Latest

Hot

On October 18, a regulatory document revealed that the U.S. Securities and Exchange Commission (SEC) had "accelerated approval" for options linked to three Bitcoin ETFs: $Fidelity Wise Origin Bitcoin Fund (FBTC.US)$ , $ARK 21Shares Bitcoin ETF (ARKB.US)$ , and $Grayscale Bitcoin Trust (GBTC.US)$. Before this, the SEC had already approved options trading for IBIT.

The exchanges will implement conservative position limits of 25,000 contracts on the same side ...

The exchanges will implement conservative position limits of 25,000 contracts on the same side ...

+1

189

80

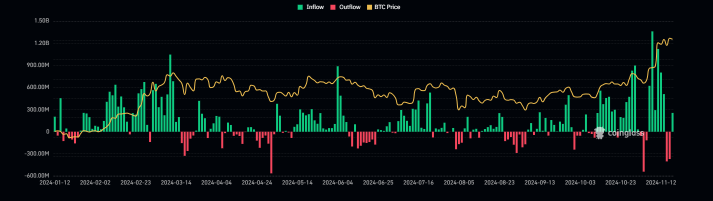

During the trading session on November 12th, Bitcoin $Bitcoin (BTC.CC)$ broke through the 93,000-point mark, hitting a new all-time high. It was just a step away from the highly anticipated 100,000-point milestone. However, since then, Bitcoin seems to have entered a "correction period". As of the latest time, Bitcoin is hovering around the 88,000 - 89,000 point range.

Will Bitcoin be able to break throug...

Will Bitcoin be able to break throug...

+7

7

2

$Bitcoin (BTC.CC)$ just got a serious upgrade. Options trading for BlackRock’s $iShares Bitcoin Trust (IBIT.US)$ is live. Finally, crypto gets the Wall Street respect it deserves! Who’s ready to ride this wave? 🌊 #BitcoinOptions

5

2

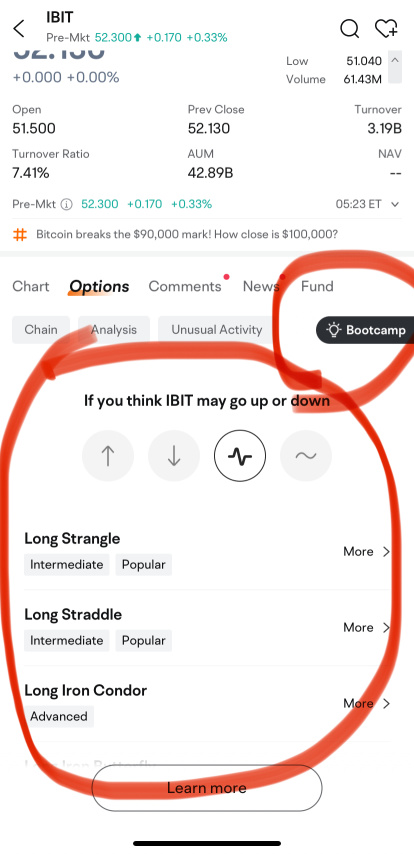

The SEC’s approval of options trading on $iShares Bitcoin Trust (IBIT.US)$ is more than just a headline—it’s a goldmine of opportunity for savvy investors. With Bitcoin's legendary volatility now married to the precision of options, we can play the game smarter, not riskier. Let’s explore some standout strategies in a fun and engaging way.

1. Selling Covered Calls: Turn Your ETF into a Payday

Got $iShares Bitcoin Trust (IBIT.US)$ shares or $Bitcoin (BTC.CC)$ sitting i...

1. Selling Covered Calls: Turn Your ETF into a Payday

Got $iShares Bitcoin Trust (IBIT.US)$ shares or $Bitcoin (BTC.CC)$ sitting i...

11

1

$Bitcoin (BTC.CC)$

🔹 The SEC has approved options trading for BlackRock's iSharesBitcoin ETF ( $iShares Bitcoin Trust (IBIT.US)$ ).

🔹 These options allow traders to hedge and speculate on Bitcoin price movements.

🔹 Strict regulations include a 25,000-contract limit to ensure market stability.

🔹 Potential effects? Increased liquidity, reduced market manipulation, and broader adoption of Bitcoin ETFs

🔹 The SEC has approved options trading for BlackRock's iSharesBitcoin ETF ( $iShares Bitcoin Trust (IBIT.US)$ ).

🔹 These options allow traders to hedge and speculate on Bitcoin price movements.

🔹 Strict regulations include a 25,000-contract limit to ensure market stability.

🔹 Potential effects? Increased liquidity, reduced market manipulation, and broader adoption of Bitcoin ETFs

5

Wow, waiting long time for this.![]()

![]()

![]()

$Blackrock (BLK.US)$ ’s Bitcoin ETF options are a game-changer. $iShares Bitcoin Trust (IBIT.US)$ More tools for hedging, better liquidity, and finally, some legit respect for $Bitcoin (BTC.CC)$ . Let's gooooo!![]()

![]()

![]()

![]()

$Grayscale Bitcoin Trust (GBTC.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Bitwise Bitcoin ETF (BITB.US)$

$Blackrock (BLK.US)$ ’s Bitcoin ETF options are a game-changer. $iShares Bitcoin Trust (IBIT.US)$ More tools for hedging, better liquidity, and finally, some legit respect for $Bitcoin (BTC.CC)$ . Let's gooooo!

$Grayscale Bitcoin Trust (GBTC.US)$ $ARK 21Shares Bitcoin ETF (ARKB.US)$ $Bitwise Bitcoin ETF (BITB.US)$

4

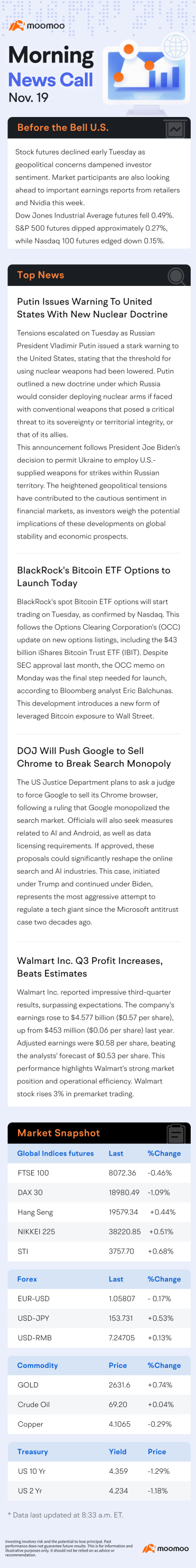

📌 The SEC has greenlit options trading on multiple Bitcoin ETFs, including BlackRock's $iShares Bitcoin Trust (IBIT.US)$.

📌 Why this matters:

1️⃣ Adds flexibility for institutional and retail investors.

2️⃣ New tools for hedging Bitcoin price risks.

3️⃣ Enhances market transparency with strict oversight.

📌 What’s next?

Broader adoption of crypto investment products in traditional finance

Crypto Briefing

Crypto Briefing

$Bitcoin (BTC.CC)$

📌 Why this matters:

1️⃣ Adds flexibility for institutional and retail investors.

2️⃣ New tools for hedging Bitcoin price risks.

3️⃣ Enhances market transparency with strict oversight.

📌 What’s next?

Broader adoption of crypto investment products in traditional finance

Crypto Briefing

Crypto Briefing

$Bitcoin (BTC.CC)$

3

What happened?

The SEC approved options trading for spot $Bitcoin (BTC.CC)$ ETFs like $iShares Bitcoin Trust (IBIT.US)$(go live today!), $ARK 21Shares Bitcoin ETF (ARKB.US)$, $Grayscale Bitcoin Trust (GBTC.US)$, $Fidelity Wise Origin Bitcoin Fund (FBTC.US)$, $Bitwise Bitcoin ETF (BITB.US)$

Why it matters:

More tools for managing Bitcoin exposure.

Increased liquidity for ETFs.

Could attract institutional investors to crypto markets.

Bottom line:

This could sta...

The SEC approved options trading for spot $Bitcoin (BTC.CC)$ ETFs like $iShares Bitcoin Trust (IBIT.US)$(go live today!), $ARK 21Shares Bitcoin ETF (ARKB.US)$, $Grayscale Bitcoin Trust (GBTC.US)$, $Fidelity Wise Origin Bitcoin Fund (FBTC.US)$, $Bitwise Bitcoin ETF (BITB.US)$

Why it matters:

More tools for managing Bitcoin exposure.

Increased liquidity for ETFs.

Could attract institutional investors to crypto markets.

Bottom line:

This could sta...

3

BTC hits 90K how close is it to 100K

BTC hits 90K how close is it to 100K

103799622 : good

Willi Will62 : Yes, the market will surge again.

Boganji4 : pls help me

PapaBull :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

105264697 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...