Latest

Hot

Columns Expert Meeting Minutes | Costco Wholesale Corporation (COST) Q2 2023 Earnings Call Transcript

Core Point:

1.Reported net income for the quarter came in at $1.466 billion or $3.30 per share compared to $1.299 billion or $2.92 per diluted share last year, an increase of 13%.

2.Membership growth has remained strong. Costco ended the second quarter with 68.1 million paid household members and 123.0 million cardholders, both up more than 7% versus a year earlier. At Q2 end, Costco had 30.6 million pai...

1.Reported net income for the quarter came in at $1.466 billion or $3.30 per share compared to $1.299 billion or $2.92 per diluted share last year, an increase of 13%.

2.Membership growth has remained strong. Costco ended the second quarter with 68.1 million paid household members and 123.0 million cardholders, both up more than 7% versus a year earlier. At Q2 end, Costco had 30.6 million pai...

$Costco (COST.US)$ Latest Earnings 👇

Beat EPS estimates 🥳

Missed Sales estimates 😩

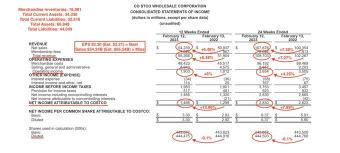

12 Weeks Ended:

• Sales +6.48%

• Operating Income +5%

• Net Income +12.86%

24 Weeks Ended:

• Sales +7.3%

• Operating Income +4.25%

• Net Income +7.89%

Beat EPS estimates 🥳

Missed Sales estimates 😩

12 Weeks Ended:

• Sales +6.48%

• Operating Income +5%

• Net Income +12.86%

24 Weeks Ended:

• Sales +7.3%

• Operating Income +4.25%

• Net Income +7.89%

Likely to be angst about Costco's 3.5% US comp in February, lowest in a long time despite still-hot food inflation. Will reignite concerns just like November's 4.6% print, which proved to be a blip. Investors in even top notch retailers can be incredibly short-term $Costco (COST.US)$

$Costco (COST.US)$ down after hours despite bottom line beat.

Reason: massive deceleration in February despite CNY tailwind.

Great company, but the consumer is rolling over and you can't squeeze enough blood from a turnip to justify this multiple.

Skate to where the puck is going.

Reason: massive deceleration in February despite CNY tailwind.

Great company, but the consumer is rolling over and you can't squeeze enough blood from a turnip to justify this multiple.

Skate to where the puck is going.

$Costco (COST.US)$ Telsey Advisory Group analyst Joseph Feldman maintains Costco Wholesale with a Outperform and lowers the price target from $580 to $540.

2

1

$Costco (COST.US)$ Q2 FY23 (ending Jan. 2023).

• Revenue +6% Y/Y to $55.3B ($0.3B miss).

• Non-GAAP EPS $3.30 ($0.1 beat).

Comparable sales Y/Y:

• US +5.7%.

• Company +5.2%.

• E-commerce -9.6%.

Second revenue miss back-to-back.

• Revenue +6% Y/Y to $55.3B ($0.3B miss).

• Non-GAAP EPS $3.30 ($0.1 beat).

Comparable sales Y/Y:

• US +5.7%.

• Company +5.2%.

• E-commerce -9.6%.

Second revenue miss back-to-back.

1

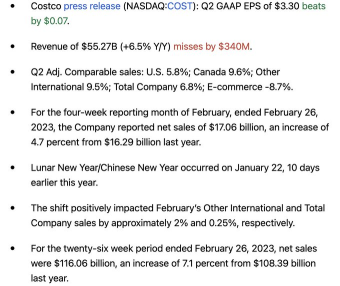

Costco $Costco (COST.US)$ posted their Q2 earnings results and that it beats most expectations. They saw a slight miss in quarterly revenue, coming in at $55.27 billion, but up 6.5% from a year ago.

Here's what Costco reported, compared to Wall Street estimates:

Revenue: $55.27 billion versus $55.58 billion expected

Adjusted earnings per share: $3.30 versus $3.21 expected

Same-store sales: up 6.8% versus up 6.16% expected

United States: up 5.8% versus up 5.56% ...

Here's what Costco reported, compared to Wall Street estimates:

Revenue: $55.27 billion versus $55.58 billion expected

Adjusted earnings per share: $3.30 versus $3.21 expected

Same-store sales: up 6.8% versus up 6.16% expected

United States: up 5.8% versus up 5.56% ...

3