Posts

News

Latest

Hot

$300 Billion and Counting

• Why are we so SERIOUS about the S&P 500 📈 and Compound Interest over time⁉️

• Over the last 20 years, through the end of Feb. 2024, the S&P 500 has posted an average annual return of 9.74%, right about in line with its long-term average.

Here’s how much you would have now if you invested in the S&P 500 20 years ago, based on varying starting amounts:

• $1,000 would grow to $2,533

• $5,000 would grow to $12,665

• $10,000 would ...

• Why are we so SERIOUS about the S&P 500 📈 and Compound Interest over time⁉️

• Over the last 20 years, through the end of Feb. 2024, the S&P 500 has posted an average annual return of 9.74%, right about in line with its long-term average.

Here’s how much you would have now if you invested in the S&P 500 20 years ago, based on varying starting amounts:

• $1,000 would grow to $2,533

• $5,000 would grow to $12,665

• $10,000 would ...

+10

52

16

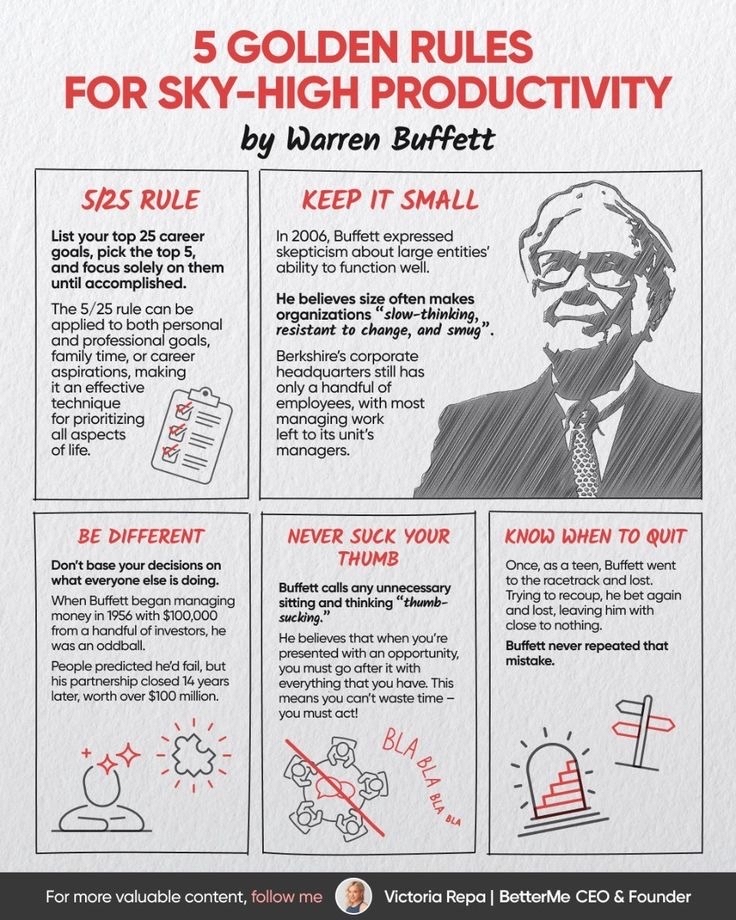

Warren Buffett has publicly stated that he advised his wife to invest 90% of her inheritance in a low-cost S&P 500 index fund after his passing, with the remaining 10% in short-term government bonds.

Top 20 Companies in S&P 500

$Apple (AAPL.US)$ Amplitude: 1.72% Mkt Cap: 3.45T Free Float: 15.18B

$Microsoft (MSFT.US)$ Amplitude: 1.15% Mkt Cap: 3.09T Free Float: 7.42B

$NVIDIA (NVDA.US)$ Amplitude: 2.61% Mkt Cap: 3.06T Free Float: 23.54B

$Alphabet-C (GOOG.US)$ Amplitude...

Top 20 Companies in S&P 500

$Apple (AAPL.US)$ Amplitude: 1.72% Mkt Cap: 3.45T Free Float: 15.18B

$Microsoft (MSFT.US)$ Amplitude: 1.15% Mkt Cap: 3.09T Free Float: 7.42B

$NVIDIA (NVDA.US)$ Amplitude: 2.61% Mkt Cap: 3.06T Free Float: 23.54B

$Alphabet-C (GOOG.US)$ Amplitude...

11

6

This Company - A2Z Cust2Mate Solutions Corp (NASDAQ: AZ) will be an absolute game changer in the realm of smart retail solutions. And it is now time for investors to give a serious look into this technology stock!

Here's what you can learn from this video:-

✓ What is AZ currently doing.

✓ The products feature of AZ.

✓ The prospects of AZ going ahead.

#AZ #SMARTCART #FINANCE #INVESTMENT #NASDAQ

$A2Z Cust2Mate Solutions (AZ.US)$

Here's what you can learn from this video:-

✓ What is AZ currently doing.

✓ The products feature of AZ.

✓ The prospects of AZ going ahead.

#AZ #SMARTCART #FINANCE #INVESTMENT #NASDAQ

$A2Z Cust2Mate Solutions (AZ.US)$

From YouTube

2

2

Last week, Berkshire Hathaway $Berkshire Hathaway-B (BRK.B.US)$ joined the elite group of public U.S. companies that have reached a $1T market cap.

Of the companies to hit this milestone, Berkshire took the longest—approximately 44.5 years from the time it went public—according to data compiled by my friends at VisualCapitalist.

Notably, Berkshire is the first non-tech company in the U.S. to achieve this feat.

In contrast, Meta $Meta Platforms (META.US)$ reached t...

Of the companies to hit this milestone, Berkshire took the longest—approximately 44.5 years from the time it went public—according to data compiled by my friends at VisualCapitalist.

Notably, Berkshire is the first non-tech company in the U.S. to achieve this feat.

In contrast, Meta $Meta Platforms (META.US)$ reached t...

8

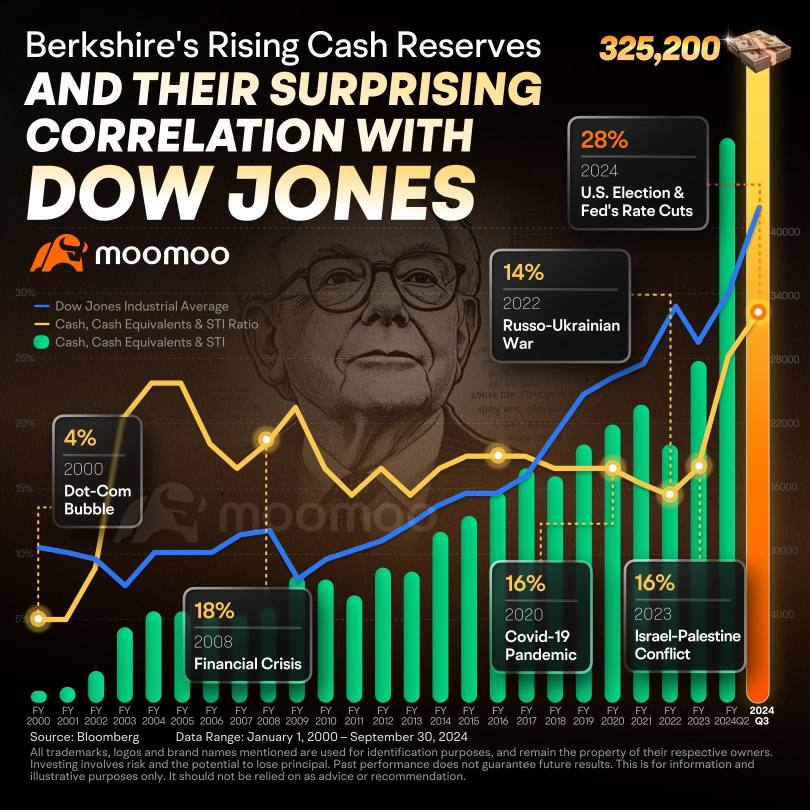

$NVIDIA (NVDA.US)$ saw some articles recently referencing September as the worst month from s&p since 2018 averaging like 1.6% in losses annually during the month. Warren Buffett is selling shares everywhere and gathering a rather large sum of free cash for Berkshire for the purpose of taking advantage of the annual drop in prices to secure more holdings during or after the sell off. you could amount a lot of the sell off during the month in securities to cover rising tuition and living expenses ...

2

4

Happy Birthday Stock Grandpa

Warren Buffett has added around $6 billion to Berkshire Hathaway’s sizable cash pile this summer with a string of Bank of America stock sales since mid-July.

According to a new filing Friday, sales of 21.1 million shares on Wednesday, Thursday, and Friday generated $848.2 million, which is an average price of $40.24.

Berkshire has sold Bank of America shares for six straight sessions. Since it began to...

According to a new filing Friday, sales of 21.1 million shares on Wednesday, Thursday, and Friday generated $848.2 million, which is an average price of $40.24.

Berkshire has sold Bank of America shares for six straight sessions. Since it began to...

2

Legendary investor Warren Buffett turned 94 on Friday. As if commemorating the occasion, Buffet’s sprawling conglomerate Berkshire Hathaway became the first nontechnology company to hit a $1 trillion market capitalization on Wednesday. Meanwhile, Buffett last week sold 21.1 million shares of Bank of America, adding $6 billion to Berkshire’s cash pile.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Apple (AAPL.US)$ $Occidental Petroleum (OXY.US)$

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Bank of America (BAC.US)$ $Apple (AAPL.US)$ $Occidental Petroleum (OXY.US)$

7

CONGRATULATIONS 🎊🎈🎉🍾 TO WARREN BUFFETT THE ORACLE OF OMAHA 👏🏽

CONGRATULATIONS 🍾🎈🎉 TO US ALL 👏🏽

CONGRATULATIONS 🍾🎉🎈 TO $Berkshire Hathaway-B (BRK.B.US)$ and HOPEFULLY TO $Sirius XM (SIRI.US)$ 😏 etc etc

CONGRATULATIONS 🍾🎈🎉 TO US ALL 👏🏽

CONGRATULATIONS 🍾🎉🎈 TO $Berkshire Hathaway-B (BRK.B.US)$ and HOPEFULLY TO $Sirius XM (SIRI.US)$ 😏 etc etc

+7

11

5

$Ulta Beauty (ULTA.US)$ reported second-quarter earnings that fell short of expectations and lowered its full-year guidance, sending shares down nearly 9% in after-hours trading on Thursday.

This marks the first revenue miss for the beauty retailer since December 2020, driven by a drop in same-store sales. Comparable sales fell 1.2% in Q2, compared to an 8% increase in the same period last year.

Despite the recent challeng...

This marks the first revenue miss for the beauty retailer since December 2020, driven by a drop in same-store sales. Comparable sales fell 1.2% in Q2, compared to an 8% increase in the same period last year.

Despite the recent challeng...

35

5

Coach Donnie OP : • The Market Ebbs and Flows… like the Ocean so be like water

so be like water  my friend

my friend

is

is short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low)

short term when there’s red because everything’s on discount (we scoop up Solid long term ETFs and stocks for the low) long term because in 5-10 years when our assets appreciate we can collect on our wealth and enjoy life.

long term because in 5-10 years when our assets appreciate we can collect on our wealth and enjoy life.

people talking about it

people talking about it

So

So

There’s Cycles and Manipulation so it goes Up and Down like a roller coaster

• Don't let the Wins go to your Head

Don't let the "losses" go to your Heart

• The Key

We win

And

We win

• Get Taught Up so you don't get Caught Up...

• Don’t let ANYBODY tell you accumulating wealth is easy

If it's easy it's sleezy

It’s simple in theory but definitely ain’t easy in practice

• Stop focusing on a quick buck. Hold, and go long.

Collect Assets at a Discount. DCA either way. Be patient.

• IF you’re new, conservative and or emotional

Consider Buying 80% or more a year ETFs like SPLG and FTEC etc

Don’t overly focus on NVDA or individual stocks

Consider Buying ETFs and stocks that do 7-10% a year or more

Do not get caught up in the hype or anything volatile even if you hear

• When it comes to Stocks, ETFs, Real Estate, Businesses, Precious Metals…

or any asset class in your Wealth Wisdom & Asset Accumulation journey:

Stick to your strategy

Adjust when necessary

Rinse and Repeat

Energy FLOWS where Energy GOES…

…Be INFORMED but not INUNDATED.

#CoachDonnie

Coach Donnie OP : • When we understand the cycles we can enjoy the journey more

we can enjoy the journey more

laugh

laugh  this is as much about us Becoming Better as it is about Asset Accumulation.

this is as much about us Becoming Better as it is about Asset Accumulation. so they control you with fear

so they control you with fear  and make you think it’s logic

and make you think it’s logic

We can buy the dips and unplug (or do nothing) when there’s downtrends, dark pool market manipulations, sell offs etc

• We can also enjoy the upswings without getting caught up in FOMO and succumbing to the pressure of buying stuff at All Time Highs

• Gotta enjoy yourself otherwise the market is more stressful than a job

Mindset produces Assets:

Enjoy the journey smile

• Propaganda is linked with Dark Pools and Market Manipulation

Remember that.

• They don’t want you to win

IF you let them

Remember that

• Look into Capital Gains Taxes, long term vs short term wherever you’re located

When you sell for a profit there are often larger gains taxes which is good to be aware of so you’re not shocked

• Do you understand what taxing unrealized capital gains means?

You can’t tax anything that’s not liquid.

Wealthy 1 5 10%-ers park millions in certain assets so they won’t be taxed on em

• SUCCESS LEAVES CLUES - WE STANDIN ON BUSINESS:

BIG BOY BLUE CHIP (NO CAP) MEGACAP HYPER-SCALERS with an AMAZING UNDENIABLE HISTORICAL TRACK RECORD

• RESULTS > Opinions, BUSINESS PERFORMANCE > Market Manipulation, HISTORICAL DATA > Chatter

#CoachDonnie

Coach Donnie OP : • Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

DISCLAIMER

DISCLAIMER

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Coach Donnie OP : This Wealth Blueprint - or something similar - is working for a lot of people also outlined in the first video I sent you and adjust the numbers for your specific needs

also outlined in the first video I sent you and adjust the numbers for your specific needs

DISCLAIMER

DISCLAIMER

50 - 30 - 20 split aka 50% 30% 20%

Example using $10,000:

5k goes to SPLG

3k goes to FTEC

2K goes to Magnificent 7 split equally (TSLA is optional)/and or individual stocks with an amazing 10+ year history such as NVDA MSFT AMZN AAPL GOOGL META etc

You can use that framework above

And/or develop your own Wealth Transfer Blueprint

Whatever you do be sure to pick ETFs that yield 7-10% a year on a 10 year average and or stocks that yield/bring 10-100% a year on a 10 year average

#CoachDonnie

Q: Coach Donnie, are there any Guarantees with Stocks ETFs or the market overall?

• A: Yes. Nothing is guaranteed.

For ANY and all aforementioned/heretofore Stocks, ETFs, side hustles or other Assets/asset classes mentioned

Remember the following:

PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

I Share Because I Care. The aforementioned is for Informational Educational & Entertainment purposes ONLY, this is NOT investment advice.

You have to do what’s best for you and yours at the end of the day. There’s NO guarantees in Investing nor Asset Accumulation.

Reach out to your Financial Advisor, CPA and or CFP.

I am not a Financial Advisor, CFP nor CPA.

Coach Donnie OP : We have 22-25 million millionaires in the USA

But we have 350-400 million people in the USA

Are you next?

View more comments...