Latest

Hot

$Snowflake (SNOW.US)$ is scheduled to report its third-quarter fiscal 2025 results on 20 Nov 2024 after market close.

Market consensus estimate for revenues is pegged at $898.77 million, indicating an increase of 22.42% from the year-ago quarter’s reported figure.

Earnings per share consensus mark we are looking at 15 cents, this is a decrease of 40% compared to same quarter one year ago.

Good Cloud Computing Growth Might Be Good News ...

Market consensus estimate for revenues is pegged at $898.77 million, indicating an increase of 22.42% from the year-ago quarter’s reported figure.

Earnings per share consensus mark we are looking at 15 cents, this is a decrease of 40% compared to same quarter one year ago.

Good Cloud Computing Growth Might Be Good News ...

+4

17

$D-MARKET Electronic Services & Trading (HEPS.US)$ what is momentum?

Momentum is a natural phenomenon which involves some force on an object, or matter that builds pressure often associated with an upwards trend or object in motion due to exacted pressure.

![]()

![]()

![]()

![]()

![]() ??

??

Momentum is a natural phenomenon which involves some force on an object, or matter that builds pressure often associated with an upwards trend or object in motion due to exacted pressure.

1

If you have been following $C3.ai (AI.US)$ , you will discover that sometimes the market see C3.ai in favour, but other times, C3.ai stock got sold off. If you notice, the bull case for C3.ai has not changed, so the sell-offs present great opportunities to buy the stock on the cheaper price.

C3.ai customer base covers both private-sector and public-sector, there have been a lot of talks on AI-enhanced security, if C3.ai can deliv...

C3.ai customer base covers both private-sector and public-sector, there have been a lot of talks on AI-enhanced security, if C3.ai can deliv...

13

1

$Navitas Semiconductor (NVTS.US)$ recently announced its Q1 earnings, surpassing expectations on both top and bottom lines. However, the company's guidance fell short of projections, echoing a trend seen across various industries. Despite this, the semiconductor sector is poised for a robust recovery in the second half of the year. Navitas, in particular, boasts a strong pipeline and rapid revenue growth. Notably, the company has highlighted its pla...

4

1

Alibaba Join The LLM race : Importance of Large Language Models in Advancing Artificial Intelligence

$Alibaba (BABA.US)$ the cloud computing unit of Alibaba Group Holding Ltd, had unveiled on 03 Aug 23 (Thursday) two open-source artificial intelligence-powered large language models (LLM).

Two LLMs called Qwen-7B and Qwen-7B-Chat, with each model boasting 7 billion parameters, these 2 LLMs could be deployed for commercial use.

This also marks the first time that a big Chinese tech company has open-...

Two LLMs called Qwen-7B and Qwen-7B-Chat, with each model boasting 7 billion parameters, these 2 LLMs could be deployed for commercial use.

This also marks the first time that a big Chinese tech company has open-...

4

$Microsoft (MSFT.US)$ has release their earnings report and here are some key areas I have looked at and Microsoft share price have dipped after its earnings release.

Revenue Guidance

Microsoft has called for a lower revenue guidance as opposed to what analysts had predicted. This is partly due to the weak performance in their business segment (which contains Windows).

Revenue Growth

Azure Cloud revenue has a slow growth from 27% (previous quarter)...

Revenue Guidance

Microsoft has called for a lower revenue guidance as opposed to what analysts had predicted. This is partly due to the weak performance in their business segment (which contains Windows).

Revenue Growth

Azure Cloud revenue has a slow growth from 27% (previous quarter)...

1

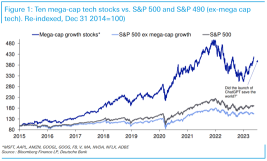

A return to Big Tech stocks while has helped the broader market through the year.

The $SPDR S&P 500 ETF (SPY.US)$ is up nearly 10%, while the equal-weighted S&P has gained a little more than 1%.

The Big Tech really has enjoyed the enthusiasm for AI, especially with the quick use of ChatGPT.

"The SPX seems increasingly divorced from decelerating consumer trends and other major indices (except the $Invesco QQQ Trust (QQQ.US)$ ) due to ...

The $SPDR S&P 500 ETF (SPY.US)$ is up nearly 10%, while the equal-weighted S&P has gained a little more than 1%.

The Big Tech really has enjoyed the enthusiasm for AI, especially with the quick use of ChatGPT.

"The SPX seems increasingly divorced from decelerating consumer trends and other major indices (except the $Invesco QQQ Trust (QQQ.US)$ ) due to ...

9