Posts

News

Latest

Hot

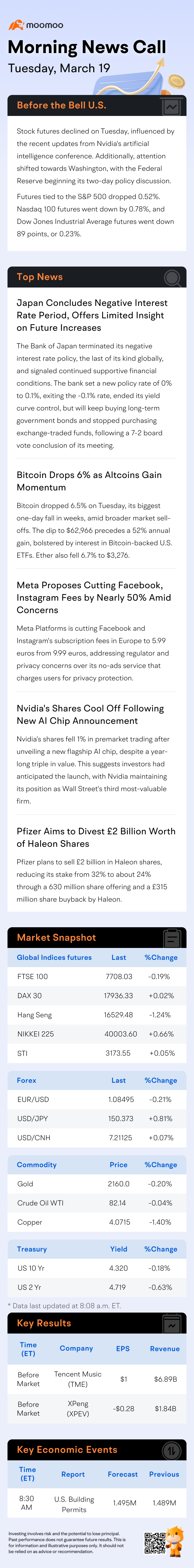

Why retail investors and institutions are now investing in Japan and will continue to so; as a place for global investors to turn for diversification

We have seen global portfolios allocate greater assets to Japanese equities and this will continue over the longer term as corporate governance and company profitability has significantly improved. And this is all underpinned by its economy's recov...

We have seen global portfolios allocate greater assets to Japanese equities and this will continue over the longer term as corporate governance and company profitability has significantly improved. And this is all underpinned by its economy's recov...

5

$NVDA 240405 810.00P$

leave brfore FOMC

1. Japan’s Role as a Creditor: Japan is highlighted as the largest creditor in the world, indicating that it holds significant financial assets and investments abroad. The BoJ’s actions may be aimed at encouraging capital to flow back into Japan, potentially to stimulate domestic investment and economic growth.

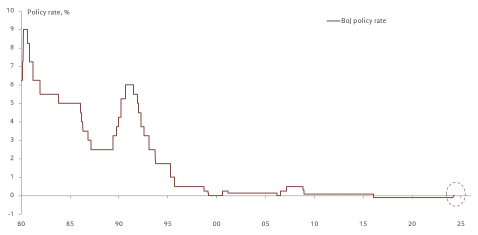

2. Interest Rate Policy: The BoJ has set its interest rates at 0% to 0.1%, which is effectively near zero. This low interes...

leave brfore FOMC

1. Japan’s Role as a Creditor: Japan is highlighted as the largest creditor in the world, indicating that it holds significant financial assets and investments abroad. The BoJ’s actions may be aimed at encouraging capital to flow back into Japan, potentially to stimulate domestic investment and economic growth.

2. Interest Rate Policy: The BoJ has set its interest rates at 0% to 0.1%, which is effectively near zero. This low interes...

2

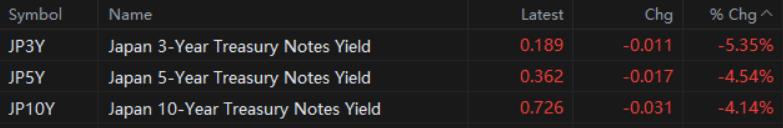

About 8 hours after the BoJ raises rates for the first time since 2007, JGB yields are down across the board. Investors are not buying that the stated shift in policy will translate to further normalization. Indeed, the BoJ left itself plenty of room to remain dovish.

$Japan 10-Year Treasury Notes Yield (JP10Y.BD)$ $Japan 5-Year Treasury Notes Yield (JP5Y.BD)$ $Japan 3-Year Treasury Notes Yield (JP3Y.BD)$

$Japan 10-Year Treasury Notes Yield (JP10Y.BD)$ $Japan 5-Year Treasury Notes Yield (JP5Y.BD)$ $Japan 3-Year Treasury Notes Yield (JP3Y.BD)$

BREAKING - Bank of Japan raises rates to policy range of 0% to 0.1%, the first such rate hike in over a decade and scraps yield curve control

The central bank will also stop buying ETFs and phase out buying of corporate debt.

Finally ends the world's only negative rates regime, an 8 year experiment and first hike in 17 years

$Nikkei 225 (.N225.JP)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$

The central bank will also stop buying ETFs and phase out buying of corporate debt.

Finally ends the world's only negative rates regime, an 8 year experiment and first hike in 17 years

$Nikkei 225 (.N225.JP)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Microsoft (MSFT.US)$

4

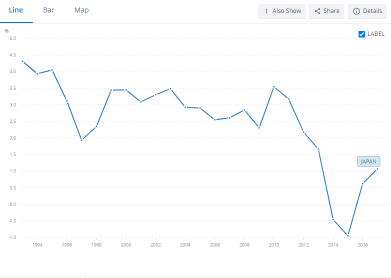

On March 19th, the Bank of Japan announced that it would raise its benchmark interest rate from -0.1% to 0-0.1%, marking the first interest rate hike by the central bank since 2007 and officially ending the eight-year era of negative interest rates. However, Japan's ultra-loose monetary policy era has roots dating back much earlier, with a fascinating investment narrative througho...

+2

10

2

Bank of Japan 🇯🇵 ENDS negative interest rates, raising them for the first time in 17 years to 0.0-0.1%.

This marks the end of the last negative interest policy among developed nations.

Alongside, BOJ ends yield curve control & ETF purchases but will continue bond buying.

BOJ Governor Ueda said there was “still some distance” to inflation expectations fully reaching 2%, and that the BOJ will maintain an easy stance until the underlying price trend hits that level.

He also said risks of a bigg...

This marks the end of the last negative interest policy among developed nations.

Alongside, BOJ ends yield curve control & ETF purchases but will continue bond buying.

BOJ Governor Ueda said there was “still some distance” to inflation expectations fully reaching 2%, and that the BOJ will maintain an easy stance until the underlying price trend hits that level.

He also said risks of a bigg...

1

Saving up monthly salaried wages will not be enough.

Bank interest rates are lower than inflation.

You need to invest the savings into a diversified index like $SPDR S&P 500 ETF (SPY.US)$

DCA is the key to success!

Bank interest rates are lower than inflation.

You need to invest the savings into a diversified index like $SPDR S&P 500 ETF (SPY.US)$

DCA is the key to success!

5

Dow tumbles

Wall Street closed lower Thursday after a key U.S. inflation gauge came in hotter-than-expected and sent Treasury yields higher. The 30-stock Dow lost more than 100 points, or 0.35%, snapping a three-day winning streak. The tech-heavy Nasdaq Composite fell 0.3%, while the S&P 500 dipped 0.29%.

Why Japan's wage talks matter

Japan's "shunto" wage negotiations hit fever pitch this week as several corporate giants revealed salary increases. The outcome of these...

Wall Street closed lower Thursday after a key U.S. inflation gauge came in hotter-than-expected and sent Treasury yields higher. The 30-stock Dow lost more than 100 points, or 0.35%, snapping a three-day winning streak. The tech-heavy Nasdaq Composite fell 0.3%, while the S&P 500 dipped 0.29%.

Why Japan's wage talks matter

Japan's "shunto" wage negotiations hit fever pitch this week as several corporate giants revealed salary increases. The outcome of these...

2