Latest

Hot

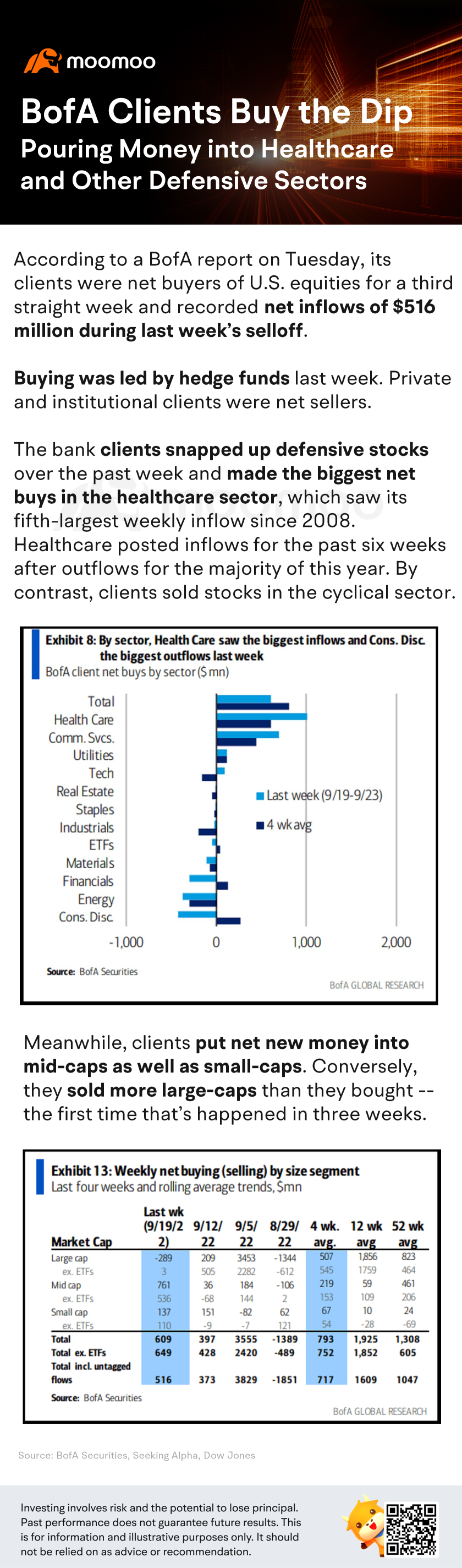

The stock market has fallen back to March 2020 numbers and is on the support line of the March 2020 crash. This has been caused by the growth of financial sector and from its creation of complex and unstable financial derivatives built on risky forms of private debt. How much deficit? Around 18 trillion dollars. Since United States (US) banks and clearing houses are backed by the Fed this required them to print then “loan” this amount out using the overnight reve...

58

26

Hi, mooers!![]()

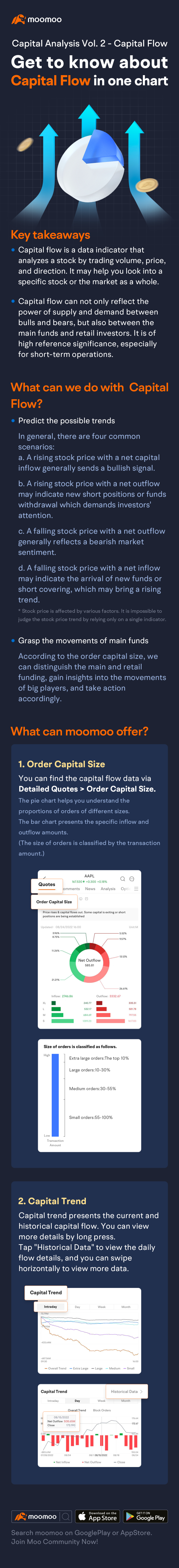

Welcome back to the Capital Analysis Series! In the last session, we received many impressive views on short sale analysis. Some of them are very inspiring. Let's explore another capital-analysis tool for weighing the power of supply and demand — Capital Flow!![]()

Knock knock~ Don't forget to share your learning notes with us: Plenty of rewards await!!!

Rewards

1. $20 Stock Cash Coupon

For 6 mooers who share original and qual...

Welcome back to the Capital Analysis Series! In the last session, we received many impressive views on short sale analysis. Some of them are very inspiring. Let's explore another capital-analysis tool for weighing the power of supply and demand — Capital Flow!

Knock knock~ Don't forget to share your learning notes with us: Plenty of rewards await!!!

Rewards

1. $20 Stock Cash Coupon

For 6 mooers who share original and qual...

Expand

Expand 48

13

BLACK MONDAY well maybe not monday but soon. It's bad it's going to get worse, please do not be long overnight. iam shorting all market spikes and peaks. The only things iam watching to buy (ONLY WATCHING) are Energy (oil, nat gas, uranium) and Food (corn specifically but also fertilizer).

American Banks are holding tons of loans (debt mostly home) and now record repos (assets and banks dont like assets, mostly autos) and both are declining in value. They must soon start selli...

American Banks are holding tons of loans (debt mostly home) and now record repos (assets and banks dont like assets, mostly autos) and both are declining in value. They must soon start selli...

+17

30

20

A good example showing the global economy is booming is $Grab Holdings (GRAB.US)$ , as it launched its first digital bank with $Singtel (Z74.SG)$ in 2022. ![]()

Not only it launched its first digital bank, it is also not desperate to do mass layoffs or hiring freezes, unlike one of its rivials, $Sea (SE.US)$ .

Extracted from:

Besides the two good news above, Grab stock price rises with positive capital inflows on 30 Sep 2022, which generally mean a bullish signal.![]()

���������...

Not only it launched its first digital bank, it is also not desperate to do mass layoffs or hiring freezes, unlike one of its rivials, $Sea (SE.US)$ .

Extracted from:

Besides the two good news above, Grab stock price rises with positive capital inflows on 30 Sep 2022, which generally mean a bullish signal.

���������...

+1

11

9

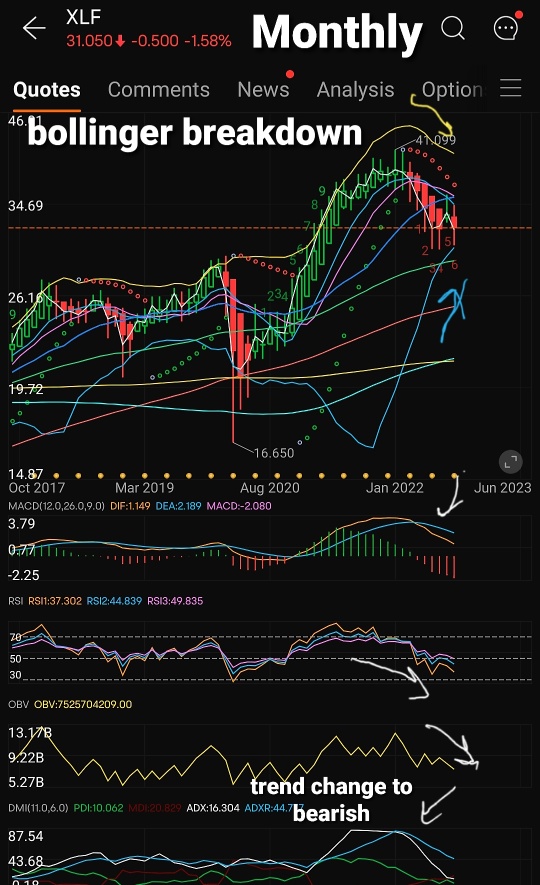

Let’s see how far and how high this could go. We are far from being bullish. Still remain the view of short the pop and sell the rip.

Meanwhile, a lot of people said 75 basis points have been priced in, high inflation has been priced in, and some even said the market is pricing in recession now. But guess what, there could still be things that are not priced in.

The scary thing is, you don’t know what you don’t know. That’s the issue that many investors faced. When you thought t...

Meanwhile, a lot of people said 75 basis points have been priced in, high inflation has been priced in, and some even said the market is pricing in recession now. But guess what, there could still be things that are not priced in.

The scary thing is, you don’t know what you don’t know. That’s the issue that many investors faced. When you thought t...

From YouTube

7

15

10

2

The overall trend in the markets is an obvious downtrend. But on the very short-term picture there are very oversold conditions. The stock market cant fall down in a straight line. There are usually small corrections or bounces to the upside to cool off a rapidly falling market. Will we get that bounce this week? Or will the market continue to crash?

Check out the video in this link to get the current Technical Analysis for the Broader markets. Here is the link: https://youtu.be...

Check out the video in this link to get the current Technical Analysis for the Broader markets. Here is the link: https://youtu.be...

5

16

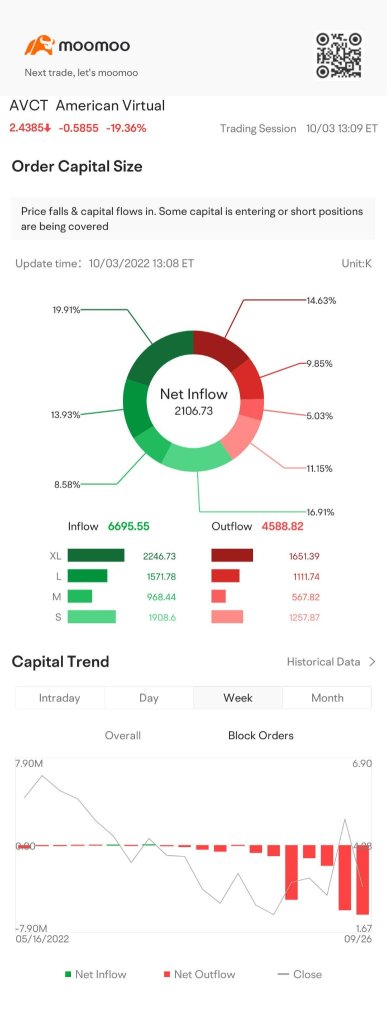

The net inflow of funds does not mean that the stock price must rise, and the net outflow does not mean that the stock price must fall. There is no indicator in the stock market that is 100% valid, all conclusions are based on a certain probability, and if there is a definite valid indicator, the stock market will no longer be valid.![]()

![]() $Invesco QQQ Trust (QQQ.US)$

$Invesco QQQ Trust (QQQ.US)$

9

1

By checking the flows of funds, we can gasp the transactions volume size (direction) or so & the moomoo app "Capital Flow" indicator features make it convenient as a guiding tool for... especially traders ![]()

![]() .

.

Let's use $Tesla (TSLA.US)$ as an example![]() :

:

Order Capital Size are being categorised in:

Extra Large Orders - XL

Large Orders - L

Medium Orders - M

Small Orders - S

As u can see, the Outflow > Inflow = Indicate downtrend for 23/9/20...

Let's use $Tesla (TSLA.US)$ as an example

Order Capital Size are being categorised in:

Extra Large Orders - XL

Large Orders - L

Medium Orders - M

Small Orders - S

As u can see, the Outflow > Inflow = Indicate downtrend for 23/9/20...

+2

7

2

trust him lol

trust him lol

long time ago but never mentioned out because it may be too sensitive for public view = (a minority point of view/things that ppls don't really like mentioning), thinking quite hard how to put it in a better way.

long time ago but never mentioned out because it may be too sensitive for public view = (a minority point of view/things that ppls don't really like mentioning), thinking quite hard how to put it in a better way. +

+ =

=  reward. So, I take it as a win-win

reward. So, I take it as a win-win

silverelf : Good to hear from you again after the long hiatus![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Bernard With Bacon : Thank you for sharing

venda akka : Thank god, good hearing from you. Hope you are doing good master.

Mcsnacks H Tupack OP silverelf : Its all bad. A loss of confidence in the Dollar and the market along with the US economy has been created to force a shift to IMF’ special drawing baskets in order to create the new Worldwide Digital currency. We are F-cked.

Kcler : Master is back in the chat with wise words

View more comments...