Latest

Hot

Core Points:

1 management change, but this does not mean big strategy or culture shifts.

2 advertising platforms: 1) open only 2 months and the demand is exceeding supply. This is a testament to lots of hard work for both Microsoft and Netflix teams. 2) plan switching. Not seeing as expected much switching from high-arm subscription plans like premium into the ads plan.

3 subscribers:a bunch of people around the world in countries were not d...

1 management change, but this does not mean big strategy or culture shifts.

2 advertising platforms: 1) open only 2 months and the demand is exceeding supply. This is a testament to lots of hard work for both Microsoft and Netflix teams. 2) plan switching. Not seeing as expected much switching from high-arm subscription plans like premium into the ads plan.

3 subscribers:a bunch of people around the world in countries were not d...

3

Columns Netflix Q1'23 - Good or Bad?

It's the time of the year for bumper earnings seasons!

After bank earnings, we start off with $Netflix (NFLX.US)$.

Used to be a darling stock and one of the FAANG members, how did Netflix do for Q1'23?

It did okay.

Here are some points to take note of their latest earnings.

1. It is still growing

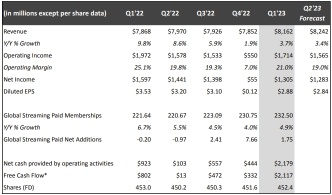

Revenue increased 3.7% YoY from USD 7.87 billion to USD 8.16 billion.

Operating income and net income, were down, however, by 13% and 18% respectively.

Diluted EPS shrunk i...

After bank earnings, we start off with $Netflix (NFLX.US)$.

Used to be a darling stock and one of the FAANG members, how did Netflix do for Q1'23?

It did okay.

Here are some points to take note of their latest earnings.

1. It is still growing

Revenue increased 3.7% YoY from USD 7.87 billion to USD 8.16 billion.

Operating income and net income, were down, however, by 13% and 18% respectively.

Diluted EPS shrunk i...

+1

4

The main focus of Netflix's financial report is as follows:

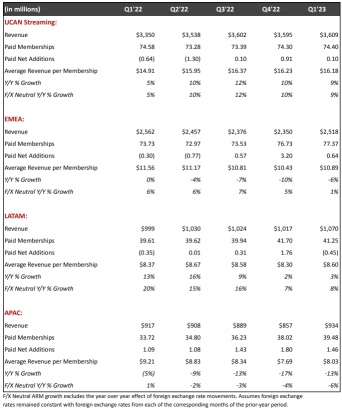

1) The growth of the number of users of the company, and the progress of cracking down on shared accounts.

2) The company's ARM performance, the effectiveness of advertising and other multi-monetization.

3) The company's industry competitiveness, including content competitiveness, etc.

1. The company's revenue fell short of expectations, its profits exceeded expectations, and its perf...

1) The growth of the number of users of the company, and the progress of cracking down on shared accounts.

2) The company's ARM performance, the effectiveness of advertising and other multi-monetization.

3) The company's industry competitiveness, including content competitiveness, etc.

1. The company's revenue fell short of expectations, its profits exceeded expectations, and its perf...

+2

4

Netflix Q1 FY23:

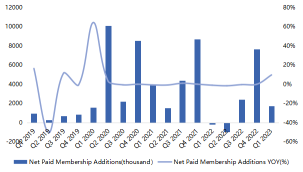

Subs +1.75M Q/Q.

ARM +4% Y/Y fx neutral.

• Revenue +4% Y/Y to $8.16B ($20M miss).

• +8% Y/Y fx neutral.

• Operating margin 21% (1pp beat).

• EPS $2.88 ($0.01 beat).

Q2 FY23 Guidance:

• Revenue +3% Y/Y (+6% fx neutral).

• Operating margin 19%.

Netflix subscribers Q1 FY23:

Overall: 232.50M (+1.75M Q/Q).

• UCAN: +0.10M Q/Q.

• EMEA: +0.64M Q/Q.

• LATAM: (0.45M) Q/Q.

• APAC: +1.46M Q/Q.

$Netflix (NFLX.US)$earnings after hours

Sell puts, they will report HORRIBLE earnings

Buy...

Subs +1.75M Q/Q.

ARM +4% Y/Y fx neutral.

• Revenue +4% Y/Y to $8.16B ($20M miss).

• +8% Y/Y fx neutral.

• Operating margin 21% (1pp beat).

• EPS $2.88 ($0.01 beat).

Q2 FY23 Guidance:

• Revenue +3% Y/Y (+6% fx neutral).

• Operating margin 19%.

Netflix subscribers Q1 FY23:

Overall: 232.50M (+1.75M Q/Q).

• UCAN: +0.10M Q/Q.

• EMEA: +0.64M Q/Q.

• LATAM: (0.45M) Q/Q.

• APAC: +1.46M Q/Q.

$Netflix (NFLX.US)$earnings after hours

Sell puts, they will report HORRIBLE earnings

Buy...

Netflix reported earnings after the bell. Here are the results.

Earnings per share: $2.88 vs $2.86 expected

Revenue: $8.16 billion vs $8.18 billion expected

A year ago, Netflix had reported its first subscriber loss in a decade, sending its shares on a downward spiral, as well as those of its media peers. The results pushed Netflix and its streaming rivals to focus on profits over subscriber numbers.

Results for the country’s new ad-supported tier will be...

Earnings per share: $2.88 vs $2.86 expected

Revenue: $8.16 billion vs $8.18 billion expected

A year ago, Netflix had reported its first subscriber loss in a decade, sending its shares on a downward spiral, as well as those of its media peers. The results pushed Netflix and its streaming rivals to focus on profits over subscriber numbers.

Results for the country’s new ad-supported tier will be...

Netflix $Netflix (NFLX.US)$ released its Q1 earnings report, which showed mixed results and raised questions about the company’s future growth potential.

While Netflix's earnings per share (EPS) of $2.88 beat analysts' expectations of $2.86, the company fell short on subscriber growth and revenue expectations, with 1.75 million net additions versus the expected 2.3 million, and revenue of $8.16 billion versus $8.18 billion expected.

Thei...

While Netflix's earnings per share (EPS) of $2.88 beat analysts' expectations of $2.86, the company fell short on subscriber growth and revenue expectations, with 1.75 million net additions versus the expected 2.3 million, and revenue of $8.16 billion versus $8.18 billion expected.

Thei...

1

Netflix $Netflix (NFLX.US)$ experienced a slow start to the year, missing Wall Street estimates after adding only 1.75 million customers in Q1, compared to the expected 2.41 million. The company also predicted lower sales and profit for the current quarter, delaying its plan to crack down on password sharing in the US. This marks the second year in a row that Netflix has started off on sh...

3

3

$Netflix (NFLX.US)$ just released their Q1’FY23 earnings and they barely beat EPS estimates by 0.70% (with EPS of $2.88), however, they barely missed revenue estimates by a small margin of 0.10% (revenue of $8.17 bil).

Key highlights (Q1’FY23):

- Revenue improved to +3.7% y-o-y

- Operating margin improved to +21.0% y-o-y

- Global streaming paid memberships improved to +4.9% y-o-y

- Net cash flow from operating activities also vastly improved

They have also delayed ...

Key highlights (Q1’FY23):

- Revenue improved to +3.7% y-o-y

- Operating margin improved to +21.0% y-o-y

- Global streaming paid memberships improved to +4.9% y-o-y

- Net cash flow from operating activities also vastly improved

They have also delayed ...

1

Today let us have a look on why $Netflix (NFLX.US)$ has been doing wo well recently.

Original Content: Netflix's strategy of investing heavily in original content has paid off well. They have created a large library of award-winning and critically acclaimed TV shows and movies, including "Stranger Things," "The Crown," "Narcos," and "House of Cards."

User Experience: Netflix's user interface is easy to navigate, and it provides a personalized exp...

Original Content: Netflix's strategy of investing heavily in original content has paid off well. They have created a large library of award-winning and critically acclaimed TV shows and movies, including "Stranger Things," "The Crown," "Narcos," and "House of Cards."

User Experience: Netflix's user interface is easy to navigate, and it provides a personalized exp...

1