Latest

Hot

Are you an options trading enthusiast? We’re on the hunt for passionate options traders to share their stories and experiences with the moomoo community! ![]()

![]()

Interested? Here’s How to Join:

🎯 Eligibility Criteria

– U.S. resident

– Experienced in options trading

– Actively traded options on moomoo in the last three months

– Willing to participate in a 30-45 minute video interview

– Open to sharing your investment story ...

Interested? Here’s How to Join:

🎯 Eligibility Criteria

– U.S. resident

– Experienced in options trading

– Actively traded options on moomoo in the last three months

– Willing to participate in a 30-45 minute video interview

– Open to sharing your investment story ...

2

7

Early part of the year 2024 made a calculated risk to Sell Put (Short Put aka naked short) $Tesla (TSLA.US)$ $Apple (AAPL.US)$ .

As its LEAP (a long duration), there were some ups and downs which even have margin calls scare.

Time for an important message.

Disclaimer Options are not for everyone. If you are new and want to learn, read up more and understand the risks 1st. Stay to the buy side of Calls and Puts. Selling options especially naked are High in risk and losses ar...

As its LEAP (a long duration), there were some ups and downs which even have margin calls scare.

Time for an important message.

Disclaimer Options are not for everyone. If you are new and want to learn, read up more and understand the risks 1st. Stay to the buy side of Calls and Puts. Selling options especially naked are High in risk and losses ar...

+2

43

36

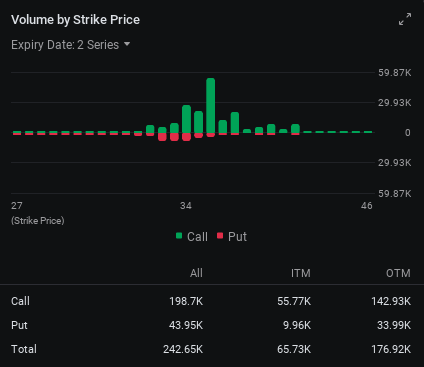

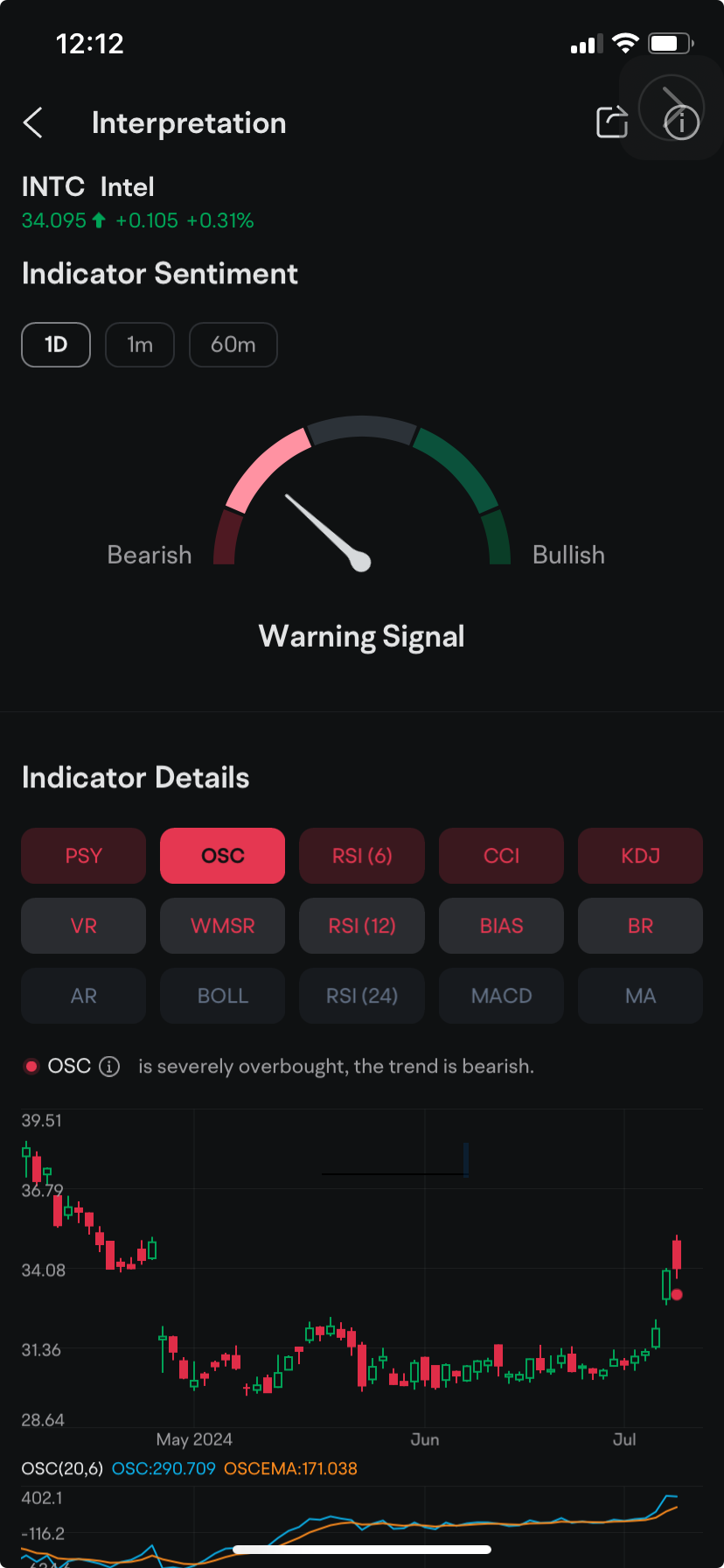

$Intel (INTC.US)$'s rally to the highest since April unleased bearish positions on the stock, spurring heavy optionstrading for the chipmaker.

On Monday, as the stock sealed a five-day gain of more than 10%, the number of shares that were sold short more than doubled to 9.69 million from a week earlier, exchange data tracked by moomoo showed. That's almost 12% of the total volume.

Investors and speculators are shorting the sto...

On Monday, as the stock sealed a five-day gain of more than 10%, the number of shares that were sold short more than doubled to 9.69 million from a week earlier, exchange data tracked by moomoo showed. That's almost 12% of the total volume.

Investors and speculators are shorting the sto...

+1

42

13

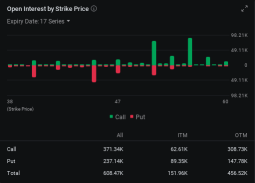

$Delta Air Lines (DAL.US)$ options are seeing the heaviest trading volume since May as financial giants pile on positions that could pay off should the share price rebound after the company reports second quarter earnings Thursday.

Total volume rose to about 150,100 contracts as of 2:36 p.m. in New York from about 70,130 a day earlier. The open interest, or the tally of outstanding contracts, are heavily concentrated on cal...

Total volume rose to about 150,100 contracts as of 2:36 p.m. in New York from about 70,130 a day earlier. The open interest, or the tally of outstanding contracts, are heavily concentrated on cal...

+1

43

8

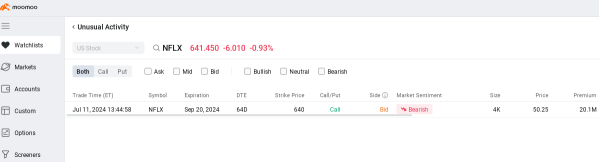

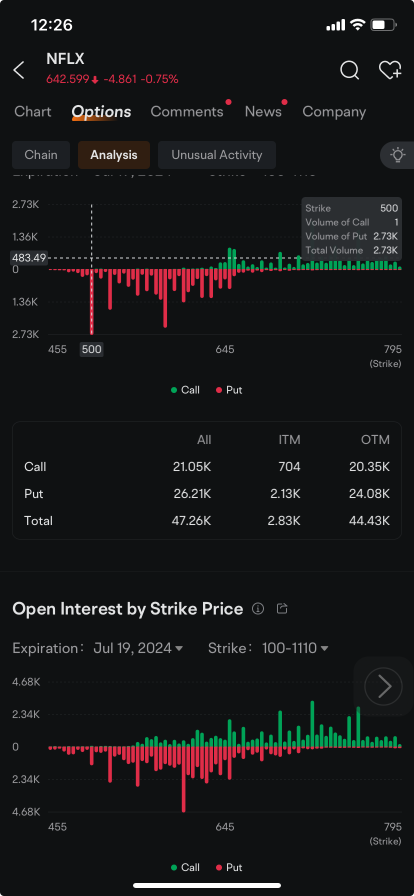

Big money took on a $20 million bearish position on $Netflix (NFLX.US)$options last week that could turn a profit as the stock price declines heading into earnings due after the market closes Thursday.

A seller wrote call options that give the holders the right to buy 400,000 Netflix shares at $640 each by Sept. 20. Those call options were sold at a price of $50.25 a share, and the trade was posted on July 11, whe...

A seller wrote call options that give the holders the right to buy 400,000 Netflix shares at $640 each by Sept. 20. Those call options were sold at a price of $50.25 a share, and the trade was posted on July 11, whe...

+1

31

9

Good morning everyone! I hope you are all enjoying your week and are gearing up for another day in the Market! I apologize for my lack of articles recently. I have been incredibly busy and have not had the time to write an article in the way I want to.

However, I think this post will make up for that.

Note: This article was intended to be only For Followers, but as a way to show my appreciation for all the support from those who aren't Followin...

However, I think this post will make up for that.

Note: This article was intended to be only For Followers, but as a way to show my appreciation for all the support from those who aren't Followin...

+47

35

4

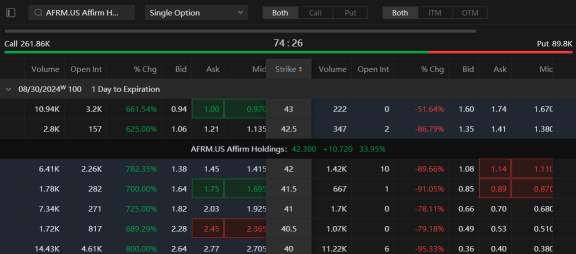

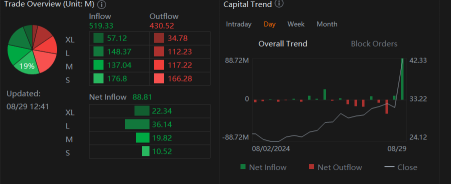

Affirm shares climbed 34% by mid-day Thursday after the firm's 14C loss for Q2 was higher than the expected 51C estimated by Wall Street analysts. The improvement led to a major price jump in $Affirm Holdings (AFRM.US)$, sending options on the underlying to the top seven stocks on the U.S. Market by volume Thursday.

One contract stood out for its volume, the $40 call expiring Friday that gives holders the right to buy Affirm at $40 at a current going ...

One contract stood out for its volume, the $40 call expiring Friday that gives holders the right to buy Affirm at $40 at a current going ...

24

6

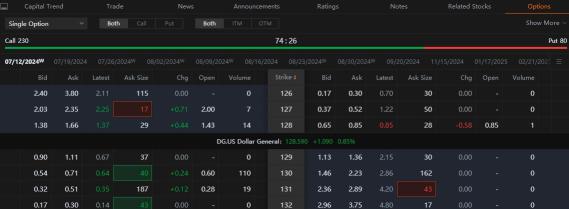

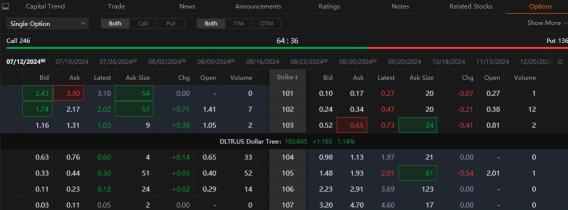

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings.

As we reach the middle of the second quarter earnings season, the $S&P 500 Index (.SPX.US)$ companies are showing mixed results. More companies than usual are r...

As we reach the middle of the second quarter earnings season, the $S&P 500 Index (.SPX.US)$ companies are showing mixed results. More companies than usual are r...

+3

23

4

$Tesla (TSLA.US)$

Ok, I'm out, prepare for next week, TGIF

Ok, I'm out, prepare for next week, TGIF

16

6

Edwar Dli : I'm super interested in joining! I'm an econ student and really excited to put what I've learned into practice in the options market. I've done some options trading already. I haven't made any money yet, but I've learned a lot so far

squirrel in my pants : I'm an options trading enthusiast, and I've been actively trading options for the past three months. Super excited about this opportunity to share my trading journey! I've got a lot of (loss) experience with different strategies and love discussing and learn risk management techniques. Looking forward to possibly joining the interview and earn the rewards!

Rational Exuberance : I’ve taken some options and derivatives courses during college, but the market in real life is far more complex than on the books. Very excited about this event, hope I can get picked for the interview to discuss my experience about options trading!![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Aly Sull : I’ve been trading options for about a year. I really like the selling of options to make passive income with lower risk with out of the money options

New93 : I started trading options on moomoo this year. been selling out of the money naked put options on moomoo every week. so far it's a steady weekly income. if the market tanks you can simply roll your options to next week.

I traded options for years previously on many other platforms such as webull, first trade and e trade.

View more comments...