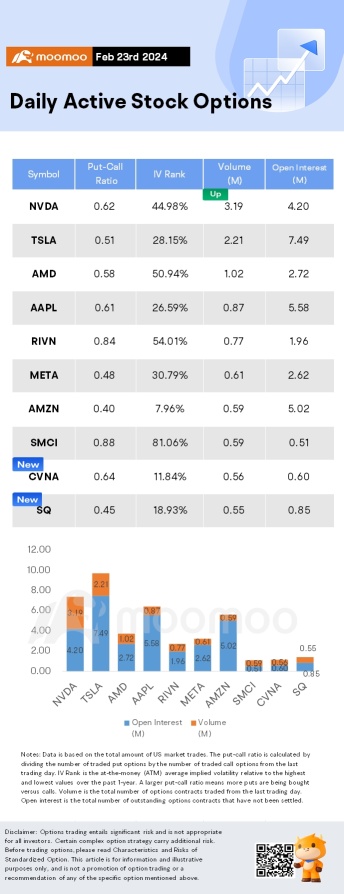

Columns Options Market Statistics: Carvana Surges After First Annual Profit and Bullish Outlook, Options Pop

News Highlights

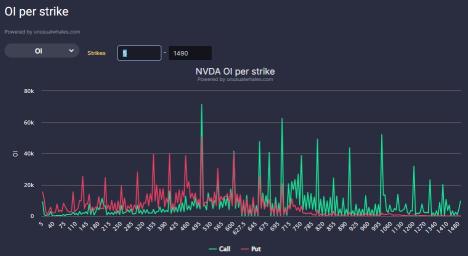

$NVIDIA (NVDA.US)$shares rose by 0.36%, closing at $788.17. Its options trading volume is 3.19 million. Call contracts account for 61.7% of the total trading volume. The most traded calls are contracts of $1300 strike price that expire on Feb 23rd. The total volume reaches 56,084 with an open interest of 16,391. The most traded puts are contracts of a $600 strike price that expires ...

$NVIDIA (NVDA.US)$shares rose by 0.36%, closing at $788.17. Its options trading volume is 3.19 million. Call contracts account for 61.7% of the total trading volume. The most traded calls are contracts of $1300 strike price that expire on Feb 23rd. The total volume reaches 56,084 with an open interest of 16,391. The most traded puts are contracts of a $600 strike price that expires ...

34

2

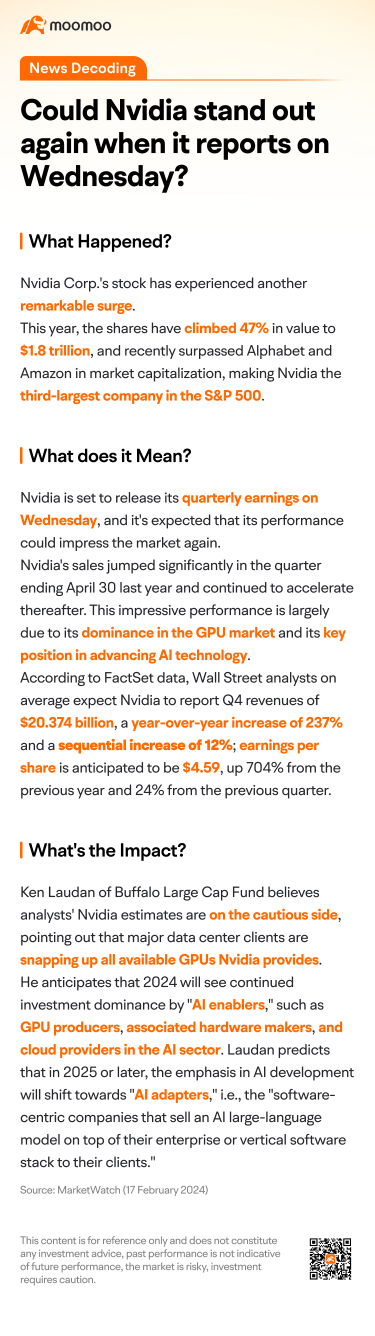

$NVIDIA (NVDA.US)$ is about to release its earnings report. Whether the AI craze can continue has become a key question in determining the outlook for U.S. stocks.

Benefiting from the AI boom, "chip leader" NVIDIA has surged 47% this year, surpassing Google and Amazon in market value to become the third-largest company in the U.S. stock market.

What are the market's expectations for the upcoming earnings report? Let's find out in today'...

Benefiting from the AI boom, "chip leader" NVIDIA has surged 47% this year, surpassing Google and Amazon in market value to become the third-largest company in the U.S. stock market.

What are the market's expectations for the upcoming earnings report? Let's find out in today'...

Expand

Expand 28

5

ZnWC : Nvidia Q4 FY24 earnings EPS and revenue will meet expectations:

EPS $4.18 est; $0.57 YOY

Revenue $20.38 billion est, $6.05 billion YOY

The accomplishment is outstanding given that Nvidia AI chips are in high demand.

Since the start of 2024, Nvidia shares have gained more than 50%, after more than tripling in value in 2023. Nvidia is expected to be one of the leading contributors to S&P 500 earnings growth in the first quarter of 2024, according to FactSet projections.

Nvidia has a consensus rating of 'Strong Buy' which is based on 34 buy ratings, 4 hold ratings and 0 sell ratings. It is not surprising that the stock has received a bullish rating but TA indicators flagged severely overbought.

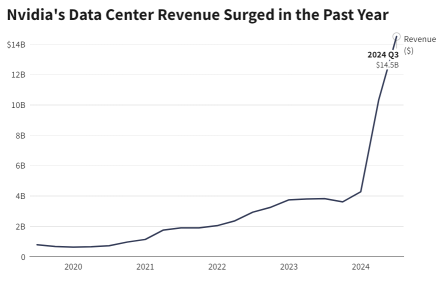

102362254 : Analysts anticipate total revenues of $20.52B for Q4 FY24, driven by optimism surrounding the strength of Nvidia’s Data Center segment. This segment has experienced a significant surge in performance, growing nearly 3.5 times since Jan 2023. The growth is attributed to robust demand for GPUs from Cloud Service Providers and the increasing adoption of accelerated computing for AI in data centers.

Despite the substantial rise in stock value, there is ongoing debate regarding the future performance of the Data Center segment. Analysts project Q1 2025 revenues to reach $18.3 billion, although estimates vary widely from $65.4 billion to $121.2 billion. However, the long-term outlook remains positive, with Nvidia positioned as a key player in the AI revolution. I’m hopeful for Nvidia to open between 750-800 on 22 Feb.

BullBravo : Will open wt gap up

Tonyco ZnWC : Gonna shoot up high that's for sure!

Walter_Del_Sol : That Thursday Morning, there's going to be a GrillMaster named Nvidia flipping Bear Burgers all day......... I say it opens at 875

View more comments...