Latest

Hot

1. Face the worst scenario, wait for your chance

I didn't add more $NIO Inc (NIO.US)$ at $38-39 a few days ago.

Time flies and it is already the end of this year. I sell lot of stocks this year to secure my gain. I worry many institution investors may rig the market at the end of year. It's hard to count days when trading stocks.

I lost a lot last December when the institutions are selling their potions. Then I won some real money at the begining of 2020.

However I was too greedy to withdraw from the market before March. The Black Swan event in March cost me lots of money. I then use day-trade to make up my lose. I became a money-loser both in June and September.

Later, I use the chance brought by election to do lots of frequently trading. I have gained and lost both for many times. And this experiecne help me to remember something when trading in stock market. Whenever I became greedy, I lose money.

2. Ranking of shares profit

TOP 4 of my gaining stocks are ...

I didn't add more $NIO Inc (NIO.US)$ at $38-39 a few days ago.

Time flies and it is already the end of this year. I sell lot of stocks this year to secure my gain. I worry many institution investors may rig the market at the end of year. It's hard to count days when trading stocks.

I lost a lot last December when the institutions are selling their potions. Then I won some real money at the begining of 2020.

However I was too greedy to withdraw from the market before March. The Black Swan event in March cost me lots of money. I then use day-trade to make up my lose. I became a money-loser both in June and September.

Later, I use the chance brought by election to do lots of frequently trading. I have gained and lost both for many times. And this experiecne help me to remember something when trading in stock market. Whenever I became greedy, I lose money.

2. Ranking of shares profit

TOP 4 of my gaining stocks are ...

30

9

On Biztech Asia TV yesterday… I spoke about the EV investing opportunity being untapped. We need to remember that, we are just at the tip of the iceberg and the EV industry still has a long way to go. This is why it remains an attractive investing opportunity;

.- The EV industry still remains one of the most attractive opportunities of this decade; especially as EV penetration is just 10% in Australia, 2% in India, and 3% in Indones...

.- The EV industry still remains one of the most attractive opportunities of this decade; especially as EV penetration is just 10% in Australia, 2% in India, and 3% in Indones...

28

1

I have been following the company since Day 1 that I open my stock account. Got in when $NIO Inc (NIO.US)$ was around $6.5 on June.Eversince its been at least %70 of my portfolio, often times %100.

Overly diversified portfolio is not my thing, I personaly like the notion of keep all my eggs in as fewer baskets possible.Therefore I can keep closest track of my investment.

Thus,I have spent majority of my time in the past four months researching all the infos that’s avaliable , in order to get the best understanding of this comoany.

Here are some of my thoughts on current status of NIO:

#1

Is NIO over priced ?

Yes and no. Yes, when you are not planing to hold it for long term. It's not, if you could just think of how much it will be worth in 6-12 months.

We all know for fact that “NIO” would had been over $100 per share if it were a US company.

#2

Will there be a major correction in the near future?

Last round of dilution(Sep) is going to get unlocked next Monday. Impossible to time the correction but %10-%15 give back wouldn’t be a suprise to me. Most importantly always remmeber buy at dips in order to accumulate as mu...

Overly diversified portfolio is not my thing, I personaly like the notion of keep all my eggs in as fewer baskets possible.Therefore I can keep closest track of my investment.

Thus,I have spent majority of my time in the past four months researching all the infos that’s avaliable , in order to get the best understanding of this comoany.

Here are some of my thoughts on current status of NIO:

#1

Is NIO over priced ?

Yes and no. Yes, when you are not planing to hold it for long term. It's not, if you could just think of how much it will be worth in 6-12 months.

We all know for fact that “NIO” would had been over $100 per share if it were a US company.

#2

Will there be a major correction in the near future?

Last round of dilution(Sep) is going to get unlocked next Monday. Impossible to time the correction but %10-%15 give back wouldn’t be a suprise to me. Most importantly always remmeber buy at dips in order to accumulate as mu...

15

5

$NIO Inc (NIO.US)$ So was it smart to buy in at 47.2?

Translated

3

11

It was a cracking open for Zeekr $ZEEKR (ZK.US)$ on the NYSE after floating, with their shares surging 34% in a day. They came on at $21 and closed at $28.26 just a day after their IPO. Very clever and well played by Geely, the parent company.Geely is the parent company of Volvo, Polster and Lotus as well, just to name a few. We cover what you need to know about the third most popular EV in Chin...

13

1

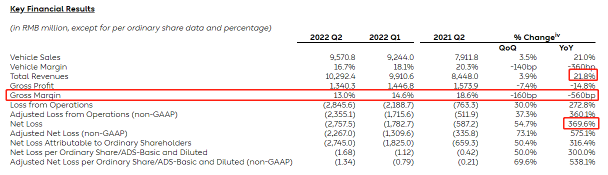

Chinese EV maker $NIO Inc (NIO.US)$ shares went down in premarket trading after it reported its Q2 earnings report before the bell.

Results

Total revenues were RMB10,292.4 million (US$1,536.6 million), representing an increase of 21.8% yoy and an increase of 3.9% qoq.

Net loss was RMB2,757.5 million (US$411.7 million), representing an increase of 369.6% yoy and an increase of 54.7% qoq.

Gross margin was 13.0%, compared with 18.6% in the second quarter of 2021 and...

Results

Total revenues were RMB10,292.4 million (US$1,536.6 million), representing an increase of 21.8% yoy and an increase of 3.9% qoq.

Net loss was RMB2,757.5 million (US$411.7 million), representing an increase of 369.6% yoy and an increase of 54.7% qoq.

Gross margin was 13.0%, compared with 18.6% in the second quarter of 2021 and...

7

2

Recently read reports by KPMG etc. on the growth of several Chinese EVs and NEVs (Neighbourhood EVs) - looking to learn more about this space as well as regional growth. Please share any resources if you have any interesting links! ![]()

![]()

![]() $NIO Inc (NIO.US)$

$NIO Inc (NIO.US)$

8

1

Obviously, with every new technology, there are new opportunities and obstacles. I believe there will be those that doubt the direction of the future, while sometimes with overinflated values, these sticks will be the Detroit of the new few decades. Tesla, Nio, Xpeng, and Li

5

1

Rivian's market cap is currently at 145B. What are some great stocks with a market cap below 150B you like more over the next few years?

$Rivian Automotive (RIVN.US)$ I keep hearing Rivian has surpassed several companies market caps over the last few days and wondering what would the best ones to go into.

What do you feel are the best ones over the coming months and years to be holding onto that are also sub 150B market caps?

$Rivian Automotive (RIVN.US)$ I keep hearing Rivian has surpassed several companies market caps over the last few days and wondering what would the best ones to go into.

What do you feel are the best ones over the coming months and years to be holding onto that are also sub 150B market caps?

5

1

cockNTail : opportunity

Kittykiki : Thanks for the sharing!!!

Clownarado : Good advice

Junping Liao : thank you

PREMOSULTRAA OP Junping Liao : my pleasure to share and help![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...