Posts

News

Latest

Hot

The Japanese anime industry is increasingly catching the attention of investors worldwide. In 2023, the Japan anime market was valued at USD 12.72 billion and is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. This steady rise is driven by global demand, digital distribution advances, and the flourishing otaku culture, which remains the backbone of anime’s sustained...

11

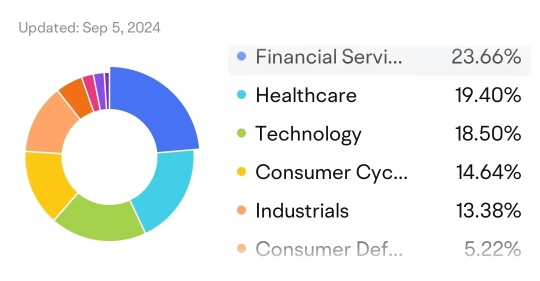

Among the three major U.S. stock indices, the $Dow Jones Industrial Average (.DJI.US)$ often gets overshadowed by the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ . However, since July, the Dow has not only outpaced these two indices but also reached an all-time high on August 30.

This shift suggests that funds might be moving out of tech stocks and into traditional industries.

Considering this trend could continue, it may be a good tim...

This shift suggests that funds might be moving out of tech stocks and into traditional industries.

Considering this trend could continue, it may be a good tim...

+3

408

181

Market comments given to media today 9.20am Wednesday, September 11, 2024

The tech rally and buy-the-dip trend continued for a second day, with the Nasdaq gaining 0.8% and the S&P 500 rising 0.5%, though both indices stopped short of breaking through key levels as caution set in. It was for a couple key reasons. The market's hesitation to push past these levels is symbolic, as investors await the Trump-Harris inaugural debate and fresh US inflation rep...

The tech rally and buy-the-dip trend continued for a second day, with the Nasdaq gaining 0.8% and the S&P 500 rising 0.5%, though both indices stopped short of breaking through key levels as caution set in. It was for a couple key reasons. The market's hesitation to push past these levels is symbolic, as investors await the Trump-Harris inaugural debate and fresh US inflation rep...

13

1

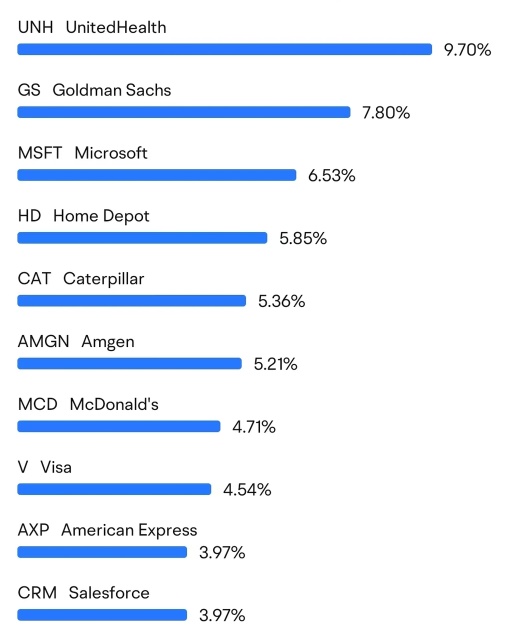

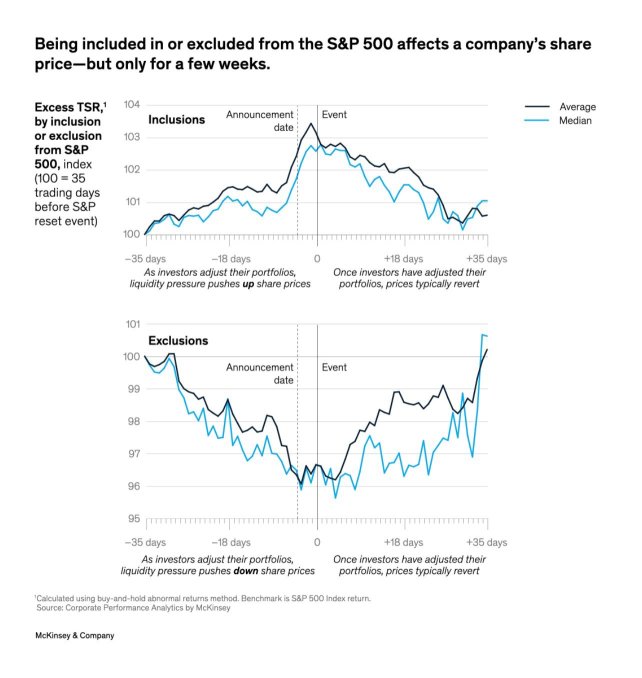

Columns Time to lock in profits $PLTR

So, Palantir getting added to the S&P500 is definitely a good sign for the long term, and I’m bullish on where it's headed. But the chart below is a good reminder of what can happen right after inclusion. We've seen companies like Tesla and Airbnb drop right after joining the index, and that could happen here too.

For long-term holders like me, I'm sticking with it. But if you're a trader, it might be worth locking in some profits before the stock sees any short-term...

For long-term holders like me, I'm sticking with it. But if you're a trader, it might be worth locking in some profits before the stock sees any short-term...

8

4

Alright, folks, let’s talk about Jerome Powell and the Fed. Apparently, Powell's out here like the DJ at the worst party ever, deciding whether to crank up the volume or turn it down a notch. And by "volume," I mean interest rates—yeah, the thing that makes your credit card feel like it’s trying to kill you.

So, the big news: they’re *probably* gonna cut rates by a quarter-point on September 18. But after that? Who...

So, the big news: they’re *probably* gonna cut rates by a quarter-point on September 18. But after that? Who...

8

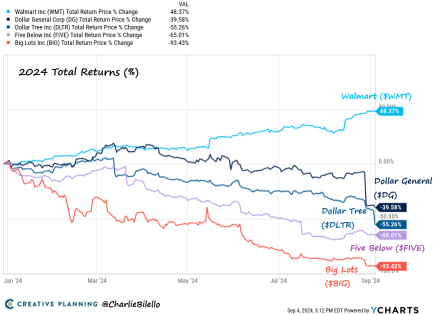

Columns 2024 Total Returns...

Walmart $Walmart (WMT.US)$ : +48%

Dollar General $Dollar General (DG.US)$ : -40%

Dollar Tree $Dollar Tree (DLTR.US)$ : -55%

Five Below $Five Below (FIVE.US)$ : -65%

Big Lots $Big Lots (BIG.US)$ : -93%

There could be several reasons for this divergence:

Walmart’s Strong Market Position: Walmart likely benefited from its broad customer base, robust supply chain, and ability to adapt to consumer needs in uncertain economic times. It also offers a variety of product ranges, attractin...

Dollar General $Dollar General (DG.US)$ : -40%

Dollar Tree $Dollar Tree (DLTR.US)$ : -55%

Five Below $Five Below (FIVE.US)$ : -65%

Big Lots $Big Lots (BIG.US)$ : -93%

There could be several reasons for this divergence:

Walmart’s Strong Market Position: Walmart likely benefited from its broad customer base, robust supply chain, and ability to adapt to consumer needs in uncertain economic times. It also offers a variety of product ranges, attractin...

4

1

• Current RPO +10% Y/Y to $26.5B.

• Revenue +9% Y/Y to $9.3B ($100M beat).

• Operating margin 19% (+2pp Y/Y).

• Non-GAAP EPS $2.56 ($0.20 beat).

FY25 guidance (unchanged):

• Revenue +9% Y/Y to $38B.

• Operating margin 20%.

$Salesforce (CRM.US)$

• Revenue +9% Y/Y to $9.3B ($100M beat).

• Operating margin 19% (+2pp Y/Y).

• Non-GAAP EPS $2.56 ($0.20 beat).

FY25 guidance (unchanged):

• Revenue +9% Y/Y to $38B.

• Operating margin 20%.

$Salesforce (CRM.US)$

16

$Vision Marine Technologies (VMAR.US)$ Stock Price is gaining momentum, it recorded a new ATL tonight before rising 83% in a few minutes and then falling back to normal. This shows that the price action has to go up and cross the famous gap ^^ Let's remember that the price rose to $4.65 and that the gap is between $4.72 and $5.25. Volatility is high, the price can fluctuate a lot... The Borrow Fee has not moved tonight and this morning.... There are...

6