Latest

Hot

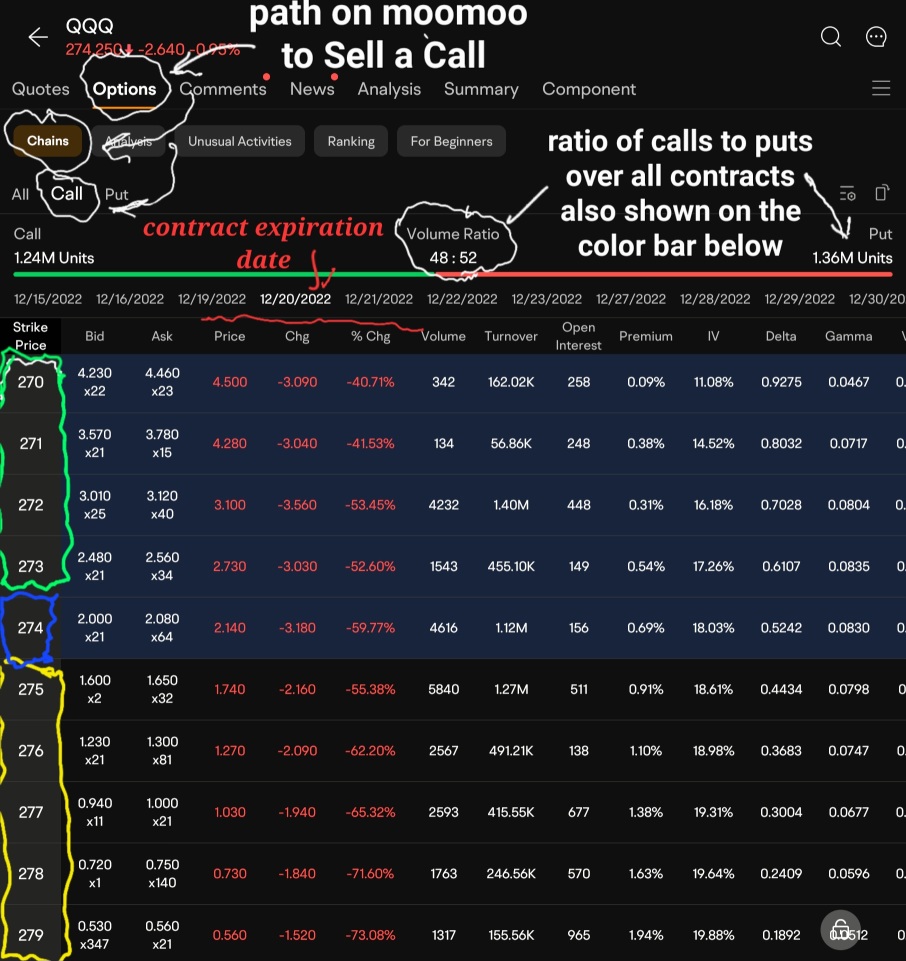

since I have some time here is a little help in this bear market.

How to protect your portfolio;

Buy a leveraged Inverse ETF - Leveraged ETFs do the work of options for you. They leverage options, company and government bonds, futures or some combination of them to obtain a return near their stated goal. (SQQQ has a goal of 3 times the inverse of QQQ etc.)

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Very easy, QQQ goes down SQQQ goes up 3 times what QQQ went down.

$ProShares UltraShort QQQ (QID.US)$ about ha...

How to protect your portfolio;

Buy a leveraged Inverse ETF - Leveraged ETFs do the work of options for you. They leverage options, company and government bonds, futures or some combination of them to obtain a return near their stated goal. (SQQQ has a goal of 3 times the inverse of QQQ etc.)

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$ Very easy, QQQ goes down SQQQ goes up 3 times what QQQ went down.

$ProShares UltraShort QQQ (QID.US)$ about ha...

+3

45

33

Options Greeks: What you should know

The Greeks

Delta – An option’s delta is the rate of change of the price of the option with respect to its underlying security’s price. The delta of an option ranges in value from 0.0 – 1.00 for calls (0 to -1.00 for puts) and reflects the increase or decrease in the price of the option in response to a 1-point movement of the underlying asset price.

Used to measure the change in value of a contract from a $1 change. Also is used to measure the probability of an Option Contract Expiring “ITM” (In-The-Money). For Example, a Delta of 0.40 can be seen as a 40% chance to Expire ITM.

Gamma – An option’s Gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a 1-point movement of the underlying stock price.

Measures the change in Delta from a 1$ movement in the underlying asset (stock, ETF, things like that). If the underlying moves an additional 1$ Then Delta would equal the Total of Delta + Gamma. After the First Dollar move, any additional moves in the same direction increases the value of Delta by the amount of Gamma.

For Example, XYZ 100 12/31/20 Call for $1.00 and has a delta of .50 and a gamma of .05.

The price of XYZ moves 1 dollar upwards so the new price of the contract becomes 1.50.

The Price of XYZ moves 1 dollar upwards again so now we add both Delta AND Gamma to find the new value. (1.00...

The Greeks

Delta – An option’s delta is the rate of change of the price of the option with respect to its underlying security’s price. The delta of an option ranges in value from 0.0 – 1.00 for calls (0 to -1.00 for puts) and reflects the increase or decrease in the price of the option in response to a 1-point movement of the underlying asset price.

Used to measure the change in value of a contract from a $1 change. Also is used to measure the probability of an Option Contract Expiring “ITM” (In-The-Money). For Example, a Delta of 0.40 can be seen as a 40% chance to Expire ITM.

Gamma – An option’s Gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a 1-point movement of the underlying stock price.

Measures the change in Delta from a 1$ movement in the underlying asset (stock, ETF, things like that). If the underlying moves an additional 1$ Then Delta would equal the Total of Delta + Gamma. After the First Dollar move, any additional moves in the same direction increases the value of Delta by the amount of Gamma.

For Example, XYZ 100 12/31/20 Call for $1.00 and has a delta of .50 and a gamma of .05.

The price of XYZ moves 1 dollar upwards so the new price of the contract becomes 1.50.

The Price of XYZ moves 1 dollar upwards again so now we add both Delta AND Gamma to find the new value. (1.00...

32

4

The Greeks: What You Should Know Part 2

A lot of us know what the Greeks do individually but aren’t as certain on how they behave in relation to each other and the underlying asset. This write up will be done with the assumption you have read the previous post here:

Quick Example

Say John buys XYZ 100 1/15/21 Call (Buy-to-Open) for 1.00 and this contract has the following values:

Delta: 0.50 Gamma: 0.05 Theta: -0.02 Vega: 0.01

and the Current price of XYZ stock is $95.00.

This tells a lot but we will start with how Delta and Gamma work together:

(1) The Delta says that for every $1 move either up or down in price, will either decrease or increase the value of the option contract by 0.50 (e.g. $50). You will notice most option contracts are bought and measured for statistical purposes in the ranges of 0-0.20, .21-.40, .41-.60, .61-80, and .81-1.00.

(2) Then because Gamma is 0.05, for every change in Delta relative to a $1 movement in the underlying asset, The value of the option contract will increase by an additional 0.05 ($5) for every additional $1dollar change in the underlying assets price which would there create a correlated change in delta which is measured by gamma. So if the option contract for XYZ is 1.00 when the price of the underlying asset is $95 and then price moves up $1 dollar then the value of the contract becomes 1.50. (1.00 + 0.50) THEN, if the price moves an additional $1, Then the equation becomes, (1.50 + 0.50 + 0.05) = 2.05.

...

A lot of us know what the Greeks do individually but aren’t as certain on how they behave in relation to each other and the underlying asset. This write up will be done with the assumption you have read the previous post here:

Quick Example

Say John buys XYZ 100 1/15/21 Call (Buy-to-Open) for 1.00 and this contract has the following values:

Delta: 0.50 Gamma: 0.05 Theta: -0.02 Vega: 0.01

and the Current price of XYZ stock is $95.00.

This tells a lot but we will start with how Delta and Gamma work together:

(1) The Delta says that for every $1 move either up or down in price, will either decrease or increase the value of the option contract by 0.50 (e.g. $50). You will notice most option contracts are bought and measured for statistical purposes in the ranges of 0-0.20, .21-.40, .41-.60, .61-80, and .81-1.00.

(2) Then because Gamma is 0.05, for every change in Delta relative to a $1 movement in the underlying asset, The value of the option contract will increase by an additional 0.05 ($5) for every additional $1dollar change in the underlying assets price which would there create a correlated change in delta which is measured by gamma. So if the option contract for XYZ is 1.00 when the price of the underlying asset is $95 and then price moves up $1 dollar then the value of the contract becomes 1.50. (1.00 + 0.50) THEN, if the price moves an additional $1, Then the equation becomes, (1.50 + 0.50 + 0.05) = 2.05.

...

29

1

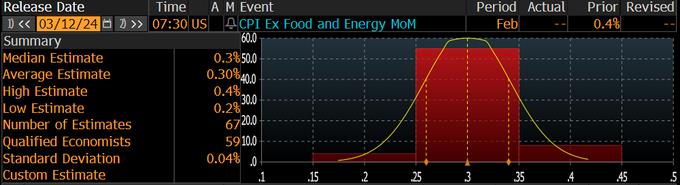

In the wake of an unexpected decline in the $S&P 500 Index (.SPX.US)$ following the latest Consumer Price Index (CPI) figures, traders in the US equity options market are on edge as the market awaits the Tuesday release of fresh inflation data.

The S&P 500 Index is predicted to move 0.9% in either direction on Tuesday, the largest shift ahead of a consumer price index announcement since April 2023, according to Citigroup's Stuart ...

The S&P 500 Index is predicted to move 0.9% in either direction on Tuesday, the largest shift ahead of a consumer price index announcement since April 2023, according to Citigroup's Stuart ...

29

3

What are option Greeks?

Option Greeks are important measures for traders. They show how an option's price reacts to different factors like changes in the asset's price, time passing, implied volatility, and more.

The main Greeks are:

1) Delta: Shows how the option's price changes with the asset's price.

2) Gamma: Predicts how the asset's price movements affect the option's price.

3) Theta: Measures how much the option's price decreases over ti...

Option Greeks are important measures for traders. They show how an option's price reacts to different factors like changes in the asset's price, time passing, implied volatility, and more.

The main Greeks are:

1) Delta: Shows how the option's price changes with the asset's price.

2) Gamma: Predicts how the asset's price movements affect the option's price.

3) Theta: Measures how much the option's price decreases over ti...

19

1

A man came one day to the great Greek philosopher Socrates and said, "Teacher, I have studied many of your precepts and yet I still do not have your success. What is the secret to your success?" Socrates looked at the young man and said, "Follow me." Perplexed, the young man followed Socrates to the river's edge. Socrates waded in, clothes on and all, and motioned the man to follow. The man followed him until the water was up to their chest. Then, without warning, Soc...

18

1

Options Greeks: What you should know

The Greeks

Delta – An option’s delta is the rate of change of the price of the option with respect to its underlying security’s price. The delta of an option ranges in value from 0.0 – 1.00 for calls (0 to -1.00 for puts) and reflects the increase or decrease in the price of the option in response to a 1-point movement of the underlying asset price.

Used to measure the change in value of a contract from a $1 change. Also is used to measure the probability of an Option Contract Expiring “ITM” (In-The-Money). For Example, a Delta of 0.40 can be seen as a 40% chance to Expire ITM.

Gamma – An option’s Gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a 1-point movement of the underlying stock price.

Measures the change in Delta from a 1$ movement in the underlying asset (stock, ETF, things like that). If the underlying moves an additional 1$ Then Delta would equal the Total of Delta + Gamma. After the First Dollar move, any additional moves in the same direction increases the value of Delta by the amount of Gamma.

For Example, XYZ 100 12/31/20 Call for $1.00 and has a delta of .50 and a gamma of .05.

The price of XYZ moves 1 dollar upwards so the new price of the contract becomes 1.50.

The P...

The Greeks

Delta – An option’s delta is the rate of change of the price of the option with respect to its underlying security’s price. The delta of an option ranges in value from 0.0 – 1.00 for calls (0 to -1.00 for puts) and reflects the increase or decrease in the price of the option in response to a 1-point movement of the underlying asset price.

Used to measure the change in value of a contract from a $1 change. Also is used to measure the probability of an Option Contract Expiring “ITM” (In-The-Money). For Example, a Delta of 0.40 can be seen as a 40% chance to Expire ITM.

Gamma – An option’s Gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a 1-point movement of the underlying stock price.

Measures the change in Delta from a 1$ movement in the underlying asset (stock, ETF, things like that). If the underlying moves an additional 1$ Then Delta would equal the Total of Delta + Gamma. After the First Dollar move, any additional moves in the same direction increases the value of Delta by the amount of Gamma.

For Example, XYZ 100 12/31/20 Call for $1.00 and has a delta of .50 and a gamma of .05.

The price of XYZ moves 1 dollar upwards so the new price of the contract becomes 1.50.

The P...

10

13

Looking to Get into NVIDIA But Options Are Too Pricey? Here's How to Open a Position with Lower Cost

$NVIDIA (NVDA.US)$'s options trajectory has been under intense scrutiny lately, with the past month alone witnessing it occupying a quarter of the options market.

Apart from those bullish on NVIDIA throughout this year, many Mooers here also believe that NVIDIA's downtrend isn't over yet: fundamentally, as its size increases, sustaining high-profit growth becomes challenging, insufficient to sup...

Apart from those bullish on NVIDIA throughout this year, many Mooers here also believe that NVIDIA's downtrend isn't over yet: fundamentally, as its size increases, sustaining high-profit growth becomes challenging, insufficient to sup...

+1

12

2

1. In a hot market, there are abundant opportunities, even for options sellers.

Shorting volatility, although akin to grabbing a hot coal, can be profitable if managed well. The volatility of $Super Micro Computer (SMCI.US)$ is excessively high; there are even trades for 1800 call options at expiration. Obviously, this strike price is unattainable, but due to the high volatility, there's a significant risk of interim losses. Position control is crucial; one must avoid being liquida...

Shorting volatility, although akin to grabbing a hot coal, can be profitable if managed well. The volatility of $Super Micro Computer (SMCI.US)$ is excessively high; there are even trades for 1800 call options at expiration. Obviously, this strike price is unattainable, but due to the high volatility, there's a significant risk of interim losses. Position control is crucial; one must avoid being liquida...

13

First, I advise those who wish to trade options should learn to use Greeks. Second you should practice using papertrade before you try the real one. Third you should know the risk before trading options especially selling options where loss can be unlimited. If you find confusing using Greeks, I recommend 3 sources:

1. Investopedia

https://www.investopedia.com/trading/getting-to-know-the-greeks/

The language used is easy to unders...

1. Investopedia

https://www.investopedia.com/trading/getting-to-know-the-greeks/

The language used is easy to unders...

8

4

. You're never to old to do anything. upgrades and down grades with low float works well. just 2 of the indicators I use. 80 to 20 profit to losses for me.

. You're never to old to do anything. upgrades and down grades with low float works well. just 2 of the indicators I use. 80 to 20 profit to losses for me.

warrior-sailormoon : I love u to the max

ReStart Hope : Thanks @iamiam! A good summary, I learnt options trading but very weak in the Greeks. Tried 0dte and short term options and got burned. Now I always get longer expiry options to avoid theta decay, and still able to profit nicely (20% instead of more than 100%). I guess for me it is much safer and lesser worries and no need to keep staring at the screen, just let my analysis and trend goes their way in a few days or even weeks.

warrior-sailormoon : I m 100% for sure i will i need to i hav to ……. Going to read ur post when all my kids in their sleep

warrior-sailormoon : Thousand of Thanks to u for ur great sharing Iamiam

mrbenje : Super helpful, thanks

View more comments...