Latest

Hot

RECAP

The $Dow Jones Industrial Average (.DJI.US)$ shed some 500 points and the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ both fell more than 1% Friday as Dow components JPMorgan Chase and Intel dragged the market lower.

The DJIA shed 470.78 points (1.2%) to a preliminary 37988.3 closer, while the $S&P 500 Index (.SPX.US)$ gave up 75.46 ticks (1.5%) to a tentative 5,123.6 finish.

Meanwhile, the $Nasdaq Composite Index (.IXIC.US)$ -- which ...

The $Dow Jones Industrial Average (.DJI.US)$ shed some 500 points and the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ both fell more than 1% Friday as Dow components JPMorgan Chase and Intel dragged the market lower.

The DJIA shed 470.78 points (1.2%) to a preliminary 37988.3 closer, while the $S&P 500 Index (.SPX.US)$ gave up 75.46 ticks (1.5%) to a tentative 5,123.6 finish.

Meanwhile, the $Nasdaq Composite Index (.IXIC.US)$ -- which ...

45

1

13

$Banks(Outdated) (LIST9025.MY)$ Malaysia banking index jsut break higher high yesterday, signaled a potential further uptrend! The index move ahead of earning release, should I expect Malaysia banks to deliver outstanding results for last quarter?

$Banks(Outdated) (LIST9025.MY)$ Daily Chart

The index was in a sideway to lower trend and marked its bottom in Jun 2023, followed by a strong rebound, all the way to more than 20% gains recently from its bottom. I would said 20% ...

$Banks(Outdated) (LIST9025.MY)$ Daily Chart

The index was in a sideway to lower trend and marked its bottom in Jun 2023, followed by a strong rebound, all the way to more than 20% gains recently from its bottom. I would said 20% ...

48

7

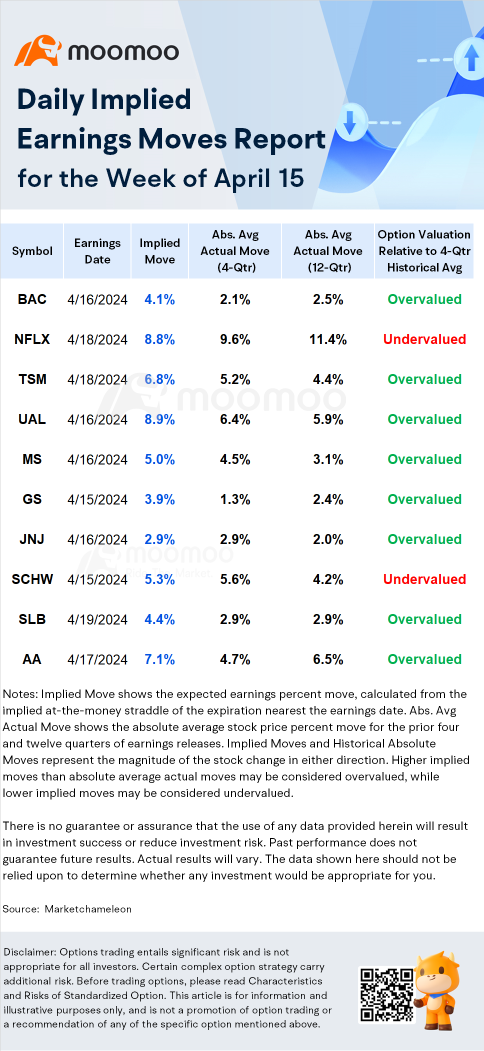

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Stock: $Bank of America (BAC.US)$

-Earnings Date: 4/16 Pre-market

-Earnings Normalized Estimate: U...

-Stock: $Bank of America (BAC.US)$

-Earnings Date: 4/16 Pre-market

-Earnings Normalized Estimate: U...

+1

28

16

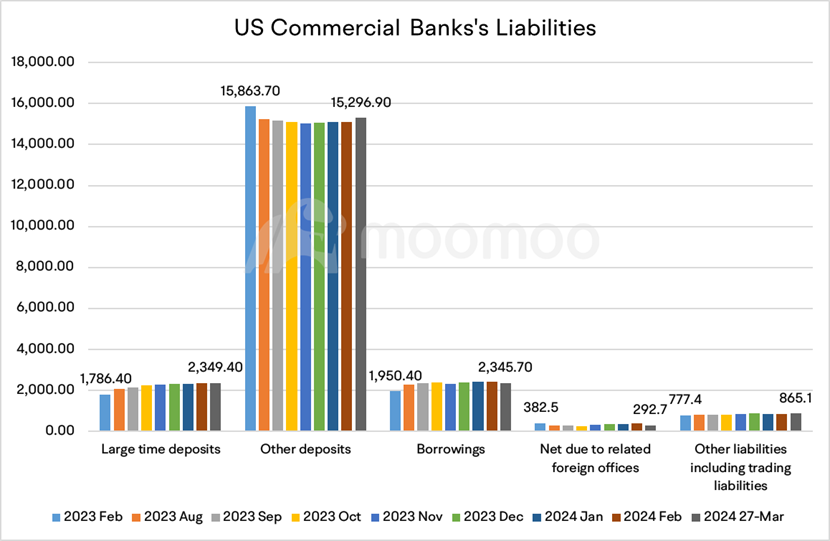

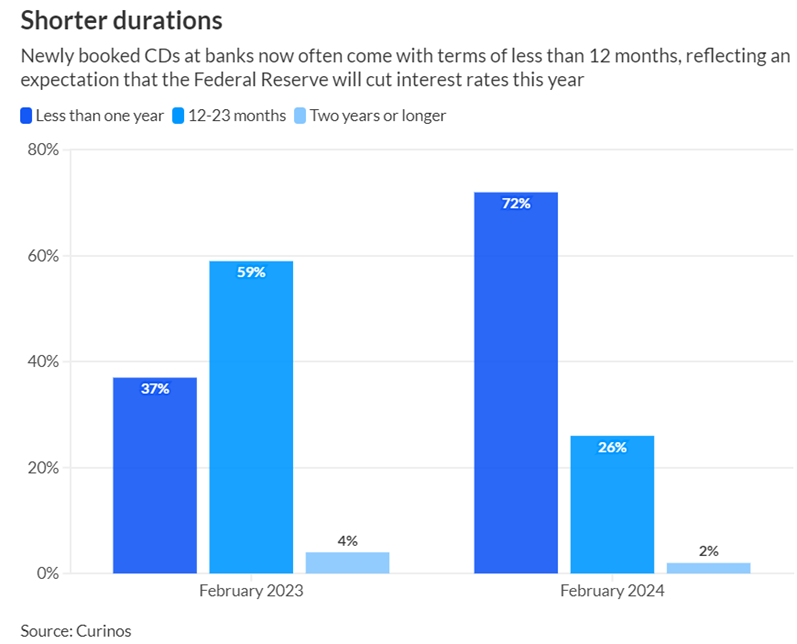

Columns Bank Earnings Preview: What Does the Expansion of the Balance Sheet Mean for Large-Cap Banks?

Major banks, including JP Morgan, Citigroup, and Wells Fargo, will release their quarterly reports this week. The Federal Reserve's H.8 table shows that in the first quarter of 2024, the balance sheet of the U.S. banking industry accelerated its expansion, likely contribute to an increase in bank profits, especially in a high interest rate environment.

■ How is the growth of deposits?

The Fed's stats sho...

■ How is the growth of deposits?

The Fed's stats sho...

+3

25

1

8

$Bank of America (BAC.US)$'s biggest share price slump in months is fueling demand for protection against further declines.

About 14,890 put options that give the holder the right to sell Bank of America at $34 each by the end of this week were traded around noontime in New York. That's the biggest volume since trading activity of those puts started to pick up in early December, according to data compiled by moomoo. The contract is the most ...

About 14,890 put options that give the holder the right to sell Bank of America at $34 each by the end of this week were traded around noontime in New York. That's the biggest volume since trading activity of those puts started to pick up in early December, according to data compiled by moomoo. The contract is the most ...

16

2

5

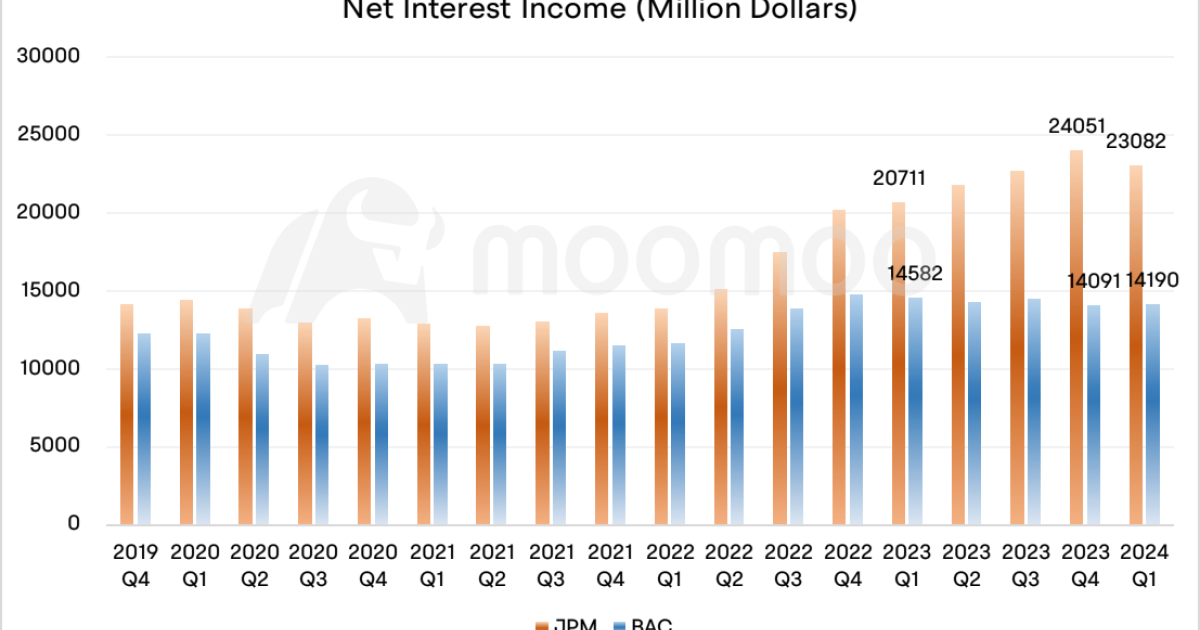

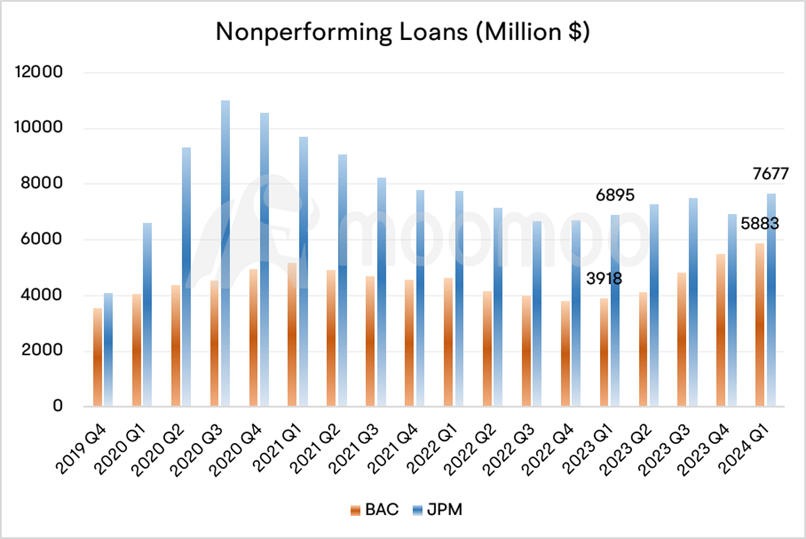

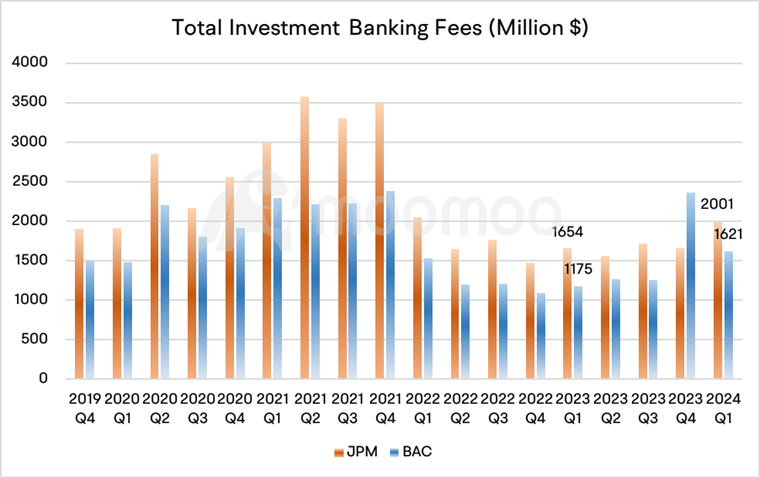

Columns Wall Street's Mixed Earnings: Fall in Interest Income Offsets Recovery in Investment Banking Revenue

As Bank of America released its first quarter report, major banks have completed their first quarter earnings disclosure. Wall Street financial giants had mixed performances.

Bank of America's earnings took a hit in the first quarter as it faced a softer consumer banking sector and increased loan charge-offs, particularly in the credit card segment. The banking giant reported a profit of $6.7 bill...

Bank of America's earnings took a hit in the first quarter as it faced a softer consumer banking sector and increased loan charge-offs, particularly in the credit card segment. The banking giant reported a profit of $6.7 bill...

19

7

$OCBC Bank (O39.SG)$ $UOB (U11.SG)$ $DBS (D05.SG)$ Possible reasons for the dip

1. Weak forecast for Q1'2024 - Interest rate uncertainty

2. Market correction

3. Regional tension in the Middle East

1. Weak forecast for Q1'2024 - Interest rate uncertainty

2. Market correction

3. Regional tension in the Middle East

5

7

$JPMorgan (JPM.US)$ is expected to release earnings results for its first quarter, before the opening bell on 12 April 2024. This earnings release is after the PPI on Thursday (11 Apr) and we have seen the market sell off after CPI came in stronger than expected at 3.5% versus 3.4% estimate.

JPM is expected to report quarterly earnings at $4.15 per share, up from $4.1 per share in the year-ago quarter. Revenue projected to be $41.96 bill...

JPM is expected to report quarterly earnings at $4.15 per share, up from $4.1 per share in the year-ago quarter. Revenue projected to be $41.96 bill...

+1

7

3

1

$JPMorgan (JPM.US)$ D day...or should I say E day. I'm sitting here having my morning coffee bracing for what's going to be either a joyous or a painful morning. I have an enormous position in JP Morgan and to say that I'm a bit worried about it is an understatement.

5

5

Excited and worried at the same time.

Excited and worried at the same time.

AnAn Shen : I'm backing up

Macheight : going up or down?

LaughingCow : Pretty nice!

sentosa island : nice

OceansWave : Down down we go when guidance is given

View more comments...