Latest

Hot

Singapore and the US are two highly-developed countries with vibe economic opportunities on opposite sides of the globe. Singapore Airlines resumed the flight from SG to NY is the Longest Flight in the World:18 hours and 40 minutes.

Despite the 12 hour time difference, the money never sleeps, as tremendous investing opportunities are happening every second.

In this SG Guidebook series, moomoo will take you through the largest stock market in the world, by introducing "why should we invest in US stocks?" and "what to know before buying US stocks?".

You can get a better understanding of the US stock market. We hope you like them.

Why should we invest in US stocks?

1. Great long-term performance![]()

The US stock market has a long-term better performance. Over the past 10 years, the $S&P 500 Index (.SPX.US)$ has a total return of 297.1%, and the $Nasdaq Composite Index (.IXIC.US)$ has a total return of 525.8%. In comparison, the $FTSE Singapore Straits Time Index (.STI.SG)$ has a total return of 14.8% in 10 years.

Image: moomoo

From top to bottom: Nasdaq Composite Index, S&P 500 Index, FTSE Singapore Strait Index

2. Industries with global advantages![]()

Other than the major indices, the US stock market also has many industries dominating global sectors, generating more opportunities for investors to trade.

The S&P Global Broad Market tracks more than 11,000 stocks across 50 different markets, and the US-based companies have a overall heavy weighting in global sectors.

Image: VisualCapitalist

According to the data, US companies are especially competitive in Info Tech, Health care, and Communication services sectors, with the ratio higher than 60%.

3. World-renowned companies![]()

Many companies listing on the Singapore stock market are well-known in Singapore or even in Asia, including $SGX (S68.SG)$, $DBS Group Holdings (D05.SG)$, $Singtel (Z74.SG)$ and $SIA (C6L.SG)$.

While in the US stock market, there are plenty of world-renowned companies with globally-recognized brands, such as $Apple (AAPL.US)$, $Meta Platforms (FB.US)$, $Adobe (ADBE.US)$, $Disney (DIS.US)$, $Tesla (TSLA.US)$, $Nike (NKE.US)$, $Hermes International SA (HESAY.US)$, $Starbucks (SBUX.US)$, $Electronic Arts Inc (EA.US)$, and $Sea (SE.US)$.

By investing in the US stock market, you can have the opportunity to participate in the global growth story.

Image: moomoo

From top to bottom: Adobe, Apple, Nike, Walt Disney

What's your thought on investing in US stocks? Do you have any investing experience to share with us?

Let us know if you have any ideas or questions. We can't wait to hear your valuable voices. Stay tuned for thepart 2: what to know before buying US stocks?

Despite the 12 hour time difference, the money never sleeps, as tremendous investing opportunities are happening every second.

In this SG Guidebook series, moomoo will take you through the largest stock market in the world, by introducing "why should we invest in US stocks?" and "what to know before buying US stocks?".

You can get a better understanding of the US stock market. We hope you like them.

Why should we invest in US stocks?

1. Great long-term performance

The US stock market has a long-term better performance. Over the past 10 years, the $S&P 500 Index (.SPX.US)$ has a total return of 297.1%, and the $Nasdaq Composite Index (.IXIC.US)$ has a total return of 525.8%. In comparison, the $FTSE Singapore Straits Time Index (.STI.SG)$ has a total return of 14.8% in 10 years.

Image: moomoo

From top to bottom: Nasdaq Composite Index, S&P 500 Index, FTSE Singapore Strait Index

2. Industries with global advantages

Other than the major indices, the US stock market also has many industries dominating global sectors, generating more opportunities for investors to trade.

The S&P Global Broad Market tracks more than 11,000 stocks across 50 different markets, and the US-based companies have a overall heavy weighting in global sectors.

Image: VisualCapitalist

According to the data, US companies are especially competitive in Info Tech, Health care, and Communication services sectors, with the ratio higher than 60%.

3. World-renowned companies

Many companies listing on the Singapore stock market are well-known in Singapore or even in Asia, including $SGX (S68.SG)$, $DBS Group Holdings (D05.SG)$, $Singtel (Z74.SG)$ and $SIA (C6L.SG)$.

While in the US stock market, there are plenty of world-renowned companies with globally-recognized brands, such as $Apple (AAPL.US)$, $Meta Platforms (FB.US)$, $Adobe (ADBE.US)$, $Disney (DIS.US)$, $Tesla (TSLA.US)$, $Nike (NKE.US)$, $Hermes International SA (HESAY.US)$, $Starbucks (SBUX.US)$, $Electronic Arts Inc (EA.US)$, and $Sea (SE.US)$.

By investing in the US stock market, you can have the opportunity to participate in the global growth story.

Image: moomoo

From top to bottom: Adobe, Apple, Nike, Walt Disney

What's your thought on investing in US stocks? Do you have any investing experience to share with us?

Let us know if you have any ideas or questions. We can't wait to hear your valuable voices. Stay tuned for thepart 2: what to know before buying US stocks?

+2

81

26

Hi, mooers!

Welcome back to the SG Guidebook series! In the previous part: "SG Guidebook: Why should we invest in US stocks?", we received so much valuable feedback that means a lot to us.

On this page, we will introduce some must-known and frequently-asked questions that you probably don't wanna miss.

Here are the key takeaways:

The US market has pre-market and post-market to extend trading hours.

You can buy or sell 1 share each time.

Taxes on dividends is 30%. But you are exempt from the US capital gains tax.

1. Different Market Rules

Market trading hours:

Unlike the Singapore stock market, the US stock market has pre-market and post-market, which expends the trading time of the day.

Note: During the US winter time (US standard time starts on the 1st Sunday in November and ends on the 2nd Sunday in March), the trading time shifts to SGT 10:30 pm to 5 am.

Minimum share:

On the US stock market, you can buy or sell 1 share for every single trade, while in the Singapore stock market, you can onlybuy or sell100 shares or the integer multiples of 100 shares each time.

Take $Apple (AAPL.US)$ as an example: you can buy 1 share for US$145.58.

Take $SGX (S68.SG)$ as another example: you have to buy at least 100 shares for SG$1,008.

2. Taxes and fees:

As people always say, there are two things that we can't get rid of, which are tax and breath.

What do you have to pay for taxes on US stocks? Let's check it out!

Taxes on dividends

Non-resident aliens are subject to a dividend tax rate of 30% on dividends paid out by US companies.

Capital gains tax

If you are a non-resident alien of the US, then you are exempt from the US capital gains taxes without being a tax-slayer. Normally, a US citizen needs to pay capital gains taxes (up to 37% of gains) when selling the shares for a profit.

Note:

Non-Resident Alien (NRA) includes people who are not US citizens, green card holders, nor living in the US for 183 days during the year.

The above information is quoted from US Tax Guide for Aliens and made available for informational purposes only. Futu does not provide tax advisory services. Please consult a licensed professional for details.

Miscellaneous fees

Besides brokerage fees, there are other miscellaneous fees collected by the SEC or Settlement Agencies.

On the US market, those fees include:

On the SG market, those fees includes:

To get more details about commission&fees, please go to "Me-HelpCenter-Fees".

3. How to start trading?

Join the US Stock Paper Trading to win up to SGD8,888

A good start is half success. Without risking your own money, you can improve your investing skills & trading strategies before you enter and beat the market.

Your $1,000,000 Virtual Cash is fully loaded. Join Now and Win Big >>

Have fun in your investing journey! Please leave your comment below for any ideas or questions.

You may also be interested in:

SG Guidebook: Why should we invest in US stocks? (Part 1)

Singapore User Guide: How to trade stocks on moomoo?

Welcome back to the SG Guidebook series! In the previous part: "SG Guidebook: Why should we invest in US stocks?", we received so much valuable feedback that means a lot to us.

On this page, we will introduce some must-known and frequently-asked questions that you probably don't wanna miss.

Here are the key takeaways:

The US market has pre-market and post-market to extend trading hours.

You can buy or sell 1 share each time.

Taxes on dividends is 30%. But you are exempt from the US capital gains tax.

1. Different Market Rules

Market trading hours:

Unlike the Singapore stock market, the US stock market has pre-market and post-market, which expends the trading time of the day.

Note: During the US winter time (US standard time starts on the 1st Sunday in November and ends on the 2nd Sunday in March), the trading time shifts to SGT 10:30 pm to 5 am.

Minimum share:

On the US stock market, you can buy or sell 1 share for every single trade, while in the Singapore stock market, you can onlybuy or sell100 shares or the integer multiples of 100 shares each time.

Take $Apple (AAPL.US)$ as an example: you can buy 1 share for US$145.58.

Take $SGX (S68.SG)$ as another example: you have to buy at least 100 shares for SG$1,008.

2. Taxes and fees:

As people always say, there are two things that we can't get rid of, which are tax and breath.

What do you have to pay for taxes on US stocks? Let's check it out!

Taxes on dividends

Non-resident aliens are subject to a dividend tax rate of 30% on dividends paid out by US companies.

Capital gains tax

If you are a non-resident alien of the US, then you are exempt from the US capital gains taxes without being a tax-slayer. Normally, a US citizen needs to pay capital gains taxes (up to 37% of gains) when selling the shares for a profit.

Note:

Non-Resident Alien (NRA) includes people who are not US citizens, green card holders, nor living in the US for 183 days during the year.

The above information is quoted from US Tax Guide for Aliens and made available for informational purposes only. Futu does not provide tax advisory services. Please consult a licensed professional for details.

Miscellaneous fees

Besides brokerage fees, there are other miscellaneous fees collected by the SEC or Settlement Agencies.

On the US market, those fees include:

On the SG market, those fees includes:

To get more details about commission&fees, please go to "Me-HelpCenter-Fees".

3. How to start trading?

Join the US Stock Paper Trading to win up to SGD8,888

A good start is half success. Without risking your own money, you can improve your investing skills & trading strategies before you enter and beat the market.

Your $1,000,000 Virtual Cash is fully loaded. Join Now and Win Big >>

Have fun in your investing journey! Please leave your comment below for any ideas or questions.

You may also be interested in:

SG Guidebook: Why should we invest in US stocks? (Part 1)

Singapore User Guide: How to trade stocks on moomoo?

+2

89

17

Previously:

Singapore User Guide: What you need to open a moomoo account?

Singapore User Guide: How to deposit funds into your account?

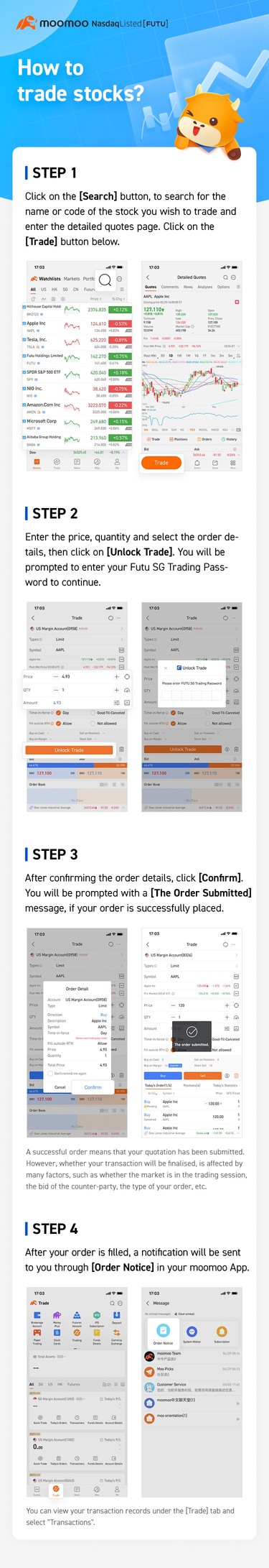

Trading securities on moomoo can be very simple by following the guide below. Have fun in your investing journey!

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Singapore User Guide: What you need to open a moomoo account?

Singapore User Guide: How to deposit funds into your account?

Trading securities on moomoo can be very simple by following the guide below. Have fun in your investing journey!

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

Expand

Expand 188

53

This is a video guide about “How to use Stock Screener?".

If you have any questions, please comment and we are willing to answer your question.

$FTSE Singapore Straits Time Index (.STI.SG)$ $FTSE Straits All-Share Index (.FSTAS.SG)$ $FTSE Straits Mid-Cap Index (.FSTM.SG)$

If you have any questions, please comment and we are willing to answer your question.

$FTSE Singapore Straits Time Index (.STI.SG)$ $FTSE Straits All-Share Index (.FSTAS.SG)$ $FTSE Straits Mid-Cap Index (.FSTM.SG)$

![[Video Tutorial] How to use Stock Screener?](https://ussnsimg.moomoo.com/2021071700001014f180e4d560e.jpg/thumb)

171

51

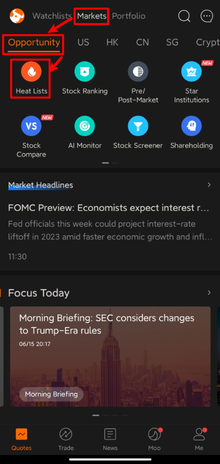

1. What is the "Heat Lists"?

The function allows you to track the heat lists (eg. Trade heat, Search heat, News heat) in different markets (eg. US stocks, HK stocks, CN stocks), helping you quickly understand the hot spots in the markets.

2. Where is the "Heat Lists"?

Position: Quotes —— Markets —— Opportunity —— Heat Lists

3. How to use "Heat Lists"?

Moomoo allows us to track the hot spots from two dimensions:

① Markets —— US、HK、CN

② Focus —— Trade、Search、News...

The function allows you to track the heat lists (eg. Trade heat, Search heat, News heat) in different markets (eg. US stocks, HK stocks, CN stocks), helping you quickly understand the hot spots in the markets.

2. Where is the "Heat Lists"?

Position: Quotes —— Markets —— Opportunity —— Heat Lists

3. How to use "Heat Lists"?

Moomoo allows us to track the hot spots from two dimensions:

① Markets —— US、HK、CN

② Focus —— Trade、Search、News...

+1

136

38

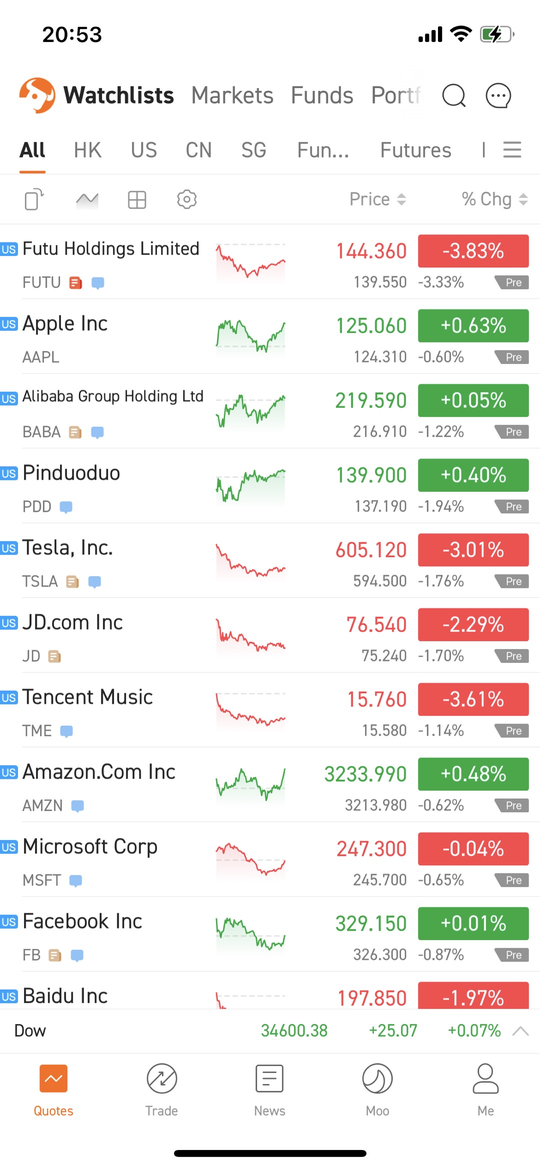

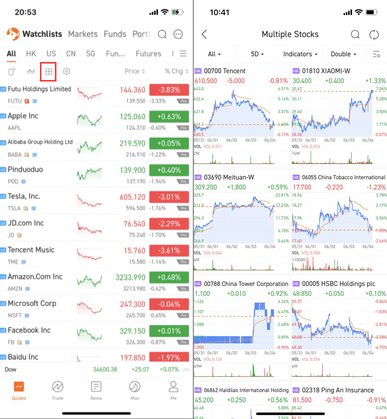

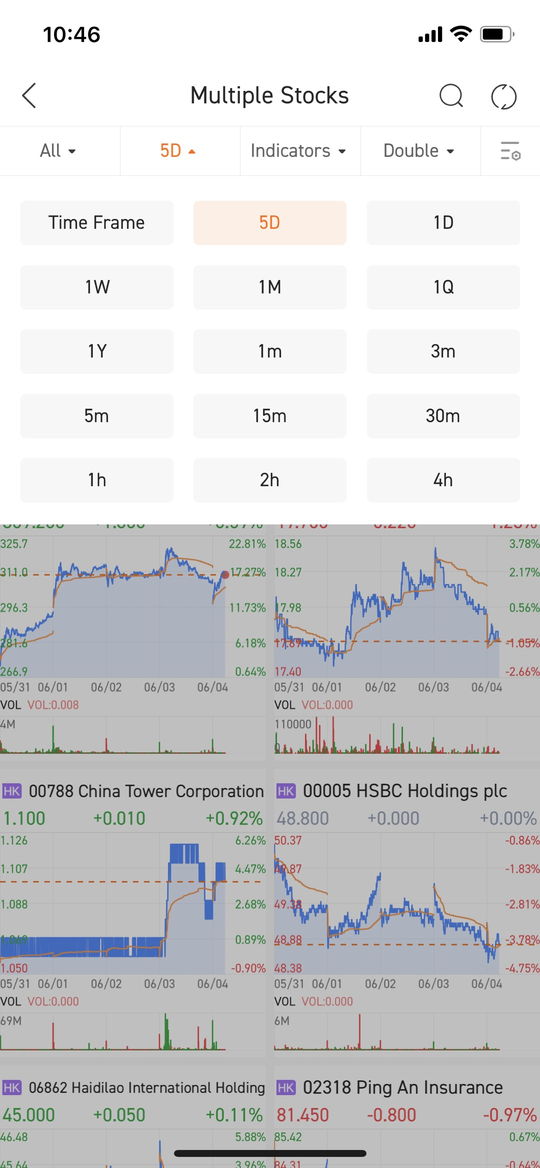

How to set up Multiple Stocks?

1: Open moomoo and then you will see Stock Quotes page

2: There will be a label bar shown in the following figure, tap on the "Multiple Stocks" icon and you will see this page.

3: In the upper setting bar, you can select time intervals, indicators, display format, etc.

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$

1: Open moomoo and then you will see Stock Quotes page

2: There will be a label bar shown in the following figure, tap on the "Multiple Stocks" icon and you will see this page.

3: In the upper setting bar, you can select time intervals, indicators, display format, etc.

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$

82

17

Previously:

How to trade stocks on moomoo?

What is margin trading and how to use it?

Here's a step-by-step guide for new users to find out which stock supports margin trading.

1: Open Moomoo and then you will see Stock Quotes page.

2: Click on one stock as you like.

3: On this page, there will be the label bar shown in the following figure. Click on the icons.

4: If there is a long (short) selling label icon (or both), it indicates that the stock supports margin trading.

...

How to trade stocks on moomoo?

What is margin trading and how to use it?

Here's a step-by-step guide for new users to find out which stock supports margin trading.

1: Open Moomoo and then you will see Stock Quotes page.

2: Click on one stock as you like.

3: On this page, there will be the label bar shown in the following figure. Click on the icons.

4: If there is a long (short) selling label icon (or both), it indicates that the stock supports margin trading.

...

+1

81

15

This is a video guide about “How to track trending stocks?".

If you have any questions, please comment and we are willing to answer your question.

$FTSE Singapore Straits Time Index (.STI.SG)$ $FTSE Straits All-Share Index (.FSTAS.SG)$ $FTSE Straits Mid-Cap Index (.FSTM.SG)$

If you have any questions, please comment and we are willing to answer your question.

$FTSE Singapore Straits Time Index (.STI.SG)$ $FTSE Straits All-Share Index (.FSTAS.SG)$ $FTSE Straits Mid-Cap Index (.FSTM.SG)$

![[Video Tutorial] How to track trending stocks?](https://ussnsimg.moomoo.com/202107120000099019e90021b5a.jpg/thumb)

84

9

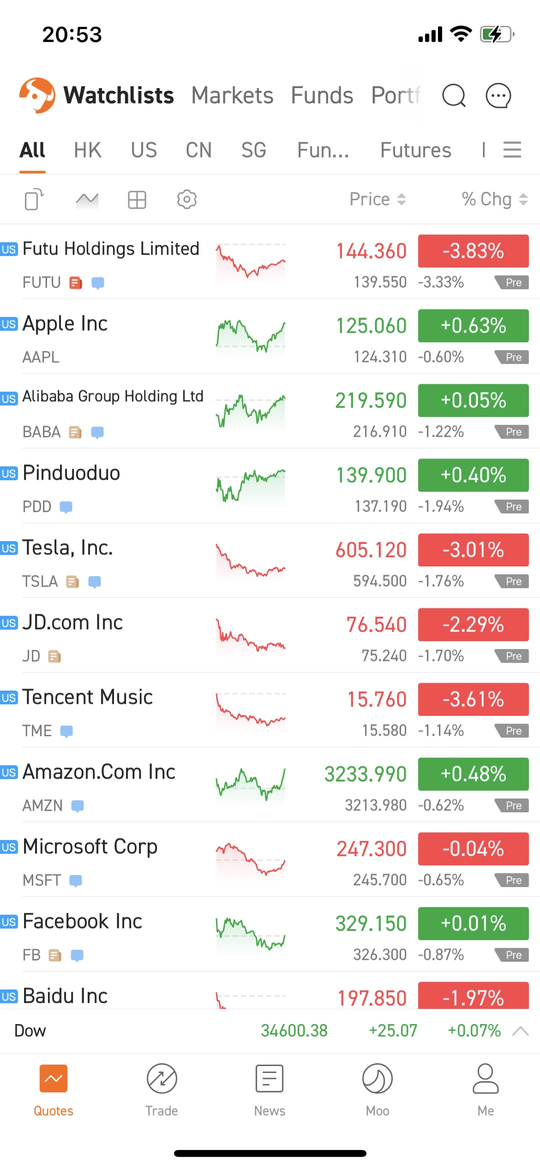

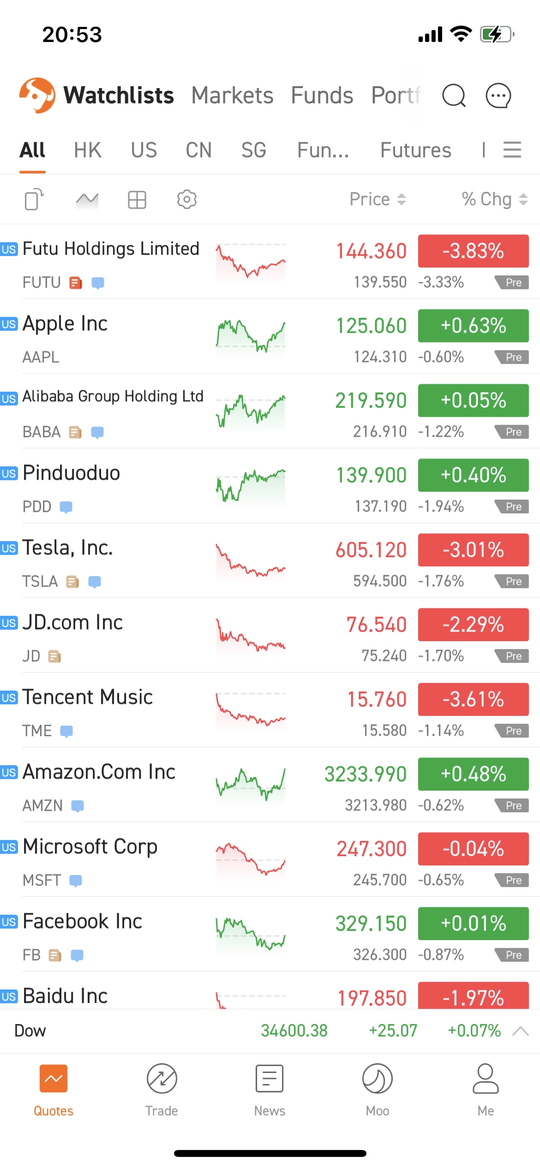

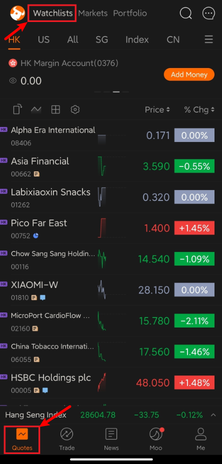

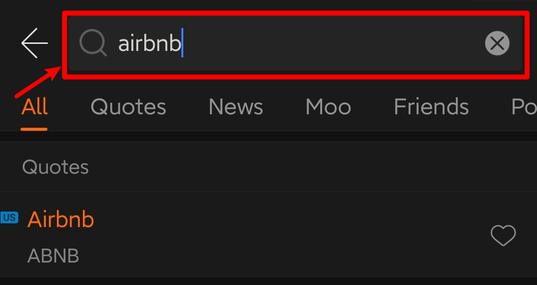

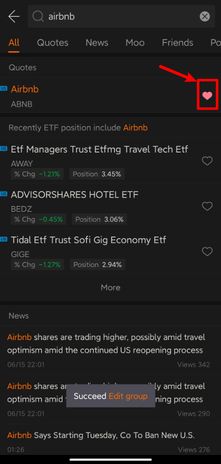

—— Where is the Function ——

When you open moomoo app, the default page is your "watchlist" page.

—— Why we use this ——

If you are fond of some stocks, adding them to "watchlists" helps you easily follow their price fluctuation.

—— How to use this ——

In Moomoo, there are two ways to add stocks to the "watchlist".

(1)Method 1: Search stock and tap on the heart icon

Step 1: Search the stock in the search bar

Step 2: tap on the "♥" icon, add the stock to "watchlist"...

When you open moomoo app, the default page is your "watchlist" page.

—— Why we use this ——

If you are fond of some stocks, adding them to "watchlists" helps you easily follow their price fluctuation.

—— How to use this ——

In Moomoo, there are two ways to add stocks to the "watchlist".

(1)Method 1: Search stock and tap on the heart icon

Step 1: Search the stock in the search bar

Step 2: tap on the "♥" icon, add the stock to "watchlist"...

+2

63

15

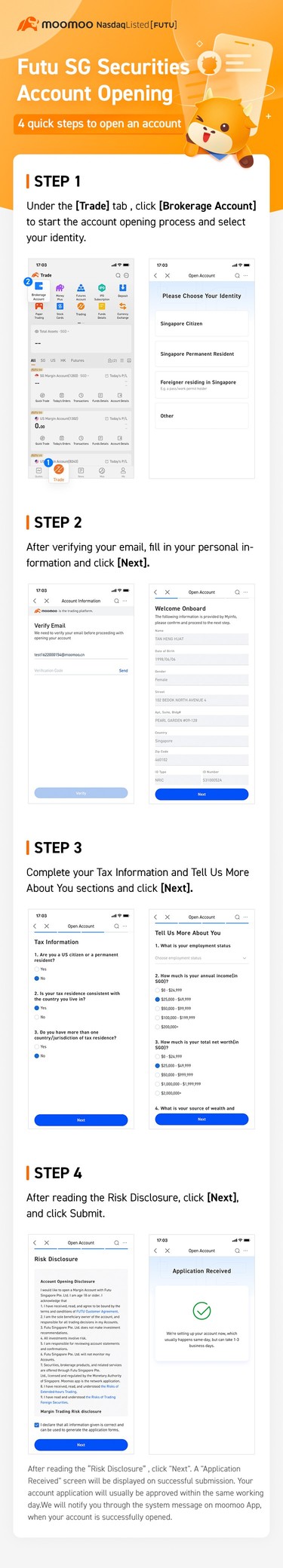

Below are 4 quick steps to open an account for Singapore users on moomoo.

If you do not reside in Singapore, to open your account, please refer to the link below:

Moomoo Courses - Starter Guide

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

If you do not reside in Singapore, to open your account, please refer to the link below:

Moomoo Courses - Starter Guide

We will post the step-by-step guide for new moomoo users daily. Follow us for more updates!

Expand

Expand 52

19

ProfitTogether : US stocks market is more vibrant than Sg.

mootastic : yeah

Walk the Snail : US is for growth, while SG is for passive income. depends on which cup of tea is ur favourite.

tlgy : Is the market inflated now ?

luciole8 : Do we get dividends from US Stocks in Singapore?

View more comments...