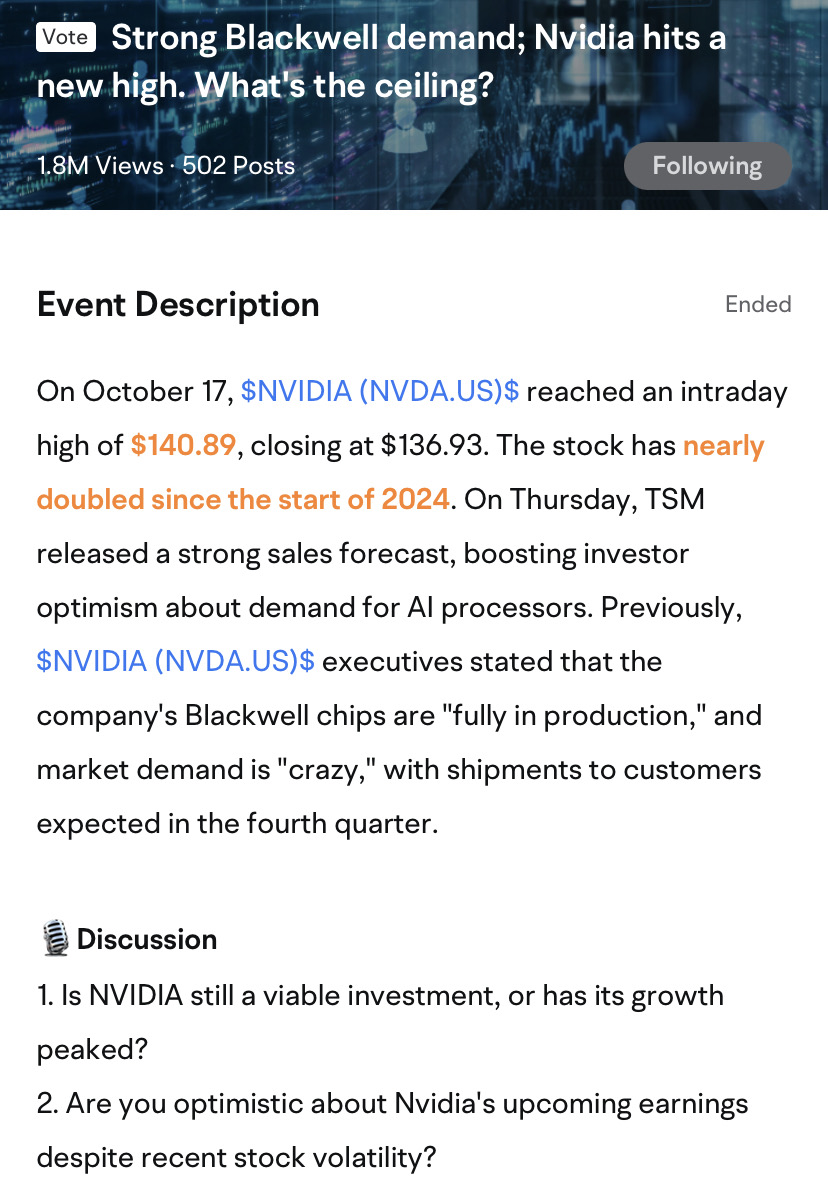

Posts

News

Latest

Hot

IN REAL LIFE & In the Market…

.

Pullbacks corrections retracements are normal.

.

Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

Me and mi ⭕️ have a Long Term Vision… Buy & Hold aka HODL.

$NVIDIA (NVDA.US)$ is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021.

...

.

Pullbacks corrections retracements are normal.

.

Don’t let FUD, market manipulation, sell offs, propaganda, or normal ebbs and flows of the market trick you out of your position.

Me and mi ⭕️ have a Long Term Vision… Buy & Hold aka HODL.

$NVIDIA (NVDA.US)$ is being added to the Dow Jones Industrial Average.

NVIDIA ($NVDA) was trading at a P/E ratio of 64 with a stock price of $15 in 2021.

...

+20

61

17

#bursamarketpulse #digitalinvesmentservices #moomoomy #shopify #FBMKLCI #CFPB #BursaMalaysia #ftsemalaysia #TradingView

WE SHOULD HAVE LISTENED TO YOU GUYS 🤦🏽♂️

Wait 🤔 I’m Glad we didn’t 💯

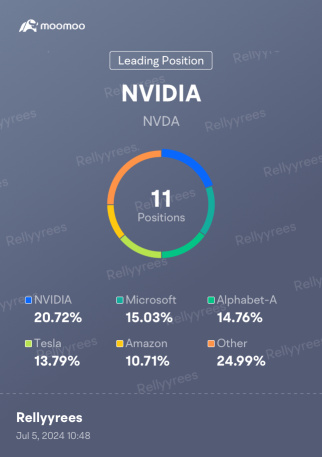

2 of the Best of all time: $NVIDIA (NVDA.US)$ ( NVDA seekingalpha.co... ) & $SPDR Portfolio S&P 500 ETF (SPLG.US)$ Me & my peeps ALL IN.

$NVIDIA (NVDA.US)$ stock was a standout gainer in the chip sector on Monday as it powered to levels that cemented a new milestone. The company's closing market cap was $3.525 trillion in Monday action.

Remember‼️Discipline, Consistency, and Pa...

Wait 🤔 I’m Glad we didn’t 💯

2 of the Best of all time: $NVIDIA (NVDA.US)$ ( NVDA seekingalpha.co... ) & $SPDR Portfolio S&P 500 ETF (SPLG.US)$ Me & my peeps ALL IN.

$NVIDIA (NVDA.US)$ stock was a standout gainer in the chip sector on Monday as it powered to levels that cemented a new milestone. The company's closing market cap was $3.525 trillion in Monday action.

Remember‼️Discipline, Consistency, and Pa...

+11

53

23

so sorry for the late response and fogive me being tardy if any future action question or summerys at mybearlest convience

1

$NVIDIA (NVDA.US)$ Who wants to but on dip buy now else go faster than expected may be…

3

4

$NVIDIA (NVDA.US)$ July will just be ups and down or flat. Will need to wait till August when next earnings is coming out. For the time being, i will just hold.

6

2

$NVIDIA (NVDA.US)$ It looks like *some* big seller pumping up price before regular trading to get a good selling price for his massive shares. Good to wait and see during the regular hours.

7

2

Master, but a Faithful

Master, but a Faithful  Servant…

Servant…  Money

Money  don’t let it master you

don’t let it master you

we can enjoy the journey more

we can enjoy the journey more

laugh

laugh  this is as much about us Becoming Better as it is about Asset Accumulation.

this is as much about us Becoming Better as it is about Asset Accumulation.

MONEY DONT MAKE NO MONEY

MONEY DONT MAKE NO MONEY

so they control you with fear

so they control you with fear

Manolani808 : I wish

Coach Donnie OP Manolani808 : It’ll go and shock everybody

and shock everybody

Or go down spook a lot of people out then go back up like crazy

Coach Donnie OP : $NVIDIA (NVDA.US)$ Dan Ives

- YouTube

Coach Donnie OP : How much risk can you take?

When it comes to investing, risk and return may come hand-in-hand. If unwilling to take risks, one should not expect returns.

However, it could be dangerous when some only have their eye on the returns and neglect the risks.

So, how to balance risk and return? This depends on how much risk you can take.

Risk tolerance varies from person to person. This is mainly related to 4 factors.

The first factor is age.

A young man in his prime and a retired senior generally have different levels of risk tolerance.

Young people usually have a longer timeline to recover from their losses.

Therefore, they may be more risk-tolerant.

However, many elderly people live off pensions or savings, and may not have other sources of income, which can make them relatively less risk-tolerant.

A commonly cited rule of thumb makes it easier to approach the relationship between age and high-risk assets, such as stocks.

According to this principle, the percentage of stocks people may consider holding is equal to 100 minus their age.

For example, a 30-year-old investor may consider allocating 70% of their idle funds to stocks, while according to this rule, that percentage for an investor aged 70 should be within 30%.

However, this formula can be flexible. You can adjust it according to your situation. But, all else being equal, the principle is the older you are, the lower the proportion of your portfolio that you might want to consider investing in high-risk assets.

Coach Donnie OP : The second factor is financial status.

For example, if someone is well-off and has no debt and he is also single, then there is a lot less financial burden on his hands. But if he is married with kids, then living expenses are high, and he might struggle to make ends meet.

There is an essential difference between his risk tolerance level in these two situations.

The former is in good financial condition. A slight loss will not affect life. Therefore, the risk tolerance is relatively strong.

The latter's financial situation is already unstable. Losing money on an investment might result in a huge burden on life.

Therefore, the risk tolerance is very weak.

The third factor is individual risk appetite.

Everyone has different perspectives on risks.

Some people are conservative even when they are young and well-off. They simply do not want to take any risks, thus they are not the best candidates for high-risk investments.

Some people are more radical. Losing money will not rattle their mindsets. Thus they are willing to take high risks to gain possible high returns.

The fourth factor is the level of investment knowledge.

The essence of risk is uncertainty. Before investing, you will not know the profits or losses it brings.

If you have done your homework in asset analysis with the right investment mindset, you may become more capable of controlling the investment risks perceived by others as huge uncertainty.

Conversely, you'll be walking a thin line if you choose to invest in financial assets that you don't know much about, especially those involving high risk.

To sum up, the investment risk that you can take depends on your age, financial situation, risk appetite, and investment knowledge. Before investing, we must know our situation, and not act on impulse.

View more comments...