Latest

Hot

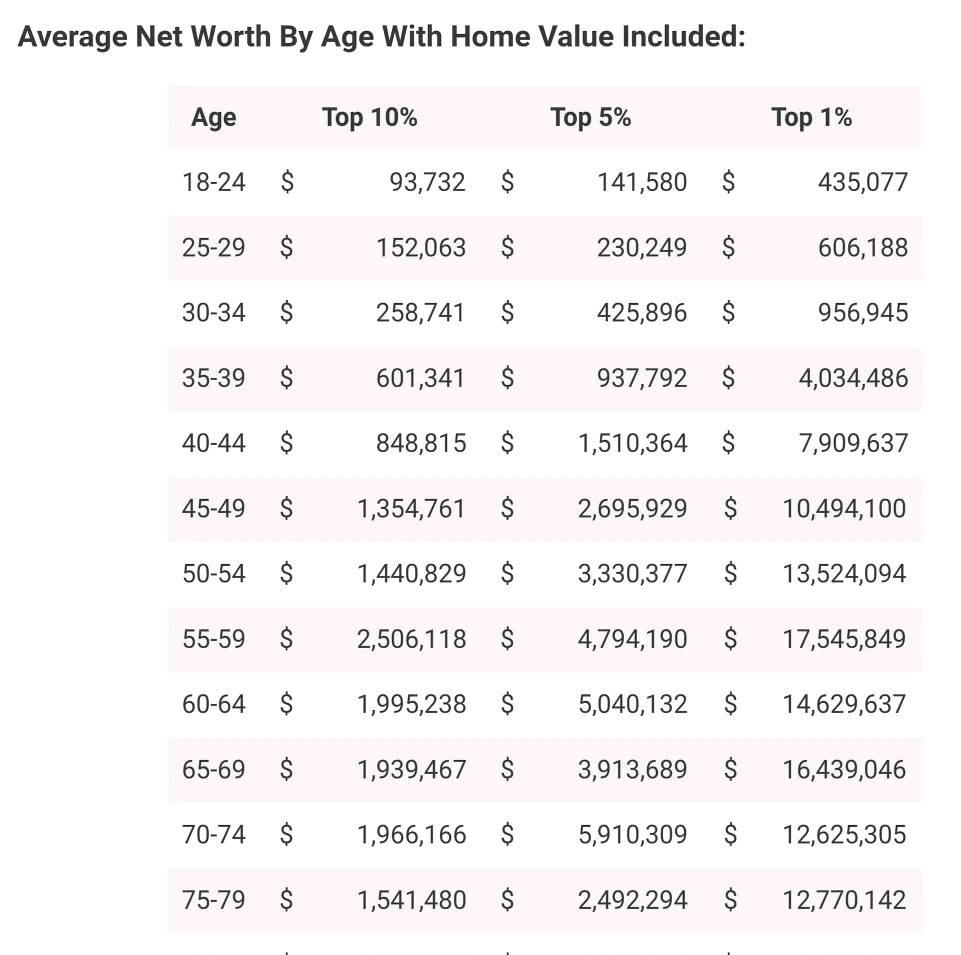

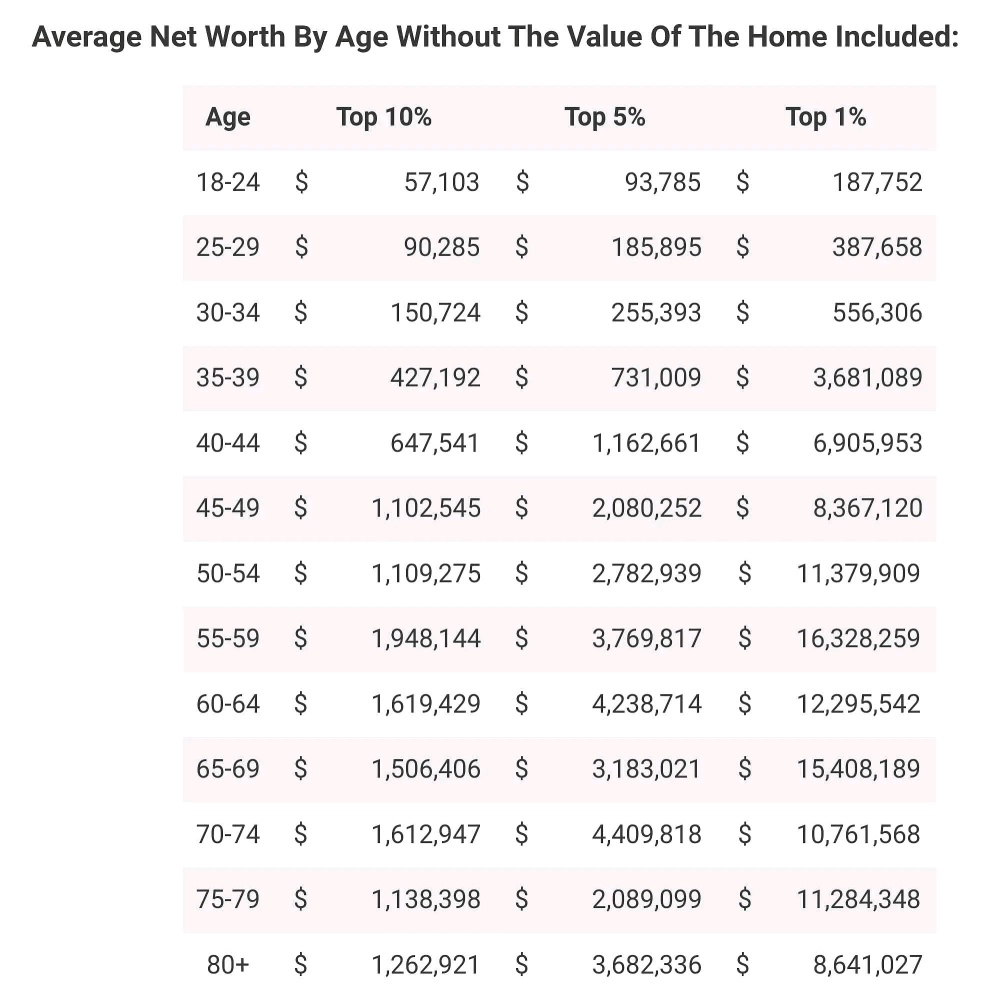

This reference data is based on the asset only situation of the top 10%, top 5%, and top 1% in the United States, regardless of age group. It can be divided into two scenarios: considering a house and not considering a house.

These data may be from individuals or families, just like tax reporting can be done alone or together as a couple.

The top 1% of the wealthiest people who do not include houses are in the age group of 55-59, with only $16.32 million in assets. In the age group of 5 years yo...

These data may be from individuals or families, just like tax reporting can be done alone or together as a couple.

The top 1% of the wealthiest people who do not include houses are in the age group of 55-59, with only $16.32 million in assets. In the age group of 5 years yo...

1

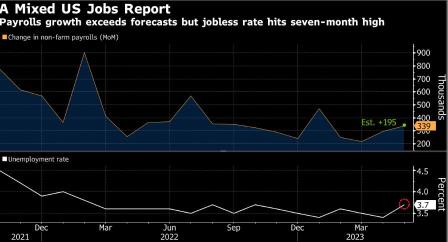

We have the U.S. labor market shows resilience on eve of June's employment report (happening on 07 July 23).

Here is a summary of what have been released on 06 July 23.

Weekly jobless claims increase 12,000 to 248,000.

Continuing claims drop 13,000 to 1.720 million.

Private payrolls jump 497,000 in June.

Job openings decline 496,000 to 9.824 million in May.

The U.S. Unemployment Rate (June) and U.S. Nonfarm Payrolls (June) data will ...

Here is a summary of what have been released on 06 July 23.

Weekly jobless claims increase 12,000 to 248,000.

Continuing claims drop 13,000 to 1.720 million.

Private payrolls jump 497,000 in June.

Job openings decline 496,000 to 9.824 million in May.

The U.S. Unemployment Rate (June) and U.S. Nonfarm Payrolls (June) data will ...

1

2

A bull market is a term used to describe a period of sustained upward movement in the prices of financial assets, such as stocks, bonds, or commodities. It is characterized by investor optimism, increasing demand, and a general belief that the upward trend will continue. While the future of financial markets is always uncertain, there are several factors that suggest the possibility of a future bull market and shed light on its ultimate aim.

Economic Gr...

Economic Gr...

1

2

The number of Americans filing new claims for unemployment benefits surged last week, suggesting that the labor market was slowing amid mounting risks of a recession.

Initial claims for state unemployment benefits jumped 28,000 to a seasonally adjusted 261,000 for the week ended June 3, the Labor Department said on Thursday. Economists polled by Reuters had forecast 235,000 claims for the latest week.

Despite the surge in applications, claims...

Initial claims for state unemployment benefits jumped 28,000 to a seasonally adjusted 261,000 for the week ended June 3, the Labor Department said on Thursday. Economists polled by Reuters had forecast 235,000 claims for the latest week.

Despite the surge in applications, claims...

1

I believe they will probably raise the rates.

1

- Former Treasury Secretary Lawrence Summers stated that the Federal Reserve should be open to raising interest rates by a half percentage point in July if it decides to hold off from tightening credit this month.

- "We are again in a situation where the risks of overheating the economy are the primary risks that the Fed needs to be mindful of," said the Harvard University professor in an interview with Bloomberg Television's David Westin last Friday.

- ...

- "We are again in a situation where the risks of overheating the economy are the primary risks that the Fed needs to be mindful of," said the Harvard University professor in an interview with Bloomberg Television's David Westin last Friday.

- ...

6

2

By one measure at least, the US stock market has slipped into negative territory since the start of the year.

The S&P 500 Equal Weight index, which gives equal value to each stock, has fallen 0.35 per cent since January, data from Refinitiv shows. That stands in stark contrast to the 9.5 per cent gain for the benchmark $S&P 500 Index (.SPX.US)$ , where companies with larger market capitalisations account for a larger share o...

The S&P 500 Equal Weight index, which gives equal value to each stock, has fallen 0.35 per cent since January, data from Refinitiv shows. That stands in stark contrast to the 9.5 per cent gain for the benchmark $S&P 500 Index (.SPX.US)$ , where companies with larger market capitalisations account for a larger share o...

11

Confirm they will raise again, same old pattern play and play won't sian de. Sit back, relax, and get ready our popcorn 🍿

1

Following the ideas the American government have been laying out for months I was certain that unemployment rates would continue to rise. In their sick twisted minds it makes sense for low income Americans to lose their jobs in order to fix the economy.

Interest hikes will continue to come perhaps after a momentary slow-down because if rates raise too sharply it will drastically affect the everyday lifestyle of common Americans.

Interest hikes will continue to come perhaps after a momentary slow-down because if rates raise too sharply it will drastically affect the everyday lifestyle of common Americans.

2

Another hike is needed.. Bite the bullet now and let economy cools.. Failing which it will b continued rising costs, wors. My 2 cents worth if thoughts.

3