Latest

Hot

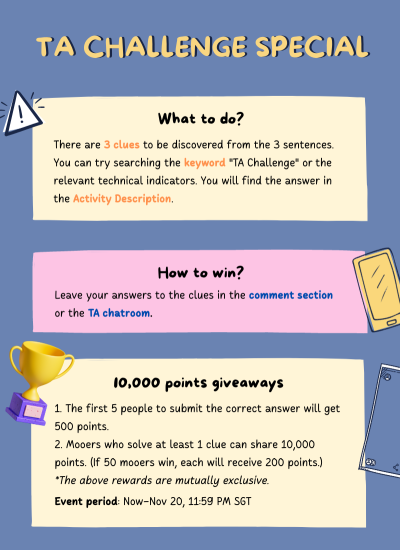

Technical analysis is often adopted to explore trading opportunities by focusing on the study of price and volume, which helps us "read" the market sentiment. After NINE sessions of the TA Challenge, we have finally arrived at the Trading Clue Challenge!

Are you ready? Winners will stand a chance to get 10,000 points!![]()

The First Clue

This indicator is composed of three lines, which visualize volatility and help traders identify whether the pr...

Are you ready? Winners will stand a chance to get 10,000 points!

The First Clue

This indicator is composed of three lines, which visualize volatility and help traders identify whether the pr...

+4

29

103

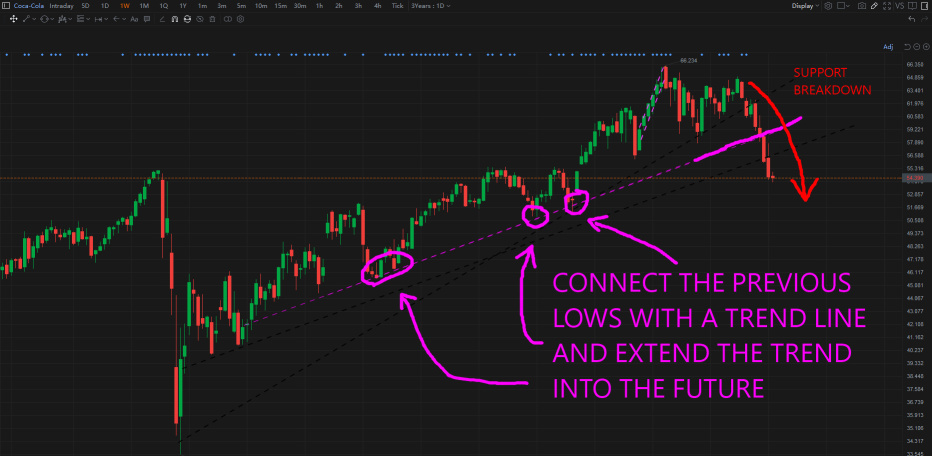

Support and resistance are two basic concepts in technical analysis, which can help traders gain insights into the strength of a price trend. Through this challenge, you can get to know the support level and the myth behind it.![]()

![]()

![]()

A support level is a price below which a stock doesn't tend to fall over a given period. Do you know how to plot it?

Think of the support level as a straight line connecting two or more low points. Use a single line w...

A support level is a price below which a stock doesn't tend to fall over a given period. Do you know how to plot it?

Think of the support level as a straight line connecting two or more low points. Use a single line w...

72

28

There are many investors who call themselves technical traders. And the first thing a technical trader learns is where to find support levels. These are areas where there is a high likelihood of potential buyers stepping in to "support" or keep the price from falling lower. Support zones are also refered to as demand zones. It is not easy to find support zones on all ticker symbols but some tickers form very clear trends with obvious t...

+4

60

24

From September till now, the $S&P 500 Index (.SPX.US)$ has already tested the 3900 level twice. This level has recently developed into a flashpoint between bulls and bears. It served as a support in mid-May and restrained gains in June and July.

Have you found the S&P 500 top holdings that encountered more fresh lows than highs? Some tech stocks even break the support levels.

$Alphabet-A (GOOGL.US)$ hit a fresh low in May and has been hovering around tha...

Have you found the S&P 500 top holdings that encountered more fresh lows than highs? Some tech stocks even break the support levels.

$Alphabet-A (GOOGL.US)$ hit a fresh low in May and has been hovering around tha...

51

22

Congratulations to mooers @SpyderCall @bullrider_21 @doctorpot1 @anchovy3 @steady Pom pipi @阿姚朋友 who have published high-quality content with indicators and charts on this topic. You will receive a reward of $5 Stock Cash Coupon. Thanks for your excellent performance at this event!![]()

Congratulations to mooers @Milk The Cow @Cow Moo-ney @Asphen @snoopy123 @winblessing @103047546 @Buffdan1for winning 88 points.![]()

All of your posts and comments are appreciated! Thank you so much for joining the "TA Cha...

Congratulations to mooers @Milk The Cow @Cow Moo-ney @Asphen @snoopy123 @winblessing @103047546 @Buffdan1for winning 88 points.

All of your posts and comments are appreciated! Thank you so much for joining the "TA Cha...

11

8

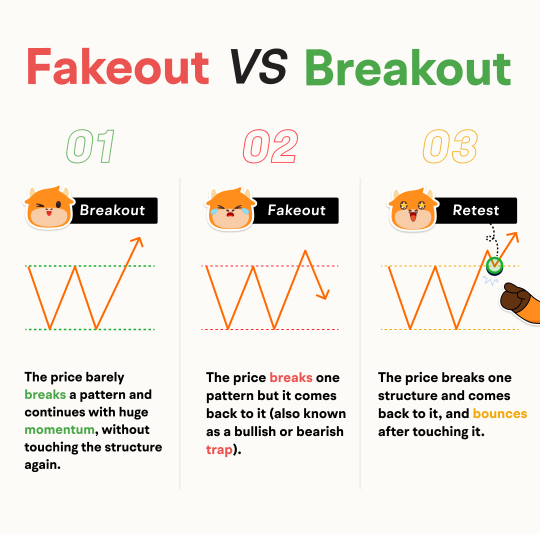

Many technical investors believe the saying “buy on breakout”, but in some cases, the stock price may briefly break past the resistance level but then quickly return to it, forcing investors to cut losses.![]()

So, how to distinguish Fakeout and Breakout? Today Cici will take a classic bullish pattern - double bottom as an example and share a practical tip:

1. Breakout: The price barely breaks a pattern and continues with huge momentum, without touchi...

So, how to distinguish Fakeout and Breakout? Today Cici will take a classic bullish pattern - double bottom as an example and share a practical tip:

1. Breakout: The price barely breaks a pattern and continues with huge momentum, without touchi...

15

2

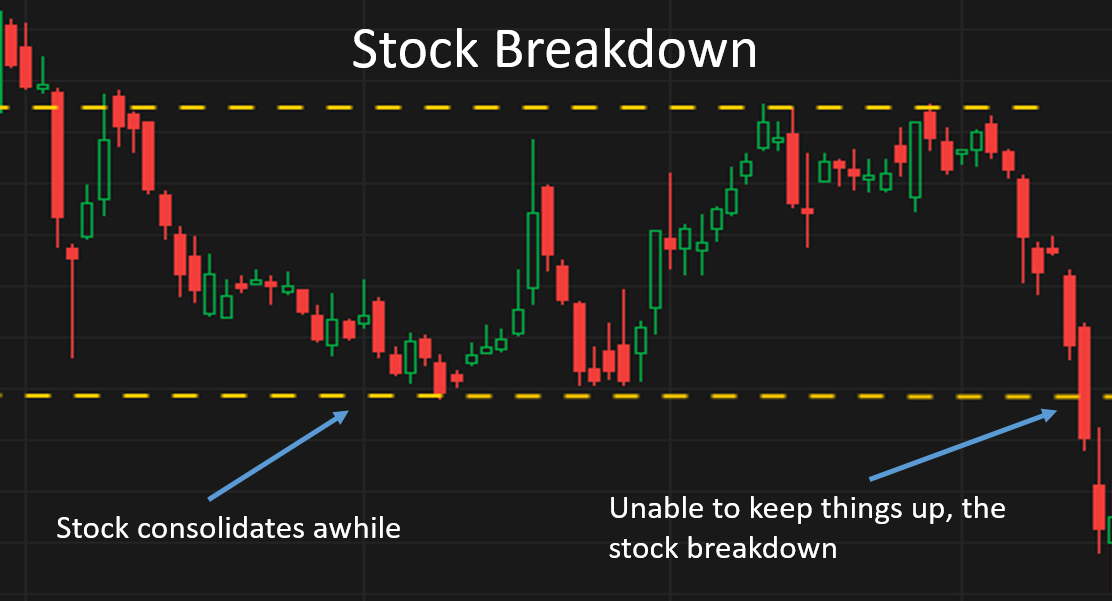

A support is the price level where a stock is likely to rebound. A strong or major support is the price level where a stock tested several times and rebounded. Conversely, a weak or minor support is the price level where a stock tested a few times and may rebound or breakdown. So what should you do when a stock breaks down? This is discussed below.

FedEx

The figure above shows the chart of $FedEx (FDX.US)$. In Sep 2022, FedEx reported a 20% yoy drop in ...

FedEx

The figure above shows the chart of $FedEx (FDX.US)$. In Sep 2022, FedEx reported a 20% yoy drop in ...

13

4

One of the biggest headaches for many investors: is the inability to effectively determine the trend and the fear of selling at a high point.

At this time, technical analysis can often come in handy to help us make some identification. Today Cici will teach you guys a method: through four steps to identify potential entry time, ride the stock take-off stage.![]()

1. Identify an uptrend by using moving averages

2. Wait for the stock to retrace to the...

At this time, technical analysis can often come in handy to help us make some identification. Today Cici will teach you guys a method: through four steps to identify potential entry time, ride the stock take-off stage.

1. Identify an uptrend by using moving averages

2. Wait for the stock to retrace to the...

10

4

$Adobe (ADBE.US)$

I think this is the best example chart I found for a breakdown![]() . The breakdown is likely due to Adobe buying a not so beneficial company?

. The breakdown is likely due to Adobe buying a not so beneficial company?

$Coca-Cola (KO.US)$

Coca-Cola took a smaller breakdown than Adobe. Welp, it's one of Warren Buffett stock, so it's actually quite stable.

$SPDR S&P 500 ETF (SPY.US)$

L1 shows a 2nd breakdown in the latest fall.

L2 is somewhere near a new level breakdown but look like not going to happen anytime soo...

I think this is the best example chart I found for a breakdown

$Coca-Cola (KO.US)$

Coca-Cola took a smaller breakdown than Adobe. Welp, it's one of Warren Buffett stock, so it's actually quite stable.

$SPDR S&P 500 ETF (SPY.US)$

L1 shows a 2nd breakdown in the latest fall.

L2 is somewhere near a new level breakdown but look like not going to happen anytime soo...

5

6

steady Pom pipi : 1. Bollinger Bands (BB)

2. Moving Average (MA)

3. KDJ

steady Pom pipi steady Pom pipi : The Bollinger Bands are the technical indicators I use most often. It is said that 90% of stock prices fluctuate within the Bollinger Bands.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

I've saved them in my notes

moomoo.com/hans...

Spritz : 1. Bollinger Bands (BB)

2. Moving Averages (MA)

3. KDJ Indicator

snoopy123 : 1. Bollinger Bands

2. Moving Averages

3. KDJ

saintlin : 1. Bollinger Bands

2. Moving Averages

3. KDJ

View more comments...