Posts

News

Latest

Hot

The market fell Tuesday after consumer and communications earnings came in mixed. Investors awaiting $Tesla (TSLA.US)$ earnings Wednesday to see if indexes keep growing to all-time highs.

After 4 pm ET, the $S&P 500 Index (.SPX.US)$ fell 0.05%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.02%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.17%.

MACRO

Senior Federal Reserve official Mary Daly said. Economic growth and the labor ma...

After 4 pm ET, the $S&P 500 Index (.SPX.US)$ fell 0.05%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.02%, and the $Nasdaq Composite Index (.IXIC.US)$ climbed 0.17%.

MACRO

Senior Federal Reserve official Mary Daly said. Economic growth and the labor ma...

39

6

There are lots of people predicting the market crash to happen. However, I don’t think market correction will happen before the US Presidential election. In my opinion there are probably another 4% to 5% upside for the stock markets as we progress into the election. Gold and silver both are also trading at its peak. precious metals may trade side ways for now with little bit of upsides and eventually all markets will have its overdue corrections downwards together in...

19

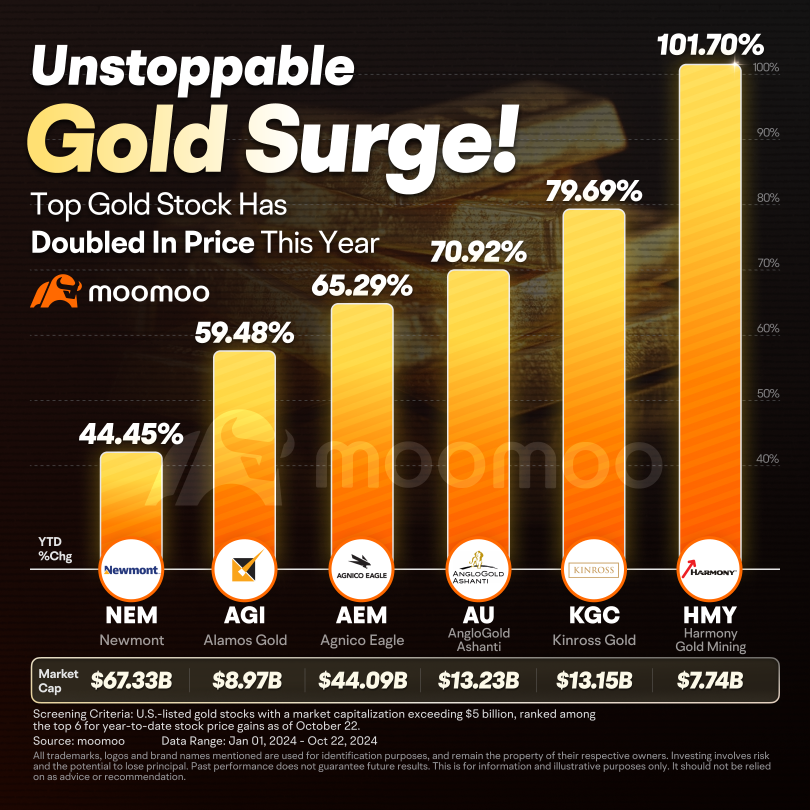

In 2024, gold has undoubtedly emerged as one of the standout global asset classes, second only to $Bitcoin (BTC.CC)$. This impressive performance, with $Gold Futures(DEC4) (GCmain.US)$ soaring by 30% year-to-date, surpasses the approximately 20% gains of both the $Nasdaq Composite Index (.IXIC.US)$ and the $S&P 500 Index (.SPX.US)$. Several factors have fueled this surge, including robust demand from central banks, frequent geopoli...

7

4

The price of gold price is scaling to new all time highs with a swag of reasons all coming together to suggest more gains are ahead. But this week Gold moved up as debt concerns rose. Global debt is now US $300 trillion - that’s 3.3 times greater than world is making in income (known as GDP).

Factors supporting gold

– And concerns are concerns are...

Factors supporting gold

– And concerns are concerns are...

From YouTube

10

1

Introduction

To say that the 2024 US presidential election circuit has been nothing short of unpredictable would be an understatement. Society has never been more divided on wide ranging topics from presidential candidates to economic policies. Hollywood stars and famous figures are also starting to take sides, staking their reputation and fans. With just 2 weeks to go, most opinion polls' margins are razor thin and by any indicatio...

To say that the 2024 US presidential election circuit has been nothing short of unpredictable would be an understatement. Society has never been more divided on wide ranging topics from presidential candidates to economic policies. Hollywood stars and famous figures are also starting to take sides, staking their reputation and fans. With just 2 weeks to go, most opinion polls' margins are razor thin and by any indicatio...

9

1

$NVIDIA (NVDA.US)$ After the Fed cut interest rates by 50BP:

Bonds have fallen sharply, and the long-term has fallen endlessly

The US dollar index has risen sharply

Gold rallied

This trend is very abnormal, and in terms of correlation, the decline of long-term US bonds is equivalent to the rise of long-term real interest rates, and the US dollar is strongly negatively correlated with gold. In this case, gold has rallied against all these negative factors.

Obviously, there is only one reasonable e...

Bonds have fallen sharply, and the long-term has fallen endlessly

The US dollar index has risen sharply

Gold rallied

This trend is very abnormal, and in terms of correlation, the decline of long-term US bonds is equivalent to the rise of long-term real interest rates, and the US dollar is strongly negatively correlated with gold. In this case, gold has rallied against all these negative factors.

Obviously, there is only one reasonable e...

11

6

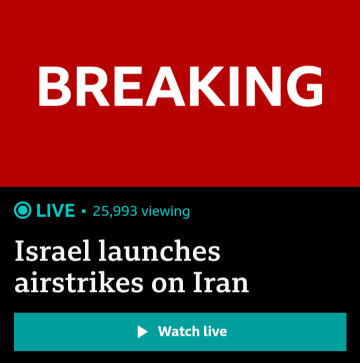

$SPDR S&P 500 ETF (SPY.US)$ Unfortunately I don't think this will effect oil , it might shake the markets a little bit not much effect .. I also think the markets already priced in this attack !

3

4

$BGF World Gold Fund (LU0368265764.MF)$

Bought a bit to diversify, quite ok fund.

Bought a bit to diversify, quite ok fund.

5

7

Here's the overview:

▶ George H.W. Bush (1989-1993), gold prices fell by 19%, reflecting post-Cold War optimism and economic expansion.

▶ Bill Clinton's era (1993-2001) continued this trend with a further 20% drop, as markets embraced globalisation and stock market booms.

▶ The major inflection point came with George W. Bush (2001-2009), where gold prices soared by 215%, driven by geopolitical tensions, 9/11, and the 2008 GFC.

▶ Barack ...

▶ George H.W. Bush (1989-1993), gold prices fell by 19%, reflecting post-Cold War optimism and economic expansion.

▶ Bill Clinton's era (1993-2001) continued this trend with a further 20% drop, as markets embraced globalisation and stock market booms.

▶ The major inflection point came with George W. Bush (2001-2009), where gold prices soared by 215%, driven by geopolitical tensions, 9/11, and the 2008 GFC.

▶ Barack ...

6

There are the twice a year IMF Meetings that will last from Monday through Saturday in Washington, DC. Leaders from the IMF and the World Bank will be there.

I wouldn't get too concerned about this, though, as these groups have a long history of providing very little in the way of value, while often making inaccurate projections. It's what they're good at, unfortunately.

What is of interest though, is the BRICS Summit. The group is meeting for three days this week in Kazan,...

I wouldn't get too concerned about this, though, as these groups have a long history of providing very little in the way of value, while often making inaccurate projections. It's what they're good at, unfortunately.

What is of interest though, is the BRICS Summit. The group is meeting for three days this week in Kazan,...

12

1

KietVo : Don’t let fake new hurting your investment

72436069 : NVDA and Avgo

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103675326 : something wrong with the report on TI how would hitting $4.1x become 100% below $4.2x or $4.5x

affable Blobfish_403 : The strength of protecting the market during the election is weak.

View more comments...