Posts

News

Latest

Hot

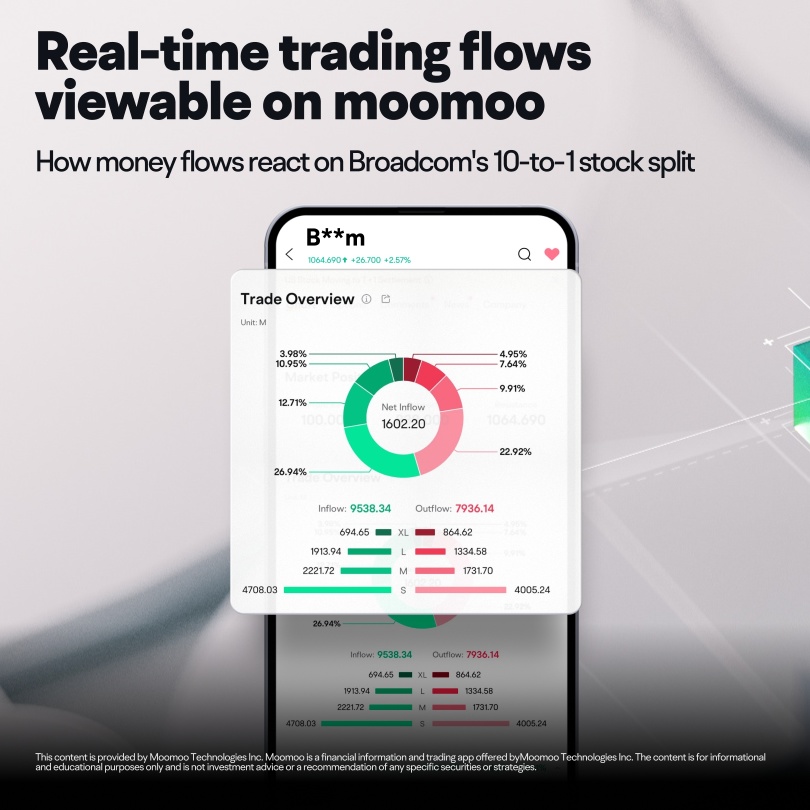

$Broadcom (AVGO.US)$ shares have risen over 20% in the past month, significantly outperforming the $S&P 500 Index (.SPX.US)$'s 3.63% return. The stock has attracted considerable investor interest due to its expanding capabilities in the AI sector and a 10-for-1 stock split.

Broadcom is capitalizing on the increasing demand for AI infrastructure and generative AI deployment, with its solutions meeting the needs of growing AI workl...

Broadcom is capitalizing on the increasing demand for AI infrastructure and generative AI deployment, with its solutions meeting the needs of growing AI workl...

146

38

68

$Broadcom (AVGO.US)$, which has soared 52% this year, will officially implement a 10-for-1 stock split plan after market close on July 12th (this Friday). This move follows $NVIDIA (NVDA.US)$, another major AI player, and has sparked market speculation.

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

+4

736

468

109

With just 5 trades, total turnover today was close to 75 grand. I had the privilege to get good profits today, despite the generally bearish behavior during Powell's talk, as was the case for AVGO yesterday.

23

6

1

Stocks to Watch

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BEARISH ↘ **]AVGO is holding below 166.65 resistance and in line with descending trendline resistance as well. A pullback below this resistance towards 149.10 support is expected. RSI indicator is toppish, approaching resistance where price pulled lower in the past.

Alternatively: A daily candlestick closing above 166.65 resistance will open a limited rise to...

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BEARISH ↘ **]AVGO is holding below 166.65 resistance and in line with descending trendline resistance as well. A pullback below this resistance towards 149.10 support is expected. RSI indicator is toppish, approaching resistance where price pulled lower in the past.

Alternatively: A daily candlestick closing above 166.65 resistance will open a limited rise to...

+3

36

3

$Broadcom (AVGO.US)$ this will trade the same way Nvidia did post split you're going to see probably 2 weeks of flat to down because people are going to sell off a hundred shares 200 shares 300 shares to diversify or buy something because now they can sell a percentage whereas before it was representative of the whole share.

9

11

$Broadcom (AVGO.US)$

During a conference call, Bank of America highlighted Broadcom as a top AI pick alongside $NVIDIA (NVDA.US)$ , underscoring its significant potential in the AI landscape.

The Broadcom management outlined three key factors that are currently attracting investors:

1. Soaring AI Business Growth: Broadcom's AI market exposure has expanded to an annual range of 30 billion to 50 billion, with no signs of demand slowdown.

2. VMware'...

During a conference call, Bank of America highlighted Broadcom as a top AI pick alongside $NVIDIA (NVDA.US)$ , underscoring its significant potential in the AI landscape.

The Broadcom management outlined three key factors that are currently attracting investors:

1. Soaring AI Business Growth: Broadcom's AI market exposure has expanded to an annual range of 30 billion to 50 billion, with no signs of demand slowdown.

2. VMware'...

12

7

5

6

1

$Broadcom (AVGO.US)$ Sys advised that new symbol is AVGO.US and split stock has been effected

4

6

Just a reminder that $Broadcom (AVGO.US)$ will trade post split tomorrow at $170 ish.

This WILL be the next stock to hit $200.

This WILL be the next stock to hit $1T market cap (which means $214ish).

This, $NVIDIA (NVDA.US)$ , and $Taiwan Semiconductor (TSM.US)$ are your best in breed semis/AI.

Period.

This WILL be the next stock to hit $200.

This WILL be the next stock to hit $1T market cap (which means $214ish).

This, $NVIDIA (NVDA.US)$ , and $Taiwan Semiconductor (TSM.US)$ are your best in breed semis/AI.

Period.

5

4

$Broadcom (AVGO.US)$ it's a great company underneath the stock so I wouldn't be worried about owning some shares (and I do, although nowhere as massive as my $Taiwan Semiconductor (TSM.US)$ shares)

10

1000proof : Ready to collect my extra shares and buy more on July 15th. Thank you very much

103824191 1000proof : https://www.moomoo.com/my/promotion/referee?inviter=103824191&global_content=%7B%22promote_id%22%3A15066%2C%22sub_promote_id%22%3A3%7D

105114306 103824191 : hi

Thomas Seymour : something

Wolverines :

View more comments...