Posts

News

Latest

Hot

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ oversold. long term yield spike despite rate cut?

$Tesla (TSLA.US)$ The Federal Reserve's latest meeting has resulted in a sharp decline in both the stock and Treasury markets, while the dollar has surged to its highest level since 2022.

Although the market had anticipated this meeting, the hawkish tone exceeded expectations, underscored by four key points:

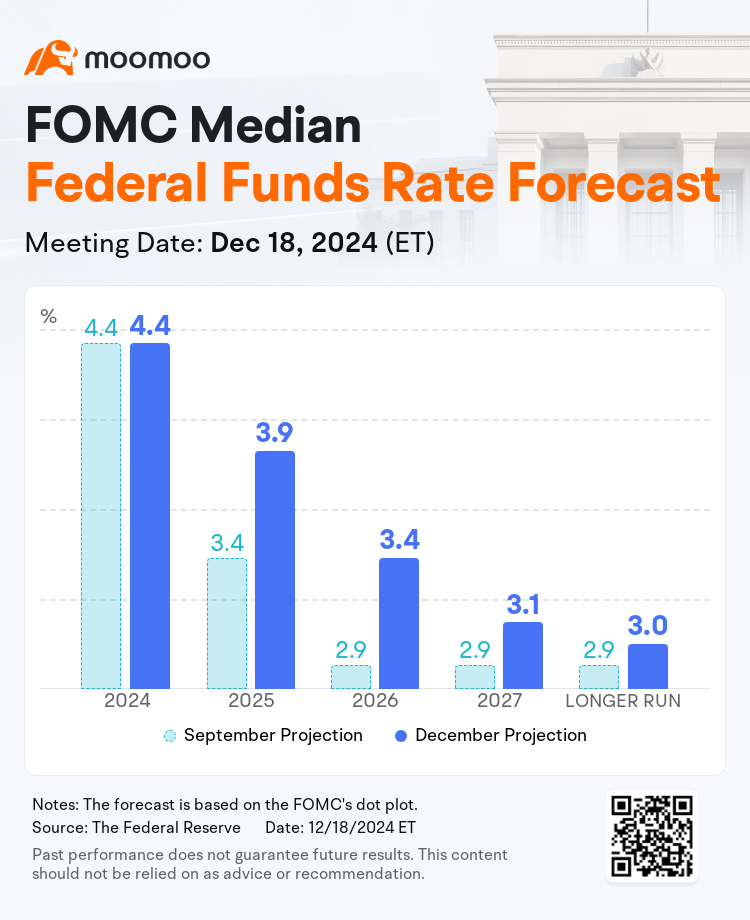

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to Inflation

4、Opposition from Several Committee Members...

Although the market had anticipated this meeting, the hawkish tone exceeded expectations, underscored by four key points:

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to Inflation

4、Opposition from Several Committee Members...

The Federal Reserve's latest meeting has resulted in a sharp decline in both the stock and Treasury markets, while the dollar has surged to its highest level since 2022. Although the market had anticipated this meeting, the hawkish tone exceeded expectations, underscored by four key points:

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to In...

1、Significant Reduction in Rate Cut Projections

2、Notable Increase in 2024 PCE Inflation Forecasts

3、Clear Indication of Upside Risks to In...

38

4

31

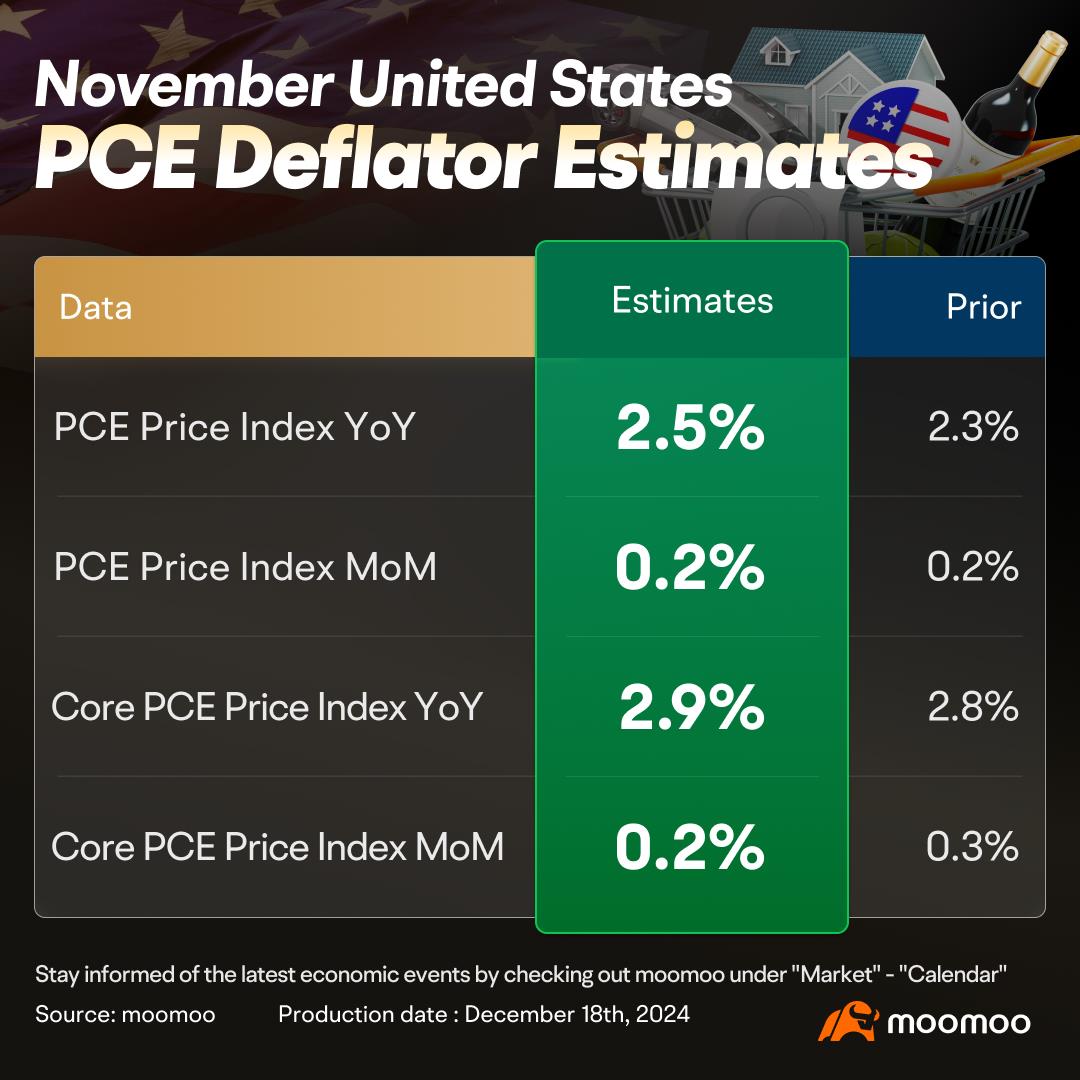

The Federal Reserve's most closely monitored inflation metric, the Personal Consumption Expenditures Price Index (PCE), is set to release its November data on Friday. However, the results are expected to have minimal impact on the market, as this figure will be released after Wednesday's Fed meeting, which has increasingly shifted its focus toward the future trajectory of the PCE.

According to Bloomberg economists, the annua...

According to Bloomberg economists, the annua...

27

6

9