Latest

Hot

$NIO Inc (NIO.US)$ is scheduled to report its quarterly earnings for the period ending 30 September 2024 on 20 November 2024 before market open.

NIO is expected to show a rise in quarterly revenue with a 0.7% increase in revenue to CNY 19.193 billion from CNY19.07 billion a year ago,

This is within the guidance given on 05 September 2024, for the period ended September 30, which was for revenue between CNY 19.11 bill...

NIO is expected to show a rise in quarterly revenue with a 0.7% increase in revenue to CNY 19.193 billion from CNY19.07 billion a year ago,

This is within the guidance given on 05 September 2024, for the period ended September 30, which was for revenue between CNY 19.11 bill...

+1

22

$NIO Inc (NIO.US)$ is scheduled to report its quarterly earnings on 05 September 2024 before market open. NIO is expected to report a 141.9% increase in revenue to $17.378 billion from $7.19 billion a year ago.

This is inline with with the company's guidance on 06 June 2024 for the period ended 30 June, was for revenue between CNY16.59 billion and CNY17.14 billion.

Market consensus EPS estimate for NIO Inc is for a loss of $...

This is inline with with the company's guidance on 06 June 2024 for the period ended 30 June, was for revenue between CNY16.59 billion and CNY17.14 billion.

Market consensus EPS estimate for NIO Inc is for a loss of $...

+3

29

$NIO Inc (NIO.US)$ is expected to report the quarterly result on 06 June 2024 before market open for the period ending 31 March 2024.

It is expected to show a fall in quarterly revenue. NIO is expected to report a 2.3% decrease in revenue to $10.431 billion from $10.68 billion a year ago. The company's guidance on 05 March 2024, for the period ended 31 March, was for revenue between CNY10.50 billion and CNY11.09 billion.

Earnings p...

It is expected to show a fall in quarterly revenue. NIO is expected to report a 2.3% decrease in revenue to $10.431 billion from $10.68 billion a year ago. The company's guidance on 05 March 2024, for the period ended 31 March, was for revenue between CNY10.50 billion and CNY11.09 billion.

Earnings p...

+2

11

2

$NIO Inc (NIO.US)$ announced November deliveries on 01 Dec with a total of 15,959 vehicles, increasing by 12.6% year-over-year. NIO delivered a total of 142,026 new vehicles year-to-date in 2023, increasing 33.1% year-over-year, bringing the cumulative total of NIO vehicle deliveries to 431,582.

On 23 December, Nio unveiled a flagship model, ET9 executive sedan, which is placed in the same class as Mercedes Benz's Maybach and Por...

On 23 December, Nio unveiled a flagship model, ET9 executive sedan, which is placed in the same class as Mercedes Benz's Maybach and Por...

1

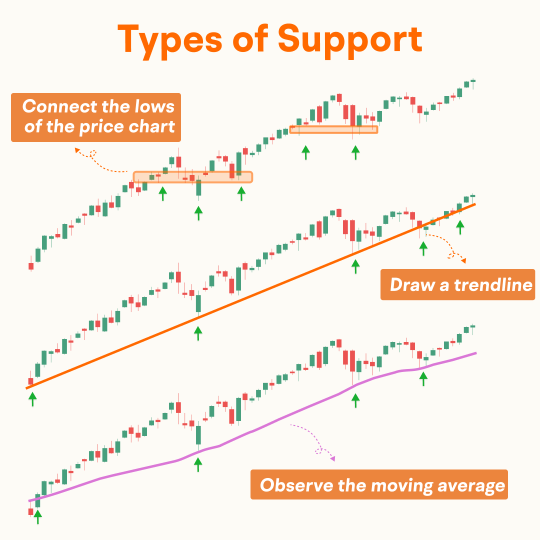

Support is a price level where potential support may stop a downtrend. It is a useful strategy for determining entry targets in the stock market.

By identifying support levels, guys can time your buying at low prices and make well-informed decisions about when to enter the market.

Today Cici will share with you three method to find support levels:![]()

1. Connect the periodic lows of the price chart

2. Draw a trendline following the price movement

3...

By identifying support levels, guys can time your buying at low prices and make well-informed decisions about when to enter the market.

Today Cici will share with you three method to find support levels:

1. Connect the periodic lows of the price chart

2. Draw a trendline following the price movement

3...

16

2

NIO stock's technical analysis suggests a strong downtrend with oversold levels. This might lead to a potential rebound or consolidation, but no definite buy point for now. It may continue to decline further. Investors should be cautious and maybe wait for more positive signals before entering a long position. For short-term gains, using options as a strategy to manage risks could be a good choice.

1

Fund Management Hong Kong, has lessened its stake in Nio by 4.3% in the 2nd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund sold a total of 55,257 shares during the period. I see a bearish trend for NIO from the company's profitability and macroeconomics points of view:

Company's profitability

Although NIO reported an increase of in sales, there was a decline in other key financial metrics, l...

Company's profitability

Although NIO reported an increase of in sales, there was a decline in other key financial metrics, l...

13

42

....

....

) hopes this help in ur trading journey.. ps I not guru only 1 yr experience but my trades may be more the regular trader . May all Huat big big!

) hopes this help in ur trading journey.. ps I not guru only 1 yr experience but my trades may be more the regular trader . May all Huat big big!