Latest

Hot

Has been going through a lot of hits and misses with swing trading and near expiry options. The overall gain is not substantial as negatives negate the positives.

But once in a blue moon, some relatively cheap and unsexy opportunities present itself, and these are the ones that came out on top.

What's your criteria for screening for such opportunities?

$Grab Holdings (GRAB.US)$

$GRAB 250117 4.50C$

But once in a blue moon, some relatively cheap and unsexy opportunities present itself, and these are the ones that came out on top.

What's your criteria for screening for such opportunities?

$Grab Holdings (GRAB.US)$

$GRAB 250117 4.50C$

Unsupported feature.

Please use the mobile app.

35

1

News Highlights

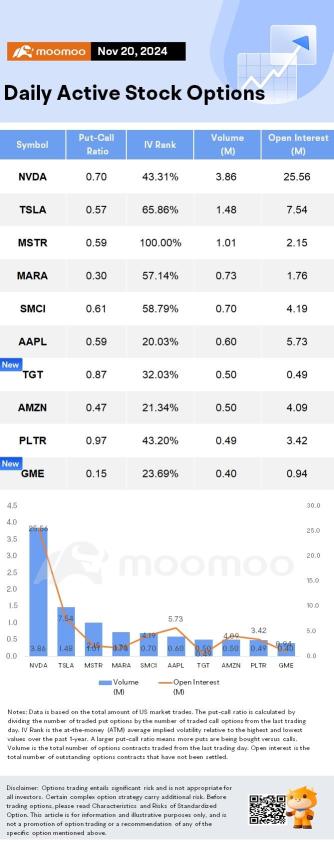

1. $NVIDIA (NVDA.US)$ once again posted a beat-and-raise quarter fueled by booming artificial-intelligence demand, but its stock was down 2% in Wednesday's extended session. Wall Street may be taking issue with two factors.

One is that the company isn't topping expectations with its guidance by the same magnitude as before. Nvidia's $37.5 billion revenue forecast for the January quarter toppe...

1. $NVIDIA (NVDA.US)$ once again posted a beat-and-raise quarter fueled by booming artificial-intelligence demand, but its stock was down 2% in Wednesday's extended session. Wall Street may be taking issue with two factors.

One is that the company isn't topping expectations with its guidance by the same magnitude as before. Nvidia's $37.5 billion revenue forecast for the January quarter toppe...

+2

28

4

$Mobileye Global (MBLY.US)$ Double bottom. Cup and handle in the making to break the resistance at around 17.35?

Look out for possible deal announcements.

Sold calls at 20 expiring at year end. Will not regret if called away, even if because of new deal announcements.

This thing is likely to recover a lot in 2025 and beyond, but is extremely volatile.

Look out for possible deal announcements.

Sold calls at 20 expiring at year end. Will not regret if called away, even if because of new deal announcements.

This thing is likely to recover a lot in 2025 and beyond, but is extremely volatile.

5

moomoo you make good money today in your stock that very good

When the market gets crazy, there are actually plenty of trading opportunities, but whether to take that risk is up to you to decide. There's a strategy called Scalpin that sounds like it can make you big money easily, but those kinds of deals don't come every day!

Why use this strategy?![]()

(1) You think the market's gonna make a big move, so you want to use a low-cost (or even profitable) way to wait for that big move a...

Why use this strategy?

(1) You think the market's gonna make a big move, so you want to use a low-cost (or even profitable) way to wait for that big move a...

+6

39

3

Got lucky with this one and caught a good rally on $Rivian Automotive (RIVN.US)$, couldve made more if i had bought call options at the start if the day and sold mid day for maximum profit but decided to take a more careful approach by watching price action during the first 2 hours then used bollinger bands and fib retracements on a 1m chart to find a good entry - ensuring that i did not hold a contract for more than hour at a time thus reducing exposure to volatility and also ke...

1

$TENCENT (00700.HK)$ For your info Tencent trading in US last night is us50. 13 =hk390. How come today nobody sell at hk390 and now it's hk410, this prove that US is shorting Tencent to sabotage China economy. It's a financial war between US and China all foreign funds talk down on China stock market yet the shanghai market continue to go up with govt support.

8

3

News Highlights

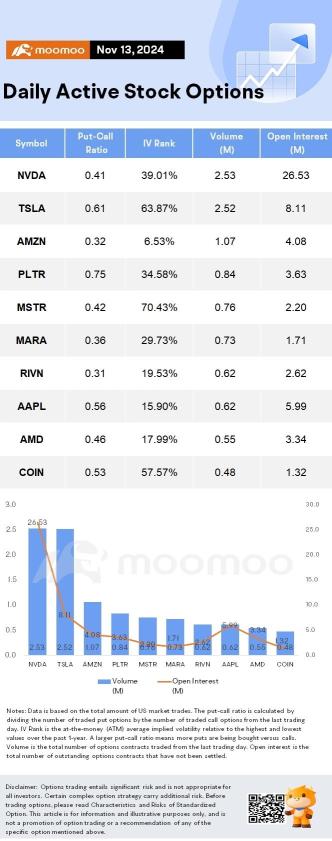

1. $Rivian Automotive (RIVN.US)$'s shares surged 13%, with the most traded calls are contracts of $11 strike price that expire on Nov. 15. The total volume reaches 29,730 with an open interest of 16,456.

The company is getting more cash from Volkswagen, sending shares of the electric-vehicle company higher early Wednesday. VW and Rivian agreed to a partnership in June that could provide the EV start...

1. $Rivian Automotive (RIVN.US)$'s shares surged 13%, with the most traded calls are contracts of $11 strike price that expire on Nov. 15. The total volume reaches 29,730 with an open interest of 16,456.

The company is getting more cash from Volkswagen, sending shares of the electric-vehicle company higher early Wednesday. VW and Rivian agreed to a partnership in June that could provide the EV start...

+1

26

3

if you understand theta and time-value erosion curve advantage, you would understand option strategy is a different ways.

i sold the put on 11-nov for META ( reasoning : 4hr chart , strong near term support , 200ma , rsi 50 means consolidating , my put strike is at the blue line. Delta 0.22 , weakest when market open last night)

I just need it to either consolidate or stay above 545 before 13 december’24.

#META #option #qqq #stock #mo...

i sold the put on 11-nov for META ( reasoning : 4hr chart , strong near term support , 200ma , rsi 50 means consolidating , my put strike is at the blue line. Delta 0.22 , weakest when market open last night)

I just need it to either consolidate or stay above 545 before 13 december’24.

#META #option #qqq #stock #mo...

7

9

cheers on the trade

cheers on the trade

iWash : Good job