Latest

Hot

It depending on individual eventually, I would prefer to go for financial freedom. For me, financial freedom = passive income more than expenses, where we do not need to worry about even we are not working anymore. I wish to invest smartly, earn enough money then retire early and travel extensively.

For some peoples, financial freedom means being able to pay the bills with money left over each month or keep for other purposes, like spend for family, personal expenses or in...

For some peoples, financial freedom means being able to pay the bills with money left over each month or keep for other purposes, like spend for family, personal expenses or in...

2

4

Sure boh ![]() ? Maybe this is one of the reasons that contributed to inflation

? Maybe this is one of the reasons that contributed to inflation ![]() .

.

Do I live paycheck-to-paycheck?

"Paycheck-to-paycheck = To spend all of the money from one paycheck before receiving the next paycheck?![]() "

"

If so, then NO![]() .

.

I can't imagine myself living such a wild life like that![]() .

.

I still preferred a future that has enough wealth & spending power 🔋& has no worries about financial at all![]() .

.

This is also one of the reasons as to why I...

Do I live paycheck-to-paycheck?

"Paycheck-to-paycheck = To spend all of the money from one paycheck before receiving the next paycheck?

If so, then NO

I can't imagine myself living such a wild life like that

I still preferred a future that has enough wealth & spending power 🔋& has no worries about financial at all

This is also one of the reasons as to why I...

6

4

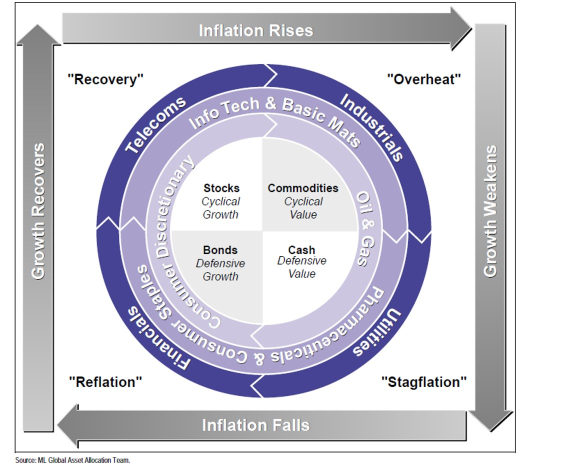

The stock market has had a roller coaster year as the Federal Reserve's aggressive rate hikes sparked recession fears.

All eyes will be on Friday's May CPI reading. Many see the report as critical to the path of Fed policy and whether the central bank will stick to its aggressive 50 basis point rate hike.

The recent rebound has somewhat eased investor pessimism. Two big questions still plague investors: is now the time to buy? Where t...

All eyes will be on Friday's May CPI reading. Many see the report as critical to the path of Fed policy and whether the central bank will stick to its aggressive 50 basis point rate hike.

The recent rebound has somewhat eased investor pessimism. Two big questions still plague investors: is now the time to buy? Where t...

+2

106

24

Win Rewards:

Place your Bet on NIO's percentage change (US Market) in closing price (i.e.+3%) of June 9 ET by 3:00 PM, June 9 ET. The mooer with the closest bet will win 300 points!

Dear mooers,

NIO's first-quarter 2022 Earnings Conference Call is to be released on June 9 prior to the opening of U.S. markets! The consensus estimate for revenue is expected at $1.5 billion, indicating a nearly 47.6% YoY growth. The EPS is ...

Place your Bet on NIO's percentage change (US Market) in closing price (i.e.+3%) of June 9 ET by 3:00 PM, June 9 ET. The mooer with the closest bet will win 300 points!

Dear mooers,

NIO's first-quarter 2022 Earnings Conference Call is to be released on June 9 prior to the opening of U.S. markets! The consensus estimate for revenue is expected at $1.5 billion, indicating a nearly 47.6% YoY growth. The EPS is ...

28

49

Putting a ceveat first, there are those who live paycheck-to-paycheck despite spending very frugally and buying only necessities. I know it because I came from a low income background and understand the pain ![]()

![]() When income doesn't match basic living expenses, you have no choice but to pray hard, nothing bad happens.

When income doesn't match basic living expenses, you have no choice but to pray hard, nothing bad happens.

However, currently in society, there are a larger number of people who live paycheck-to-paycheck despite earning m...

However, currently in society, there are a larger number of people who live paycheck-to-paycheck despite earning m...

9

2

honestly, it is a surprising figure and interesting statistic to know that more than half of the US population do not save much but spend it (un)wisely /extravagantly. perhaps, they do not have any means of saving a portion of their income as their essential bills are too many. but let's say that a portion of people here can save but aren't saving and just carelessly spending their income. well, I guess what will bug them in the future is their extra cash for any needed e...

5

12

And their investment performance beats a lot of people

5

2

$SPDR S&P 500 ETF (SPY.US)$ There is a legitimate and serious concern that SPY may go to 300-350$ in the coming months if it hits bear markets. More of not "if" but rather "when" it hits. I do not want to run the risk of losing my investments by such a large percentage, and hence hedging seems to be the best option at the moment. Of course keep cash on the side and invest as it allows. And, given the conditions, buying these spreads and selling at 50-80% profits...

8

If you are able to put away certain amount of money from you paycheck away in savings is good. Then you can take a small percentage of that and invest. If you want to invest all you can, there is no limit. You should be able to bear the loss in the event it happens, since it is stock market. You have to be able to bear the loss without hurting your day to day life. I live paycheck to paycheck, but still try to put in the stock market what I can bear as a loss. Since many brokers...

1

3

Johnnie Worker : Thx million for such great insight!

whqqq : thanks a bunch!

雪鸟飞 : Mind to share how passive income can be more than expenses? How much capital is needed for this purpose?

cola1010 OP 雪鸟飞 : Hi, i earned the passive income from my stock investment, unit trust and online shopping platform shop. So you will need to know how heavy is your expense like housing, car, lifestyles, bills and so on. If your passive income can cover most of the expenses then you can actually have the financial freedom, it is not easy though (stock up and down), sometimes still need to cover by job income.