Latest

Hot

In January, the SEC approved the trading of 11 spot Bitcoin ETFs on the 11th. This approval allows investors to diversify their portfolios with crypto exposure without worrying about the complicated issues of custody. Microsoft had overtaken Apple as the most valuable company for the first time since 2021, which may be largely due to its investment in generative AI, including a stake in ChatGPT. The EV sector also faces fierce competition;...

+11

326

82

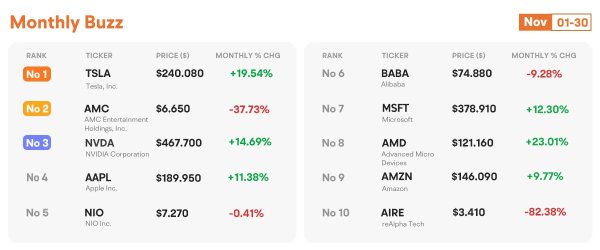

In November, Wall Street's primary indices rebounded after three months of weakness. The easing of US inflation suggested that stubbornly high prices were loosening their grip on the economy. The softer-than-expected consumer price index also boosted confidence in the market that the Federal Reserve would end its rate-hiking cycle soon. These developments point to the possibility of a soft landing for the US economy with...

+5

135

19

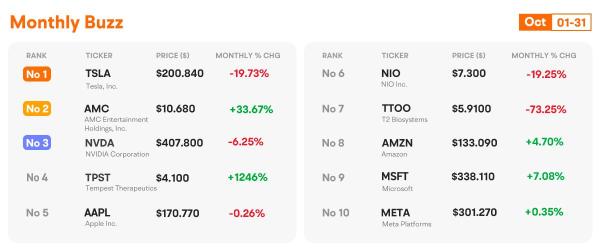

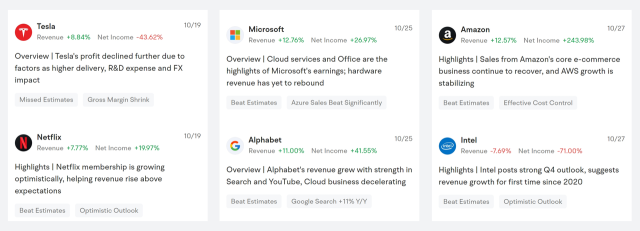

October has been a month of instability for the stock market as several significant events resulted in fluctuations in stock prices. Fears over a broader conflict in the Middle East raised oil prices, gold prices, and bond yields, pushing the US 10-year benchmark beyond 5 percent for the first time in 16 years. This development is detrimental to global growth and stock values. Moreover, the Q3 earnings season introduced ...

+6

176

27

just case if you are too lazy to read, Li and Lei were the earlier investors of $NIO Inc (NIO.US)$ . They are doing better off without William now. Xpeng also tried to help him earlier on:

Xpeng CEO says he bought shares of Nio during the latter's toughest time in 2019

. William is someone who cannot take feedback, took him sooooo long to accept his mistakes:

eletric-vehicle...

Deserve a slap in the face![]()

$Li Auto (LI.US)$ $XPeng (XPEV.US)$ $XIAOMI-W (01810.HK)$

Xpeng CEO says he bought shares of Nio during the latter's toughest time in 2019

. William is someone who cannot take feedback, took him sooooo long to accept his mistakes:

eletric-vehicle...

Deserve a slap in the face

$Li Auto (LI.US)$ $XPeng (XPEV.US)$ $XIAOMI-W (01810.HK)$

2

2

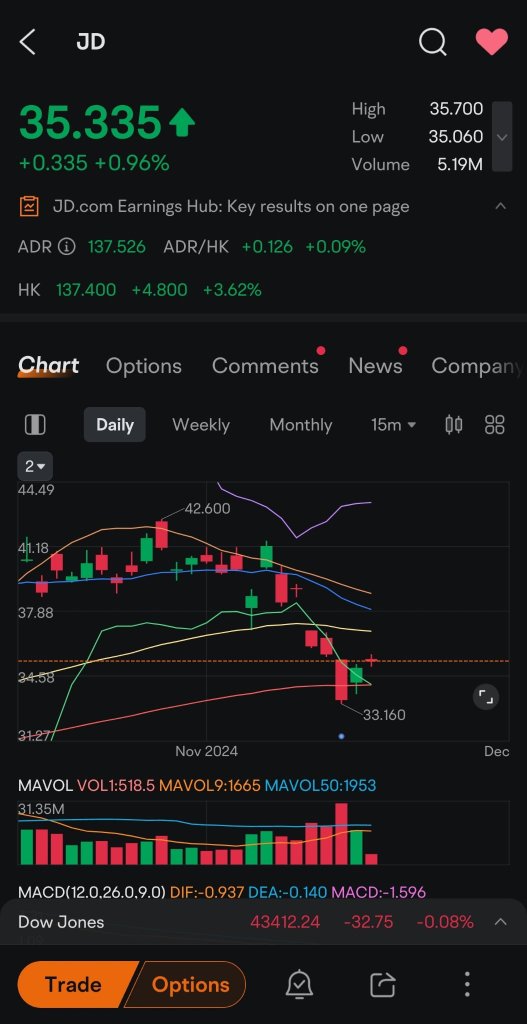

$JD.com (JD.US)$

watch for 33.16 to hold, if not next stop is 30. Chart is developing nicely, double bottom, higher highs and higher lows.

$KraneShares CSI China Internet ETF (KWEB.US)$

watch for 33.16 to hold, if not next stop is 30. Chart is developing nicely, double bottom, higher highs and higher lows.

$KraneShares CSI China Internet ETF (KWEB.US)$

5

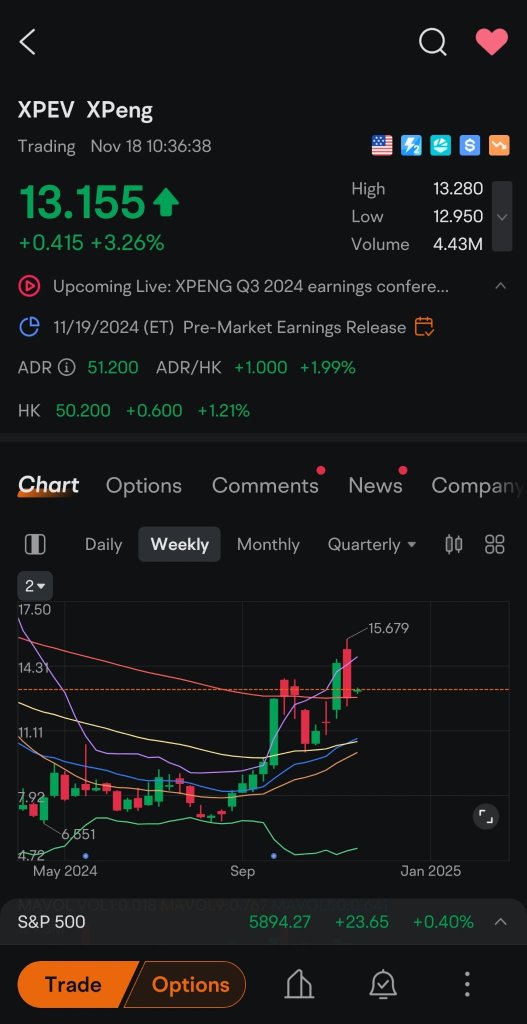

$XPeng (XPEV.US)$

Currently on a bounce off of bottom. heavy resistance at around 18.43. above that uptrend starts.

Currently on a bounce off of bottom. heavy resistance at around 18.43. above that uptrend starts.

5

1

$Rivian Automotive (RIVN.US)$

For me, RIVN is the second most spotted EV in the USA.

$SPDR S&P 500 ETF (SPY.US)$

For me, RIVN is the second most spotted EV in the USA.

$SPDR S&P 500 ETF (SPY.US)$

3

$Eli Lilly and Co (LLY.US)$

Not a good sign when other pharmas are not following. watch out for below 714.89, big drop after that.

$Bright Minds Biosciences (DRUG.US)$

$DRUG FREE SOLUTION INC (DSOL.US)$

Not a good sign when other pharmas are not following. watch out for below 714.89, big drop after that.

$Bright Minds Biosciences (DRUG.US)$

$DRUG FREE SOLUTION INC (DSOL.US)$

2

over 5 now but it's fine for it to pull back for a quick test of 4.82.

over 5 now but it's fine for it to pull back for a quick test of 4.82.

mr_cashcow : Right now the consensus seems to be towards semiconductors which are heavily used in ai sectors so keeping a close eyes on it![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

费北敬 : us pumping money for semicon industry, pump pump pump all the way to the moon

quekky : Although AI had already been around for the past 20 years, it only just become popular due to the release of ChatGPT last year. After that, almost every companies try to incorporate AI into their products. This may be the starting of AI phase for the next 10 or 29 years, until something better comes along and replace the trend. So far now, it's safe to say that buying companies that is heavily invested in AI is a safe bet.

102362254 : We should seek out sources that adhere to high standards of journalism, such as accuracy, fairness, transparency, and accountability, in order to filter the headlines to focus on what truly matters.

小trader : Prioritize reliable sources, focus on key indicators, and analyze long-term impacts when filtering overwhelming information. To leverage news, align findings with your strategy, assess risks, and stay informed about global economic trends for sound investment decisions.

Ultimately, have your own judgement and take all the information you see online with a pinch of salt :))

View more comments...