Latest

Hot

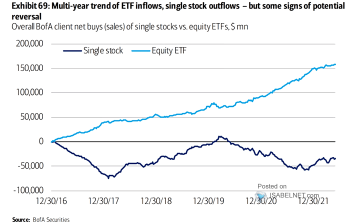

The S&P 500, Dow Jones and Nasdaq 100 fell 0.90%, 0.5% and 1.5% respectively on Monday due to soaring inflation, the Fed's rate hikes and the gloomy economic outlook. However, the inverse ETF SQQQ bucked the market and rose 16.84% in the last 5 trading days, highlighting the benefits of inverse ETFs.![]()

How to reduce risk in a volatile market? Making a well-diversified investment portfolio and layouting some inverse ETFs...

How to reduce risk in a volatile market? Making a well-diversified investment portfolio and layouting some inverse ETFs...

48

1

28

Whether or not this just turns out to be a temporary bear market rally remains to be seen.

After all, we can see inflation is still roaring, and interest rates are starting to stifle growth and manufacturing. The US economy just experienced its 2nd straight quarter of negative GDP growth.

104

19

70

Market bearish sentiment intensifies as inverse ETFs rise sharply. US stock leveraged inverse ETFs received inflows of $1.4 billion as of July 12.

Many investors may have considered using inverse ETFs to magnify short-term profits or hedge against risks.![]()

![]()

![]() Here are some noteworthy Inverse ETFs. Click banner to find out about investment opportunities!

Here are some noteworthy Inverse ETFs. Click banner to find out about investment opportunities!

$ProShares UltraPro Short S&P500 ETF (SPXU.US)$, $ProShares UltraPro Short QQQ ETF (SQQQ.US)$, $ProShares UltraShort QQQ (QID.US)$,���������...

Many investors may have considered using inverse ETFs to magnify short-term profits or hedge against risks.

$ProShares UltraPro Short S&P500 ETF (SPXU.US)$, $ProShares UltraPro Short QQQ ETF (SQQQ.US)$, $ProShares UltraShort QQQ (QID.US)$,���������...

14

4

When the Volatility Index (VIX) exceeds 20%, it is indicating heightened market volatility and potential downside risk, inverse ETFs can serve as a tactical hedge.

In this article, I would like to share the approach I would use to effectively utilize inverse ETFs.

Current VIX Level - Above 27

Currently the $CBOE Volatility S&P 500 Index (.VIX.US)$ is above 27 which signal market is experiencing high volatility and fear, there are panic selling a...

In this article, I would like to share the approach I would use to effectively utilize inverse ETFs.

Current VIX Level - Above 27

Currently the $CBOE Volatility S&P 500 Index (.VIX.US)$ is above 27 which signal market is experiencing high volatility and fear, there are panic selling a...

+1

8

4

If you have been trading in the market despite the volatility, you would discover that the impact from the latest wave of tariffs (25% on most imports from Mexico and Canada and 10% on Chinese goods) has caused the market to remain unpredictable.

These tariffs have officially escalated a global trade war years in the making. While market might look out for negotiations, they have delayed some measures, the broader implications for b...

These tariffs have officially escalated a global trade war years in the making. While market might look out for negotiations, they have delayed some measures, the broader implications for b...

+1

20

2

$Vanguard Australian Shares ETF (VAS.AU)$

Thank you to anyone that participates.![]()

First time trialling a poll. Would love to see other opinions!

Thank you to anyone that participates.

First time trialling a poll. Would love to see other opinions!

2

1

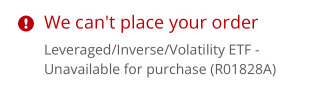

Note: some brokerage accounts (e.g., JPMS) do not allow the purchase of Leveraged/Inverse/Volatility ETFs, soOo…

Hi, moomoo! Thank you, for allowing folks to exercise free will, as they potentially mitigate risk.

More? Inverse ETFs, in charts…

etf.com/section...

Hi, moomoo! Thank you, for allowing folks to exercise free will, as they potentially mitigate risk.

More? Inverse ETFs, in charts…

etf.com/section...

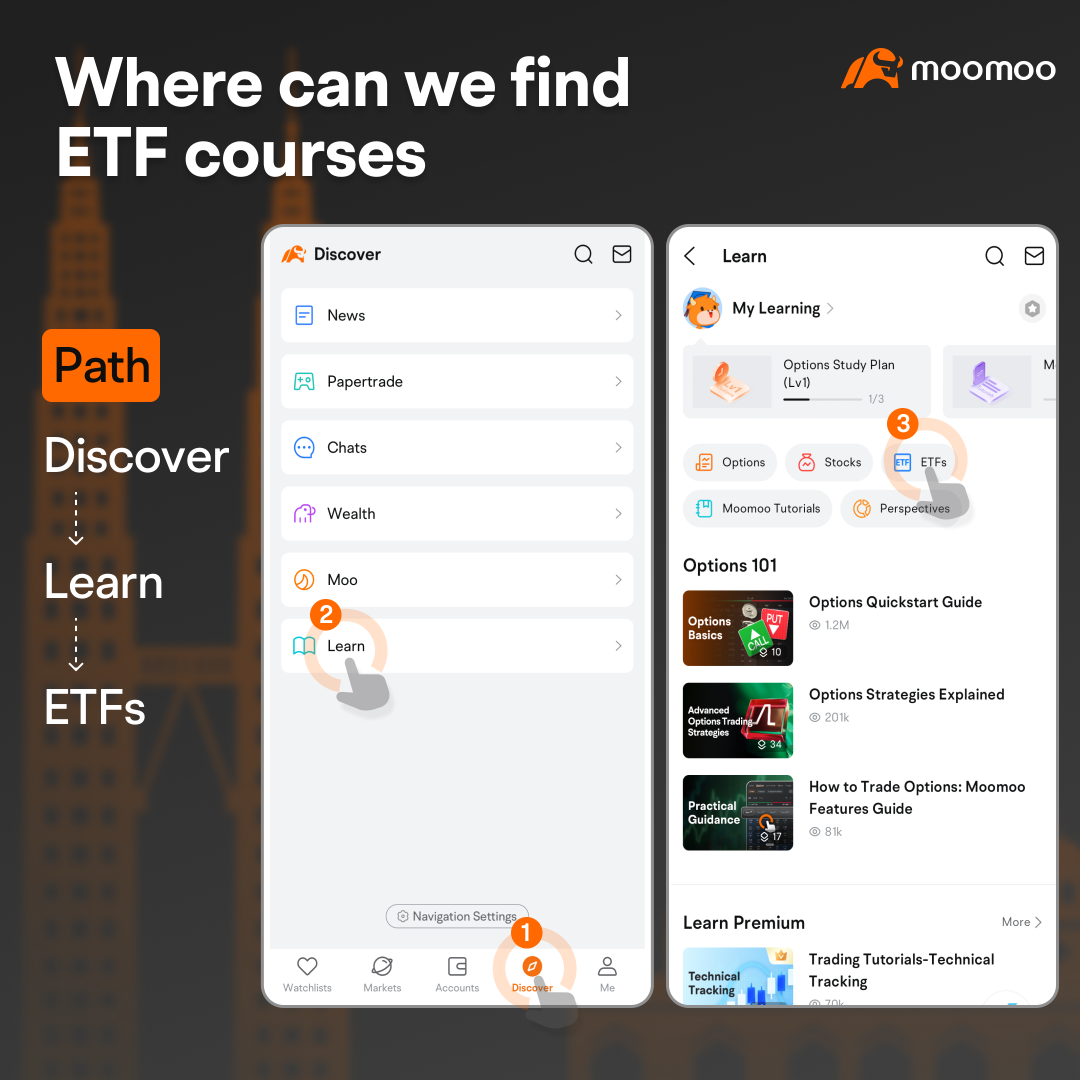

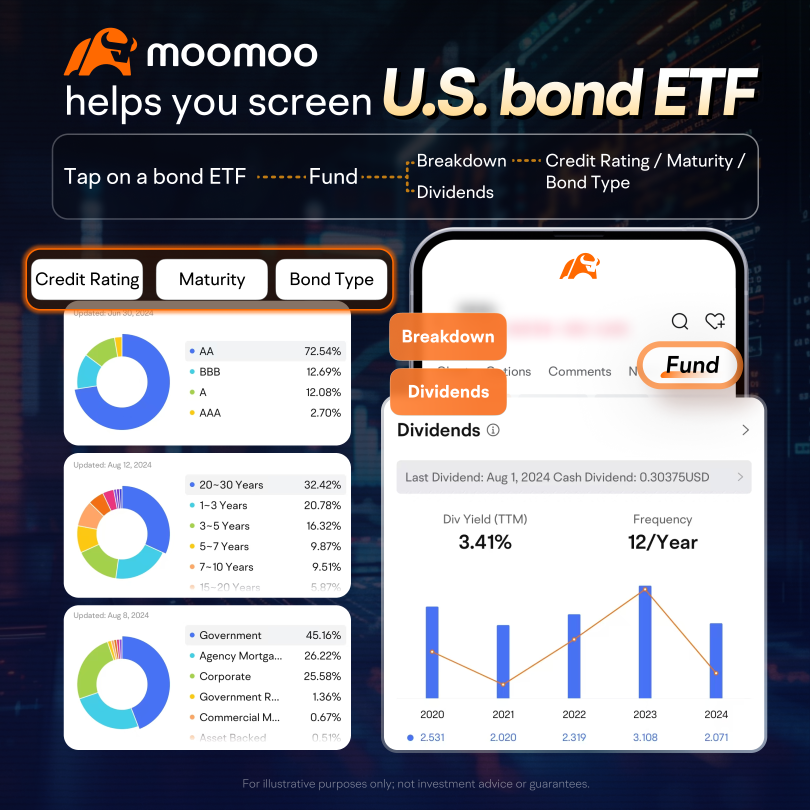

Curious why investors are turning to ETFs? They offer access to a diversified blend of asset classes to make stock selection easier. Moomoo Learn has prepared a comprehensive ETF guide for you.

This post will focus on explaining different types of ETFs and how to leverage moomoo's features to identify potential opportunities. We hope this post helps you find the courses you need and better understand ETF investments.

![]() 3 simple steps to ...

3 simple steps to ...

This post will focus on explaining different types of ETFs and how to leverage moomoo's features to identify potential opportunities. We hope this post helps you find the courses you need and better understand ETF investments.

+1

3

1

The Bank of Canada cut interest rates by 25 basis points to 4.5% for the second consecutive month, in line with market expectations, and hinted at further rate cuts in the future. This is the second action since the first rate cut in June, when Canada became the first G7 country to enter an easing cycle. The easing of inflationary pressure is the main reason for the rate cut, with CPI falling from a high in May to 2.7...

+16

17

3

1

I think as investors we would also want to have some assets which are resilient to any uncertainty brought by economic events, for example, interest rates hike.

We know that interest rate hike is not new. The Federal Reserve has been raising interest rates for a year now, which has created some uncertainty in the markets.

However, despite rising rates and market uncertainty, we should stay disciplined ...

We know that interest rate hike is not new. The Federal Reserve has been raising interest rates for a year now, which has created some uncertainty in the markets.

However, despite rising rates and market uncertainty, we should stay disciplined ...

+1

7

4

moomoo, above all other reasons, for empowering their community to better exercise freedoms.

moomoo, above all other reasons, for empowering their community to better exercise freedoms.

GODGIVENFOOL139 : i