Latest

Hot

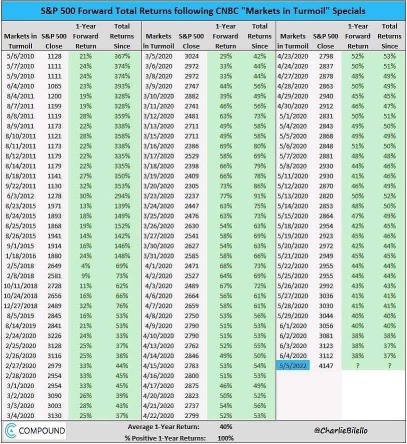

The Charlie Bilello research had a 100% win rate. On the surface, it looked very impressive. But it is based on data from 2010 to 2020, during the Super Bull Run. So it was not surprising. It was always "buying the dips" as prices always go up after a dip.

This research is incomplete as it only include data from the bull years and not from the years where there were recessions such as 2008 and 2000. In those years, the 1-Y returns were negative...

This research is incomplete as it only include data from the bull years and not from the years where there were recessions such as 2008 and 2000. In those years, the 1-Y returns were negative...

2

From the chart we can see that during the 2010, 2011, 2015, 2018, 2019, 2020's dip, the market is surrounded by bearish news. This is the time when the potential profit and win rate goes up!

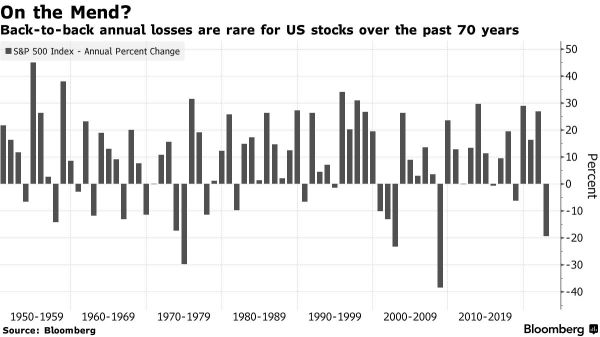

As the French said, buy the cannon. 2022 is also a year full of banishment. In that case, we can expect a pretty decent rally in 2023 very likely.

Based on my observations of investment gurus, buying the leading companies with strong moats during a bear market is ...

As the French said, buy the cannon. 2022 is also a year full of banishment. In that case, we can expect a pretty decent rally in 2023 very likely.

Based on my observations of investment gurus, buying the leading companies with strong moats during a bear market is ...

10

5

What to expect

Here are the notable earnings for the rest of the week. After mixed earnings of bank sectors, which reflected the impact of the sluggish macro environment on their investment banking business, the market will keep an eye on the tech earnings led by $Netflix (NFLX.US)$ on Thursday after the bell.

Analyst Opinions

Traders expect the turmoil that roiled markets last year to ease due to the cooling down inflation and potentia...

Here are the notable earnings for the rest of the week. After mixed earnings of bank sectors, which reflected the impact of the sluggish macro environment on their investment banking business, the market will keep an eye on the tech earnings led by $Netflix (NFLX.US)$ on Thursday after the bell.

Analyst Opinions

Traders expect the turmoil that roiled markets last year to ease due to the cooling down inflation and potentia...

31

2

Hey, Family,

How are you feeling about bonds for 2023? ( $Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$ $Vanguard Total Bond Market ETF (BND.US)$)

If you missed my video from today, be sure to check it out! It goes over where my head is at with bonds.

Follow me here on Moomoo for more great info!!

How are you feeling about bonds for 2023? ( $Direxion Daily 20+ Year Treasury Bull 3X Shares ETF (TMF.US)$ $Vanguard Total Bond Market ETF (BND.US)$)

If you missed my video from today, be sure to check it out! It goes over where my head is at with bonds.

Follow me here on Moomoo for more great info!!

16

2

The fall in energy commodities is the largest contributor to the drop of US CPI in Dec 2022, the fall was so huge that even though there was an increase in many other factors, overall CPI still fell to 6.5%. In my earlier post on the CPI number, I mentioned that this is worrying because it seems like oil is the factor that helps to lower inflation but there are many factors that are outside of US's control...

6

4

Why Investors Need to Welcome the Cryptocurrency Bear Market With Open Arms.

$Bitcoin (BTC.CC)$

$Ethereum (ETH.CC)$ $Cardano (ADA.CC)$ $Polygon (MATIC.CC)$ $ARK Innovation ETF (ARKK.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $ChainLink (LINK.CC)$ $DOT/BTC (DOTBTC.CC)$ $Polkadot (DOT.CC)$ $Algorand (ALGO.CC)$ $XRP (XRP.CC)$ $Uniswap (UNI.CC)$ $Grayscale Bitcoin Trust (GBTC.US)$ $Grayscale Ethereum Trust (ETHE.US)$ $Grayscale Digital Large Cap Fund (GDLC.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Netflix (NFLX.US)$ $Meta Platforms (META.US)$ $Palantir (PLTR.US)$ $Dogecoin (DOGE.CC)$ $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$ $��������...

$Bitcoin (BTC.CC)$

$Ethereum (ETH.CC)$ $Cardano (ADA.CC)$ $Polygon (MATIC.CC)$ $ARK Innovation ETF (ARKK.US)$ $ARK Next Generation Internet ETF (ARKW.US)$ $Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $ChainLink (LINK.CC)$ $DOT/BTC (DOTBTC.CC)$ $Polkadot (DOT.CC)$ $Algorand (ALGO.CC)$ $XRP (XRP.CC)$ $Uniswap (UNI.CC)$ $Grayscale Bitcoin Trust (GBTC.US)$ $Grayscale Ethereum Trust (ETHE.US)$ $Grayscale Digital Large Cap Fund (GDLC.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Netflix (NFLX.US)$ $Meta Platforms (META.US)$ $Palantir (PLTR.US)$ $Dogecoin (DOGE.CC)$ $GameStop (GME.US)$ $AMC Entertainment (AMC.US)$ $��������...

5

2

$Nasdaq Composite Index (.IXIC.US)$ $S&P 500 Index (.SPX.US)$ $Affirm Holdings (AFRM.US)$ $Block (SQ.US)$ $Snap Inc (SNAP.US)$ $Upstart (UPST.US)$

me personally, I believe this is a fake out green morning and well will move to the downside around 11am-12:30pm

this is just an estimate from the data I have seen and my previous experience with this market.

wish you all the best!!!

--BIZ--

me personally, I believe this is a fake out green morning and well will move to the downside around 11am-12:30pm

this is just an estimate from the data I have seen and my previous experience with this market.

wish you all the best!!!

--BIZ--

4

2

Is profitting from news "market in turmoil" possible?

If you believe in the Merrill Lynch's Investment Clock (also known as Economic cycle), after stagflation (bear market) economy will recover (recovery stage) eventually. When that happened, bull market will begin. This is consistent with the "Market in turmoil" (MIT) strategy. But I don't think we can profit from the strategy as it is based on past performance.

"Past performance m...

If you believe in the Merrill Lynch's Investment Clock (also known as Economic cycle), after stagflation (bear market) economy will recover (recovery stage) eventually. When that happened, bull market will begin. This is consistent with the "Market in turmoil" (MIT) strategy. But I don't think we can profit from the strategy as it is based on past performance.

"Past performance m...

6

Jan 18 (Reuters) - Shares of $TENCENT (00700.HK)$, the world's largest gaming company, and smaller rival $NetEase (NTES.US)$ rose on Wednesday after China's video games regulator granted the first gaming licences in 2023, further easing an industry crackdown.

Tencent's shares rose as much as 1.7% in early trade before paring gains, while NetEase's stock jumped as much as 5.8% to its highest in more than four months.

The granting of publi...

Tencent's shares rose as much as 1.7% in early trade before paring gains, while NetEase's stock jumped as much as 5.8% to its highest in more than four months.

The granting of publi...

4

“The best chance to deploy capital is when things are going down.”

— Warren Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$

— Warren Buffett

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Apple (AAPL.US)$ $Tesla (TSLA.US)$

2