Latest

Hot

Can investors profit from getting a ride (from Guru)?

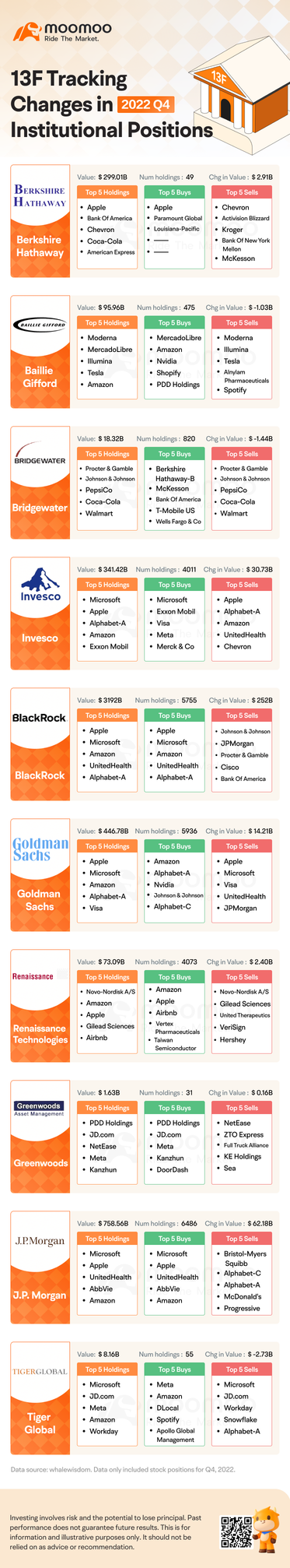

I used Institution Tracking to check where the Gurus or Institutions are investing. It is just one of the many ways to select/verify which stocks to invest.

I believe some Guru invest on value stock which is also my investment goal. But I must be mindful that these hedge funds' risk appetite is different - can ride the volatility storm which we may not.

As retail investor, we can only ride the tide ...

I used Institution Tracking to check where the Gurus or Institutions are investing. It is just one of the many ways to select/verify which stocks to invest.

I believe some Guru invest on value stock which is also my investment goal. But I must be mindful that these hedge funds' risk appetite is different - can ride the volatility storm which we may not.

As retail investor, we can only ride the tide ...

4

Taiwan Semiconductor's $Taiwan Semiconductor (TSM.US)$ stock price drooped 6% to $92 in Wednesday's premarket after disciples of Warren Buffet were spooked by the Oracle of Omaha's sudden scrapping of his position. A 13F filing with the Securities & Exchange Commission (SEC) shows that Buffet's Berkshire Hathaway sold off about 86% of his $5 billion position during the fourth quarter.

“It’s surprising that Berkshire cut its h...

“It’s surprising that Berkshire cut its h...

4

Warren Buffett's Berkshire Hathaway Inc. $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ sent shares of Taiwan Semiconductor Manufacturing Co. Ltd. $Taiwan Semiconductor (TSM.US)$ plunging as much as 6% Wednesday morning after unexpectedly dumping most of its stake in the chipmaker just months after taking a position.

Berkshire sold more than 50 million shares of Taiwan Semiconductor in the fourth quarter, or 86% of the $4.1 billion position it o...

Berkshire sold more than 50 million shares of Taiwan Semiconductor in the fourth quarter, or 86% of the $4.1 billion position it o...

7

There are thousands of stocks in the market. Which should I pick?

How about learning from the world's greatest investors, such as Warren Buffett, Charlie Munger, Bill Ackman, and many more?

You may develop great investment ideas by looking at what these gurus buy or sell.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

How about learning from the world's greatest investors, such as Warren Buffett, Charlie Munger, Bill Ackman, and many more?

You may develop great investment ideas by looking at what these gurus buy or sell.

$S&P 500 Index (.SPX.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Dow Jones Industrial Average (.DJI.US)$

5

$Berkshire Hathaway-A (BRK.A.US)$'s 13F of Q4 2022 revealed that Berkshire added more than 333,800 shares of Apple stock to its portfolio. But don't get too excited -- the number of new shares is equivalent to the amount held by Alleghany, the insurer Berkshire bought early last year.

This means Bershire's AAPL position is effectively unchanged if that factor is excluded, but it remains the largest position in its portfolio....

This means Bershire's AAPL position is effectively unchanged if that factor is excluded, but it remains the largest position in its portfolio....

4

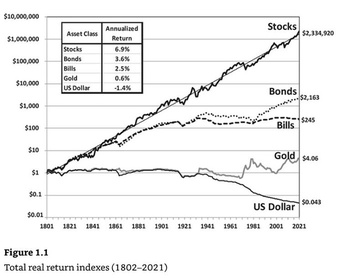

“Over the long term, the stock market news will be good. In the 20th century, the U.S. endured two world wars…the Depression; a dozen or so recessions…oil shocks; a fly epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

- Warren Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$

- Warren Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Apple (AAPL.US)$ $Coca-Cola (KO.US)$

3

1

Meaning of Form 13 F

Form 13F filings provide investors with a look at the holdings of “Smart Money” who also have the ability to move markets

IMPORTANT TO KNOW:

Institutional investment managers are only required to report long positions, apart from their put and call options, American Depositary

Receipts (ADRs), and convertible notes.

It means that Form 13F DOES NOT INCLUDE SHORT POSITIONS AND the long positions are often only for the purpose of hedging against those short position as many ...

Form 13F filings provide investors with a look at the holdings of “Smart Money” who also have the ability to move markets

IMPORTANT TO KNOW:

Institutional investment managers are only required to report long positions, apart from their put and call options, American Depositary

Receipts (ADRs), and convertible notes.

It means that Form 13F DOES NOT INCLUDE SHORT POSITIONS AND the long positions are often only for the purpose of hedging against those short position as many ...

3

The SEC Form 13F - is a quarterly reporting form required to be filed by all institutional investment managers with at least $100 million in assets under management;

Congress intended to provide transparency on the holdings of the institutional investors via these filings; to increase public access to information regarding the securities holdings held by institutional investors; was believed that this institutional disclosure program would increase transparency and thus increase investor confid...

Congress intended to provide transparency on the holdings of the institutional investors via these filings; to increase public access to information regarding the securities holdings held by institutional investors; was believed that this institutional disclosure program would increase transparency and thus increase investor confid...

MattSully : Why did not include Berkshire Hathaway selling 86% stake in TSM 2022 Q4?

Wesy MattSully : Good