Latest

Hot

Co-Wise: moomoo tutorial contest part 3 "How do you set the stop loss point / profit target?" had closed up perfectly. Thanks for all your participation.![]()

Here comes the reward for your hard work: 10 extraordinary mooers will get a stock, outstanding posts will be rewarded with 888 points, and other posts with a minimum of 30 words will be rewarded with 88 points.

Part Ⅰ: Read and learn from the mentors

![]() Congratulations to all the winners! Now, let’s get to their quality posts. The selected excerpts are the core ideas of loss-stopping and profit-taking. Don't forget to click the title and read the full content to learn more.

Congratulations to all the winners! Now, let’s get to their quality posts. The selected excerpts are the core ideas of loss-stopping and profit-taking. Don't forget to click the title and read the full content to learn more.

1. @cowabanga Stop loss/profit target

It depends on which school of thoughts you choose. The market is driven by demand and supply, and the stronger force will win. The meaning of having a stop-loss is to avoid the falling knife and prevent a greater loss in our position by taking a small loss hence it wouldn't be sensible to take another position below the stop loss.

2. @nigedernigeder Confidence, optimism and critical evaluation on your portfolio

Super investor's secret recipe is optimism, confidence, and critical thinking spirit. If you are seeking excitement in investment, better go genting liao lo; quoting Paul Samuel here: investing should be more like watching paint dry or grass grow, if you want excitement, take 800 and go to Las Vegas.

3. @Powerhouse Stop the pain, take the happiness

For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. There is a need to react to stop loss or take profit. Nevertheless, determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult.

4. @treydongui The School of Hard Knocks

After studying the futures and margin markets a while, I've learned that openly giving up your stop loss and take profit position might not always be a good idea! I prefer to use a a trailing stop loss when in profits (I would usually prefer to take some profit before doing this).

5. @NANA123 Engrave the stop loss into your DNA

Almost all losses are related to two points: "not seeing the trend and not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

6. @Qwinbie How do you set the stop loss point / profit target?

Main activities I do are to read financial statements, study the ratios, see the cashflow, and see the past years performance. Try not to spend the day worrying about the “point” and the “target”. Stop Loss Point and Profit Target strategy is more for the speculators, who has a short time frame and expect to beat the market in shorter time frame.

7. @Syuee Win the War, Not the Battle

The Stop Loss and Profit Target is extremely easy as long as you have significant self-control. The only reason to not stop is purely driven by emotions. Knowing when to cut your losses literally means overriding the irrational part of your brain.

8. @Moolin Disregard the “what if” and focus on target prices

Setting a stop loss price helps us make a decision that is not influenced by our emotions triggered by the price movement. A good rule of thumb is to let go once the stock price has dipped more than 10% below your purchase price.

9. @战神鑫爷 How do your set the stop lost point / profit target?

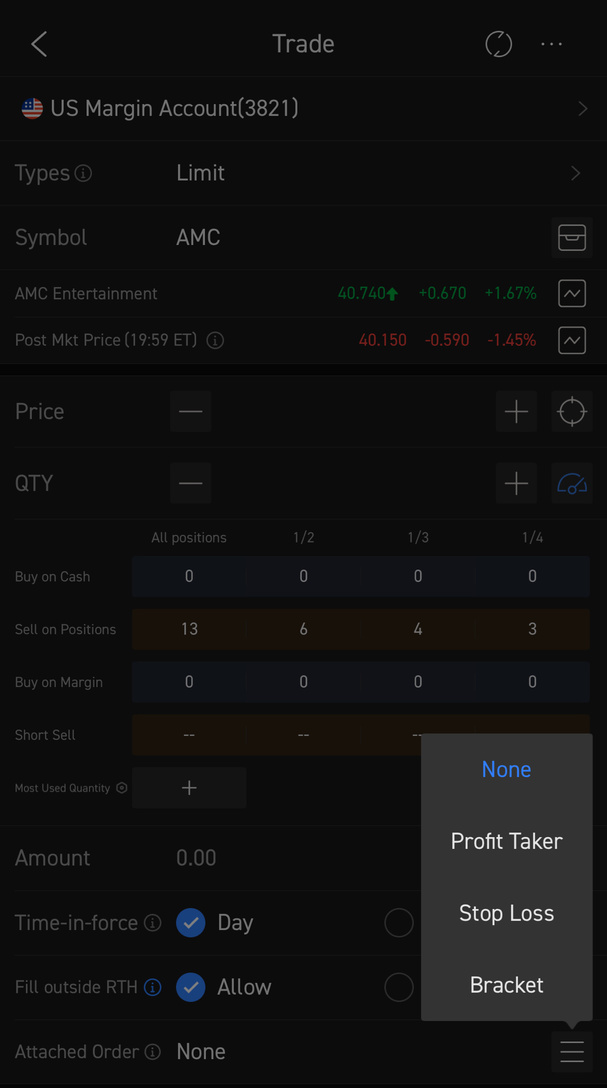

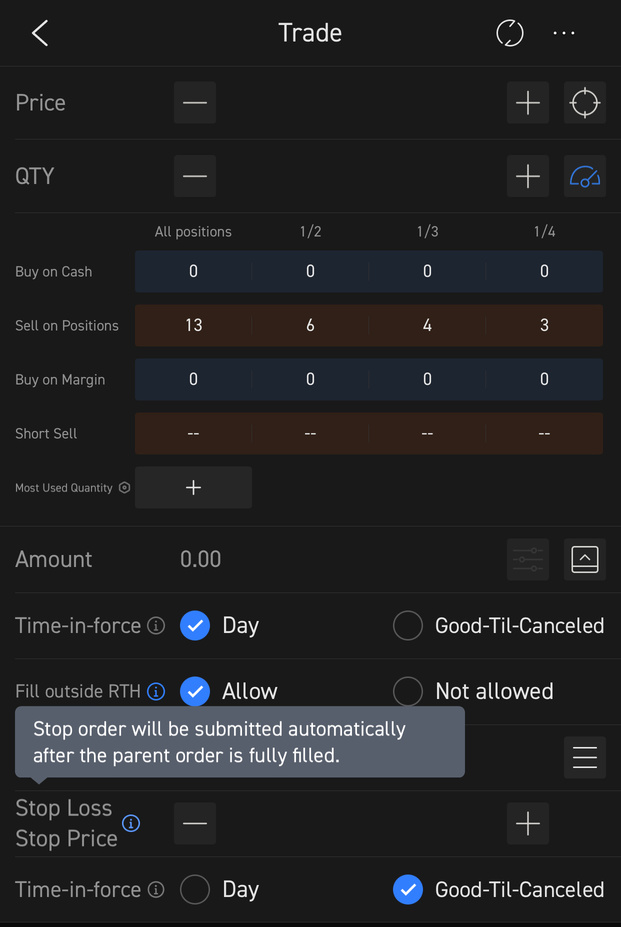

The pictures below show how we can use the App to do a stop loss setting. Failure is the opportunity to begin again more intelligently. If you are in a hole, stop digging.

10. @GT1982 When to exit from a position

Generally speaking, stop loss and position sizing are inter related. If I may add, try to limit the stop loss to maximum 1% of the portfolio size. It also depends on the trend.

*You will receive your rewards within 10 working days.

Part Ⅱ: Voting for “Mentor Moo” Title

Now, we want to invite you to vote for your favorite mooers who wrote for the theme.![]() The selection rules will take into account the following factors:

The selection rules will take into account the following factors:

1. logical and practical content

2. typesetting and pictures

3. interaction with other mooers

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!![]() Let’s review their wonderful posts.

Let’s review their wonderful posts.

![]() @cowabanga Stop loss / profit target

@cowabanga Stop loss / profit target

![]() @Powerhouse Stop the pain, take the happiness

@Powerhouse Stop the pain, take the happiness

![]() @Syuee Win the War, Not the Battle

@Syuee Win the War, Not the Battle

![]() @Moolin Disregard the “what if” and focus on target prices

@Moolin Disregard the “what if” and focus on target prices

![]() @Qwinbie How do you set the stop loss point / profit target ?

@Qwinbie How do you set the stop loss point / profit target ?

Please support your favorite contestant, your vote means a lot to him/her.![]() Your encouragement and appreciation are great motivation for him/her to share in the Community.

Your encouragement and appreciation are great motivation for him/her to share in the Community. ![]()

![]()

![]() Tell us how his/her points influence you on loss-stopping/profit-taking and what you gained from this topic in the comments section.

Tell us how his/her points influence you on loss-stopping/profit-taking and what you gained from this topic in the comments section.

In three days, we will have our new “Mentor Moo”. Let’s see who will get the support of the majority and gain the glory.![]() If you want to be honored too, participate in the next topic! Looking forward to your thoughts.

If you want to be honored too, participate in the next topic! Looking forward to your thoughts.![]()

After reading these topflight posts, you may feel fulfilling and want to view more, please click on the topic again: How do you set the stop loss point / profit target? Share your thoughts and join the discussion.![]() Don't forget to leave your comment and tell mooers about what you have learned. They will be happy to get your feedback!

Don't forget to leave your comment and tell mooers about what you have learned. They will be happy to get your feedback! ![]()

*We found some people write their posts by copying recently. Plagiarism or cheating is not acceptable on moomoo in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

Here comes the reward for your hard work: 10 extraordinary mooers will get a stock, outstanding posts will be rewarded with 888 points, and other posts with a minimum of 30 words will be rewarded with 88 points.

Part Ⅰ: Read and learn from the mentors

1. @cowabanga Stop loss/profit target

It depends on which school of thoughts you choose. The market is driven by demand and supply, and the stronger force will win. The meaning of having a stop-loss is to avoid the falling knife and prevent a greater loss in our position by taking a small loss hence it wouldn't be sensible to take another position below the stop loss.

2. @nigedernigeder Confidence, optimism and critical evaluation on your portfolio

Super investor's secret recipe is optimism, confidence, and critical thinking spirit. If you are seeking excitement in investment, better go genting liao lo; quoting Paul Samuel here: investing should be more like watching paint dry or grass grow, if you want excitement, take 800 and go to Las Vegas.

3. @Powerhouse Stop the pain, take the happiness

For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. There is a need to react to stop loss or take profit. Nevertheless, determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult.

4. @treydongui The School of Hard Knocks

After studying the futures and margin markets a while, I've learned that openly giving up your stop loss and take profit position might not always be a good idea! I prefer to use a a trailing stop loss when in profits (I would usually prefer to take some profit before doing this).

5. @NANA123 Engrave the stop loss into your DNA

Almost all losses are related to two points: "not seeing the trend and not holding the position." I think traders should write down the losses, analyze where they went wrong, and categorize them, then never go to that place.

6. @Qwinbie How do you set the stop loss point / profit target?

Main activities I do are to read financial statements, study the ratios, see the cashflow, and see the past years performance. Try not to spend the day worrying about the “point” and the “target”. Stop Loss Point and Profit Target strategy is more for the speculators, who has a short time frame and expect to beat the market in shorter time frame.

7. @Syuee Win the War, Not the Battle

The Stop Loss and Profit Target is extremely easy as long as you have significant self-control. The only reason to not stop is purely driven by emotions. Knowing when to cut your losses literally means overriding the irrational part of your brain.

8. @Moolin Disregard the “what if” and focus on target prices

Setting a stop loss price helps us make a decision that is not influenced by our emotions triggered by the price movement. A good rule of thumb is to let go once the stock price has dipped more than 10% below your purchase price.

9. @战神鑫爷 How do your set the stop lost point / profit target?

The pictures below show how we can use the App to do a stop loss setting. Failure is the opportunity to begin again more intelligently. If you are in a hole, stop digging.

10. @GT1982 When to exit from a position

Generally speaking, stop loss and position sizing are inter related. If I may add, try to limit the stop loss to maximum 1% of the portfolio size. It also depends on the trend.

*You will receive your rewards within 10 working days.

Part Ⅱ: Voting for “Mentor Moo” Title

Now, we want to invite you to vote for your favorite mooers who wrote for the theme.

1. logical and practical content

2. typesetting and pictures

3. interaction with other mooers

The one who gets the most votes at the end of the poll will win the "mentor moo" title. What a crowning honor!

Please support your favorite contestant, your vote means a lot to him/her.

In three days, we will have our new “Mentor Moo”. Let’s see who will get the support of the majority and gain the glory.

After reading these topflight posts, you may feel fulfilling and want to view more, please click on the topic again: How do you set the stop loss point / profit target? Share your thoughts and join the discussion.

*We found some people write their posts by copying recently. Plagiarism or cheating is not acceptable on moomoo in any kind of community activity. Please "Report" the post if you see any. Once confirmed, the user committed shall be disqualified from the activity.

+4

63

37

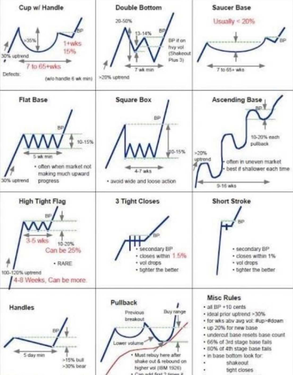

You know an uptrend consists of higher highs and lows.This means you can use the swing low to trail your stop loss because if the trend holds, it shouldn’t close below it.Here’s how to do it.

Identify the previous swing lowSet your trailing stop loss below the swing lowIf the price closes below it, exit the tradeAn example…

Pro Tip: The market tends to “hunt” stop losses below Support or swing low.To avoid it, set your stop loss 1 ATR below the market structure.

$Futu Holdings Ltd (FUTU.US)$

$AMC Entertainment (AMC.US)$

$GameStop (GME.US)$

$UP Fintech (TIGR.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$Meta Platforms (FB.US)$

$Moderna (MRNA.US)$

$Merck & Co (MRK.US)$

Identify the previous swing lowSet your trailing stop loss below the swing lowIf the price closes below it, exit the tradeAn example…

Pro Tip: The market tends to “hunt” stop losses below Support or swing low.To avoid it, set your stop loss 1 ATR below the market structure.

$Futu Holdings Ltd (FUTU.US)$

$AMC Entertainment (AMC.US)$

$GameStop (GME.US)$

$UP Fintech (TIGR.US)$

$Apple (AAPL.US)$

$Tesla (TSLA.US)$

$Meta Platforms (FB.US)$

$Moderna (MRNA.US)$

$Merck & Co (MRK.US)$

110

As a long term fundamental investor, the question of how to set the profit target or stop loss point is based mainly on my investment thesis for each of my stock investment $Alibaba (BABA.US)$, $Apple (AAPL.US)$, $Bank of America (BAC.US)$, $Microsoft (MSFT.US)$, $NVIDIA (NVDA.US)$ in my long term portfolio. Once the company fundamental changes, this will be the trigger point to take profit or stop loss. In terms of financials, a company showing slowing revenue or profit growth for consecutive quarters hint that the fundamentals may have deteriorated which could affect the intrinsic value of the stock. Another area to monitor will be the company's market share. If the market share is slipping due to more innovative products or better services offered by competitiors at more competitve prices, future challenges may lie ahead to boost the company's sales or earnings. A change in management will be a significant issue of concern, particularly so when unwise decisions are made, like in the case of the new management taking up excessive debt or venturing into questionable businesses. In general, substantial changes that contradict my investment thesis will be the determining factor for long term investors like myself to offload a portion of my holdings. As for now, I have not observed any fundamental changes that will affect the underlying value of the stocks in my portfolio and will continue to hold the stocks so long as they run high quality businesses at reasonable valuations.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

56

64

By cutting out “emotion” of the equation. The Stop Loss and Profit Target is extremely easy - as long as you have significant self control.

Whenever you trade, invest and everything in between, have a fixed, rational cut-off. Sell/stop the moment you hit that point. It is truly that easy.

E.g.

![]() An active trader : > 5% level

An active trader : > 5% level

![]() Long-term investor : 15-20% or more (depending on your risk appetite)

Long-term investor : 15-20% or more (depending on your risk appetite)

The only reason to not stop - is purely driven by emotions.

Knowing when to cut your losses literally means overriding the irrational part of your brain.![]()

Profit Target is equally easy. When I invest, I have a target in mind - if I exceed that special number, I will take out my profit which I wanted to make. And, let the profits run it’s course. Will it continue to soar to the Moon![]() ...? Awesome if it does, but no problem, I got what I wanted anyway.

...? Awesome if it does, but no problem, I got what I wanted anyway.

It's not about how to program an automated trading algorithm. The phrase is more about psychology. Traders are more likely to be tempted to realize profits earlier than it’s optimal or to hold onto losing stocks in the hope they bounce back. This has more to do with how people think than technical details. Don't overthink it.

A Profit Target or an Exit Strategy? YES, you do need to take profits eventually. While profit-taking should not be concluded by staring at your account's unrealized gains column, you ought to have some sense of where and when momentum's dried up or sentiment's changed. That's when you need to re-assess or get out.

I am up 200% on $NVIDIA (NVDA.US)$ stock.![]() Should I take profits?

Should I take profits?![]()

What’s my pick?![]() Should I go long, into 2022?

Should I go long, into 2022?![]() $NVIDIA (NVDA.US)$ seem to have a bright outlook and profits are really growing.

$NVIDIA (NVDA.US)$ seem to have a bright outlook and profits are really growing.

However, that’s how trend trading works in principle, and yes - I could hypothetically hold a profit forever (if the market stayed green forever). NO - cancel that; at some point, I would![]() to cash out and buy myself an island - maybe Tasmania… ( totally kidding, I don’t have that much Nvidia

to cash out and buy myself an island - maybe Tasmania… ( totally kidding, I don’t have that much Nvidia ![]() )

)

![]() Do remember, Stop Loss or Profit Target - It is not about winning every battle. It is about winning the War.

Do remember, Stop Loss or Profit Target - It is not about winning every battle. It is about winning the War.

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Hang Seng Index (800000.HK)$ $Apple (AAPL.US)$ $Starbucks (SBUX.US)$ $Fiverr International (FVRR.US)$ $QuidelOrtho (QDEL.US)$ $Tesla (TSLA.US)$ $American Express (AXP.US)$ $Paychex (PAYX.US)$ $Fortinet (FTNT.US)$ $Futu Holdings Ltd (FUTU.US)$ $Microsoft (MSFT.US)$ $Ford Motor (F.US)$ $Stitch Fix (SFIX.US)$ $Lennar Corp (LEN.US)$ $Salesforce (CRM.US)$

Whenever you trade, invest and everything in between, have a fixed, rational cut-off. Sell/stop the moment you hit that point. It is truly that easy.

E.g.

The only reason to not stop - is purely driven by emotions.

Knowing when to cut your losses literally means overriding the irrational part of your brain.

Profit Target is equally easy. When I invest, I have a target in mind - if I exceed that special number, I will take out my profit which I wanted to make. And, let the profits run it’s course. Will it continue to soar to the Moon

It's not about how to program an automated trading algorithm. The phrase is more about psychology. Traders are more likely to be tempted to realize profits earlier than it’s optimal or to hold onto losing stocks in the hope they bounce back. This has more to do with how people think than technical details. Don't overthink it.

A Profit Target or an Exit Strategy? YES, you do need to take profits eventually. While profit-taking should not be concluded by staring at your account's unrealized gains column, you ought to have some sense of where and when momentum's dried up or sentiment's changed. That's when you need to re-assess or get out.

I am up 200% on $NVIDIA (NVDA.US)$ stock.

What’s my pick?

However, that’s how trend trading works in principle, and yes - I could hypothetically hold a profit forever (if the market stayed green forever). NO - cancel that; at some point, I would

$Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Hang Seng Index (800000.HK)$ $Apple (AAPL.US)$ $Starbucks (SBUX.US)$ $Fiverr International (FVRR.US)$ $QuidelOrtho (QDEL.US)$ $Tesla (TSLA.US)$ $American Express (AXP.US)$ $Paychex (PAYX.US)$ $Fortinet (FTNT.US)$ $Futu Holdings Ltd (FUTU.US)$ $Microsoft (MSFT.US)$ $Ford Motor (F.US)$ $Stitch Fix (SFIX.US)$ $Lennar Corp (LEN.US)$ $Salesforce (CRM.US)$

58

24

Being punctual means only that your mistake will be made on time. People always say we need learn from our mistakes but in reality we need to know we are making a mistake in order to learn from it. By having experience we also tend to make new mistakes instead of old ones. There’s an old saying if we enjoy what we’re doing we’re probably wrong. But be not afraid to venture for the journey of one needs a first step to be made.

Below shows how we can use the app to do a stop lost setting.

Failure is the opportunity to begin again more intelligently. If you are in a hole, stop digging.

These are the things I always look into when doing tradings.

Yes true life experience from Ocugen stock , I learn my mistake from making a stop lost back then where I buy in at $8.9 and when it change hands the stock begins to drop in order to make a greater lost I decided to use stop lost to prevent further lost. But looking back now at the price of $10 I know I have made a wrong path it’s jus a two months wait before it actually went back up.

Buying a stock to trade really depends on your instincts if you really think it will grow and it’s the correct time to enter.

For profit taking, I believe some of us have notice the trend that whenever there’s a quarterly announcement for the company jus one week before, the price will tend to fall so that’s the day I would normally take my returns

Leave a like & comment if you like what I’ve written or share your thoughts if you think otherwise.

$AMC Entertainment (AMC.US)$

$Vinco Ventures (BBIG.US)$

$Globalstar (GSAT.US)$

$GameStop (GME.US)$

$Futu Holdings Ltd (FUTU.US)$

$Apple (AAPL.US)$

$Starbucks (SBUX.US)$

Below shows how we can use the app to do a stop lost setting.

Failure is the opportunity to begin again more intelligently. If you are in a hole, stop digging.

These are the things I always look into when doing tradings.

Yes true life experience from Ocugen stock , I learn my mistake from making a stop lost back then where I buy in at $8.9 and when it change hands the stock begins to drop in order to make a greater lost I decided to use stop lost to prevent further lost. But looking back now at the price of $10 I know I have made a wrong path it’s jus a two months wait before it actually went back up.

Buying a stock to trade really depends on your instincts if you really think it will grow and it’s the correct time to enter.

For profit taking, I believe some of us have notice the trend that whenever there’s a quarterly announcement for the company jus one week before, the price will tend to fall so that’s the day I would normally take my returns

Leave a like & comment if you like what I’ve written or share your thoughts if you think otherwise.

$AMC Entertainment (AMC.US)$

$Vinco Ventures (BBIG.US)$

$Globalstar (GSAT.US)$

$GameStop (GME.US)$

$Futu Holdings Ltd (FUTU.US)$

$Apple (AAPL.US)$

$Starbucks (SBUX.US)$

49

11

Columns When should you sell?

This column is inspired from reading a memo by OakTree's Capital Co-Founder Howard Marks on "Selling Out". I have listed down key learning points from his sharing. I hope that this sharing will benefit everyone in their journey in investing.

Starting Point: Buy Low Sell High

This is the most basic/common sense of the discussion. In our human instincts, we want to make money and the most easy way to do it is to buy it at $1 to sell it at $100. However, is it that easy to do?

...

Starting Point: Buy Low Sell High

This is the most basic/common sense of the discussion. In our human instincts, we want to make money and the most easy way to do it is to buy it at $1 to sell it at $100. However, is it that easy to do?

...

40

1

Rumor has it that the biggest market crash in history usually comes in October. Under such a terrifying risk, it is imperative to know when to take profit and when to stop loss. Last year might be the easiest one for all the investors to gain as the stock market went all the way up and showed no sign of stopping.

However, it's not always the case. The market is unpredictable for most of the time. Investors need to set a stop loss limit and a profit target for every si...

However, it's not always the case. The market is unpredictable for most of the time. Investors need to set a stop loss limit and a profit target for every si...

25

9

Know when to cut your losses! If your stock have been dropping a lot and do not show much sign of recovering, maybe it's time to sell it and invest these sum into something that is growing steadily. For instance, at the start of the year, I got $NIO Inc (NIO.US)$ for around $45 before it shot up to the peak of $66 until the China market crackdown occured. My slight profits became massive losses instantly. Many say to HODL due to the long term growth in the EV industry. However, after keeping for many months, I was still incurring much losses. One technique I used was to compare to its fellow competitor $XPeng (XPEV.US)$ to see if it was just the whole of China EV market or just NIO being a weak stock. After seeing how Xpeng slowly grew and even overtook NIO, I decided to cut my losses and got rid of NIO to reinvest in other growth stocks like Microsoft.

So, don't HODL if you know during that time of losses, you could be earning slight profits in other stocks!!!

So, don't HODL if you know during that time of losses, you could be earning slight profits in other stocks!!!

18

8

As a smaller and more prudent investor who is doing dollar averaging strategy now.

Main activities I do is to read financial statements, study the ratios, see the cashflow, see the past years performance. Not really spending the day worrying about the “point” and the “target”.

I stressed again that my strategy is based on an assumption that if I invest, the stock must be fundamentally sound. The financial reports must make sense, the ratio must be in the better positions.

Loss Point & Profit Target strategy does not really work well with dollar averaging strategy. Loss Point and Profit Target strategy is more for the speculators, who has a short time frame and expect to beat the market in shorter time frame. With expectation like bring some chips into casino. Expecting to come out of casino at the end of the day with more chips before exchanging and going back.

At the end of the day, I come into Moo Moo daily is not to find a position to take advantage of a buy or sell rush. If you wish to take position advantages then Loss Point and Profit Target is very important. You worry a lot about the best timing to buy and sell. If you do not get it, you feel very frustrated.

I had gone through that stage. Take position advantage without knowing the fundamental analysis indeed can help you make in a short spree but also can be a bad losing streak.

I personally think to if you want to invest time on Loss Point and Profit Target, casino is a better place to wack.

Enter stock market with basic financial fundamental knowledge. Know what the companies are doing, how much revenue they are making, how they are managing their cashflow, what are their debts. These are basics. That Everyone who want to come into Moo Moo need to know. There are a lot of free materials to learn, the ratios, how to read the reports, what to look out for.

Then when the basic skills are there, learn the charts. How the stock price move? The trend, the intersection points. Past days, months, years, whatever chart you like to read as a basic, maybe look at MAVOL & MACD trend lines. Once fundamentally you had analyzed that the company is performing ok, then start to read more about the technical charts. When to go in what is the best time to come out.

I think many who survive will tell you the same thing. i make not because I know how to set stop the loss point and how to set profit target. If the stock is good and consistent. Over a long period of time the stock price is moving up. Do stress yourself too much on set loss points or setting profit target.

Tomorrow I will come in and do my dollar averaging buying again.

I won’t want to convince myself my theory and strategy is wrong and coming daily to moo moo and set a proft target.

By the way, all the lessons for fundamental analysis and technical analysis learning materials are available at MooMoo. Please after reading my super long-winded sharing. Go and refresh what are all the ratio representing.

Good luck, My Moo Moo buddies!

Lets Moo Moo together!

![]()

Main activities I do is to read financial statements, study the ratios, see the cashflow, see the past years performance. Not really spending the day worrying about the “point” and the “target”.

I stressed again that my strategy is based on an assumption that if I invest, the stock must be fundamentally sound. The financial reports must make sense, the ratio must be in the better positions.

Loss Point & Profit Target strategy does not really work well with dollar averaging strategy. Loss Point and Profit Target strategy is more for the speculators, who has a short time frame and expect to beat the market in shorter time frame. With expectation like bring some chips into casino. Expecting to come out of casino at the end of the day with more chips before exchanging and going back.

At the end of the day, I come into Moo Moo daily is not to find a position to take advantage of a buy or sell rush. If you wish to take position advantages then Loss Point and Profit Target is very important. You worry a lot about the best timing to buy and sell. If you do not get it, you feel very frustrated.

I had gone through that stage. Take position advantage without knowing the fundamental analysis indeed can help you make in a short spree but also can be a bad losing streak.

I personally think to if you want to invest time on Loss Point and Profit Target, casino is a better place to wack.

Enter stock market with basic financial fundamental knowledge. Know what the companies are doing, how much revenue they are making, how they are managing their cashflow, what are their debts. These are basics. That Everyone who want to come into Moo Moo need to know. There are a lot of free materials to learn, the ratios, how to read the reports, what to look out for.

Then when the basic skills are there, learn the charts. How the stock price move? The trend, the intersection points. Past days, months, years, whatever chart you like to read as a basic, maybe look at MAVOL & MACD trend lines. Once fundamentally you had analyzed that the company is performing ok, then start to read more about the technical charts. When to go in what is the best time to come out.

I think many who survive will tell you the same thing. i make not because I know how to set stop the loss point and how to set profit target. If the stock is good and consistent. Over a long period of time the stock price is moving up. Do stress yourself too much on set loss points or setting profit target.

Tomorrow I will come in and do my dollar averaging buying again.

I won’t want to convince myself my theory and strategy is wrong and coming daily to moo moo and set a proft target.

By the way, all the lessons for fundamental analysis and technical analysis learning materials are available at MooMoo. Please after reading my super long-winded sharing. Go and refresh what are all the ratio representing.

Good luck, My Moo Moo buddies!

Lets Moo Moo together!

15

16

Super investor secret recipe is optimism, confidence and critical thinking spirit. Can one be trained to have these qualities? To be honest, 3 person of these different qualities can buy the same share but could be making different monies, losing on one end or could be printing monies, not to be judged alone.

Optimism: is a positive quality personal trait and if you have a natural optimistic attitude, you can go to the moon 🚀🌛 $AMC Entertainment (AMC.US)$. All successful investors must be optimistic and develop some business sense so that he dares to buy when a good share is running bull.

Confidence: a healthy attribute when we have confidence, good results can be achieved easily. A good investors should have confidence in understanding what they read and perceive from the annual report bearing in mind that all analysts reposrtt are usually buy recommendations.

Critical thinking: this is actually the main point 🤣 In order to stop loss and making profit at the right time, one investor needs to evaluate his risk appetite, overall portfolio and his fundamental investment strategy. What is your confidence level of your particular holding $Apple (AAPL.US)$ to go against its resistance level or support level? How optimistic are you on $Genting Sing (G13.SG)$ $SIA (C6L.SG)$? Do always remember the cost of overconfidence and over optimism. But all these lies back on your portfolio. Failure to diversify is a fatal blow to your hard earned monies. On my personal rule, I set a 20 percent plus minus. How about you my readers 😎.

If you are seeking excitement in investment, better go genting liao lo; quoting Paul Samuel here: investing should be more like watching paint dry or watching grass grow, if you want excitement, take 800 and go to Las Vegas. 🥤

Optimism: is a positive quality personal trait and if you have a natural optimistic attitude, you can go to the moon 🚀🌛 $AMC Entertainment (AMC.US)$. All successful investors must be optimistic and develop some business sense so that he dares to buy when a good share is running bull.

Confidence: a healthy attribute when we have confidence, good results can be achieved easily. A good investors should have confidence in understanding what they read and perceive from the annual report bearing in mind that all analysts reposrtt are usually buy recommendations.

Critical thinking: this is actually the main point 🤣 In order to stop loss and making profit at the right time, one investor needs to evaluate his risk appetite, overall portfolio and his fundamental investment strategy. What is your confidence level of your particular holding $Apple (AAPL.US)$ to go against its resistance level or support level? How optimistic are you on $Genting Sing (G13.SG)$ $SIA (C6L.SG)$? Do always remember the cost of overconfidence and over optimism. But all these lies back on your portfolio. Failure to diversify is a fatal blow to your hard earned monies. On my personal rule, I set a 20 percent plus minus. How about you my readers 😎.

If you are seeking excitement in investment, better go genting liao lo; quoting Paul Samuel here: investing should be more like watching paint dry or watching grass grow, if you want excitement, take 800 and go to Las Vegas. 🥤

18

4

Very clearly explained for easy understanding.

Very clearly explained for easy understanding.

Renee1007 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

NANA123 : Thank you![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) I have learned much from the experienced traders, thanks again for your shares

I have learned much from the experienced traders, thanks again for your shares![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Syuee :

cowabanga : Thank you so much for the golden opportunity to share my knowledge and insights here @moomoo Academy!!! Incurable for Futu making this possible and easy via the app!!! You Shine Bright Like a Diamond in the World of Fintech

Panda2102 : Congrats to all winners

View more comments...