Posts

News

Latest

Hot

Hi, mooers! Q4 earnings season is looming. Are you ready for it? ![]()

On Friday, major banks including $JPMorgan (JPM.US)$ , $Citigroup (C.US)$ , $Bank of America (BAC.US)$ , and $Wells Fargo & Co (WFC.US)$ are releasing their quarterly earnings. How will the market react to the companies' results? Let's make a guess!![]()

Rewards

![]() An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in Fr...

An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in Fr...

On Friday, major banks including $JPMorgan (JPM.US)$ , $Citigroup (C.US)$ , $Bank of America (BAC.US)$ , and $Wells Fargo & Co (WFC.US)$ are releasing their quarterly earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

56

9

2

Columns Earnings Volatility: Bank of America's Post Earnings Move Edge Higher as Treasury Yields Fluctuate

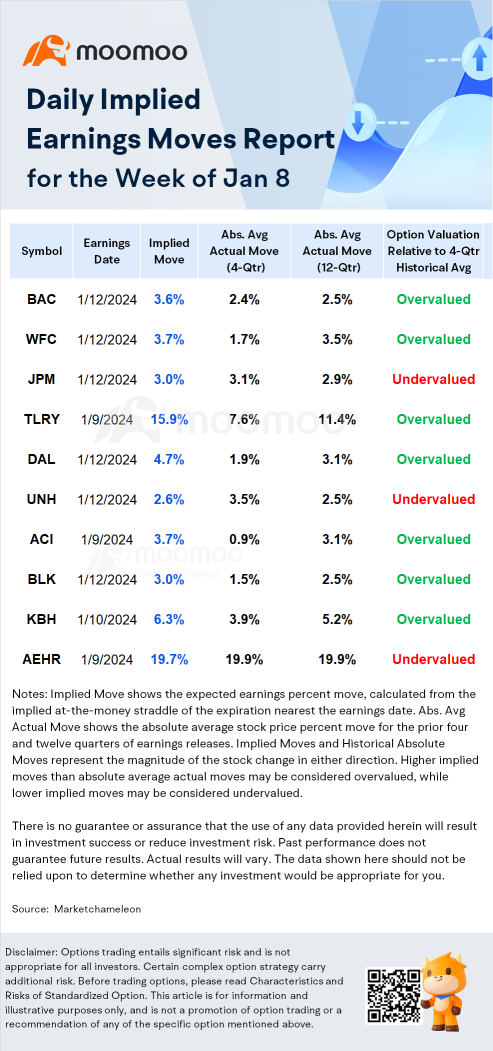

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Stock: $Bank of America (BAC.US)$

-Earnings Date: 1/12 Before market open

-Implied...

-Stock: $Bank of America (BAC.US)$

-Earnings Date: 1/12 Before market open

-Implied...

+2

20

2

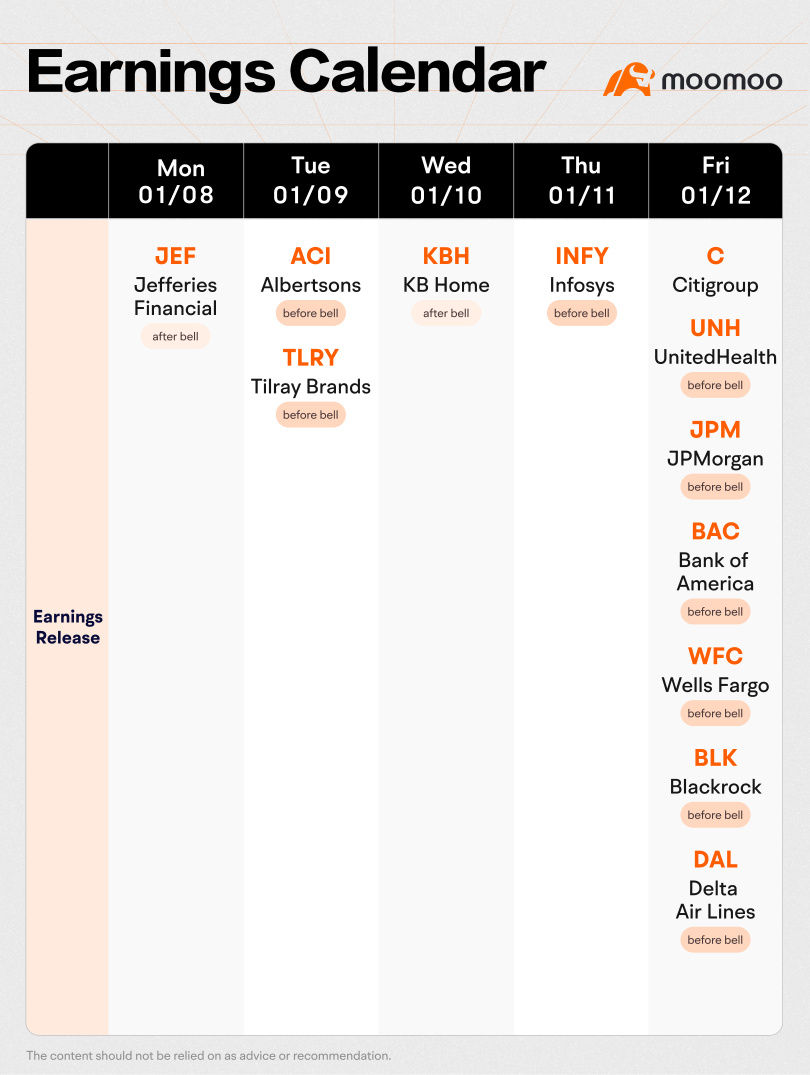

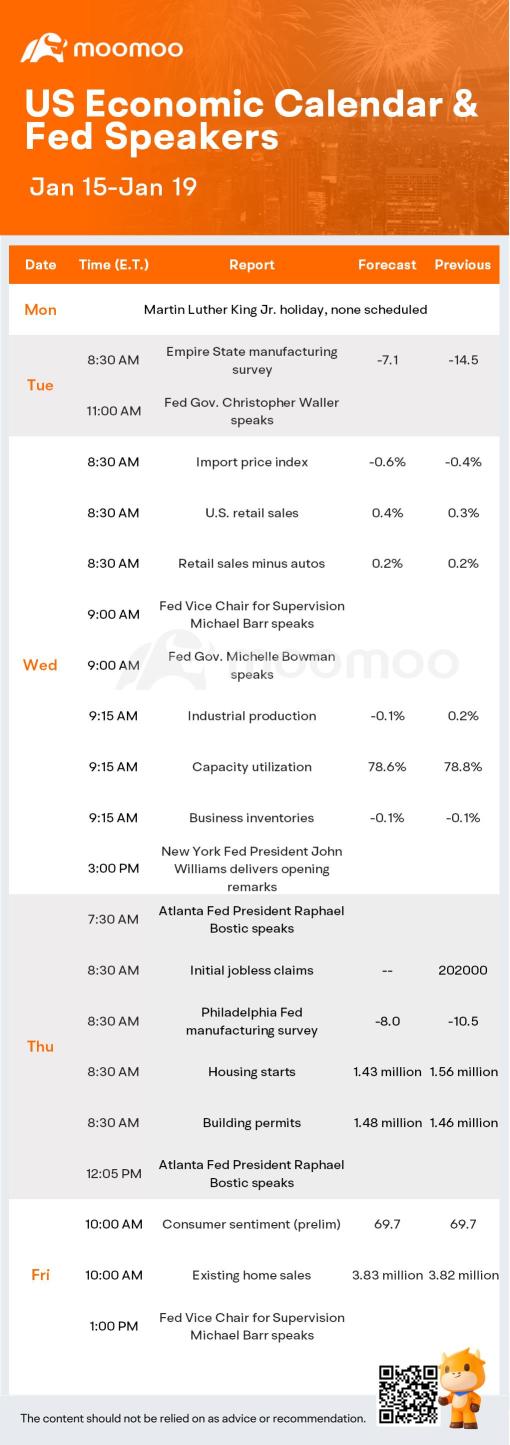

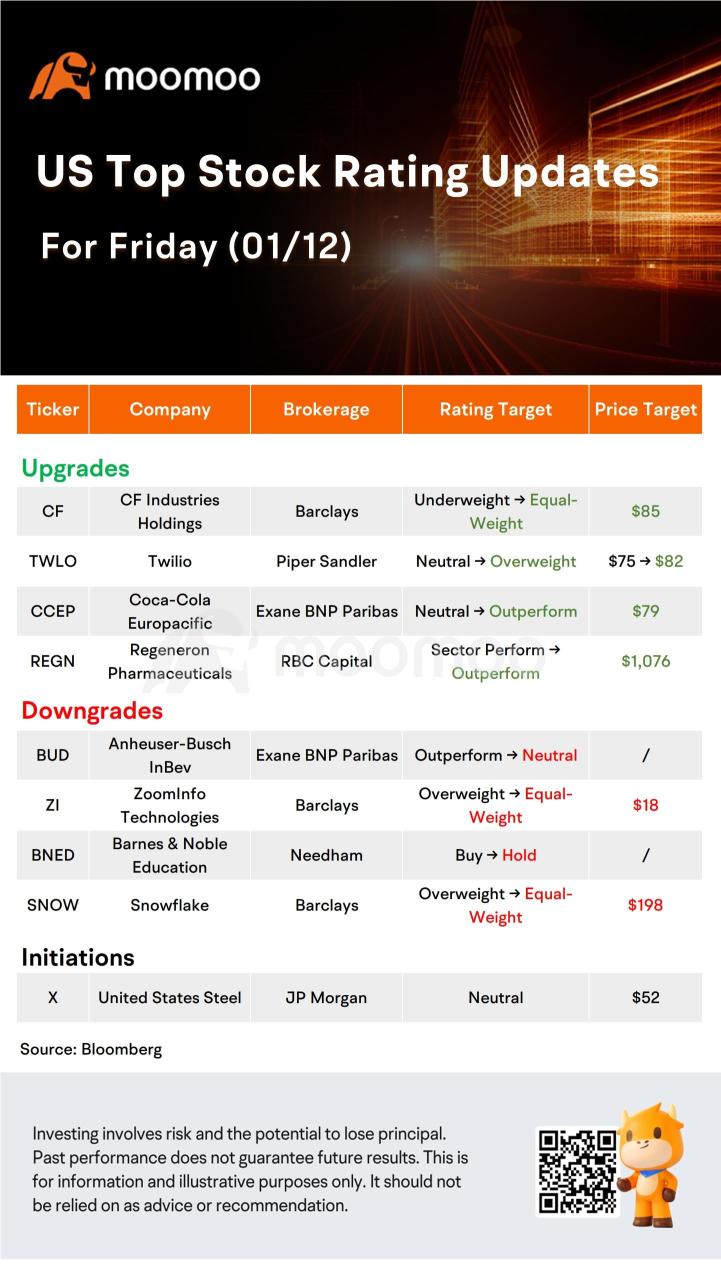

This week's macroeconomic focus is on inflation, with December's Consumer Price Index due Thursday and the Producer Price Index on Friday, against a backdrop of minimal earnings reports. Meanwhile, financial markets have moderated their expectations for early U.S. rate cuts, following initial reactions to the Federal Reserve's dovish turn in December.

The upcoming week's important earnings inlcude $Jefferies Financial (JEF.US)$ on Monday...

The upcoming week's important earnings inlcude $Jefferies Financial (JEF.US)$ on Monday...

+3

52

5

23

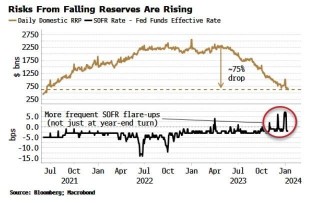

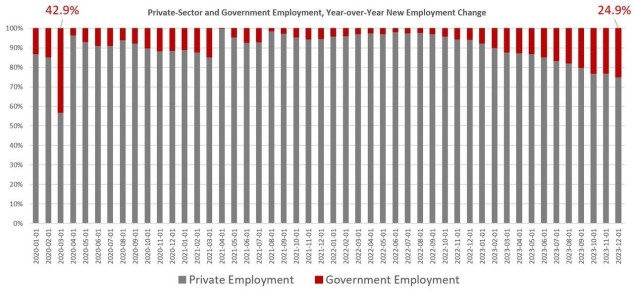

Trading on rate cut expectations undoubtedly remains one of the most crucial themes in the market this year. Despite the Fed's dot plot indicating the potential for only 75 bp in cuts for 2024, the market is widely anticipating a 150 bp cut in policy rates for the year. After hawkish speeches by Federal Reserve officials this week weakened expectations for a rate cut, traders are still placing a 63.96% probability on the ...

+1

36

9

43

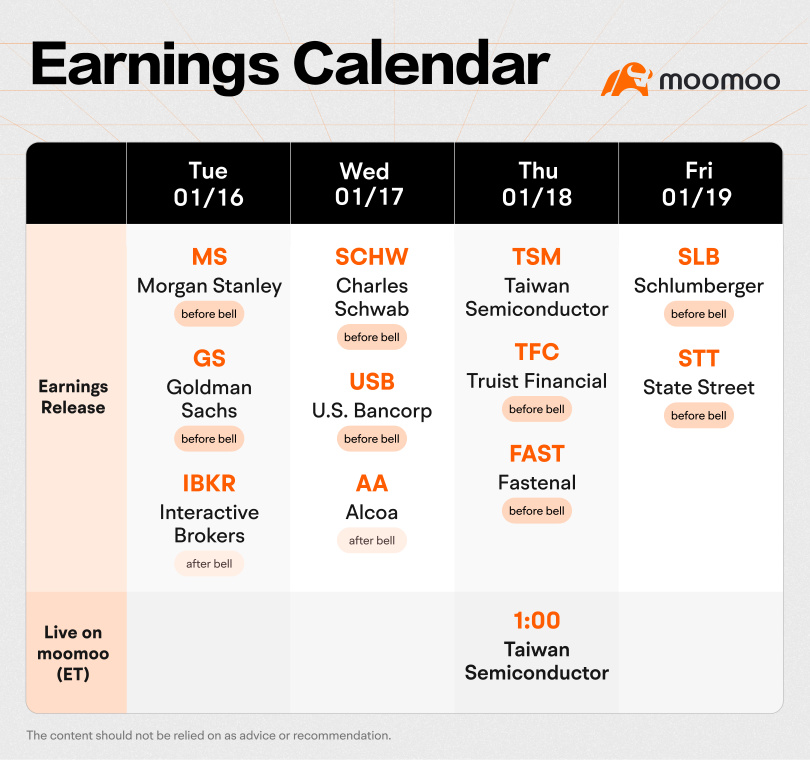

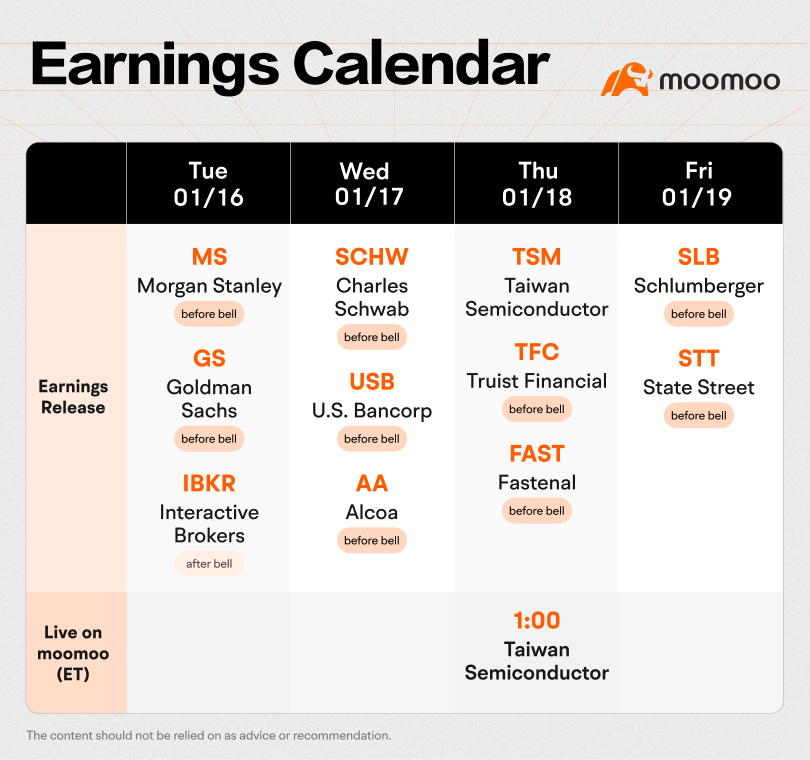

As we approach next week, the earnings season is set to gradually pick up pace, with the remaining major banks scheduled to report their financial results. Additionally, investors will remain focused on analyzing the Consumer Price Index (CPI) and Producer Price Index (PPI) data in anticipation of the Federal Reserve's upcoming meeting on January 30-31.

The market is closed for Martin Luther King Jr Day. $Morgan Stanley (MS.US)$, ��������...

The market is closed for Martin Luther King Jr Day. $Morgan Stanley (MS.US)$, ��������...

+3

38

22

Hi, mooers! Q4 earnings season is looming. Are you ready for it? ![]()

This week, various companies including $Morgan Stanley (MS.US)$ , $Goldman Sachs (GS.US)$ , and $Taiwan Semiconductor (TSM.US)$ are releasing their quarterly earnings. How will the market react to the companies' results? Let's make a guess!![]()

Rewards

![]() An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in intraday trading on the day ...

An equal share of 1,000 points: For mooers who correctly guess the winner who makes the biggest gains in intraday trading on the day ...

This week, various companies including $Morgan Stanley (MS.US)$ , $Goldman Sachs (GS.US)$ , and $Taiwan Semiconductor (TSM.US)$ are releasing their quarterly earnings. How will the market react to the companies' results? Let's make a guess!

Rewards

22

6

3

Banks kick off earnings season as $JPMorgan (JPM.US)$, $Bank of America (BAC.US)$, $Wells Fargo & Co (WFC.US)$ and $Citigroup (C.US)$ released earnings reports last Friday. This week, more companies are expected to announce their earnings reports.

The strong performance of the US stock market in 2023Q4 has amplified the importance of the upcoming earnings season, making it a crucial period for investors who are eager to review the latest financia...

The strong performance of the US stock market in 2023Q4 has amplified the importance of the upcoming earnings season, making it a crucial period for investors who are eager to review the latest financia...

+2

22

2

3

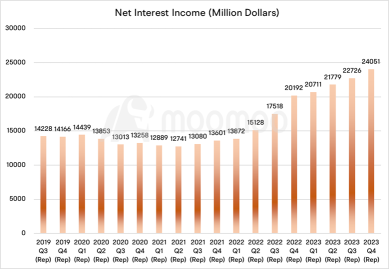

$JPMorgan (JPM.US)$ achieved unprecedented profit levels, despite experiencing a downturn in the last quarter due to a one-time hit of roughly $3 billion to pay for a special assessment charged by the Federal Deposit Insurance Corporation.

The company announced on Friday that it had generated a historic $49.6 billion in net income over the year, setting a new record for the American banking sector. This milestone was reac...

The company announced on Friday that it had generated a historic $49.6 billion in net income over the year, setting a new record for the American banking sector. This milestone was reac...

+1

22

4

7

Morning Movers

Gapping up

$JPMorgan (JPM.US)$ The financial giant added nearly 2% after fourth-quarter revenue topped expectations. However, JPMorgan Chase reported a 15% year-over-year profit decline for the October-December period.

$Qualcomm (QCOM.US)$ The semi stock added 1.6% on the back of a Citi upgrade to buy from neutral. The bank also opened a positive catalyst watch and raised the stock's estimates and price target, not...

Gapping up

$JPMorgan (JPM.US)$ The financial giant added nearly 2% after fourth-quarter revenue topped expectations. However, JPMorgan Chase reported a 15% year-over-year profit decline for the October-December period.

$Qualcomm (QCOM.US)$ The semi stock added 1.6% on the back of a Citi upgrade to buy from neutral. The bank also opened a positive catalyst watch and raised the stock's estimates and price target, not...

24

2

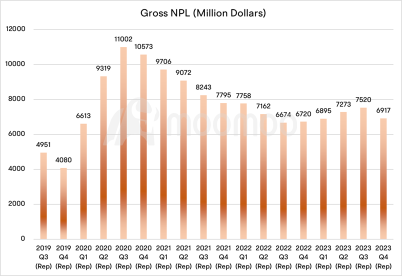

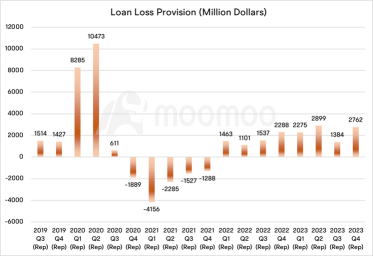

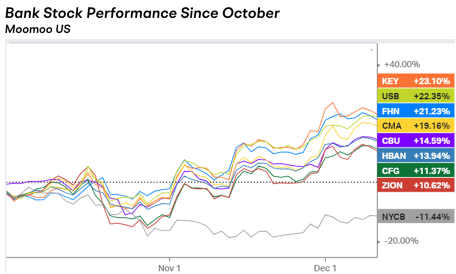

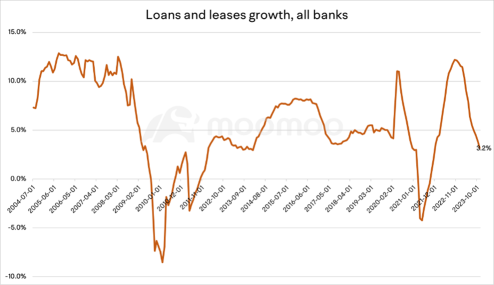

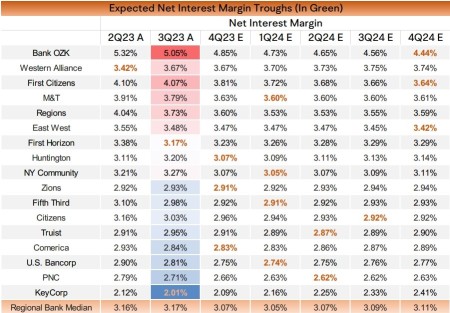

Following the bank collapses and significant interest rate hikes in March, regional banks have been grappling with rising funding costs, tighter regulations, and deteriorating credit quality. However, as inflation cools and the prospect of potential rate cuts looms, market sentiment could shift. Lenders such as KeyCorp, Zions, which were previously affected by early-year banking turmoil, have seen their fortunes rebound fro...

+2

21

1

11

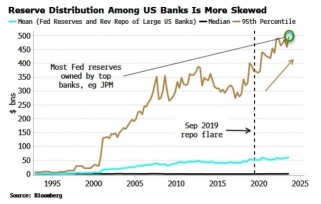

The Fed and its policies can be tough to comprehend. You must understand what the Fed and other central banks are doing to become a more profitable investor. They essentially control the money in circulation. If you control the money, then you can sway the markets in certain directions. Just like we have seen over the past few years since the pandemic and many other times in the past.

The Fed and its policies can be tough to comprehend. You must understand what the Fed and other central banks are doing to become a more profitable investor. They essentially control the money in circulation. If you control the money, then you can sway the markets in certain directions. Just like we have seen over the past few years since the pandemic and many other times in the past.

102362254 : The US banks are expected to report mixed Q4 earnings, as they deal with higher interest rates, inflation, geopolitical risks, and regulatory pressures. $JPMorgan (JPM.US)$ may lead the pack with its diversified business and strong capital markets. Citigroup, Bank of America, and Wells Fargo may lag behind with lower loan demand, higher deposit costs, and weaker fee income. Goldman Sachs and Morgan Stanley may excel with their investment banking and wealth management segments. The outlook for 2024 may be cautious, but the banks may have some positive surprises.

Just Born : I believe JP Morgan will still be the leader in the banking sector in US. Their quarterly financial earnings will be attractive.

ZnWC : JP Morgan will make the biggest gains in Friday's intraday trading.

JPMorgan Chase & Co. (in short JP Morgan) is a multinational financial services and the largest bank in the US and the world's largest bank by market capitalization as of 2023. In May 2023, CNBC reported JPMorgan Chase was developing a new tool for investment advisers using artificial intelligence called IndexGPT. Via trademark filing, this would rely on a "disruptive form of artificial intelligence" and cloud computing software to select investments for customers. This move was a sign the bank intended to launch AI product amid the development ChatGPT.

The bank has a long history of lawsuits. The latest was benefiting and closing their eyes to Epstein's sex trafficking operations. In September 2023, JPMorgan agreed to a $75 million settlement with the United States Virgin Islands Department of Justice for its alleged facilitation and failure to notify law enforcement of Epstein's illegal activities.

The company reported a higher than expected during the Q3 earnings last year. Its revenue of $39.87 billion, up 21.9% over the same period last year and EPS came in at $4.33, compared to $3.12 QOQ. Despite the negative reports and bearish market conditions, I think the bank has a great potential to reach a greater height given its size and far-sightedness.

KhaiZ : biggest bank in US

Koroi46 : JP MORGAN will be the market winner

View more comments...