Latest

Hot

TA (Technical Analysis) tools are a set of methods and techniques to help analyze financial instruments' prices and volumes to make informed trading decisions. By utilizing those TA tools, we may improve trading accuracy and avoid emotional trading to some extent. The winner's list will be announced at the end of this article.

![]() If you are new to TA, you may want to go through mooer @SpyderCall’s overview to learn the basics about T...

If you are new to TA, you may want to go through mooer @SpyderCall’s overview to learn the basics about T...

+2

34

4

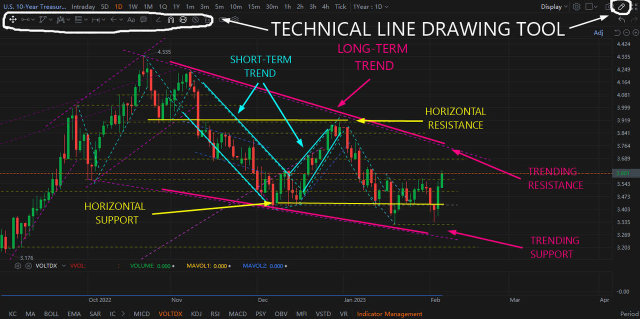

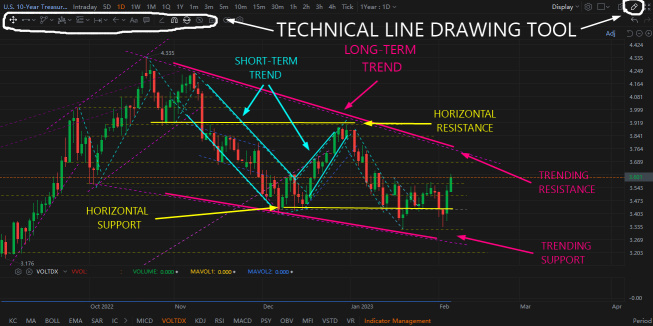

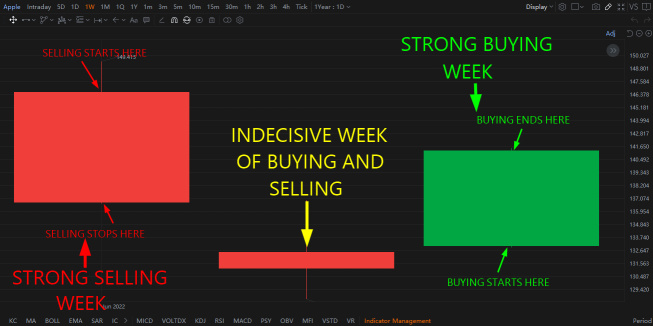

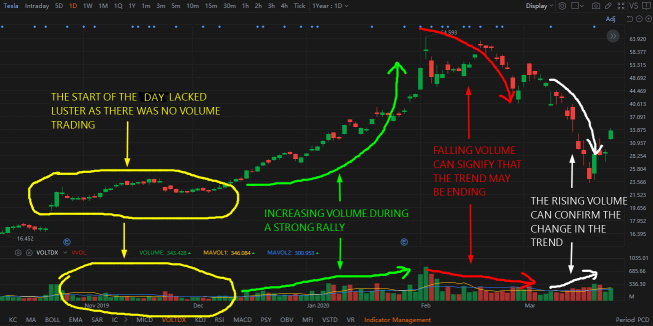

There are so many aspect to technical analysis(TA) that it can be very overwhelming and intimidating to anybody that is new to investing. With hundreds of different technical indicators and strategies it can be difficult to decide where to start learning technical analysis.

The most important aspects of technical analysis are actually the most basic fundamentals of TA. They are the first thing you should learn in TA. Price action, volume, and the overall tr...

The most important aspects of technical analysis are actually the most basic fundamentals of TA. They are the first thing you should learn in TA. Price action, volume, and the overall tr...

+2

220

67

BOLL is my favorite TA tool. I am gonna show my reasons. However, I am still a newbie, and this is something I learned just a couple of days ago. So, correct me if I was wrong.

Generally speaking, the first time I learned BOLL, I was confused by its literal definition online. However, thanks to some vivid descriptions in moo's community, I think I grasped the basic understanding.

Adding the link now. These might be really helpful if you are still not clear about BOLL

...

Generally speaking, the first time I learned BOLL, I was confused by its literal definition online. However, thanks to some vivid descriptions in moo's community, I think I grasped the basic understanding.

Adding the link now. These might be really helpful if you are still not clear about BOLL

...

29

10

There are many technical indicators can be used in stock analysis and the best indicator will depend on the investment goals and risk tolerance.

My favourite technical indicator is SAR+RSI. The parabolic SAR works well for capturing profits by entering the trade during a trend in a steady market. This is important for determining an asset's price direction as well as drawing attention to when the price direction changes. This SAR tracks price movements and enables the inves...

My favourite technical indicator is SAR+RSI. The parabolic SAR works well for capturing profits by entering the trade during a trend in a steady market. This is important for determining an asset's price direction as well as drawing attention to when the price direction changes. This SAR tracks price movements and enables the inves...

28

4

Recently I successfully predicted price reversal for Tesla - recognized a Dragon pattern (W pattern).

I'm using Bollinger Bands (BB) to explain a reversal in share price.

The price fell below its lower band but close near the high for the interval. It should indicate a reversal (price rising) and that I could go long and target the middle band.

I'm new to TA but still find BB easier to use compared to others. I'm learning TA to help me find the right time to trade o...

I'm using Bollinger Bands (BB) to explain a reversal in share price.

The price fell below its lower band but close near the high for the interval. It should indicate a reversal (price rising) and that I could go long and target the middle band.

I'm new to TA but still find BB easier to use compared to others. I'm learning TA to help me find the right time to trade o...

20

8

Hi, everyone. It's Emma here.

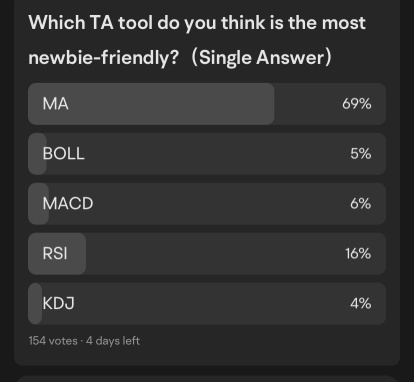

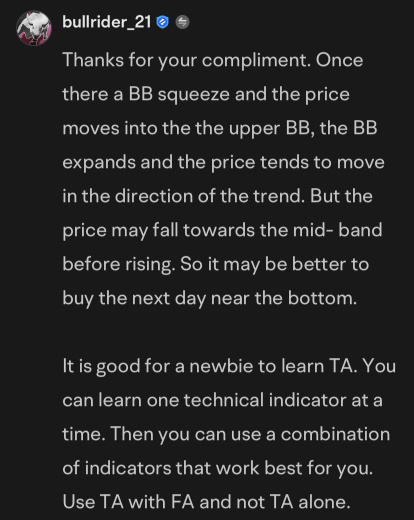

So, two days ago, I posted a comment asking which TA tool is the most newbie-friendly. Wow, that post has received many likes and suggestions so far, especially from @bullrider. Thank you so much. They say that MA is the most newbie-friendly, and I studied MA.

Well, how should I put that.... umm it's really not easy, guys. Feels like I have got the theory and I have known the basic knowledge of it, but once I apply it to a...

So, two days ago, I posted a comment asking which TA tool is the most newbie-friendly. Wow, that post has received many likes and suggestions so far, especially from @bullrider. Thank you so much. They say that MA is the most newbie-friendly, and I studied MA.

Well, how should I put that.... umm it's really not easy, guys. Feels like I have got the theory and I have known the basic knowledge of it, but once I apply it to a...

+1

19

5

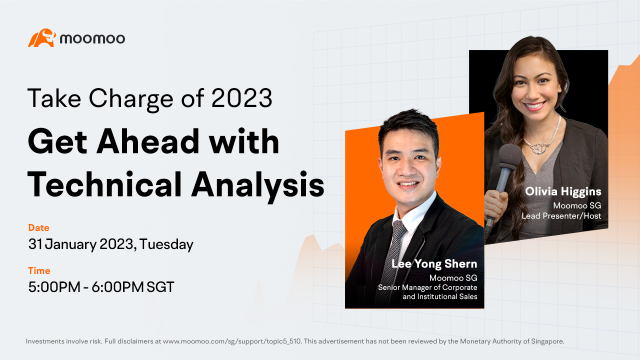

Learn the foundations of doing technical analysis on the moomoo desktop app and spot potential trading opportunities, price trends and patterns to kickstart your new year with our trading representative from moomoo Singapore, Lee Yong Shern.

Speaker: Lee Yong Shern, Senior Manager of Corporate and Institutional Sales, Moomoo SG

Speaker: Lee Yong Shern, Senior Manager of Corporate and Institutional Sales, Moomoo SG

Take Charge of 2023 by Getting Ahead with Technical Analysis

Jan 31 03:00

14

1

Easy and effective.

10

2

I used the bollinger bands in my video!

Bollinger bands are incredible for identifying times of consolidation and moments of extreme price movements. Watching a security’s price, such as $Invesco QQQ Trust (QQQ.US)$ today, break 2 standard deviations above the mean puts the price action in unusual territory. The law of large numbers suggests that values will tend towards the mean. So, we can take the bollinger bands and combine that with the extended run up, and an RSI over 70, is ...

Bollinger bands are incredible for identifying times of consolidation and moments of extreme price movements. Watching a security’s price, such as $Invesco QQQ Trust (QQQ.US)$ today, break 2 standard deviations above the mean puts the price action in unusual territory. The law of large numbers suggests that values will tend towards the mean. So, we can take the bollinger bands and combine that with the extended run up, and an RSI over 70, is ...

4

3

The Moving Average Convergence Divergence (MACD) is a trend following indicator and momentum indicator which shows the relationship between two moving averages of a security’s price.

Calculation:

Step1. Calculate a 12-period exponential moving average of the close price.

Step2. Calculate a 26-period exponential moving average of the close price.

Step3. Subtract the 26-period moving average from the 12 periods moving average. This is the fast MACD li...

Calculation:

Step1. Calculate a 12-period exponential moving average of the close price.

Step2. Calculate a 26-period exponential moving average of the close price.

Step3. Subtract the 26-period moving average from the 12 periods moving average. This is the fast MACD li...

3

1

ZnWC : Congratulations to all winners!

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

CasualInvestor :

doctorpot1 : congrats to all winners![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

RyanT2021 : congrats to the winners![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)