Latest

Hot

MAYDAY!!!

🤣 hahaha, my favorite gif 🤣

🎵 Here's where the story ends

It's that little souvenir of a terrible year

Which makes my eyes feel sore

It's that little souvenir of a terrible year

Surprise, surprise, surprise 🎵

I'm going to try and get a post out. I'm really uncomfortable and sore, but there are some big moves and big news ahead.

A little Sundays to start the day

As I said, I'm fresh out of the hospital again. I've been oversleeping and much too tired 😫. I feel gu...

🤣 hahaha, my favorite gif 🤣

🎵 Here's where the story ends

It's that little souvenir of a terrible year

Which makes my eyes feel sore

It's that little souvenir of a terrible year

Surprise, surprise, surprise 🎵

I'm going to try and get a post out. I'm really uncomfortable and sore, but there are some big moves and big news ahead.

A little Sundays to start the day

As I said, I'm fresh out of the hospital again. I've been oversleeping and much too tired 😫. I feel gu...

loading...

21

4

The Fed announced upcoming rate cuts yesterday. Afterwards, gold prices rose to a record high. Why?

Interest rates and gold have an inverse relationship. When rates dip, gold prices become more attractive than fixed-income assets.

Interest rates and gold have an inverse relationship. When rates dip, gold prices become more attractive than fixed-income assets.

1

I was going to post this in the group, but I will just make it public.

I'm doing a controlled burn 🔥 so that I can begin planting soon. Therefore, this will be written in between checking on my fires 😆

That's the thing with controlled burns. I can leave it, it can look extinguished, but as long as it burns underneath, I just need to stir it up to ignite it again. 😉🤔

Here is where we are.

2 hr chart

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

on the 2 hr chart, we have reach...

I'm doing a controlled burn 🔥 so that I can begin planting soon. Therefore, this will be written in between checking on my fires 😆

That's the thing with controlled burns. I can leave it, it can look extinguished, but as long as it burns underneath, I just need to stir it up to ignite it again. 😉🤔

Here is where we are.

2 hr chart

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$

on the 2 hr chart, we have reach...

loading...

24

3

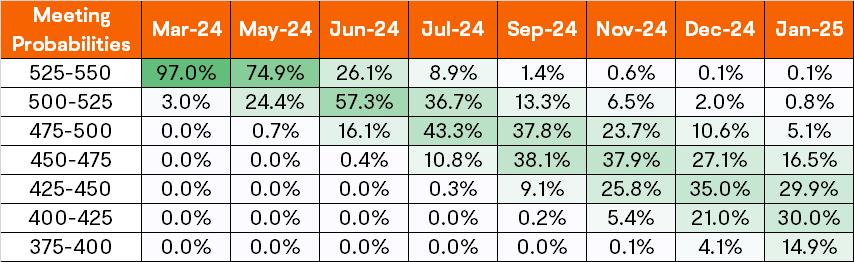

All Eyes on the Upcoming Fed Meeting

With interest rates and inflation being the main concern for investors these days, all eyes will be on the Federal Reserve's interest rate decision coming this Wednesday.

Many analysts are calling for a resurgence in inflation. While the Federal Reserve has been standing by their word, saying that inflation is under control and we are on the path towards rate cuts this year.

If the Fed believes that inflation is no longer...

With interest rates and inflation being the main concern for investors these days, all eyes will be on the Federal Reserve's interest rate decision coming this Wednesday.

Many analysts are calling for a resurgence in inflation. While the Federal Reserve has been standing by their word, saying that inflation is under control and we are on the path towards rate cuts this year.

If the Fed believes that inflation is no longer...

+4

22

16

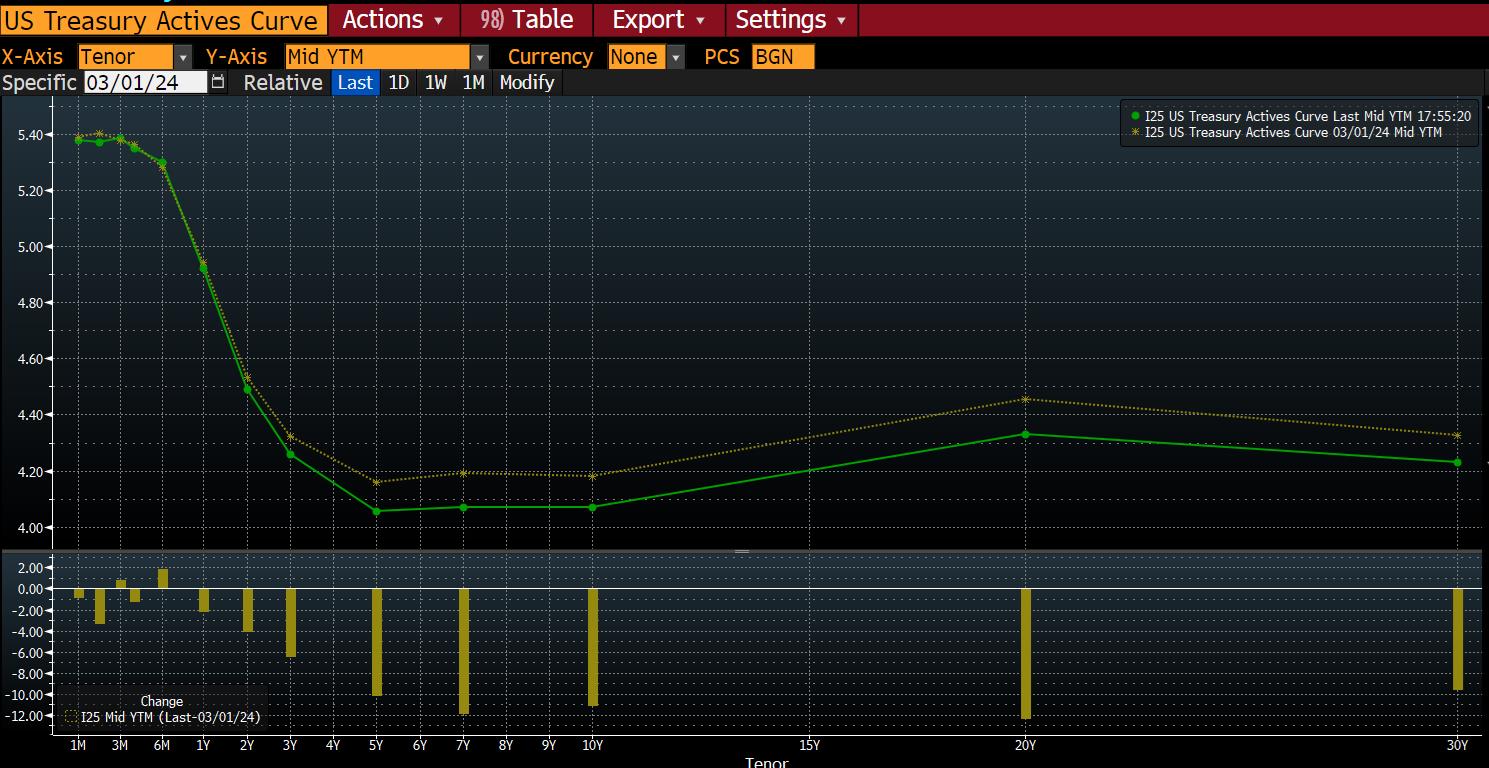

The likelihood of US 2-year yields moving back towards 5% is increasing, as the Federal Reserve's March dot plot may suggest only two 25bps interest rate cuts this year instead of three. This shift comes after US CPI data revealed a slowdown in inflation, indicating that rates may need to remain higher for longer.

The split within the Fed between those projecting two rate reductions and those indicating three is close, with potential for a more haw...

The split within the Fed between those projecting two rate reductions and those indicating three is close, with potential for a more haw...

3

Boosted by a combination of softer manufacturing figures and accommodating dovish comments from Federal Reserve officials, US bond funds racked up large inflows in the seven days to March 6 as expectations raised for interest rate cuts later this year.

Investment data from the London Stock Exchange Group revealed significant interest in US bond funds, with the most notable investments being directed toward US short/inte...

Investment data from the London Stock Exchange Group revealed significant interest in US bond funds, with the most notable investments being directed toward US short/inte...

18

1

👉 Key Highlights:

📍 Consumer long-term inflation expectations rise, with 3-year outlook at 2.7% and 5-year at 2.9%.

📍 All figures exceed the Fed's 2% inflation goal, suggesting tighter monetary policy may continue.

📍 Fed Chair Jerome Powell emphasizes commitment to 2% target, despite rising expectations.

📍 Headline inflation at 2.4%, with core level at 2.8% for January, showing progress but challenges ahead.

📍 Survey in...

📍 Consumer long-term inflation expectations rise, with 3-year outlook at 2.7% and 5-year at 2.9%.

📍 All figures exceed the Fed's 2% inflation goal, suggesting tighter monetary policy may continue.

📍 Fed Chair Jerome Powell emphasizes commitment to 2% target, despite rising expectations.

📍 Headline inflation at 2.4%, with core level at 2.8% for January, showing progress but challenges ahead.

📍 Survey in...

8

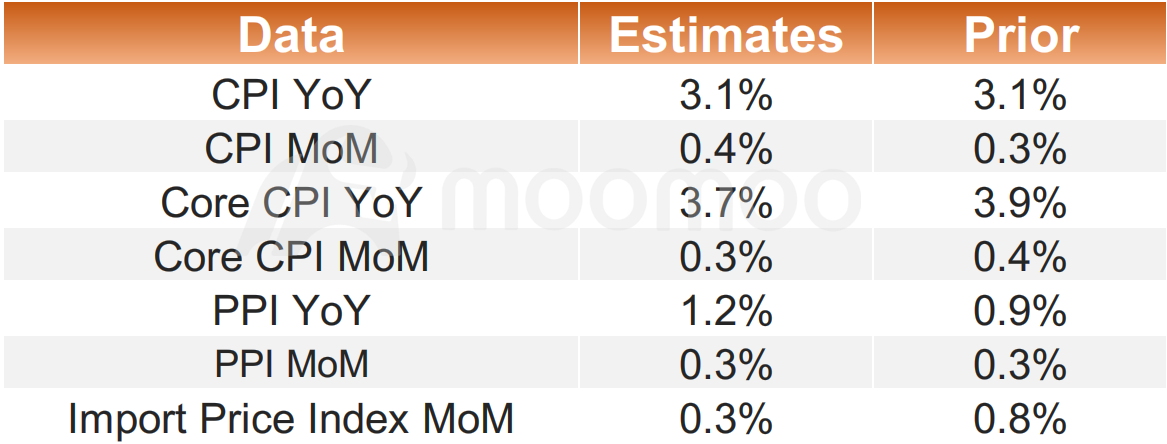

Columns Feb. CPI Preview:The Fed May Cautiously Give Easing Signals As Inflation Likely Remains Above 3%

The US February CPI data will be released by the Bureau of Labor Statistics at 8:30 ET on Mar. 12th. Economists polled by Bloomberg estimate that CPI in February remained at 3.1% year-on-year. Core CPI is expected to increase by 3.7% (vs. the previous value of 3.9%).

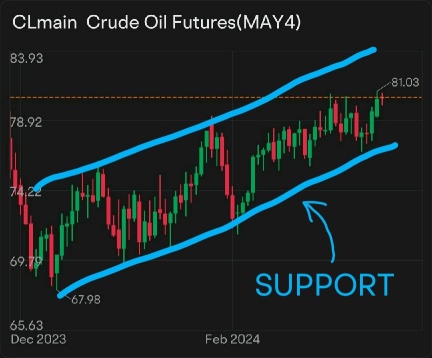

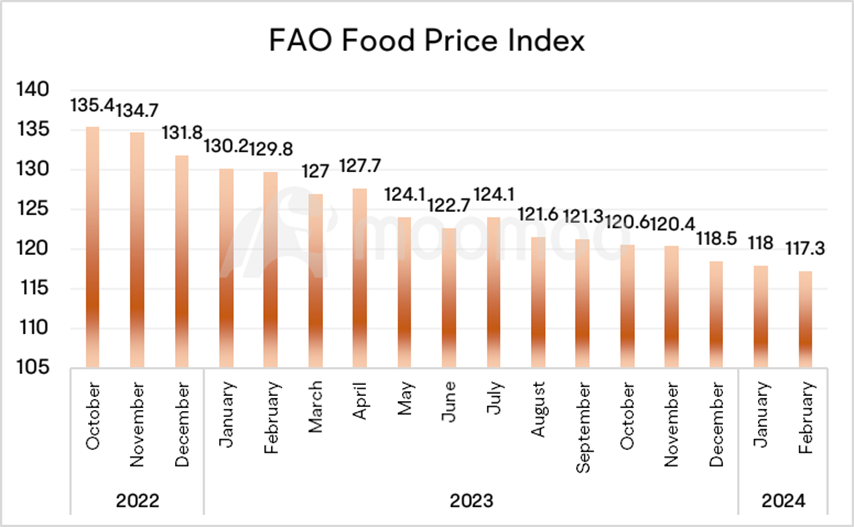

■ Energy prices could be one of the main factors behind the rise in headline CPI

Energy prices trended higher in February as WTI crude o...

■ Energy prices could be one of the main factors behind the rise in headline CPI

Energy prices trended higher in February as WTI crude o...

+4

33

2

Macro watch; US inflation to ease, retail sales to rise, China to cut rates, and EIA crude inventory report on watch

In the US, this week economic focus may underscore that the Fed can keep rates as they are for now. The US CPI report for February (due March 12) which could also validate the run up in equities if core CPI falls to 0.3% (vs 0.4% prior) as expected driven by cooling used-ca...

In the US, this week economic focus may underscore that the Fed can keep rates as they are for now. The US CPI report for February (due March 12) which could also validate the run up in equities if core CPI falls to 0.3% (vs 0.4% prior) as expected driven by cooling used-ca...

8

3

- The Fed's Beige Book survey released last week showed that the US economy has grown at a modest pace since earlier in the year, while consumers demonstrated increased sensitivity to rising prices.

- Last week, headline services ISM dropped by 0.8 points to 52.6 (consensus: 53.0) in February, reversing a portion of January's significant increase.

- Continuing claims rose 8k to 1,906k, for the week ending Feb 24, which is above pre-pandemic average of 16...

- Last week, headline services ISM dropped by 0.8 points to 52.6 (consensus: 53.0) in February, reversing a portion of January's significant increase.

- Continuing claims rose 8k to 1,906k, for the week ending Feb 24, which is above pre-pandemic average of 16...

2

Mod Tanyatorn : thanks for sharing![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

TinkerB3ll : Thanks @iamiam for the extensive list wondering what’s your thoughts on MSOS?

iamiam OP TinkerB3ll : I would rather have the individual companies. MSOS is a Blackrock creation with lots of swaps and derivatives, they even have bonds its not bad if you hold it. it's just not my thing. too many swaps and derivatives for my liking.

its not bad if you hold it. it's just not my thing. too many swaps and derivatives for my liking.

Wacho-el-Wero : $Vale SA (VALE.US)$