Latest

Hot

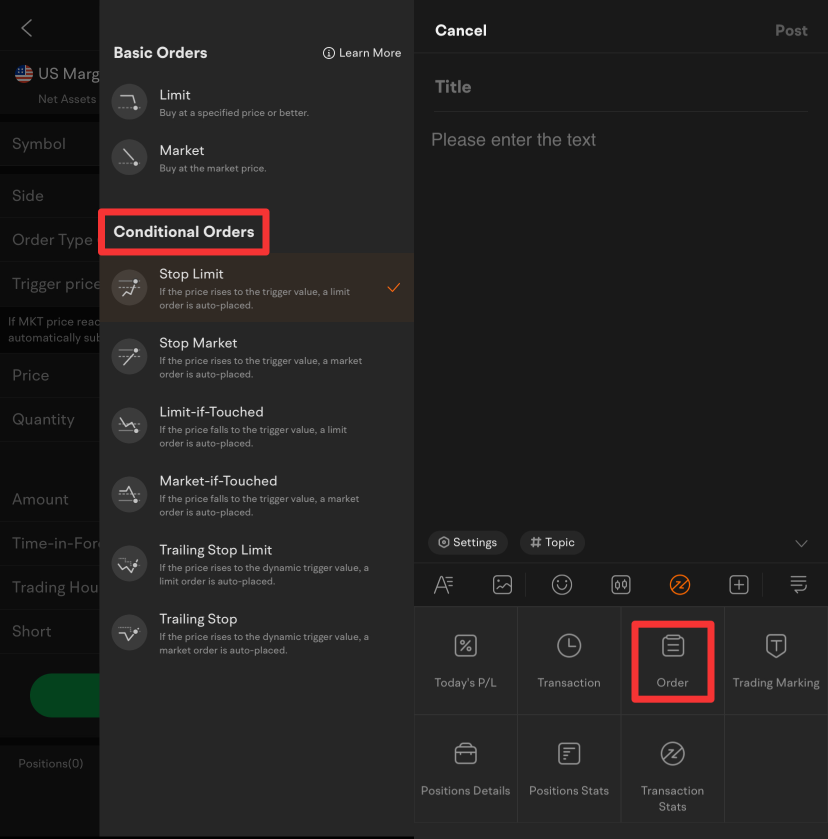

I use conditional orders very often for many different reasons. There are several types of conditional orders that all have their own strengths and weaknesses. And they have different uses depending on the situation. Limit orders, Stop orders, and Market orders are the most common types of conditional orders which I use often. But my favorite is a Trailing Stop order.

A Market order is the best way to get in and out very fast as it will fill the order immediately at the ask. Th...

A Market order is the best way to get in and out very fast as it will fill the order immediately at the ask. Th...

10

5

3

trailing stop I use when I want to sell the stock that move a lot in price range. when you sell trailing stop, it let you sell at max benefit. if the price move up, you can set to sell by % of price change. FOR example you set trailing stop price sell at 10% from the current price. if the price go up they will automatically sell at the highest price by 10% which is better than stop price sell.

7

2

here are many types of orders in the stock market like Market Order, Limit Order, Stop Loss Order etc. In this video, we cover everything about different order types and what they mean.

3

1

Spoiler:

Free Coupons Giveaways! Tap here and join the discussion, stand the chance to win rewards!

Stock prices are fluctuating all the time. That's not something we could possibly change. But with the help of different order types, we can implement our trading strategies more efficiently. Then what are they? What is a conditional order? What is the difference among all of them?

![]() No worry! Check the ...

No worry! Check the ...

Free Coupons Giveaways! Tap here and join the discussion, stand the chance to win rewards!

Stock prices are fluctuating all the time. That's not something we could possibly change. But with the help of different order types, we can implement our trading strategies more efficiently. Then what are they? What is a conditional order? What is the difference among all of them?

20

12

5

I love my oil 🛢 and oil companies ⛽ but being this heavily invested in oil, I must protect my investments from decline and more losses coming.

How did I protect myself from losses?

- I took profits and sold half - then I sold calls on the remaining while simultaneously buying puts (this is called a synthetic short, I'm basically selling my own shares short rather than borrowing someone else's shares) - and finally the strategy I'm using on moomoo and my ETF account $Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP.US)$ a 2X inv...

How did I protect myself from losses?

- I took profits and sold half - then I sold calls on the remaining while simultaneously buying puts (this is called a synthetic short, I'm basically selling my own shares short rather than borrowing someone else's shares) - and finally the strategy I'm using on moomoo and my ETF account $Direxion Daily S&P Oil & Gas Exp. & Prod. Bear 2X Shares (DRIP.US)$ a 2X inv...

+9

14

17

1

$Henry Hub Natural Gas Futures(MAY5) (NGmain.US)$

natural gas Futures have had a nice bounce over the past couple weeks. they also had one of their best days in a very long time last Friday. you can see in the first chart directly below this beautiful Elliott wave pattern following a well-defined up trending support. this is almost a perfect textbook Elliott wave formation which shows that this rally is very strong and it could very well continue. but Elliott waves do not l...

natural gas Futures have had a nice bounce over the past couple weeks. they also had one of their best days in a very long time last Friday. you can see in the first chart directly below this beautiful Elliott wave pattern following a well-defined up trending support. this is almost a perfect textbook Elliott wave formation which shows that this rally is very strong and it could very well continue. but Elliott waves do not l...

+1

8

43

2

$Bitcoin (BTC.CC)$

a lot of cryptocurrencies are having a nice rally right now. it seems like a broader crypto rally. some of the alt coins have been doing especially well over the past 24 hours like one of my favorites to swing trade on occasion $ETC (ETC.CC)$

if you are thinking about investing in these cryptos then personally I would wait until Bitcoin reaches the resistance level mentioned below. after we see what Bitcoin does at this pr...

a lot of cryptocurrencies are having a nice rally right now. it seems like a broader crypto rally. some of the alt coins have been doing especially well over the past 24 hours like one of my favorites to swing trade on occasion $ETC (ETC.CC)$

if you are thinking about investing in these cryptos then personally I would wait until Bitcoin reaches the resistance level mentioned below. after we see what Bitcoin does at this pr...

11

7

1

just here to learn as much as possible

9

3

I often use limit orders or trailing stop limit orders on Questrade but they don't always get filled when they should.... Not sure if anyone else has the same problem?

What I do for trailing stop limit orders is place a buy order at a trailing percentage of 1% and an offset of like 5%. What this does is it buys the stock only if the stock increases by 1% and as long as it doesn't jump over 5%. I love this strategy because it allows me to al...

What I do for trailing stop limit orders is place a buy order at a trailing percentage of 1% and an offset of like 5%. What this does is it buys the stock only if the stock increases by 1% and as long as it doesn't jump over 5%. I love this strategy because it allows me to al...

10

3

2

5

not-a-cow : I don't understand why you placed a stop order to buy AMZN when it reached a certain point and then purchased at market rate. Why didn't you just do a limit buy order instead?

SpyderCall OP not-a-cow : that's a better idea for Amzn because it is so liquid all of the time. i should have done that with a stock like amzn. Other less liquid stock would sometimes skip over my fill price because the would move very volatile and skip over my entry point price. This most likely would not have happened with amzn. Good point.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

102766980 : As always thank you very much for sharing . Appreciate it .![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Kendra Vandy : Limit buys are life but market buys have really helped in trying to buy in options I have major underlying stock conviction in.

but market buys have really helped in trying to buy in options I have major underlying stock conviction in.

SpyderCall OP Kendra Vandy : i almost always do market buys for options. it get me in and out of a trade very fast while the price is rising or falling very fast