Latest

Hot

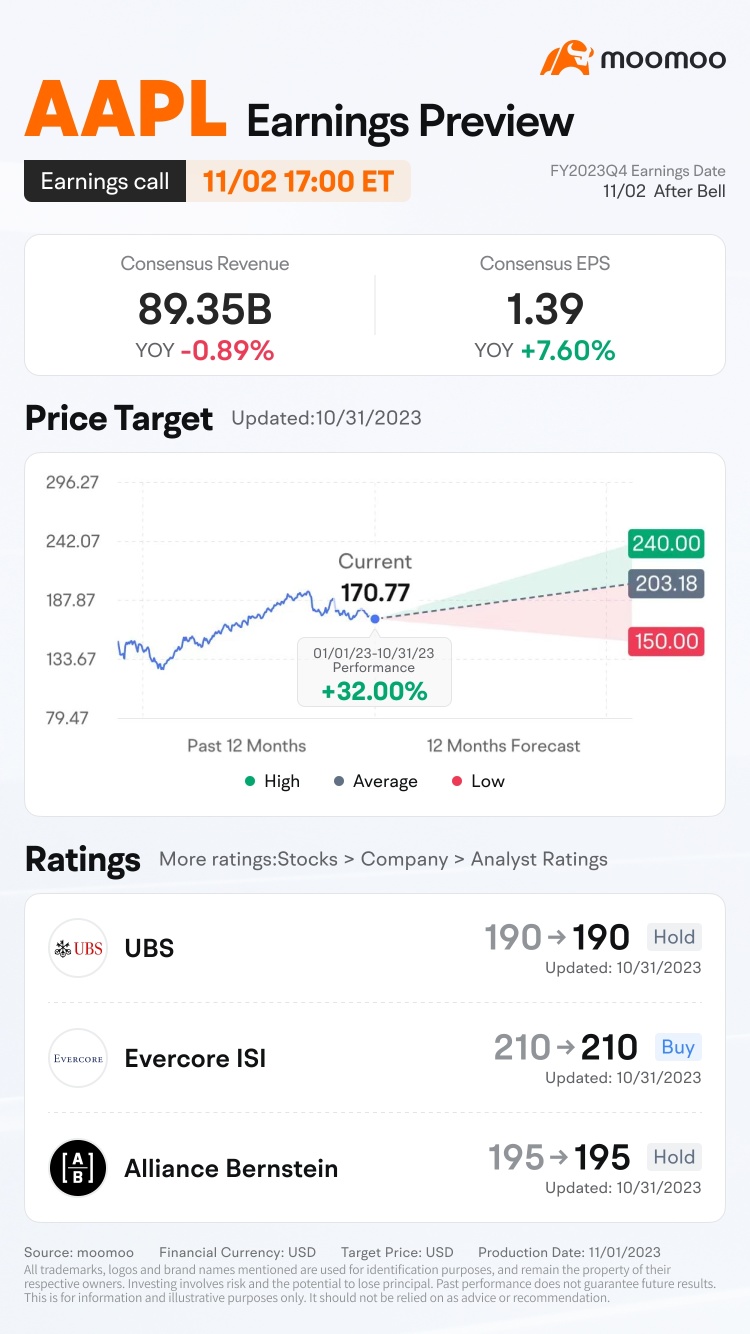

$Apple (AAPL.US)$ is releasing its Q4 FY2023 earnings on November 2 after the bell. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Apple (AAPL.US)$'s opening price at 9:30 AM ET November 3 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Apple (AAPL.US)$'s opening price at 9:30 AM ET November 3 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will...

76

64

5

$Apple (AAPL.US)$ is going to report earnings on 01 Feb 2024 after market close. Investors would be looking out for Apple’s iPhone sales performance, particularly in China.

Analysts from Barclays and TF International Securities have downgraded Apple’s stocks in early January and also predict 15% decline in iPhone shipments respectively. This has cause Apple shares to decline by 3.5% in January....

Analysts from Barclays and TF International Securities have downgraded Apple’s stocks in early January and also predict 15% decline in iPhone shipments respectively. This has cause Apple shares to decline by 3.5% in January....

+1

12

$Apple (AAPL.US)$

Apple for the first time became the largest smartphone vendor in China by shipments, new data for 2023 released on Thu showed.

The iPhone maker's market share in China stood at 17.3% in 2023, according to the International Data Corporation (IDC), a record-high.

Apple's overall smartphone shipments fell 2.2% year-on-year in 2023, while the overall market fell 5%, IDC said. Shipments are the devices that Apple sen...

Apple for the first time became the largest smartphone vendor in China by shipments, new data for 2023 released on Thu showed.

The iPhone maker's market share in China stood at 17.3% in 2023, according to the International Data Corporation (IDC), a record-high.

Apple's overall smartphone shipments fell 2.2% year-on-year in 2023, while the overall market fell 5%, IDC said. Shipments are the devices that Apple sen...

5

2

$Apple (AAPL.US)$

Mixed Blessings for AAPL Stock Investors

On Nov. 2 in the company’s fiscal 2023 fourth-quarter earnings press release, Apple CEO Tim Cook touted a “September quarter revenue record for iPhone.” This may be true, but it doesn’t tell the full story.

Maybe Cook can’t be blamed for accentuating the positive aspects of Apple’s financial results. After all, being a hype man is part of a chief executive’s job description.

In...

Mixed Blessings for AAPL Stock Investors

On Nov. 2 in the company’s fiscal 2023 fourth-quarter earnings press release, Apple CEO Tim Cook touted a “September quarter revenue record for iPhone.” This may be true, but it doesn’t tell the full story.

Maybe Cook can’t be blamed for accentuating the positive aspects of Apple’s financial results. After all, being a hype man is part of a chief executive’s job description.

In...

4

1

$Apple (AAPL.US)$

Conclusion:

1. Apple will upgrade existing iPad models and launch new a new model in 2024, but shipments are still far from the peak in 2022 due to the decline in work-from-home (WFH) demand and a lack of structural change in the entertainment and productivity user experience.

2. Key upgrades to focus on include the M3 processor and OLED displays.

3. iPad shipments in 2024 are estimated at 52–54 million units (vs. a...

Conclusion:

1. Apple will upgrade existing iPad models and launch new a new model in 2024, but shipments are still far from the peak in 2022 due to the decline in work-from-home (WFH) demand and a lack of structural change in the entertainment and productivity user experience.

2. Key upgrades to focus on include the M3 processor and OLED displays.

3. iPad shipments in 2024 are estimated at 52–54 million units (vs. a...

1

1

Woodring forecasts that AI implementation may boost Apple's product monetization and enhance user base's long-term value. This could benefit through hardware share gains, new users, increased Services pricing, App Store purchases and a premium Siri subscription.

2

$Apple (AAPL.US)$

12NOV2023

✔ 那天没有回调到 176 就一直上涨到 187 了。

✔ 等待它突破和站稳在压力线 187 的附近。

✔ 那个时候便是个好的进场点。

✘ 失败了记得设止损在 180 。

12NOV2023

✔ It went up to 187 without a pullback to 176 that day.

✔ Wait for it to break out and stand firm near the pressure line 187.

✔ That time is a good entry point.

✘ Remember to set the stop loss at 180 if it fail.

12NOV2023

✔ 那天没有回调到 176 就一直上涨到 187 了。

✔ 等待它突破和站稳在压力线 187 的附近。

✔ 那个时候便是个好的进场点。

✘ 失败了记得设止损在 180 。

12NOV2023

✔ It went up to 187 without a pullback to 176 that day.

✔ Wait for it to break out and stand firm near the pressure line 187.

✔ That time is a good entry point.

✘ Remember to set the stop loss at 180 if it fail.

5

1

$Apple (AAPL.US)$

On the daily, Apple has broken out of the flag (or whatever the pattern indicated by blue lines is), and could reach the red resistence level of 189 and either pullback to the breakout point to continue it's move, or just straight surpass it.

This is following a retracement from the previous bullish rally as shown in the 2nd image.

However currently I'm not rlly bullish on the previous earning reports so I'm not sure how long this bullish move will last ...

On the daily, Apple has broken out of the flag (or whatever the pattern indicated by blue lines is), and could reach the red resistence level of 189 and either pullback to the breakout point to continue it's move, or just straight surpass it.

This is following a retracement from the previous bullish rally as shown in the 2nd image.

However currently I'm not rlly bullish on the previous earning reports so I'm not sure how long this bullish move will last ...

9

2

$Apple (AAPL.US)$ must break out of $189.729 from the inverted head and shoulders formation or Cup formation convincingly now

3

4

$Apple (AAPL.US)$ ’s Q1 revenue guidance appeared flat year-over-year, but it’s more positive than it seems. The upcoming Q1 has one less week than the previous year, which added seven percentage points to last year’s revenue.

Excluding this extra week, Apple’s guidance shows 7% growth. This is noteworthy, given the challenging economic environment marked by inflation and high interest rates.

Apple’s services segment, demonstrating robust and sustained growth, is ...

Excluding this extra week, Apple’s guidance shows 7% growth. This is noteworthy, given the challenging economic environment marked by inflation and high interest rates.

Apple’s services segment, demonstrating robust and sustained growth, is ...

1

RickPANDA : PCT: AAPL Earnings Effects v1.0 :

PCT = Pandas Coffee Talk.

MSFT & AAPL are archenemies brother & sister in arms. So when MSFT increase Revenue YOY by 26%. Shares prices opened increase by +3%. AAPL will do minimum likewise.

junclj1223 : Apple should fall down to below 160 because i am waiting for chance to ride the boat.

104568613 : Hope in good target

无名小雕 : $Apple (AAPL.US)$

$178

HuatHuatManyCome : 176

View more comments...