Latest

Hot

When it comes to trading lingo, it’s a jungle out there, with trading expressions that can be difficult to understand. We’ve rounded up the usual suspects and tamed them into short definitions so you can speculate with confidence. ![]()

![]() First and foremost, let's say a big thanks to our amazing mooers to contribute so many good ideas by joining the topic #What lingos did you learn along the way? Thank you all!

First and foremost, let's say a big thanks to our amazing mooers to contribute so many good ideas by joining the topic #What lingos did you learn along the way? Thank you all!

Please leave a thumbs-up or share it if you find this useful!

![]()

![]() Basic Terms

Basic Terms

Stonk: an intentional misspelling of stock

YOLO - You only live once and refers to people who invest heavily in a certain stock

HODL - Slang for "hold your position" and resist the urge to sell your holdings.

Hold the Line - A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common.

Falling knife - Refers to a sharp drop, which is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it."

Hanging man - is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come

Inverted hammer - a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal

Gay Bear - It refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears

I Eat Crayons - More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise

Paytience - Used as a reminder that patience generally pays off

Restricted Shares - Shares only available to company insiders

Tenbanger - An investment that rises to 10* its purchase price (or has the potential to do so)

Odd Lot - A trade where the position size is less than the standard lot

Babysitting - Holding onto a trade, despite losses, in the hope of breaking even or making a profit if the market turns around

Dark Pools - Liquidity that exists between institutions on private exchanges, and is not available to the public

Dip - The rapid decrease in the value of a coin or stock, or an entire market

Fiat - Currency issued by the government, e.g. US dollar

Circuit breakers - temporary measures that halt trading to curb panic-selling on stock exchanges

![]()

![]()

![]() Animals in Trading

Animals in Trading

Bulls - an upward trending market, a cycle of growth; the optimists who often go long

Bears - a depressed and/or downward-trending market; the bearish trader or investor is pessimistic

Stags - a short-term speculator, usually refers to a day trader, the opportunists

Wolves - the unethical stock market wunderkinds famous for unscrupulous success

Rabbits - the scalpers who buy shares for very short periods of time, ranging from a couple of weeks to intra-day buying and selling

Turtles - the long-term trader, trend-following trader

Pigs - the slaughtered, high-risk investors who is greedy, having forgotten their original investment strategy to focus on securing unrealistic future gains.

Ostrich - the ignorant investors who tend to ignore the bad news and bury their heads in the figurative sand.

Chicken - the fearful investors that are highly risk-averse and are really afraid to lose any amount. They are driven with so much fear that it sometimes overrides their common sense in making sound investment decisions.

Sheep - the herd-follower who lacks discipline and whose trading strategy is unfocused and predicated on the suggestions of others.

Whales - Whales are movers and shakers (whether a trust, bank or even an individual) with such a lot of capital that their buys and sells make waves in the market.

Bearwhale - Someone with a large position in a particular coin but with a 'bearish' vision.

Bullwhale - Someone with a large position in a particular coin but with a 'bullish' vision.

Apes - the meme, favorite strategy: HODL, favorite destination: moon /Moon and favorite mode of transport: rocket

Black swans - they look beautiful in white. But adding the word “black” – it killed it which resulting in a meaning of a completely unforeseen and unexpected stance

Grey rhinos - preparing for highly probable events that potentially could have a high impact. They are often neglected, are not random surprises, but occur after a series of warnings and visible evidence.

Unicorns - startups that have come to be valued at $1 billion or more

Hawks and doves - the central bank’s decisions regarding interest rates. ‘Hawkish’ are those in favour of raising the interest rate and a tighter monetary policy to curb inflation. A meeker ‘dove’ stance is of the opinion that the central bank should keep interest rates low or flat.

![]()

![]() Popular slang to define market/ investor moves

Popular slang to define market/ investor moves

Tanking - When a market falls suddenly.

Short squeeze - When traders who hold short positions are forced to close their trades due to the rapid price increase.

Long squeeze - the opposite of short squeeze when a market drops significantly and unexpectedly very quickly

Jigged out - when the market turns against a general trend, forcing traders to close their position.

Flip - Buying and selling for a quick profit, usually intraday.

Gamma squeeze - It occurs when the price of a stock surges in a short period of time, often associated with the purchase of call options to drive up the price.

The dead cat bounce - the last gap rallying movement of a ‘dead market, when a stock’s price rises from depression briefly, only to fall again.

Crunching - A market's price falling rapidly and going beyond a presumed support level.

Sell-off (Dumping) - When an abnormal amount of traders are selling a position.

Buy the dip - Place the trade when the price is down, on the assumption that it will rebound soon enough.

Pump and dump - A group of investors colluded and bought the same stock at the same time to momentarily drive up the price of the stock and to sell it a short time later to turn them into a profit. Thereafter the price will drop back to the normal level.

Bottom fishing - Buying or going long on securities after their prices have fallen considerably, expecting they will rise in time.

Ask slapping - Buying shares at the ask price.

Choppy - High volatility within a narrow range.

![]()

![]() WSB Special

WSB Special

To the moon - a rallying cry for certain stocks

ATH - all time high

Apes together strong - It's a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon.

Paper hands - It means the investor is quick ot sell a stock at the first sign of trouble.

Diamond hands - Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase.

DFV - Refers to the aforementioned Reddit user DeepF--kingValue, who posted about making call options for GameStop stock (NYSE:GME) and became the “granddaddy” of the GME stock surge

ROARING KITTY - The social media pseudonym of Keith Gill, a financial adviser in Massachusetts whose Reddit posts and YouTube video streams helped drive interest in GameStop's stock.

Bagholder - Someone who holds on to a coin or stock that has dropped in price and hopes it increases to the price where they originally purchased.

TENDIES - Shorthand for chicken tenders, which WSB uses as slang for profits on a trade.

![]()

![]() Acronym

Acronym

DD - Due diligence

DYODD- Do you own due diligence

FOMO - Fear of missing out

FUD - Fear, Uncertainty, and Doubt

MOASS - mother of all short squeezes

DYOR - Do your own research

PAD - Pump and Dump

NHOD - New High Of Day

OTM - Out of the money

ITM - In the money

FTD - Fail to deliver

HFT - High frequency trading

AMA - Ask me Anything

ATL - All Time Low, when coins or stock breaks its previous lowest price record.

BTD - Buy the dip

DCA - Dollar-cost averaging, an investment technique where a fixed sum of money is used to invest in coin or stocks.

DCB - Dead Cat Bounce, a brief price recovery before a major crash.

FA - Fundamental Analysis, a method to evaluate an investment by looking at its intrinsic value.

ETF - Exchange-Traded-Fund, a tradable product that follows the price of an underlying asset.

JOMO - Joy of Missing Out, refers to someone who is happy for not taking a certain position as the price keep on dropping.

Lambo - Abbreviation of Lamborghini, used often when the price is going to rise sharply so that one can pay for such car with the winnings.

LEAPS - long-term equity anticipation security, basically an options that is has a very long expiry (>=1 year).

PMCC - Poor man covered call. Using a deep in the money call LEAPS to cover the call option instead of the underlying stock (generally lower upfront payment)

![]()

![]() Crypto Special

Crypto Special

2FA (2 Factor Authentication) - A double layer security used to provide double protection to user account.

51% Attack - A possible attack on blockchain by a group of miners who hold more than 50% of the hash rate.

Airdrop - A way to distribute coins to end users for free or exchange for performing a small task.

Altcoin - Any cryptocurrency that is not bitcoin.

ICO - Initial Coin Offering. Issued to be exchanged on launch. Similar to IPO's.

Paper Wallet - The public and private keys of the cryptocurrency wallet held on a piece of paper.

Gas - Fee paid to miners for executing a transaction on the Ethereum blockchain.

POW - Proof of work, a requirement defined by computer calculation.

REKT - Used in the crypto community to indicate huge losses.

SAFU - A term used in cryptocurrency world to mean safe.

Wholecoiner - Someone who owns 1 full Bitcoin

Nocoiner - A person who does not possess any cryptocurrency.

OCD - Obsessive Cryptocurrency Disorder, for people who cannot stop monitoring their cryptocurrency daily.

Hot Wallet - Storing of crypto coins online, connected to the Internet.

Cold Wallet - Storing of crypto coins offline.

DAO - Decentralized Autonomous Organization, whereby it run by itself without any human interventions.

DEX - Decentralized Exchange, where people can do trading without the need of a middleman.

![]()

![]() Give a thumbs-up to acknowledge mooers' contribution and share this post if you find this useful!

Give a thumbs-up to acknowledge mooers' contribution and share this post if you find this useful!![]()

![]()

![]()

![]()

![]()

Cheers!

Please leave a thumbs-up or share it if you find this useful!

Stonk: an intentional misspelling of stock

YOLO - You only live once and refers to people who invest heavily in a certain stock

HODL - Slang for "hold your position" and resist the urge to sell your holdings.

Hold the Line - A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common.

Falling knife - Refers to a sharp drop, which is commonly used in phrases like, "don't try to catch a falling knife," which can be translated to mean, "wait for the price to bottom out before buying it."

Hanging man - is a bearish candlestick pattern that forms at the end of an uptrend and warns of lower prices to come

Inverted hammer - a type of candlestick pattern found after a downtrend and is usually taken to be a trend-reversal signal

Gay Bear - It refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears

I Eat Crayons - More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise

Paytience - Used as a reminder that patience generally pays off

Restricted Shares - Shares only available to company insiders

Tenbanger - An investment that rises to 10* its purchase price (or has the potential to do so)

Odd Lot - A trade where the position size is less than the standard lot

Babysitting - Holding onto a trade, despite losses, in the hope of breaking even or making a profit if the market turns around

Dark Pools - Liquidity that exists between institutions on private exchanges, and is not available to the public

Dip - The rapid decrease in the value of a coin or stock, or an entire market

Fiat - Currency issued by the government, e.g. US dollar

Circuit breakers - temporary measures that halt trading to curb panic-selling on stock exchanges

Bulls - an upward trending market, a cycle of growth; the optimists who often go long

Bears - a depressed and/or downward-trending market; the bearish trader or investor is pessimistic

Stags - a short-term speculator, usually refers to a day trader, the opportunists

Wolves - the unethical stock market wunderkinds famous for unscrupulous success

Rabbits - the scalpers who buy shares for very short periods of time, ranging from a couple of weeks to intra-day buying and selling

Turtles - the long-term trader, trend-following trader

Pigs - the slaughtered, high-risk investors who is greedy, having forgotten their original investment strategy to focus on securing unrealistic future gains.

Ostrich - the ignorant investors who tend to ignore the bad news and bury their heads in the figurative sand.

Chicken - the fearful investors that are highly risk-averse and are really afraid to lose any amount. They are driven with so much fear that it sometimes overrides their common sense in making sound investment decisions.

Sheep - the herd-follower who lacks discipline and whose trading strategy is unfocused and predicated on the suggestions of others.

Whales - Whales are movers and shakers (whether a trust, bank or even an individual) with such a lot of capital that their buys and sells make waves in the market.

Bearwhale - Someone with a large position in a particular coin but with a 'bearish' vision.

Bullwhale - Someone with a large position in a particular coin but with a 'bullish' vision.

Apes - the meme, favorite strategy: HODL, favorite destination: moon /Moon and favorite mode of transport: rocket

Black swans - they look beautiful in white. But adding the word “black” – it killed it which resulting in a meaning of a completely unforeseen and unexpected stance

Grey rhinos - preparing for highly probable events that potentially could have a high impact. They are often neglected, are not random surprises, but occur after a series of warnings and visible evidence.

Unicorns - startups that have come to be valued at $1 billion or more

Hawks and doves - the central bank’s decisions regarding interest rates. ‘Hawkish’ are those in favour of raising the interest rate and a tighter monetary policy to curb inflation. A meeker ‘dove’ stance is of the opinion that the central bank should keep interest rates low or flat.

Tanking - When a market falls suddenly.

Short squeeze - When traders who hold short positions are forced to close their trades due to the rapid price increase.

Long squeeze - the opposite of short squeeze when a market drops significantly and unexpectedly very quickly

Jigged out - when the market turns against a general trend, forcing traders to close their position.

Flip - Buying and selling for a quick profit, usually intraday.

Gamma squeeze - It occurs when the price of a stock surges in a short period of time, often associated with the purchase of call options to drive up the price.

The dead cat bounce - the last gap rallying movement of a ‘dead market, when a stock’s price rises from depression briefly, only to fall again.

Crunching - A market's price falling rapidly and going beyond a presumed support level.

Sell-off (Dumping) - When an abnormal amount of traders are selling a position.

Buy the dip - Place the trade when the price is down, on the assumption that it will rebound soon enough.

Pump and dump - A group of investors colluded and bought the same stock at the same time to momentarily drive up the price of the stock and to sell it a short time later to turn them into a profit. Thereafter the price will drop back to the normal level.

Bottom fishing - Buying or going long on securities after their prices have fallen considerably, expecting they will rise in time.

Ask slapping - Buying shares at the ask price.

Choppy - High volatility within a narrow range.

To the moon - a rallying cry for certain stocks

ATH - all time high

Apes together strong - It's a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon.

Paper hands - It means the investor is quick ot sell a stock at the first sign of trouble.

Diamond hands - Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase.

DFV - Refers to the aforementioned Reddit user DeepF--kingValue, who posted about making call options for GameStop stock (NYSE:GME) and became the “granddaddy” of the GME stock surge

ROARING KITTY - The social media pseudonym of Keith Gill, a financial adviser in Massachusetts whose Reddit posts and YouTube video streams helped drive interest in GameStop's stock.

Bagholder - Someone who holds on to a coin or stock that has dropped in price and hopes it increases to the price where they originally purchased.

TENDIES - Shorthand for chicken tenders, which WSB uses as slang for profits on a trade.

DD - Due diligence

DYODD- Do you own due diligence

FOMO - Fear of missing out

FUD - Fear, Uncertainty, and Doubt

MOASS - mother of all short squeezes

DYOR - Do your own research

PAD - Pump and Dump

NHOD - New High Of Day

OTM - Out of the money

ITM - In the money

FTD - Fail to deliver

HFT - High frequency trading

AMA - Ask me Anything

ATL - All Time Low, when coins or stock breaks its previous lowest price record.

BTD - Buy the dip

DCA - Dollar-cost averaging, an investment technique where a fixed sum of money is used to invest in coin or stocks.

DCB - Dead Cat Bounce, a brief price recovery before a major crash.

FA - Fundamental Analysis, a method to evaluate an investment by looking at its intrinsic value.

ETF - Exchange-Traded-Fund, a tradable product that follows the price of an underlying asset.

JOMO - Joy of Missing Out, refers to someone who is happy for not taking a certain position as the price keep on dropping.

Lambo - Abbreviation of Lamborghini, used often when the price is going to rise sharply so that one can pay for such car with the winnings.

LEAPS - long-term equity anticipation security, basically an options that is has a very long expiry (>=1 year).

PMCC - Poor man covered call. Using a deep in the money call LEAPS to cover the call option instead of the underlying stock (generally lower upfront payment)

2FA (2 Factor Authentication) - A double layer security used to provide double protection to user account.

51% Attack - A possible attack on blockchain by a group of miners who hold more than 50% of the hash rate.

Airdrop - A way to distribute coins to end users for free or exchange for performing a small task.

Altcoin - Any cryptocurrency that is not bitcoin.

ICO - Initial Coin Offering. Issued to be exchanged on launch. Similar to IPO's.

Paper Wallet - The public and private keys of the cryptocurrency wallet held on a piece of paper.

Gas - Fee paid to miners for executing a transaction on the Ethereum blockchain.

POW - Proof of work, a requirement defined by computer calculation.

REKT - Used in the crypto community to indicate huge losses.

SAFU - A term used in cryptocurrency world to mean safe.

Wholecoiner - Someone who owns 1 full Bitcoin

Nocoiner - A person who does not possess any cryptocurrency.

OCD - Obsessive Cryptocurrency Disorder, for people who cannot stop monitoring their cryptocurrency daily.

Hot Wallet - Storing of crypto coins online, connected to the Internet.

Cold Wallet - Storing of crypto coins offline.

DAO - Decentralized Autonomous Organization, whereby it run by itself without any human interventions.

DEX - Decentralized Exchange, where people can do trading without the need of a middleman.

Cheers!

377

23

Hey mooers, we have good news to share!![]()

Since the Courses has been launched in March, many mooers have expressed desires to learn more about investing. We feel so inspired by such encouragement, which motivates us to create more high-quality courses for our friends.

We plan to hold regular learning activities every Thursday.

Here you can learn the latest courses in time. More importantly, you can exchange your opinions with other friends. Communication is definitely a good way to learn and improve skills.

What’s new this week:

The U.S. stock market keeps breaking new records. Some investors feel the urge to know more about investment basics.

Just like what Benjamin Franklin once said, an investment in knowledge always pays the best interest.

What is an investment? Investing is not just buying stocks and waiting to appreciate in value. You need…

What are bull and bear markets? How to tell them and maximize your profit, avoid risks of losing money?

What is an investment portfolio? Why should I have a diversified investment portfolio?

All these questions will be answered in our selected course. In addition, some courses are in videos. Hope it will bring a refreshing learning experience.

Weekly Wins:

![]() Award: 10 lucky winners (88 Points/person)

Award: 10 lucky winners (88 Points/person)

![]() How to participate:

How to participate:

Learn this course and share your feedback on the course or investment ideas.

![]() How to be selected:

How to be selected:

Anyone who actively participates in this event could be the winner.

If your voice is helpful to the Courses and to others of the mooer family, you'll have a greater chance of being selected.

![]() Winners announcement:

Winners announcement:

Next Monday (Points will be received in accounts before Next Thursday.)

Bottom Line:

moomoo Courses will host such events every week on Thursday. Please follow us to stay tuned and you won’t miss any chance to win rewards.

Let’s get started. Click to access the selected course for free.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Tesla (TSLA.US)$

Since the Courses has been launched in March, many mooers have expressed desires to learn more about investing. We feel so inspired by such encouragement, which motivates us to create more high-quality courses for our friends.

We plan to hold regular learning activities every Thursday.

Here you can learn the latest courses in time. More importantly, you can exchange your opinions with other friends. Communication is definitely a good way to learn and improve skills.

What’s new this week:

The U.S. stock market keeps breaking new records. Some investors feel the urge to know more about investment basics.

Just like what Benjamin Franklin once said, an investment in knowledge always pays the best interest.

What is an investment? Investing is not just buying stocks and waiting to appreciate in value. You need…

What are bull and bear markets? How to tell them and maximize your profit, avoid risks of losing money?

What is an investment portfolio? Why should I have a diversified investment portfolio?

All these questions will be answered in our selected course. In addition, some courses are in videos. Hope it will bring a refreshing learning experience.

Weekly Wins:

Learn this course and share your feedback on the course or investment ideas.

Anyone who actively participates in this event could be the winner.

If your voice is helpful to the Courses and to others of the mooer family, you'll have a greater chance of being selected.

Next Monday (Points will be received in accounts before Next Thursday.)

Bottom Line:

moomoo Courses will host such events every week on Thursday. Please follow us to stay tuned and you won’t miss any chance to win rewards.

Let’s get started. Click to access the selected course for free.

$S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Tesla (TSLA.US)$

115

58

Investing is about balancing risk and reward. Reaching our investment goals will take patience and hard work. Avoiding bad investment is an important key to successful investing. It can take several years for a portfolio to recover from a few wrong investment that could have been avoided in the first place. As such, investors need to be watchful for warning signs that could signal companies in trouble. While continuous decline in earnings may be a reason for concern, investors should be more wary of companies that struggle to maintain a consistent cashflow profile, especially those that show continuous negative cash flow over a prolonged period as these companies tend to run a higher risk of insolvency. Increasing and high debt level is another warning sign to watch out for. Debt is not necessarily bad as it can be used to improve earnings and profit margins. But when companies are struggling to make scheduled interest and principal payments, this is a huge red flag to watch out for as such companies run a higher risk of liquidation should they be unable to meet their debt obligations. Other than unusually high insider selling that can be interpreted as an ominous sign, investors can check if a company's shares are the target of short sellers, especially hedge funds that aggressively bet against a company's share price. When a company's shares are consistently targeted by short sellers, it could be an early warning of greater danger ahead. Investors should also be cautioned should there be any frequent change of auditors or if a company changes its auditors abruptly as this may indicate that the company could be trying to conceal information they do not wish to disclose. To help spot stock I should avoid, I would always relook at a stock whenever I notice consecutive quarters of declining earnings, a company's cash shrinking or debt increasing. Unusual insider sales, heavy short selling or auditor resignation are other warning signs that a company may be in trouble.

$BlackBerry (BB.US)$

$Clover Health (CLOV.US)$

$ContextLogic (WISH.US)$

$Luckin Coffee (LKNCY.US)$

$Oatly Group AB (OTLY.US)$

$SNDL Inc (SNDL.US)$

$Virgin Galactic (SPCE.US)$

$Zomedica (ZOM.US)$

$BlackBerry (BB.US)$

$Clover Health (CLOV.US)$

$ContextLogic (WISH.US)$

$Luckin Coffee (LKNCY.US)$

$Oatly Group AB (OTLY.US)$

$SNDL Inc (SNDL.US)$

$Virgin Galactic (SPCE.US)$

$Zomedica (ZOM.US)$

98

101

The lingos I had learnt are all acquired from MooMoo. In the past, I knew nuts about all these terms till I read all the comments and advices from MooMoo’s section.

“The Dead Cat Bounce” simply means the last rallying movement of a stock’s price where it rises from a downward trend briefly, before tumbling again. This is often seen in Paypal and Futu stocks now. $PayPal (PYPL.US)$ $Futu Holdings Ltd (FUTU.US)$

Next would be the “Whales” where the whales are the movers and shakers in the market whom have so gignormous amount of capital that their buys and sells can cause the market to swing either way much like the small animals being displaced by this giant!

“Apes Together Strong” is a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon!!! Only if stayed focus collectively together, then they can achieve the target price. $AMC Entertainment (AMC.US)$

Haha, the recent favorite phrase “Short Squeezes” where the squeezes refer to unusual market movements. A short squeeze is when the asset traded e.g. a stock’s share price, unexpectedly appreciated to super high price over a short period of time. This is because it had ‘squeezes’ any short sellers of that market, who often exit their trades in a short squeeze to limit their losses as the market’s price rises. Stocks like AMC and Gamestop come to our mind. $GameStop (GME.US)$

“Buy The Dip” is a no brainer phrase when you have to place the trade when the price is down, on the assumption that it will rebound soon enough. This is often mentioned by people whom are permanently bullish on a particular stock, regardless of market conditions. That is the reason why we all buy stocks anyway. Duh!! Phunware is still dipping. HAHAHA $Phunware (PHUN.US)$

“Paper Hands” is when the investor is quick to sell a stock at the first sign of trouble; they cannot take the tumultuous journey and may result to early exits and missed opportunities.

Then we see this “Pump And Dump” when a group of investors colluded and bought the same stock at the same time to momentarily drive up price of the stock and to sell in a short time later to turn them into a profit. Thereafter the price will drop back to the normal level. Those caught in this wave will make or lose big time! Digital World Acquisition Corp (DWAC) is the example. $Digital World Acquisition Corp (DWAC.US)$

Last but not the least, “Jigged Out” is where one noticed the market moving in an unfavorable position and then you quickly close out your trade, only for the market to rally into a higher position which you could have made a huge profit out of it and is known as ‘jigged out’. This is exactly how I felt each time; ‘I just jigged myself out of a profit by reading the market wrong!’ Tesla and of course Microsoft are one of my many big mistakes! $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

“The Dead Cat Bounce” simply means the last rallying movement of a stock’s price where it rises from a downward trend briefly, before tumbling again. This is often seen in Paypal and Futu stocks now. $PayPal (PYPL.US)$ $Futu Holdings Ltd (FUTU.US)$

Next would be the “Whales” where the whales are the movers and shakers in the market whom have so gignormous amount of capital that their buys and sells can cause the market to swing either way much like the small animals being displaced by this giant!

“Apes Together Strong” is a clique or expression of solidarity with other common investors going for the same goal like buying AMC to the moon!!! Only if stayed focus collectively together, then they can achieve the target price. $AMC Entertainment (AMC.US)$

Haha, the recent favorite phrase “Short Squeezes” where the squeezes refer to unusual market movements. A short squeeze is when the asset traded e.g. a stock’s share price, unexpectedly appreciated to super high price over a short period of time. This is because it had ‘squeezes’ any short sellers of that market, who often exit their trades in a short squeeze to limit their losses as the market’s price rises. Stocks like AMC and Gamestop come to our mind. $GameStop (GME.US)$

“Buy The Dip” is a no brainer phrase when you have to place the trade when the price is down, on the assumption that it will rebound soon enough. This is often mentioned by people whom are permanently bullish on a particular stock, regardless of market conditions. That is the reason why we all buy stocks anyway. Duh!! Phunware is still dipping. HAHAHA $Phunware (PHUN.US)$

“Paper Hands” is when the investor is quick to sell a stock at the first sign of trouble; they cannot take the tumultuous journey and may result to early exits and missed opportunities.

Then we see this “Pump And Dump” when a group of investors colluded and bought the same stock at the same time to momentarily drive up price of the stock and to sell in a short time later to turn them into a profit. Thereafter the price will drop back to the normal level. Those caught in this wave will make or lose big time! Digital World Acquisition Corp (DWAC) is the example. $Digital World Acquisition Corp (DWAC.US)$

Last but not the least, “Jigged Out” is where one noticed the market moving in an unfavorable position and then you quickly close out your trade, only for the market to rally into a higher position which you could have made a huge profit out of it and is known as ‘jigged out’. This is exactly how I felt each time; ‘I just jigged myself out of a profit by reading the market wrong!’ Tesla and of course Microsoft are one of my many big mistakes! $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

122

13

The ultimate point of a stop loss is to limit one's losses. With today's high volumes of trading and free flow of information, market volatility now comes more into play than perhaps ever before. As my stock investment is based on longer timelines and company fundamentals, I am not overly concerned with short term volatility and price fluctuations. One losing investment in my stock portfolio is $Alibaba (BABA.US)$ which I would not hesitate to hold. The stock price of $Alibaba (BABA.US)$ has been hammered due to China's regulatory crackdown on the tech sector. Nevertheless, $Alibaba (BABA.US)$ remains a fundamentally strong company as its core operating businesses continue to grow at increasing rates. Despite its strong growth rates, $Alibaba (BABA.US)$ is still trading at very low valuations, below its intrinsic value, making it an attractive long term investment. Though $Alibaba (BABA.US)$ has suffered from multiple setbacks for the past year arising from Chinese regulatory pressures, its core businesses continue to deliver. Not only that, its other businesses including international retail, logistics and cloud computing, which is seen an increasing challenge to US tech giants $Amazon (AMZN.US)$ and $Microsoft (MSFT.US)$, are all expanding at impressive rates. Despite the decline in stock price, $Alibaba (BABA.US)$ is a fundamentally solid company that continues to perform well across all its business segments. Furthermore, its recent investments will not only mitigate its regulatory risks but expand its total potential market in the future. The recent increased investment of $Alibaba (BABA.US)$ from the legendary investor, Charlie Munger shows that with a little patience, it is worthwhile to take some short term pain for long term gain. As such, $Alibaba (BABA.US)$ not only remains in my stock portfolio but I have raised my stakes in this Chinese tech stalwart.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

75

73

There are many super bull stocks in the U.S. market, I missed the opportunity to buy before it broke out due to inexperience.![]() Eventually, I saw the wonderful performance of big bull stocks in the news and information, I was secretly regretting that I didn't buy them in time.

Eventually, I saw the wonderful performance of big bull stocks in the news and information, I was secretly regretting that I didn't buy them in time.![]() Since then, I have been paying attention to stock selection indicators.

Since then, I have been paying attention to stock selection indicators.![]()

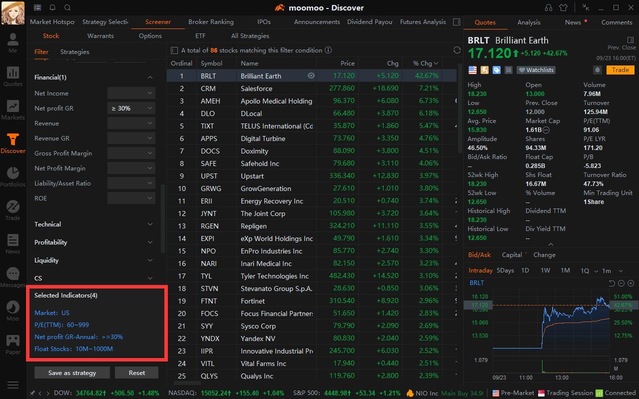

I usually use moo stock selection tool to select the super big stocks that are temporarily unknown among stocks. Now, I use the tool to show you.

We need to set the following screening conditions in the stock screener:

1. Higher net profit growth rate (≥30%)

Higher net profit growth rate is more attractive to investment capital.

2. Higher price-to-earnings ratio (≥60)

The high price-earnings ratio shows that many professional investment institutions on the market have greater confidence in its rapid growth prospects.

3. Fewer shares outstanding (≤1billion)

It is best not to have too many shares in circulation, so that institutional investors holding positions will be more likely to raise the stock price.

At this time, we can see the results from the filter, such as $Switch (SWCH.US)$ $Netflix (NFLX.US)$ $Zoom Video Communications (ZM.US)$

After sharing my stock selection strategy, now I will talk about my red flags while deciding on a stock:

1. Stock trading volume

I think that stocks with daily trading volume of less than 100 million dollars should not be participated. Due to the existence of short selling in US stocks, it’s very likely that some stocks will be manipulated.

2. Plunged stocks

When a stock plummets, there is a high probability that the company’s fundamentals have undergone tremendous changes. At this time, you must be cautious and not buy it at the bottom. For example, $New Oriental (EDU.US)$ $TAL Education (TAL.US)$ .You can earn less, but you can't put yourself in a dangerous place because of temporary greed.

Finally, I want to share some of my own experience. There are thousands of stocks in the U.S. stock market. Why is there a large amount of funds that continue to pursue $Tesla (TSLA.US)$ ? Because Tesla's products, models, and appeal are constantly proving itself. Stock selection is simple, but it is very difficult to operate.

If you like and agree with my point of view, welcome to interact with me and follow me![]()

![]()

![]()

I usually use moo stock selection tool to select the super big stocks that are temporarily unknown among stocks. Now, I use the tool to show you.

We need to set the following screening conditions in the stock screener:

1. Higher net profit growth rate (≥30%)

Higher net profit growth rate is more attractive to investment capital.

2. Higher price-to-earnings ratio (≥60)

The high price-earnings ratio shows that many professional investment institutions on the market have greater confidence in its rapid growth prospects.

3. Fewer shares outstanding (≤1billion)

It is best not to have too many shares in circulation, so that institutional investors holding positions will be more likely to raise the stock price.

At this time, we can see the results from the filter, such as $Switch (SWCH.US)$ $Netflix (NFLX.US)$ $Zoom Video Communications (ZM.US)$

After sharing my stock selection strategy, now I will talk about my red flags while deciding on a stock:

1. Stock trading volume

I think that stocks with daily trading volume of less than 100 million dollars should not be participated. Due to the existence of short selling in US stocks, it’s very likely that some stocks will be manipulated.

2. Plunged stocks

When a stock plummets, there is a high probability that the company’s fundamentals have undergone tremendous changes. At this time, you must be cautious and not buy it at the bottom. For example, $New Oriental (EDU.US)$ $TAL Education (TAL.US)$ .You can earn less, but you can't put yourself in a dangerous place because of temporary greed.

Finally, I want to share some of my own experience. There are thousands of stocks in the U.S. stock market. Why is there a large amount of funds that continue to pursue $Tesla (TSLA.US)$ ? Because Tesla's products, models, and appeal are constantly proving itself. Stock selection is simple, but it is very difficult to operate.

If you like and agree with my point of view, welcome to interact with me and follow me

75

23

Now there are more and more slang words that I don’t know, I have to prove that I’m not old.

Gay bear: Bulls expect stocks to go up. Bears expect them to go down. WallStreetBets, often deliberately incorporating un-politically-correct terms and symbols, refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears.

“I eat crayons:” More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise.

$GameStop (GME.US)$ $AMC Entertainment (AMC.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Phunware (PHUN.US)$ $Tesla (TSLA.US)$

Gay bear: Bulls expect stocks to go up. Bears expect them to go down. WallStreetBets, often deliberately incorporating un-politically-correct terms and symbols, refers to people who WANT stocks to go down, and are seeking to profit off of the position, as “gay bears.” They are denoted by a picture of an LBGT flag and a bear emoji, or sometimes a strange video clip of dancing animated bears.

“I eat crayons:” More subversive self-deprecation, often used by members of the group to imply that their foolhardy bets, and possible resulting losses, should not be mistaken for formal investment expertise.

$GameStop (GME.US)$ $AMC Entertainment (AMC.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Phunware (PHUN.US)$ $Tesla (TSLA.US)$

67

6

"Fly High, Fly to the Moon", that's my sentiments for Singapore Airlines (SIA) shares all along. As expected, SIA stocks soared up to 9.6% after the announcement of Singapore government's decision to open up of borders to 11 countries worldwide including those in Europe and North America. As of today, SIA shares nose dived down to $5.26 despite of the easing of the travelling curbs.

The question is whether SIA can sustain this decline. Next, is of course should SIA continue to under perform, would the investors be alarmed and apply a "stop-loss " principle on $SIA (C6L.SG)$ or $SATS (S58.SG)$ stocks. Personally, I hope not because this blue chip business has solid fiancial back up. Moreover, SIA

has past experiences of facing more adverse situations without faltering.

Currently, I am holding some portions of the losing $SIA (C6L.SG)$ shares but I am not unduly worried. I have pulled the trigger off for those shares but I will not sell them either, because SIA will remain s strong, reliable company for long term investments.

$SIA (C6L.SG)$ shares' prices have been negatively impacted since mid 2019 when Covid 19 pandemic emerged, and travelling was hazardous internationally.

Pre Covid time, our National aircraft was faring extremely well. Travellers worldwide opt to travel in SIA flights because they are awared that when they fly in SIA, they are embarking on a journey of safety and luxurious comfort. Being a prestigious 5 stars aircraft, SIA offers stella service. This aviation service operates 3% of the 10 current longest flights in the world. The inclusion of more countries VTL (vaccinated travel lanes) will ultimately usher in tourist and business locations from UK, US and Italy which are vital long hauls in markets for SIA.

Moving forward, SIA shares will continue to face some challenges in the early Q4 phase. In hindsight however, investors should focus more on the outlook over the next 2 years. I believe by year end, situation will improve, as more people are vaccinated globally and air travel becomes more flexible. By then more travellers are willing to splurge on the next trip.

Once again we can envision SIA flying high to the Moon. Along with this increase trend in travelling, the other travel-related stocks to gain momentum are:

$SATS (S58.SG)$

$Genting Sing (G13.SG)$

$Air Transport Services (ATSG.US)$

$Shangri-La HKD (S07.SG)$

$Marriott International (MAR.US)$

$Las Vegas Sands (LVS.US)$

The question is whether SIA can sustain this decline. Next, is of course should SIA continue to under perform, would the investors be alarmed and apply a "stop-loss " principle on $SIA (C6L.SG)$ or $SATS (S58.SG)$ stocks. Personally, I hope not because this blue chip business has solid fiancial back up. Moreover, SIA

has past experiences of facing more adverse situations without faltering.

Currently, I am holding some portions of the losing $SIA (C6L.SG)$ shares but I am not unduly worried. I have pulled the trigger off for those shares but I will not sell them either, because SIA will remain s strong, reliable company for long term investments.

$SIA (C6L.SG)$ shares' prices have been negatively impacted since mid 2019 when Covid 19 pandemic emerged, and travelling was hazardous internationally.

Pre Covid time, our National aircraft was faring extremely well. Travellers worldwide opt to travel in SIA flights because they are awared that when they fly in SIA, they are embarking on a journey of safety and luxurious comfort. Being a prestigious 5 stars aircraft, SIA offers stella service. This aviation service operates 3% of the 10 current longest flights in the world. The inclusion of more countries VTL (vaccinated travel lanes) will ultimately usher in tourist and business locations from UK, US and Italy which are vital long hauls in markets for SIA.

Moving forward, SIA shares will continue to face some challenges in the early Q4 phase. In hindsight however, investors should focus more on the outlook over the next 2 years. I believe by year end, situation will improve, as more people are vaccinated globally and air travel becomes more flexible. By then more travellers are willing to splurge on the next trip.

Once again we can envision SIA flying high to the Moon. Along with this increase trend in travelling, the other travel-related stocks to gain momentum are:

$SATS (S58.SG)$

$Genting Sing (G13.SG)$

$Air Transport Services (ATSG.US)$

$Shangri-La HKD (S07.SG)$

$Marriott International (MAR.US)$

$Las Vegas Sands (LVS.US)$

57

14

Diamond Hands

Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase. The phrase is represented by a combination of diamond and hand emojis. When GameStop shares traded wildly, calls for users to have “diamond hands” filled the forum.

Hold the Line

A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common. Often seen in conjunction with “diamond hands” and “to the moon.”

Paper Hands

The opposite of diamond hands, paper hands are when a user sells their shares at the first sign of a downward trend. Used in a derogatory manner toward those who are not fully committed to a position.

$GameStop (GME.US)$ $Digital World Acquisition Corp (DWAC.US)$

Continuing to hold a stock despite losses, adversity, and volatility, confident that the price will increase. The phrase is represented by a combination of diamond and hand emojis. When GameStop shares traded wildly, calls for users to have “diamond hands” filled the forum.

Hold the Line

A battle cry for users during volatility in the markets. When stocks favored by the forum began to drop, appeals to “hold the line” became common. Often seen in conjunction with “diamond hands” and “to the moon.”

Paper Hands

The opposite of diamond hands, paper hands are when a user sells their shares at the first sign of a downward trend. Used in a derogatory manner toward those who are not fully committed to a position.

$GameStop (GME.US)$ $Digital World Acquisition Corp (DWAC.US)$

57

1

“Stop-loss is used to protect yourself if your trade goes WRONG.”

Stop-loss allows you to exit at a “price” automatically, I presumed. By setting auto-sell off at your “loss threshold price”, a price that your heart can withstand. But through my experience, I ever encountered times when you set sell at $15.00 but when the auto-sell off triggered, the price plunge into $14.50. Then it recover again. And shot all the way back to $19-$20. I am not quoting any stock but these scenarios do exist and always happen.

That’s why it is called “Stop Loss”. But there are some stocks below our buying price that we decide to hold for a longer time still.

I always believe in dollar cost average (DCA) as I’m a long term investor. I tend to hold stocks for longer period of time so they weather the ups and downs. Stop loss is pretty much not really a big thing or strategy for DCA man like me.

Why don't you sell the losing trade?

Unless it goes bust, if you never sell, technically you are only in a paper loss postion. I usually will just keep if it turns against me as long as possible or rather forever.

When will you sell?

How do you decide when it is time to take a loss on a trade?

Never. Touchwood. I do have a fair bits of those, misjudge stocks that is still way below my buying prices. Fortunately, it is a small percentage of my portfolio.

But touchwood, I still kept them until now. If you don’t sell it, it will only remains as paper loss.

$DiDi Global (Delisted) (DIDI.US)$ is one of the classic stock in my portfolio that bought it at $15+ just look at how much is it now? Some-how, i didn’t adopt to any stop-loss strategy as well and i am still doing fine.

Weather it through.

Good luck.

Stop-loss allows you to exit at a “price” automatically, I presumed. By setting auto-sell off at your “loss threshold price”, a price that your heart can withstand. But through my experience, I ever encountered times when you set sell at $15.00 but when the auto-sell off triggered, the price plunge into $14.50. Then it recover again. And shot all the way back to $19-$20. I am not quoting any stock but these scenarios do exist and always happen.

That’s why it is called “Stop Loss”. But there are some stocks below our buying price that we decide to hold for a longer time still.

I always believe in dollar cost average (DCA) as I’m a long term investor. I tend to hold stocks for longer period of time so they weather the ups and downs. Stop loss is pretty much not really a big thing or strategy for DCA man like me.

Why don't you sell the losing trade?

Unless it goes bust, if you never sell, technically you are only in a paper loss postion. I usually will just keep if it turns against me as long as possible or rather forever.

When will you sell?

How do you decide when it is time to take a loss on a trade?

Never. Touchwood. I do have a fair bits of those, misjudge stocks that is still way below my buying prices. Fortunately, it is a small percentage of my portfolio.

But touchwood, I still kept them until now. If you don’t sell it, it will only remains as paper loss.

$DiDi Global (Delisted) (DIDI.US)$ is one of the classic stock in my portfolio that bought it at $15+ just look at how much is it now? Some-how, i didn’t adopt to any stop-loss strategy as well and i am still doing fine.

Weather it through.

Good luck.

41

14

Dont Lose Money : Thinks , thks for sharing

, thks for sharing

沉稳的劳猫 : OK

Mars Mooo :

Mars Mooo : Thank you for loving my post https://www.moomoo.com/en-sg/community/feed/107185323442182![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Mars Mooo :

View more comments...