Latest

Hot

$Warren Buffett Portfolio (LIST2999.US)$

$Soros Holdings (LIST2120.US)$

$Tiger Global Holdings (LIST2121.US)$

$Brigewater Holdings (LIST2122.US)$

$Vanguard Group Holdings (LIST2599.US)$

$Microsoft (MSFT.US)$

$Apple (AAPL.US)$

$Amazon (AMZN.US)$

$Alphabet-A (GOOGL.US)$

$Johnson & Johnson (JNJ.US)$

$JPMorgan (JPM.US)$

$Meta Platforms (FB.US)$

$Alphabet-C (GOOG.US)$

$Disney (DIS.US)$

$Visa (V.US)$

126

86

Can we ride on the coattails of star institutions to the moon? Moomoo app allows us to see the positions of top funds based on 13F filings (Quotes > Explore > Star Institutions). Compared to retail investors, institutional investors (sovereign funds, hedge funds, mutual funds, insurance companies, pension funds, etc) have the advantage of immense capital, teams of dedicated analysts and connections retail investors can only dream of. They may be aware of information that retail investor are not aware of or get the information earlier and they can influence the price of a stock due to the size of their trades. Thus, the positions they take can serve as a useful clue of which stocks are undervalued or overvalued.

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Check out Long Term Investment - A Strategy For Growing Returns Without Sleepless Nights https://www.moomoo.com/community/feed/107495017873414?lang_code=2

151

16

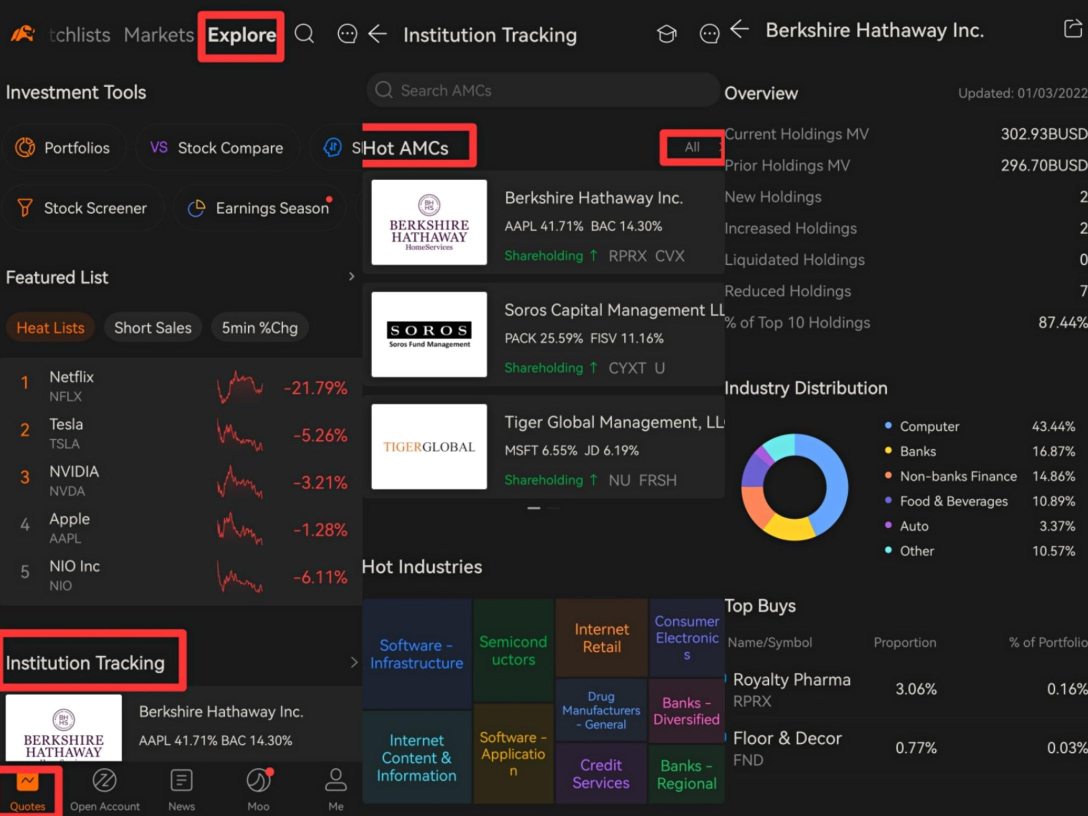

Just tried this new feature "star institution" and it provides pretty neat information.

I can easily grasp the information on those big corps and institutional investors hodling onto which companies. From the below screenshot, I get to know some key information: the position hodling data of the specific institution, top industry as well as top favorites by these giant investors.

I can easily get to know that Buffet has increased holding $Chevron (CVX.US)$ and bought $Royalty Pharma (RPRX.US)$ $Floor & Decor (FND.US)$![]()

![]()

![]() rather than reading the 13F page by page. We can further zoomed into these corporate investor's portfolio by clicking their name

rather than reading the 13F page by page. We can further zoomed into these corporate investor's portfolio by clicking their name ![]()

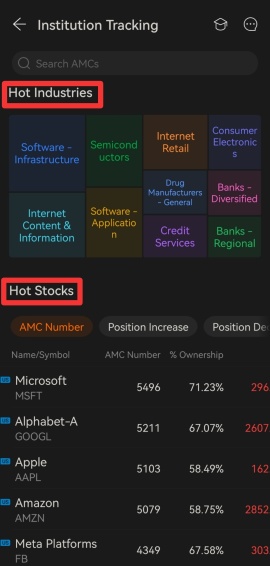

For the industries and sectors, IT related sectors are still the favorites with software-infrastructure is the top followed by the Internet content and information sector. This is further illustrated by the hot stocks which is dominated by $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ and $Amazon (AMZN.US)$. Thanks for this function![]()

I can easily grasp the information on those big corps and institutional investors hodling onto which companies. From the below screenshot, I get to know some key information: the position hodling data of the specific institution, top industry as well as top favorites by these giant investors.

I can easily get to know that Buffet has increased holding $Chevron (CVX.US)$ and bought $Royalty Pharma (RPRX.US)$ $Floor & Decor (FND.US)$

For the industries and sectors, IT related sectors are still the favorites with software-infrastructure is the top followed by the Internet content and information sector. This is further illustrated by the hot stocks which is dominated by $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ and $Amazon (AMZN.US)$. Thanks for this function

107

9

Greetings mooers!

Recently the Institution Tracking Feature has just been fully upgraded in iOS as well as Android version of moomoo. At present, it is open to mooers to query the position data of nearly 6000 AMCs (Asset Management Company)! I guess some mooers might want to ask, 'what is it? what can it be used for?' Don't worry, scroll down to get more details with us!

![]() What is 13F?

What is 13F?![]()

Form 13F is a quarterly report filed, per United States Sec...

Recently the Institution Tracking Feature has just been fully upgraded in iOS as well as Android version of moomoo. At present, it is open to mooers to query the position data of nearly 6000 AMCs (Asset Management Company)! I guess some mooers might want to ask, 'what is it? what can it be used for?' Don't worry, scroll down to get more details with us!

Form 13F is a quarterly report filed, per United States Sec...

+3

89

11

Making the Most of Star Institutions’ Positions

Can we ride on the coattails of star institutions to the moon? Moomoo app allows us to see the positions of top funds based on 13F filings (Quotes > Explore > Star Institutions). Compared to retail investors, institutional investors (sovereign funds, hedge funds, mutual funds, insurance companies, pension funds, etc) have the advantage of immense capital, teams of dedicated analysts and connections retail investors can only dream of. They may be aware of information that retail investor are not aware of or get the information earlier and they can influence the price of a stock due to the size of their trades. Thus, the positions they take can serve as a useful clue of which stocks are undervalued or overvalued.

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

Can we ride on the coattails of star institutions to the moon? Moomoo app allows us to see the positions of top funds based on 13F filings (Quotes > Explore > Star Institutions). Compared to retail investors, institutional investors (sovereign funds, hedge funds, mutual funds, insurance companies, pension funds, etc) have the advantage of immense capital, teams of dedicated analysts and connections retail investors can only dream of. They may be aware of information that retail investor are not aware of or get the information earlier and they can influence the price of a stock due to the size of their trades. Thus, the positions they take can serve as a useful clue of which stocks are undervalued or overvalued.

$ARK Fintech Innovation ETF (ARKF.US)$ $ARK Innovation ETF (ARKK.US)$ $ARK Autonomous Technology & Robotics ETF (ARKQ.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Apple (AAPL.US)$ $Alphabet-C (GOOG.US)$ $Alphabet-A (GOOGL.US)$ $Tesla (TSLA.US)$ $Meta Platforms (FB.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Advanced Micro Devices (AMD.US)$ $Lucid Group (LCID.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tiger Global Holdings (LIST2121.US)$ $BYD Co. (BYDDF.US)$ $Alibaba (BABA.US)$ $DiDi Global (Delisted) (DIDI.US)$ $PDD Holdings (PDD.US)$ $Temasek Holdings (LIST2536.US)$ $Snowflake (SNOW.US)$ $Microsoft (MSFT.US)$ $TAL Education (TAL.US)$

Having said that, institutional investors are not infallible. They have made their share of costly mistakes because they too cannot predict the future (the regulation in China against the private education sector was a prime example $New Oriental (EDU.US)$ which caught institutional funds like Temasek Holdings by surprise).

Most importantly, the structuring of one’s investment portfolio should be guided by one’s investment objective, financial needs, time horizon of investment and risk profile which would not match those of institutional investors. What is a suitable investment for the fund may not be suitable for oneself due to differences in the depth of the pocket and exposure to risks, among others.

In addition, the information from 13F may be too late for retail investors to leverage on as the price may have changed since the trades. It also does not tell us the whole story; for instance, institutional funds may take up long positions as a hedge against short positions.

While we all desire our investments to fly to the moon, the positions of star institutions should be used with care; it should be one of many things to consider as part of our research rather than something to be followed blindly.

Disclaimer: The above is my personal opinion. It is not financial advice or a recommendation to invest. Please consult a financial advisor before making any investment decision.

103

1

Hello, mooers!

Not too long ago, we released the Institution Tracking feature.

We have gathered many positive comments on our feature from your lively discussions in the first part.

As @Anonymoosaid: we can see the top AMCs (Asset Management Company) of the United States with their holdings, and their position changes with their total investment funds, Normally it is in trillions.

By observing the position movements of these to...

Not too long ago, we released the Institution Tracking feature.

We have gathered many positive comments on our feature from your lively discussions in the first part.

As @Anonymoosaid: we can see the top AMCs (Asset Management Company) of the United States with their holdings, and their position changes with their total investment funds, Normally it is in trillions.

By observing the position movements of these to...

+2

46

35

Welcome back Mooers ![]()

In this post, we are going to use the SI feature to create our SI Portfolio, by following our 'Clone an SI portfolio in 8 simple steps'.

Here we go!![]()

![]() Step 1. Identify the number of stocks that we are willing to trade.

Step 1. Identify the number of stocks that we are willing to trade.

We will need to know what is the number of stocks that we are comfortable trading with. This number should be in a range between 5 to 35 and should be flexible for later fine-tune if required.

![]() Step 2. Identify the list of favorite stocks that we can afford to trade with.

Step 2. Identify the list of favorite stocks that we can afford to trade with.

Besides knowing the number of stocks that we are comfortable trading with, we can also list down our favorite stocks that we can afford to trade should we buy them all. The number of favorite stocks should be in a range between 25% to 75% of the total number of stocks we had identified in step 1.

![]() Step 3. Identify the budget that we are going to spend on our portfolio.

Step 3. Identify the budget that we are going to spend on our portfolio.

Next, we will need to know how much money we are comfortable to invest in our SI portfolio. This amount should be flexible enough to be tweaked at a later time if required.

![]() Step 4. Look thru the SI we are familiar with listed in the SI feature.

Step 4. Look thru the SI we are familiar with listed in the SI feature.

Now, we will scan thru the SI list to select those SI that we are familiar with, and try to match the SI top X number of stocks with our preferences set in the first 3 steps.

![]() Step 5. Check if SI have at least 8 consecutive years of quarterly 13F filings.

Step 5. Check if SI have at least 8 consecutive years of quarterly 13F filings.

As a precaution, we would want our SI to have at least 8 consecutive years of quarterly 13F filings. This helps to let us know that the SI is committed and shown a certain degree of portfolio resilient during stock market volatility.

![]() Step 6. Look out for any restatements (for both buys and sells) issued by SI.

Step 6. Look out for any restatements (for both buys and sells) issued by SI.

Restatements may contain strategic & valuable information that is associated with significant abnormal returns. This was described in a 2021 interuniversity research report done by Sean Cao, Zhi Da, Xin Daniel Jiang and Baozhong Yang.

![]() Step 7. Using our magic formula.

Step 7. Using our magic formula.

The magic formula to find out the maximum number of each stock that we can buy for our SI portfolio is:

[ (Stock weightage in SI portfolio / Total weightage of trimmed SI portfolio) x our budget (Step 3) ] / current Stock price.

Each result will be round down to the nearest integer.

![]() Step 8. Begin our cloning via trading.

Step 8. Begin our cloning via trading.

Finally, we can place our trading to make a similar clone of the SI portfolio to form our SI Portfolio.

Before we end this post, please vote if you wish to have an example to illustrate the above steps.![]()

Remember to show your support![]() and thank you very much.

and thank you very much. ![]()

![]()

Top 10 Actives (10 Dec 2021)

$Ford Motor (F.US)$

$Apple (AAPL.US)$

$Lucid Group (LCID.US)$

$AMC Entertainment (AMC.US)$

$Bank Bradesco SA(prefer share ADS) (BBD.US)$

$Nu Holdings (NU.US)$

$NVIDIA (NVDA.US)$

$Oracle (ORCL.US)$

$New Oriental (EDU.US)$

$AT&T (T.US)$

In this post, we are going to use the SI feature to create our SI Portfolio, by following our 'Clone an SI portfolio in 8 simple steps'.

Here we go!

We will need to know what is the number of stocks that we are comfortable trading with. This number should be in a range between 5 to 35 and should be flexible for later fine-tune if required.

Besides knowing the number of stocks that we are comfortable trading with, we can also list down our favorite stocks that we can afford to trade should we buy them all. The number of favorite stocks should be in a range between 25% to 75% of the total number of stocks we had identified in step 1.

Next, we will need to know how much money we are comfortable to invest in our SI portfolio. This amount should be flexible enough to be tweaked at a later time if required.

Now, we will scan thru the SI list to select those SI that we are familiar with, and try to match the SI top X number of stocks with our preferences set in the first 3 steps.

As a precaution, we would want our SI to have at least 8 consecutive years of quarterly 13F filings. This helps to let us know that the SI is committed and shown a certain degree of portfolio resilient during stock market volatility.

Restatements may contain strategic & valuable information that is associated with significant abnormal returns. This was described in a 2021 interuniversity research report done by Sean Cao, Zhi Da, Xin Daniel Jiang and Baozhong Yang.

The magic formula to find out the maximum number of each stock that we can buy for our SI portfolio is:

[ (Stock weightage in SI portfolio / Total weightage of trimmed SI portfolio) x our budget (Step 3) ] / current Stock price.

Each result will be round down to the nearest integer.

Finally, we can place our trading to make a similar clone of the SI portfolio to form our SI Portfolio.

Before we end this post, please vote if you wish to have an example to illustrate the above steps.

Remember to show your support

Top 10 Actives (10 Dec 2021)

$Ford Motor (F.US)$

$Apple (AAPL.US)$

$Lucid Group (LCID.US)$

$AMC Entertainment (AMC.US)$

$Bank Bradesco SA(prefer share ADS) (BBD.US)$

$Nu Holdings (NU.US)$

$NVIDIA (NVDA.US)$

$Oracle (ORCL.US)$

$New Oriental (EDU.US)$

$AT&T (T.US)$

85

3

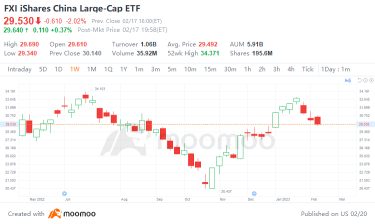

Recently, major institutions filed 13F reports with the U.S. Securities and Exchange Commission (SEC), disclosing their holdings and the size of their positions in U.S. stocks during the fourth quarter.

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!![]()

Michael ...

It is worth noting that large Wall Street private equity funds are buying Chinese stocks on a large scale, and the allocation strategy for Chinese stocks has gradually shifted from [underweight] to [Neutral]!

Michael ...

56

6

First and foremost, I would like to thank to the 50+ supporters and participants who have voted for an example ![]() , and because of your loves and likes, we shall go through an example in today's discussion.

, and because of your loves and likes, we shall go through an example in today's discussion. ![]()

So here we go!![]()

![]() Step 1. Identify the number of stocks that we are willingly to trade.

Step 1. Identify the number of stocks that we are willingly to trade.

We will select 8 as the number of stocks that we are willing to trade.

![]() Step 2. Identify the list of favourite stocks that we can afford to trade with.

Step 2. Identify the list of favourite stocks that we can afford to trade with.

We will select $Apple (AAPL.US)$ , $Bank of America (BAC.US)$ , $Coca-Cola (KO.US)$ and $Moody's (MCO.US)$ as our favorite stocks. The price is 179.45, 44.52, 56.28 and 397.75 as of 10 Dec 2021 in USD.

This is 50% of the total number of stocks we have selected in Step 1.

![]() Step 3. Identify the budget that we going to spend on our portfolio.

Step 3. Identify the budget that we going to spend on our portfolio.

We will be investing USD $12,000 on our SI portfolio.

![]() Step 4. Look thru the SI we are familiar with in the SI feature.

Step 4. Look thru the SI we are familiar with in the SI feature.

We have found the following SI that we are familiar with.

Berkshire Hathaway Inc.

Soros Capital Management LLC.

Dimensional Fund Advisors L.P.

Temasek Holdings (Private) Limited.

Also, in the Berkshire Hathaway Inc. top 8 holdings list, it has all the favourite stocks that we want.

![]() $Apple (AAPL.US)$ *, 179.45, 46.77%

$Apple (AAPL.US)$ *, 179.45, 46.77%

![]() $Bank of America (BAC.US)$ *, 44.52, 13.21%

$Bank of America (BAC.US)$ *, 44.52, 13.21%

![]() $American Express (AXP.US)$ , 167.03, 7.44%

$American Express (AXP.US)$ , 167.03, 7.44%

![]() $Coca-Cola (KO.US)$ *, 56.28, 6.61%

$Coca-Cola (KO.US)$ *, 56.28, 6.61%

![]() $The Kraft Heinz (KHC.US)$ , 34.15, 3.27%

$The Kraft Heinz (KHC.US)$ , 34.15, 3.27%

![]() $Moody's (MCO.US)$ *, 397.75, 2.88%

$Moody's (MCO.US)$ *, 397.75, 2.88%

![]() $BYD COMPANY (01211.HK)$ , 289.8, 2.45%

$BYD COMPANY (01211.HK)$ , 289.8, 2.45%

![]() $Verizon (VZ.US)$ , 50.19, 2.34%

$Verizon (VZ.US)$ , 50.19, 2.34%

Total: 84.97% of SI portfolio

Cost: 1219.17

* favourite stocks as in step 2, and the first number is the stock price as of 10 Dec 2021 while the second number represent the stock weightage in the portfolio.

Thus, we shall select Berkshire Hathaway Inc portfolio to be cloned.

![]() Step 5. Check if SI have at least 8 consecutive years of quarterly 13F filings.

Step 5. Check if SI have at least 8 consecutive years of quarterly 13F filings.

Berkshire Hathaway Inc. (Yes![]() )

)

Soros Capital Management LLC. (No)

Dimensional Fund Advisors L.P. (Yes![]() )

)

Temasek Holdings (Private) Limited. (Yes![]() )

)

![]() Step 6. Look out for any restatements (for both buys and sells) issued by SI.

Step 6. Look out for any restatements (for both buys and sells) issued by SI.

A quick check shows that there is no restatement for the past 5 years from Berkshire Hathaway Inc.

![]() Step 7. Using our magic formula.

Step 7. Using our magic formula.

Using the magic formula:

[ (Stock weightage in SI portfolio / Total weightage of trimmed SI portfolio) x our budget (Step 3) ] / current Stock price. Each result will be round down to the nearest integer.

We will buy the following number of stocks

![]() $Apple (AAPL.US)$ , 36 stocks

$Apple (AAPL.US)$ , 36 stocks

![]() $Bank of America (BAC.US)$ , 41 stocks

$Bank of America (BAC.US)$ , 41 stocks

![]() $American Express (AXP.US)$ , 6 stocks

$American Express (AXP.US)$ , 6 stocks

![]() $Coca-Cola (KO.US)$ , 16 stocks

$Coca-Cola (KO.US)$ , 16 stocks

![]() $The Kraft Heinz (KHC.US)$ , 13 stocks

$The Kraft Heinz (KHC.US)$ , 13 stocks

![]() $Moody's (MCO.US)$ , 1 stocks

$Moody's (MCO.US)$ , 1 stocks

![]() $BYD COMPANY (01211.HK)$ , 1 stocks

$BYD COMPANY (01211.HK)$ , 1 stocks

![]() $Verizon (VZ.US)$ , 6 stocks

$Verizon (VZ.US)$ , 6 stocks

![]() Step 8. Begin our cloning via trading.

Step 8. Begin our cloning via trading.

Now, we shall place our trades in the $Futu Holdings Ltd (FUTU.US)$ MooMoo apps to clone the SI portfolio and turn it to become our SI portfolio.

![]() $Apple (AAPL.US)$ , 36 stocks @ USD 179.45

$Apple (AAPL.US)$ , 36 stocks @ USD 179.45

![]() $Bank of America (BAC.US)$ , 41 stocks @ USD 44.52

$Bank of America (BAC.US)$ , 41 stocks @ USD 44.52

![]() $American Express (AXP.US)$ , 6 stocks @ USD 167.03

$American Express (AXP.US)$ , 6 stocks @ USD 167.03

![]() $Coca-Cola (KO.US)$ , 16 stocks @ USD 56.28

$Coca-Cola (KO.US)$ , 16 stocks @ USD 56.28

![]() $The Kraft Heinz (KHC.US)$ , 13 stocks @ USD 34.15

$The Kraft Heinz (KHC.US)$ , 13 stocks @ USD 34.15

![]() $Moody's (MCO.US)$ , 1 stocks @ USD 397.75

$Moody's (MCO.US)$ , 1 stocks @ USD 397.75

![]() $BYD COMPANY (01211.HK)$ , 1 stocks @ USD 289.8

$BYD COMPANY (01211.HK)$ , 1 stocks @ USD 289.8

![]() $Verizon (VZ.US)$ , 6 stocks @ USD 50.19

$Verizon (VZ.US)$ , 6 stocks @ USD 50.19

That's all for the example. Please give a like![]() to show your support, and do vote if you will be cloning any SI portfolio in the next 3 months.

to show your support, and do vote if you will be cloning any SI portfolio in the next 3 months.

So here we go!

We will select 8 as the number of stocks that we are willing to trade.

We will select $Apple (AAPL.US)$ , $Bank of America (BAC.US)$ , $Coca-Cola (KO.US)$ and $Moody's (MCO.US)$ as our favorite stocks. The price is 179.45, 44.52, 56.28 and 397.75 as of 10 Dec 2021 in USD.

This is 50% of the total number of stocks we have selected in Step 1.

We will be investing USD $12,000 on our SI portfolio.

We have found the following SI that we are familiar with.

Berkshire Hathaway Inc.

Soros Capital Management LLC.

Dimensional Fund Advisors L.P.

Temasek Holdings (Private) Limited.

Also, in the Berkshire Hathaway Inc. top 8 holdings list, it has all the favourite stocks that we want.

Total: 84.97% of SI portfolio

Cost: 1219.17

* favourite stocks as in step 2, and the first number is the stock price as of 10 Dec 2021 while the second number represent the stock weightage in the portfolio.

Thus, we shall select Berkshire Hathaway Inc portfolio to be cloned.

Berkshire Hathaway Inc. (Yes

Soros Capital Management LLC. (No)

Dimensional Fund Advisors L.P. (Yes

Temasek Holdings (Private) Limited. (Yes

A quick check shows that there is no restatement for the past 5 years from Berkshire Hathaway Inc.

Using the magic formula:

[ (Stock weightage in SI portfolio / Total weightage of trimmed SI portfolio) x our budget (Step 3) ] / current Stock price. Each result will be round down to the nearest integer.

We will buy the following number of stocks

Now, we shall place our trades in the $Futu Holdings Ltd (FUTU.US)$ MooMoo apps to clone the SI portfolio and turn it to become our SI portfolio.

That's all for the example. Please give a like

From YouTube

43

6

Columns What's New in Courses (12/15)

Moomoo Courses is committed to providing high-quality content for investors. Learn first before trading, make investing easier and not alone.

Let’s take a look at what's new in Courses last week!![]()

【New Courses】

Are you still finding it hard to make money? Secure a better future for your family by starting investing. If you don't break the old way of thinking, it will be very hard to get you to start investing in the world.

![]() Easy Ways to Start Investing

Easy Ways to Start Investing

Here is a packaged how-to guide to solve your operation problems. How to access market news? How to track trading stocks? How to use stock screener? Come and enjoy it!

![]() Explore Investing Ideas

Explore Investing Ideas

The Federal Reserve could announce plans to cut economic support faster, and may signal 2022 rate increases, at its Dec. 14-15 meeting.

Why does the Federal funds rate matter to us? Follow moomoo Courses to see the updated news about Federal Funds Rate.

![]() The Federal Reserve

The Federal Reserve

【A Little Change】

Did you notice that moomoo Courses is quietly changing?

Our covers are all wordless. That's right!![]()

How about the simple and abstract cover art? Your voice will be forwarded to our designers.

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

Let’s take a look at what's new in Courses last week!

【New Courses】

Are you still finding it hard to make money? Secure a better future for your family by starting investing. If you don't break the old way of thinking, it will be very hard to get you to start investing in the world.

Here is a packaged how-to guide to solve your operation problems. How to access market news? How to track trading stocks? How to use stock screener? Come and enjoy it!

The Federal Reserve could announce plans to cut economic support faster, and may signal 2022 rate increases, at its Dec. 14-15 meeting.

Why does the Federal funds rate matter to us? Follow moomoo Courses to see the updated news about Federal Funds Rate.

【A Little Change】

Did you notice that moomoo Courses is quietly changing?

Our covers are all wordless. That's right!

How about the simple and abstract cover art? Your voice will be forwarded to our designers.

For more investment knowledge and trends, welcome to Courses in the Community.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

32

5

post

post

Jeet Kune Do : Very good writing on star institutions, helps one to learn and make rewarding investment decisions.

102089245 : Nice sharing of Star Institutions. Is very helpful to know what the funds are doing with their investments

101767718 : Investors info, can you allow investors to how the big funds are important

VCSuccess : Great feature. We can know use it to find out more about what the funds are buying and selling![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

HuatEver : Thanks for your sharing of how the contents included in the Star Institutions can guide me in my investments’ journey. Also a Big thanks to Futu for your constant support.

View more comments...