Latest

Hot

Both ways wouldn't work IMO. This is more like a betting than investing to me. It depends on your luck without any analysis to support your decision making. Your head is influenced by greed and emotions. Do not go for shortcut and work hard for genuine returns, try not to be play gimmicky or be opportunistic.

6

3

As a new investor, this is a common mistake to buy a winning stock and sell a losing one often resulted in buying high and selling low. It is misguided by greed and fear (emotional trading). 🤑😱

We should DYODD before investing in a stock - buy the stock because of the company fundamental and not just based on the share price. Hence I always remind myself to follow some investment rules:

1. Set up an investment objective. Have an exit strategy for short...

We should DYODD before investing in a stock - buy the stock because of the company fundamental and not just based on the share price. Hence I always remind myself to follow some investment rules:

1. Set up an investment objective. Have an exit strategy for short...

2

1

The ideal is to sell the losers and let the winners ride. Of course, it’s quite tough to know which suffering stocks will turn around and which won’t. From analysis, the investors tend to sell winners early and hold losers longer. This demonstrates that investors prefer to sell winning positions before selling losing positions. We typically only sell a winning position if the stock price has risen to our set target, or other factors like meeting the risk tolerance, investment objective and...

4

1

Welcome back Mooers, ![]()

In today discussion, we will talk about the factors that may have caused the US stock market correction and what we can do to reduce losses.![]()

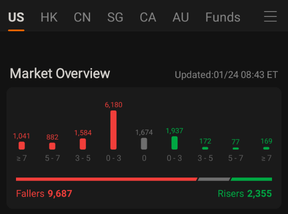

Last week (17 Jan 2022 to 22 Jan 2022) saw major indexes falling sharply and breaking several key support levels. Many Mooers may have sold their position to avoid greater losses.![]()

However, it is noted that none of the factors (inflation, omicron variant, interest rate hikes, etc) had really hit ...

In today discussion, we will talk about the factors that may have caused the US stock market correction and what we can do to reduce losses.

Last week (17 Jan 2022 to 22 Jan 2022) saw major indexes falling sharply and breaking several key support levels. Many Mooers may have sold their position to avoid greater losses.

However, it is noted that none of the factors (inflation, omicron variant, interest rate hikes, etc) had really hit ...

11

17

The S&P 500 has rallied 17% from its low and the usual question arose - is this a dead cat bounce?

This is a time where many investors will look for statistics in market history in order to get some guidance.

Some may look at the state of the economy.

No matter which methods were used, the polls which I have put out in the past two weeks showed that more than 70% of the voters were bearish and believe this is a bear market rally or a.k.a. a dead c...

This is a time where many investors will look for statistics in market history in order to get some guidance.

Some may look at the state of the economy.

No matter which methods were used, the polls which I have put out in the past two weeks showed that more than 70% of the voters were bearish and believe this is a bear market rally or a.k.a. a dead c...

11

1

I just don't understand the logic behind holding a ton of cash on the sidelines waiting for some special signal that we've hit the bottom. If anything I think the last few months have shown us that the market is anticipatory towards future events, and if you wait until you're sure X/Y/Z event is happening you've probably already missed out.

$Apple (AAPL.US)$ $Bitcoin (BTC.CC)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

$Apple (AAPL.US)$ $Bitcoin (BTC.CC)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

6

3

I am wondering if it makes sense to buy stocks that are showing good relative strength, such as $Netflix (NFLX.US)$ , $Amazon (AMZN.US)$ , $Uber Technologies (UBER.US)$ , Meli or ones that are making new 52 week lows and seem more oversold, such as $Meta Platforms (META.US)$ , $Intel (INTC.US)$ , WBD, and some others

Is there any data on this type of stuff in a bear market?

I have been a majority in all cash for the entire year besides some swing tr...

Is there any data on this type of stuff in a bear market?

I have been a majority in all cash for the entire year besides some swing tr...

8

1

3

4

I can't answer this, but I would ask you why you'd want to? Battery and metal companies have lower margins, are more commoditized, and there's tens if not hundreds of companies in these fields. Picking (one of) the best ones is going to be very difficult.

On the other hand, you could just buy Tesla, which is already pretty much locked in as the biggest winner, stil...

On the other hand, you could just buy Tesla, which is already pretty much locked in as the biggest winner, stil...

7

Bill Ackman, billionaire investor and CEO of Pershing Square Capital Management, said Tuesday that investors would be prompted to buy stocks when the Federal Reserve decides to pause interest rate hikes.

“I think once people realize the Fed doesn’t have to keep increasing rates and will soon be taking rates down, that’s kind of a buy signal for markets,” Ackman said. He predicted that if the Fed raised interest rates further and held t...

“I think once people realize the Fed doesn’t have to keep increasing rates and will soon be taking rates down, that’s kind of a buy signal for markets,” Ackman said. He predicted that if the Fed raised interest rates further and held t...

6

, but do you think there are 18 layers of hell

, but do you think there are 18 layers of hell  in the end?

in the end?

我好懒 : consents![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Johnnie Worker : I remember Peter Lynch said the same thing as well

一新 2021 Johnnie Worker : O loo Olin