Latest

Hot

Key takeaways:

The Fed has no choice. Goodbye to the era of near-zero interest rates.

Why inflation and the Fed decision matter.

The historical impacts of rate hikes on the stock market.

Is it a good time to buy? How to invest during inflation times? Take the advice of Musk and Buffett.

- The Fed has no choice.

It's time to say goodbye to the era of near-zero interest rates.

The U.S. central bank is expected to wrap up its two-day meet...

The Fed has no choice. Goodbye to the era of near-zero interest rates.

Why inflation and the Fed decision matter.

The historical impacts of rate hikes on the stock market.

Is it a good time to buy? How to invest during inflation times? Take the advice of Musk and Buffett.

- The Fed has no choice.

It's time to say goodbye to the era of near-zero interest rates.

The U.S. central bank is expected to wrap up its two-day meet...

+5

117

20

What's your thought on it?

$FREDDIE MAC (FMCC.US)$ $FEDERAL NATIONAL MORTGAGE ASSOC (FNMA.US)$ $Zillow-C (Z.US)$ $Compass (COMP.US)$ $Redfin (RDFN.US)$

$FREDDIE MAC (FMCC.US)$ $FEDERAL NATIONAL MORTGAGE ASSOC (FNMA.US)$ $Zillow-C (Z.US)$ $Compass (COMP.US)$ $Redfin (RDFN.US)$

Expand

Expand 24

4

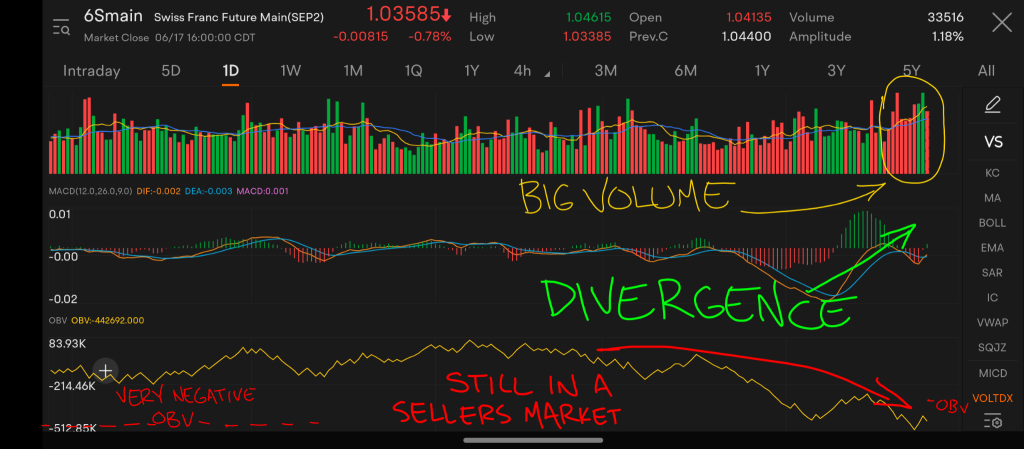

$Swiss Franc Futures(DEC4) (6Smain.US)$

What is going on with the Swiss currency. The Swiss National Bank made a historical intrest rate increase. This was the first increase in Switzerland in around 14 years. Please any currency guys out there correct me if Im wrong but I believe it was one of the lowest interest rate before the increase in borrowing cost. The Swiss interest rate is still in the negative zone which is accommodative to growth. But this is a lar...

What is going on with the Swiss currency. The Swiss National Bank made a historical intrest rate increase. This was the first increase in Switzerland in around 14 years. Please any currency guys out there correct me if Im wrong but I believe it was one of the lowest interest rate before the increase in borrowing cost. The Swiss interest rate is still in the negative zone which is accommodative to growth. But this is a lar...

2

1

Some charts on ETFs performing well.

what is an ETF: https://www.investopedia.com/terms/e/etf.asp

$SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US)$ This is a basket of pipeline operators, gas explorers, and refiners. No single position is more that 3% so it is a very diversified oil and gas ETF. It pays a quarterly dividend (the last few have been around .48). Showing the monthly and weekly charts because these are ETFs and long holds (especially now)

145 for the...

what is an ETF: https://www.investopedia.com/terms/e/etf.asp

$SPDR S&P Oil & Gas Exploration & Production ETF (XOP.US)$ This is a basket of pipeline operators, gas explorers, and refiners. No single position is more that 3% so it is a very diversified oil and gas ETF. It pays a quarterly dividend (the last few have been around .48). Showing the monthly and weekly charts because these are ETFs and long holds (especially now)

145 for the...

+6

7

2

Agriculture commodity milling group like $Archer Daniels Midland (ADM.US)$ $Bunge (BG.US)$ lead the way up. Looking at a small cap for entry to catch up. Love Fertilizers like $Nutrien Ltd (NTR.CA)$

Click and watch the video below on YouTube (Pro Tip: adjust the speed to 1.5–2X):

Click and watch the video below on YouTube (Pro Tip: adjust the speed to 1.5–2X):

3

2

What a wild week. good or bad it was wild, but have we reversed?

I don't believe we have reversed, and I will explain why I am still Bearish, hopefully also explain why we may be entering another stretch where energy and metals surge while tech declines.

Here are NQ charts, the trendline (blue) is the same the only thing changing is the time frame. $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Invesco QQQ Trust (QQQ.US)$

NQ remains in overbought territory, while th...

I don't believe we have reversed, and I will explain why I am still Bearish, hopefully also explain why we may be entering another stretch where energy and metals surge while tech declines.

Here are NQ charts, the trendline (blue) is the same the only thing changing is the time frame. $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $Invesco QQQ Trust (QQQ.US)$

NQ remains in overbought territory, while th...

+14

23

41

The entire goal of the FED is self preservation, they will do whatever they need to do to keep the economy from exploding. In what scenario will a bank or the FED EVER tell you they don’t have something under control? Doing so would cause panic, bank runs, and your uncle’s wet dream coming true. The FED will find any reason to keep printing. If 2018 is any indicator, a reversal on rate hikes is inevitable. $S&P 500 Index (.SPX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$

2

With interest rates finally being raised on Wednesday, there’s a lot to look forward to in 2022 as well as the following decade. The FED has announced a 0.25% rate hike with what sounds like a target of 7 this year, leaving the target range somewhere between 1.75%-2.00%. What does this mean? It means money is becoming more expensive to borrow. This results in a tightening of the money supply in both the market and the economy. Borrowed money is permanently returned and removed from the system. T...

6

2

Milk The Cow : The funny![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) thing is that "they" still expect "us" not dead yet.

thing is that "they" still expect "us" not dead yet.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) to investors.

to investors.

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) +

+ ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) =

= ![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

One more to go, a "war" popped out of no where to deal the final blow

Moomoo Learn OP : When it comes to hedging against inflation, Elon Musk and Warren Buffett have recommended similar strategies.

Own or invest in good companies. Make good use of your cash.

HarDWireD : race riots(class), then pandemic, now verge of global war. .....little to perfect.

destabilize nations before war. I think a asian general wrote. a book a while back with a chapter similar

Sianzsation Moomoo Learn OP : Elon is saying buy Tesla good company. He is hunting indirectly!

Upncoming1841 : Tech stocks are relatively cheap and most are trading at or near 52 weeks low. I will be buying some with a long term investment horizon. As long is the companies I choose are fundamentally good, I am certain it will earn me profits over a two year holding period ceteris paribus.

View more comments...