Latest

Hot

$Advanced Micro Devices (AMD.US)$ is scheduled to report its quarterly earnings tomorrow (30 July) after the market close.

During the last reported quarter, AMD has met the revenue expectation with revenue coming in at $5.47 billion, up 2.2% year on year. It was a mixed quarter for the company, with a decent beat of analysts' EPS estimates but an increase in its inventory levels.

For this reporting quarter, AMD revenue is expecte...

During the last reported quarter, AMD has met the revenue expectation with revenue coming in at $5.47 billion, up 2.2% year on year. It was a mixed quarter for the company, with a decent beat of analysts' EPS estimates but an increase in its inventory levels.

For this reporting quarter, AMD revenue is expecte...

+1

15

1

$Advanced Micro Devices (AMD.US)$ is expected to release earnings on Jan 30, 2024 after the market closes (AMC).

Market expect a year-over-year increase in both the top and bottom lines, with earnings per share of $0.77 on revenues of $6.14 billion. AMD is anticipated to report Q4 results in line with expectations, but the company's Q1 guidance is expected to miss market estimates following Intel's (INTC) weak report.

We saw...

Market expect a year-over-year increase in both the top and bottom lines, with earnings per share of $0.77 on revenues of $6.14 billion. AMD is anticipated to report Q4 results in line with expectations, but the company's Q1 guidance is expected to miss market estimates following Intel's (INTC) weak report.

We saw...

+2

4

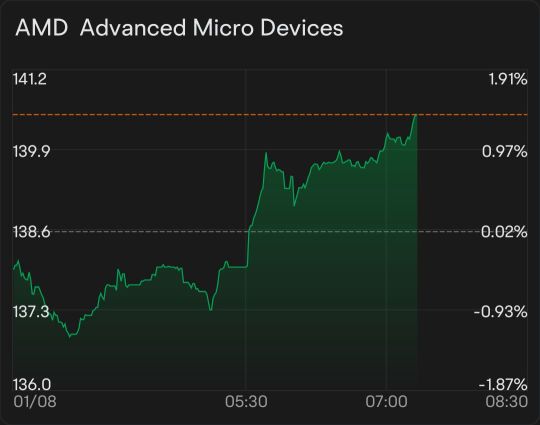

$Advanced Micro Devices (AMD.US)$

A price upgrade on a great company like AMD during a semiconductor rally will likely add to the bullishness. AMD will also have a presentation at the CES conference today. Often, you will see big intraday price moves while a company is showcasing their products at a trade show. We might see the same thing today if we don't get a bloody Monday to follow last week's very bearish week.

I would be very cautious...

A price upgrade on a great company like AMD during a semiconductor rally will likely add to the bullishness. AMD will also have a presentation at the CES conference today. Often, you will see big intraday price moves while a company is showcasing their products at a trade show. We might see the same thing today if we don't get a bloody Monday to follow last week's very bearish week.

I would be very cautious...

+1

3

10

$Advanced Micro Devices (AMD.US)$ is scheduled to deliver its third quarter update after market close on 31 Oct (Tuesday) at 4:15PM ET.

Advanced Micro Devices will suffer a challenging week ahead, as its upcoming earnings report will show a sharp slowdown in both profit and sales growth because of a weak PC market.

Though there is only a 7% decline in global PC shipments in Q3 2023, which is the smallest contraction. AMD market...

Advanced Micro Devices will suffer a challenging week ahead, as its upcoming earnings report will show a sharp slowdown in both profit and sales growth because of a weak PC market.

Though there is only a 7% decline in global PC shipments in Q3 2023, which is the smallest contraction. AMD market...

+2

AMD's short-term outlook seems to be bearish. It has been falling for 2 months. It's below its 50-day and 200-day averages.

Reasons include the global chip shortage, competition from Nvidia and Intel, and issues with acquiring Xilinx.

Technically, AMD is consolidating between $108-$112, showing low volatility. It's oversold but faces resistance at $112.

Support is at $108, with possible drops to $104, $100, and $96 if it falls belo...

Reasons include the global chip shortage, competition from Nvidia and Intel, and issues with acquiring Xilinx.

Technically, AMD is consolidating between $108-$112, showing low volatility. It's oversold but faces resistance at $112.

Support is at $108, with possible drops to $104, $100, and $96 if it falls belo...

Nvda is too high and possibly has price in. I hope Amd could share some glory by their new cards.

nvidia has clearly shown their intentions to exit consumer gou market or reduce allocation of resources to it

1

Just look at what the Lisa Su of AMD said in the end of Q2 results, their AI products will be in the markets by end of year of early 2024. Just hours ago, she again announced that the interests in their AI products are converting to sales now. Better hold your stocks or buy the dip, you won't regret it.

Credible Commerce : How did the report for the MI300 go?