Latest

Hot

Columns SUMMARY OF FED FOMC STATEMENT:

1. The Fed cut rates by 50 basis points to 5.00%. This is the first rate cut since March 2020.

2. The Fed's dot-plot projected another 50bps of rate cuts in 2024, which would take interest rates to 4.50%.

3. Fed officials said risks to employment, inflation goals are now in balance.

4. The Fed’s statement said that the FOMC is strongly committed to supporting max employment, 2% inflation.

Key Takeaway:

Contrary to market expectations, the Fed delivered a 50bps cut.

...

2. The Fed's dot-plot projected another 50bps of rate cuts in 2024, which would take interest rates to 4.50%.

3. Fed officials said risks to employment, inflation goals are now in balance.

4. The Fed’s statement said that the FOMC is strongly committed to supporting max employment, 2% inflation.

Key Takeaway:

Contrary to market expectations, the Fed delivered a 50bps cut.

...

5

Now that rate cuts from the Federal Reserve are anticipated, it's important to think about how your portfolio is set up for this change. Lower rates usually cause the market to behave differently, and exchange-traded funds (ETFs) provide an adaptable option to rebalance your portfolio. To assist you in navigating this new climate, let's take a look at certain sectors and ETFs you might want to explore.

1. Homebuilders: A Rate-Cut Winner

Lower interest rat...

1. Homebuilders: A Rate-Cut Winner

Lower interest rat...

11

1

2

With inflation cooling from its recent highs, all the focus has been on when the Fed might cut its key interest rate. But, in the meantime, the central bank has been doing a subtle yet crucial thing that a lot of folks have overlooked: raising its estimates for the long-term “neutral” interest rate.

The long-term neutral rate is the amount of interest that keeps the economy roughly in balance – neither too hot nor too cold (bar...

The long-term neutral rate is the amount of interest that keeps the economy roughly in balance – neither too hot nor too cold (bar...

9

1

5

We are still in the sweet spot...

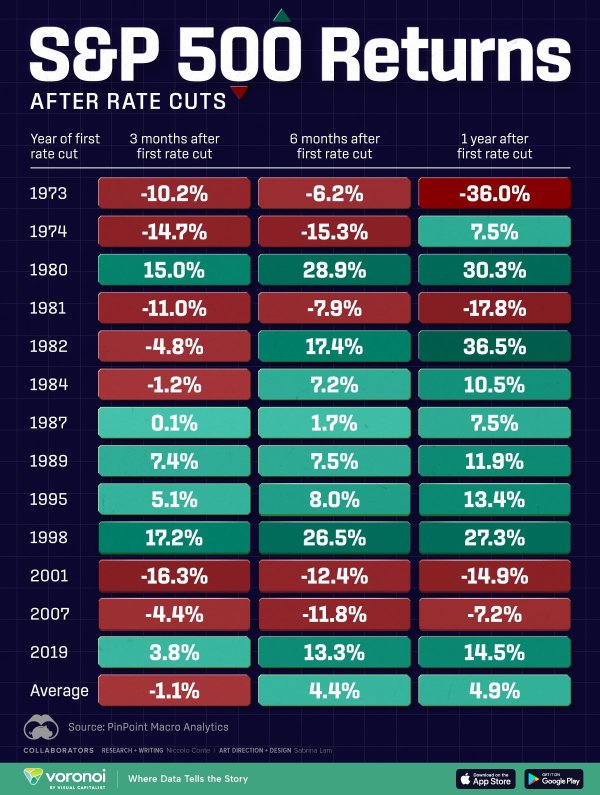

While many investors are eagerly awaiting the first rate cut by the fed, the best phase of the equity market is historically BEFORE the first rate cut rather than the months that follow.

As shown on the chart below courtesy of Strategas, on average, the S&P 500 $SPX has fallen 23.5% over a period of 195 days from the first Fed cut to the market low.

Keep this in mind when the Fed finally decides to start cutting!

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Meta Platforms (META.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $Tesla (TSLA.US)$ $Advanced Micro Devices (AMD.US)$ $Invesco S&P 500 Momentum Etf (SPMO.US)$

While many investors are eagerly awaiting the first rate cut by the fed, the best phase of the equity market is historically BEFORE the first rate cut rather than the months that follow.

As shown on the chart below courtesy of Strategas, on average, the S&P 500 $SPX has fallen 23.5% over a period of 195 days from the first Fed cut to the market low.

Keep this in mind when the Fed finally decides to start cutting!

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Meta Platforms (META.US)$ $Netflix (NFLX.US)$ $NVIDIA (NVDA.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Alphabet-C (GOOG.US)$ $Tesla (TSLA.US)$ $Advanced Micro Devices (AMD.US)$ $Invesco S&P 500 Momentum Etf (SPMO.US)$

3

1

Initiation Date: October 2021

Last Week Post: My Weekly Top 5 Funds (11/6/2023) - Awesome Week!

Strategy: Daily DCA $100/ day, only fund with proven annualized return of 5-6% pa, no commodities, gold, banks & properties, daily DCA on laggard first, then leaders and repeat the cycle, min: 23 funds, max: 30 funds.

Leader this week: US funds, Sustainability & Technology funds (in the money now!!)

Wishlist: MooMoo to provide margin for funds inve...

Last Week Post: My Weekly Top 5 Funds (11/6/2023) - Awesome Week!

Strategy: Daily DCA $100/ day, only fund with proven annualized return of 5-6% pa, no commodities, gold, banks & properties, daily DCA on laggard first, then leaders and repeat the cycle, min: 23 funds, max: 30 funds.

Leader this week: US funds, Sustainability & Technology funds (in the money now!!)

Wishlist: MooMoo to provide margin for funds inve...

+3

2

1

STOCK MARKET WARNING! Was The FOMC Meeting Rate Hike Decision Leaked after CPI Inflation Data?! Find Out Live as we break down all of the action in the #StockMarket Today and Discuss How Far we think this Stock Market Rally can go on tonight's #StockMarketLive stream!

Did the May CPI Inflation data and inflation report just signal that the #FED will pause rate hikes in June?...

Did the May CPI Inflation data and inflation report just signal that the #FED will pause rate hikes in June?...

True Trading Group is revealing the truth in the #stockmarket this week & no, we’re not talking about Aliens or UFO Whistleblower David Grusch! This week is all about #CPI #Inflation Data, The #FOMC Meeting and Fed Chair Jerome Powell.

As far as stock market predictions are concerned this week is a GO FOR #MakingMoney #Trading action in the stock market. It all starts Tomorrow...

As far as stock market predictions are concerned this week is a GO FOR #MakingMoney #Trading action in the stock market. It all starts Tomorrow...

2

efficentupup :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Distinguish07 : Aand other 5.0% million people came

John_5657 : Does that mean stocks will fall tomorrow?

RashL :

小粉红的papa :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...