Latest

Hot

Hi, mooers! ![]()

The U.S. Federal Reserve is scheduled to hold an FOMC meeting and press conference on December 18.![]() This will be the last FOMC meeting in 2024.

This will be the last FOMC meeting in 2024.

On December 11, the U.S. Bureau of Labor Statistics released the latest CPI data. The consumer price index showed a 12-month inflation rate of 2.7%, increasing 0.3% monthly. The annual rate was 0.1 percentage points higher than in October. Given the current inflation rate,...

The U.S. Federal Reserve is scheduled to hold an FOMC meeting and press conference on December 18.

On December 11, the U.S. Bureau of Labor Statistics released the latest CPI data. The consumer price index showed a 12-month inflation rate of 2.7%, increasing 0.3% monthly. The annual rate was 0.1 percentage points higher than in October. Given the current inflation rate,...

12

6

2

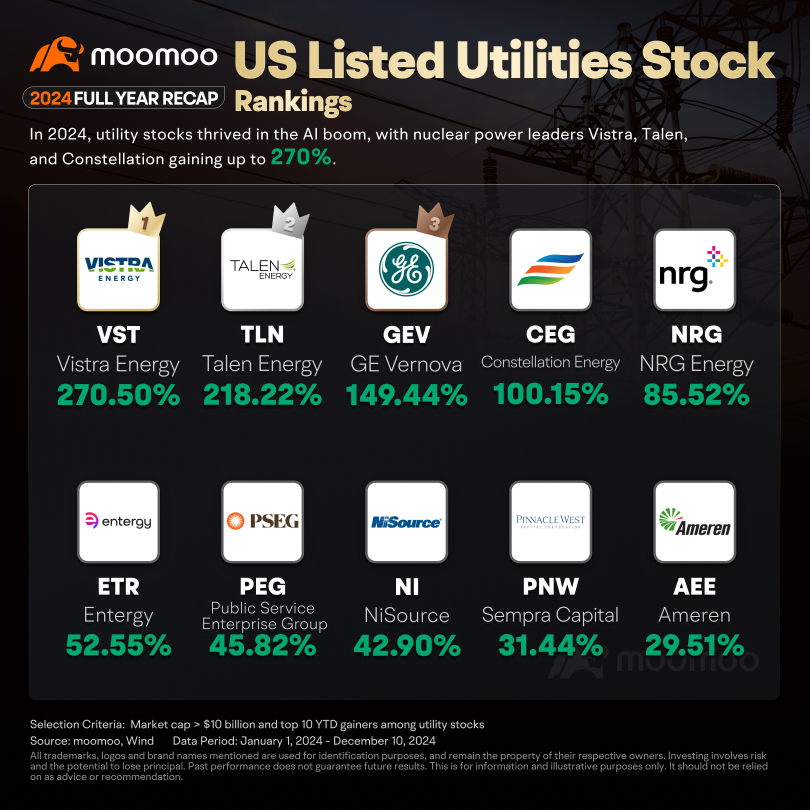

As of December 12, 2024, the three major U.S. stock indices have repeatedly hit historical highs throughout the year. The $Dow Jones Industrial Average (.DJI.US)$ exceeded the 45,000-point mark, the $S&P 500 Index (.SPX.US)$ hit 6,000 points, and more excitingly, the $Nasdaq Composite Index (.IXIC.US)$ topped 20,000 for the first time on Wednesday.

Amid the artificial intelligence frenzy and expectations of Federal Reserve rate cuts, along with ...

Amid the artificial intelligence frenzy and expectations of Federal Reserve rate cuts, along with ...

39

1

17

After a brief pullback yesterday, glove stocks are on the rise again. $TOPGLOV (7113.MY)$ and $SUPERMX (7106.MY)$ have seen an increase of over 6.8% today, $KOSSAN (7153.MY)$ has risen by more than 3.5%, and $HARTA (5168.MY)$ has climbed by over 2.6%. The share prices of these leading manufacturers have still achieved substantial gains since October, rising between 30% and 40% during this period. Notably, Top Glove alone surged over 12.8% in December...

21

3

20

One day after we got an inflation data (CPI) that came in line with expectation, the market received a hotter-than-expected producer price index (PPI) reading for November.

This is probably why the market is retreating a little bit.

That said, I believe the Fed will still proceed with its expected 25 basis point rate cut next week because other inflation data over the past few months are showing that it is trending downwards.

$Vanguard S&P 500 ETF (VOO.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $First Republic Bank (FRCB.US)$ $Crude Oil Futures(FEB5) (CLmain.US)$ $Goldman Sachs (GS.US)$ $Citigroup (C.US)$ $ChargePoint (CHPT.US)$ $LivePerson (LPSN.US)$ $Clover Health (CLOV.US)$ $Vanguard Growth ETF (VUG.US)$ $JD.com (JD.US)$ $Baidu (BIDU.US)$ $FuboTV (FUBO.US)$ $Merck & Co (MRK.US)$ $The Trade Desk (TTD.US)$

This is probably why the market is retreating a little bit.

That said, I believe the Fed will still proceed with its expected 25 basis point rate cut next week because other inflation data over the past few months are showing that it is trending downwards.

$Vanguard S&P 500 ETF (VOO.US)$ $KraneShares CSI China Internet ETF (KWEB.US)$ $First Republic Bank (FRCB.US)$ $Crude Oil Futures(FEB5) (CLmain.US)$ $Goldman Sachs (GS.US)$ $Citigroup (C.US)$ $ChargePoint (CHPT.US)$ $LivePerson (LPSN.US)$ $Clover Health (CLOV.US)$ $Vanguard Growth ETF (VUG.US)$ $JD.com (JD.US)$ $Baidu (BIDU.US)$ $FuboTV (FUBO.US)$ $Merck & Co (MRK.US)$ $The Trade Desk (TTD.US)$

From YouTube

8

The S&P 500 and Nasdaq both ended in the red territory yesterday as as a hotter-than-expected US inflation report weighed on investors’ sentiment. The technology stocks were hit the hardest.

November's PPI rose 0.4%, more than the estimate of 0.2%, which signals that the Fed’s fight towards inflation is not over yet.

$Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $MicroStrategy (MSTR.US)$ $Super Micro Computer (SMCI.US)$ $Bitcoin (BTC.CC)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Adobe (ADBE.US)$ $Oracle (ORCL.US)$ $Advanced Micro Devices (AMD.US)$ $Ethereum (ETH.CC)$ $iShares Bitcoin Trust (IBIT.US)$ $Riot Platforms (RIOT.US)$

November's PPI rose 0.4%, more than the estimate of 0.2%, which signals that the Fed’s fight towards inflation is not over yet.

$Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $MicroStrategy (MSTR.US)$ $Super Micro Computer (SMCI.US)$ $Bitcoin (BTC.CC)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Amazon (AMZN.US)$ $Adobe (ADBE.US)$ $Oracle (ORCL.US)$ $Advanced Micro Devices (AMD.US)$ $Ethereum (ETH.CC)$ $iShares Bitcoin Trust (IBIT.US)$ $Riot Platforms (RIOT.US)$

From YouTube

2

3

On Wednesday (11 Dec), we saw stocks surged which was led by a rally in shares of major technology companies that pushed NASDAQ above 20,000 points for the first time.

NASDAQ rose 1.77% to finish Wednesday's session at 20,035, while the S&P 500 added 0.82% to close just shy of a new high. The Russell 2000 gained 0.6% while DJIA closed 0.22% lower after giving back earlier gains.

U.S. stocks were coming off of two s...

NASDAQ rose 1.77% to finish Wednesday's session at 20,035, while the S&P 500 added 0.82% to close just shy of a new high. The Russell 2000 gained 0.6% while DJIA closed 0.22% lower after giving back earlier gains.

U.S. stocks were coming off of two s...

+4

13

2

It’s Friday, $S&P 500 Index (.SPX.US)$ looks to be holding at 6060+ ![]() . Be mindful and take profits whenever possible. Don’t want to juggle too much and lose focus.

. Be mindful and take profits whenever possible. Don’t want to juggle too much and lose focus. ![]()

$Tesla (TSLA.US)$seems unstoppable at above 425.![]()

$NVIDIA (NVDA.US)$looks to have hit its head at 140.![]()

Made a capital secured Put strategy as I see a good entry point. Effectively the stock price 133 - premium 21.30 = 112. Close to my entry target for $NVIDIA (NVDA.US)$. with an annual return of 15%.![]() Too lo...

Too lo...

$Tesla (TSLA.US)$seems unstoppable at above 425.

$NVIDIA (NVDA.US)$looks to have hit its head at 140.

Made a capital secured Put strategy as I see a good entry point. Effectively the stock price 133 - premium 21.30 = 112. Close to my entry target for $NVIDIA (NVDA.US)$. with an annual return of 15%.

+2

17

After the stocks surged on Wednesday (11 Dec), with NASDAQ above 20,000 points for the first time, catalyst by the soaring of technology companies shares.

We saw that the equities returned the previous big gains after the release of PPI economic data which set a negative tone for trading. We have S&P 500 and DJIA drop 0.54% and 0.53% respectively while NASDAQ declined more with -0.66%.

The monthly report on producer pric...

We saw that the equities returned the previous big gains after the release of PPI economic data which set a negative tone for trading. We have S&P 500 and DJIA drop 0.54% and 0.53% respectively while NASDAQ declined more with -0.66%.

The monthly report on producer pric...

+4

11

Stock futures were higher premarket after markets gave back some recent gains in the previous session. Tech stocks seem to be regaining strength. Let’s see if Nasdaq can close back above the milestone level of 20,000.

Meanwhile, sticky and persistent inflation could force Fed to re-consider their rate cut campaign next year. But that’s for 2025. Next week’s FOMC meeting will likely see the Fed cutting interest rate by 25 basis points again – probably setting the market up for ...

Meanwhile, sticky and persistent inflation could force Fed to re-consider their rate cut campaign next year. But that’s for 2025. Next week’s FOMC meeting will likely see the Fed cutting interest rate by 25 basis points again – probably setting the market up for ...

From YouTube

4

1

$SPDR S&P 500 ETF (SPY.US)$ done for day, 3 days in a row, 3 trades, all winners this is just from today.

2

102362254 : I’d keep my portfolio balanced. Some steady, reliable stocks and some in growing industries like tech. As for the global economy, it feels shaky but full of opportunities if patient and ready to adapt

Diamond kuku bird ❤ : I will position my portfolio in a way that won't lost the way. And if Federal Reserve can cut interest rates by 100 basic points every month will reboost the whole global economy again. Next year with Trump leadership will make china leader everyday cannot sleep well and china will had more panda in the house.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Lucas Cheah : In light of the Fed's rate cuts and the global trend toward monetary easing, this is an opportunity to lean into growth-oriented sectors. Lower interest rates often fuel tech and consumer discretionary stocks, so I suggest adding names like Nvidia or Amazon to my portfolio. At the same time, I would keep an eye on dividend-paying stocks for steady income in this environment. Overall, I feel cautiously optimistic about the global economy as this easing cycle could support recovery and growth, but I am staying mindful of potential inflation risks down the road.

骨神 Diamond kuku bird ❤ : Then my China shares all die

P the man : I think it can rise

View more comments...