Latest

Hot

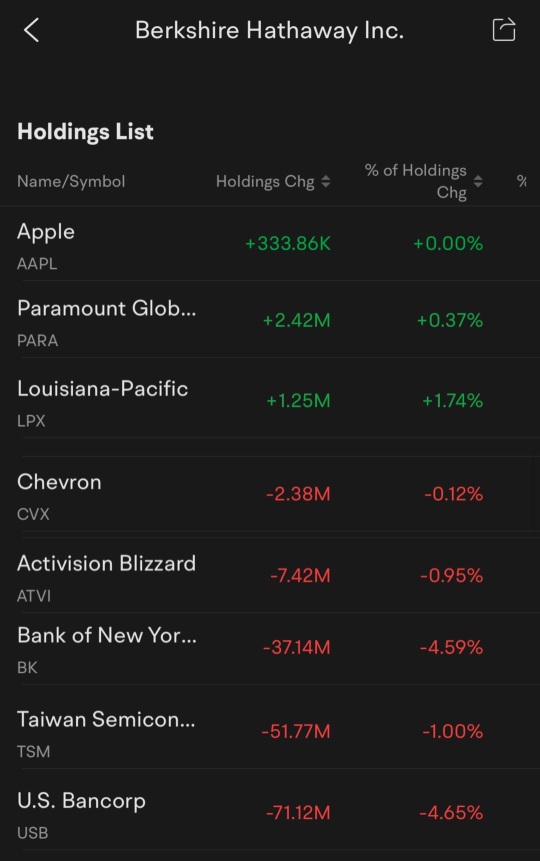

The positions added to, were:

$Apple (AAPL.US)$ - by 333,856 shares to 895.136 million Apple shares.

$Paramount Global-B (PARA.US)$ - by 2.421 million shares to 93.637 million shares.

$Louisiana-Pacific (LPX.US)$ - by 1.249 million shares to 7.044 million shares.

Berkshire scaled back in eight positions. Here are four of them.

$Chevron (CVX.US)$ - from 164.4 million to 163.0 million shares.

$Activision Blizzard (ATVI.US)$ - f...

$Apple (AAPL.US)$ - by 333,856 shares to 895.136 million Apple shares.

$Paramount Global-B (PARA.US)$ - by 2.421 million shares to 93.637 million shares.

$Louisiana-Pacific (LPX.US)$ - by 1.249 million shares to 7.044 million shares.

Berkshire scaled back in eight positions. Here are four of them.

$Chevron (CVX.US)$ - from 164.4 million to 163.0 million shares.

$Activision Blizzard (ATVI.US)$ - f...

8

Q & A

1. His opinion regarding the us n world banking situation

2. His insight for the 2023 semester 2 stock market n economic condition and what is the best strategy for it

3. His next target company

4. what does he think about the Dollar 💲💰

1. His opinion regarding the us n world banking situation

2. His insight for the 2023 semester 2 stock market n economic condition and what is the best strategy for it

3. His next target company

4. what does he think about the Dollar 💲💰

1

3

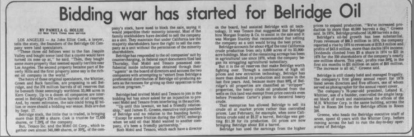

In 1977, Charlie was offered 300 shares of Belridge Oil.

Charlie’s comments on Belridge: “ An idiot could have told you that there was no possibility of losing money and a large possibility of making money”

Charlie even exclaimed that this was the most undervalued stock he had seen in his life, as the market was valuing Belridge’s oil reserves at 29c/barrel while the going rate was $5-6/barrel.

Charlie bought those 300 shares at...

Charlie’s comments on Belridge: “ An idiot could have told you that there was no possibility of losing money and a large possibility of making money”

Charlie even exclaimed that this was the most undervalued stock he had seen in his life, as the market was valuing Belridge’s oil reserves at 29c/barrel while the going rate was $5-6/barrel.

Charlie bought those 300 shares at...

4

1

Questions to ask Warren Buffett or Charlie Munger:

1. What is your process for identifying undervalued or overlooked companies in the market?

2. In today's rapidly changing technology landscape, how do you evaluate technology businesses and determine their long-term prospects? What advise do you have for business leaders aiming to develop long-term, sustainable, and successful companies?

3. What are your thoughts on the current state of the US stock market, and where do you see inve...

1. What is your process for identifying undervalued or overlooked companies in the market?

2. In today's rapidly changing technology landscape, how do you evaluate technology businesses and determine their long-term prospects? What advise do you have for business leaders aiming to develop long-term, sustainable, and successful companies?

3. What are your thoughts on the current state of the US stock market, and where do you see inve...

3

1

what is the next destination / taget ,after have achieved all those successful in company and stock market ?

1

2

We are in a special and complicated situation right now.

Inflation is stubbornly high, and the rates are high, but the market is not crashing.

Under such circumstances, can the world escape a recession? What to invest if that is the case?

If not, what should we invest conversely?

Inflation is stubbornly high, and the rates are high, but the market is not crashing.

Under such circumstances, can the world escape a recession? What to invest if that is the case?

If not, what should we invest conversely?

2

1

What advice would you give to young entrepreneurs who are looking to start a successful business in today's economy?

2

1

what is your advice to investors who start investing late and do not have as much benefits of the compounding effects to long term holdings?

2