Latest

Hot

Here’s what you need to know about the latest Fed meeting:

- We have a pause in interest rate hikes, for now

- Interest rates could stay high for the rest of the year

- Nevertheless, we are quite close to peak interest rates

The $SPDR S&P 500 ETF (SPY.US)$ has entered a bull market after rising more than 20% from its October low.

Read more about what we are looking out for next: Fed pauses on rate hikes. Here’s what it means for T-bills and stocks

- We have a pause in interest rate hikes, for now

- Interest rates could stay high for the rest of the year

- Nevertheless, we are quite close to peak interest rates

The $SPDR S&P 500 ETF (SPY.US)$ has entered a bull market after rising more than 20% from its October low.

Read more about what we are looking out for next: Fed pauses on rate hikes. Here’s what it means for T-bills and stocks

2

What's New

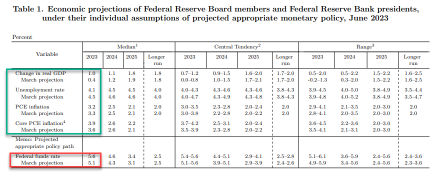

The Federal Reserve (Fed) opted not to raise the federal funds rate at the June 2023 Federal Open Market Committee (FOMC) meeting, keeping the federal funds rate at 5.00%-5.25% and maintaining this policy rate at its highest level in sixteen years. The decision received unanimous support from FOMC voting members, just like the previous seven meetings since July last year.

This is the first pause in the Fed's current cycle of rate hikes, bu...

The Federal Reserve (Fed) opted not to raise the federal funds rate at the June 2023 Federal Open Market Committee (FOMC) meeting, keeping the federal funds rate at 5.00%-5.25% and maintaining this policy rate at its highest level in sixteen years. The decision received unanimous support from FOMC voting members, just like the previous seven meetings since July last year.

This is the first pause in the Fed's current cycle of rate hikes, bu...

25

3

16

The dollar extends its losses to reach a three-week low after data from the U.S. Labor Department showed inflation eased in May. Headline inflation fell to 4.0% on-year in May from 4.9% in April while core inflation dropped to 5.3% from 5.5%, as expected by analysts in a WSJ survey. The data shows the Federal Reserve "needs to take the summer off now" with respect to monetary policy tightening, Zaye Capital Markets chief investment officer Naeem Aslam...

The 30-stock benchmark is higher by a mere 2% for the year, while its more volatile peers are blasting off.

The Dow Jones Industrial Average eked out a tiny 0.1% gain on Friday to cap a week of thin trading. Wall Street’s blue-chip index has been massively outperformed by its two peers – the S&P 500 and the Nasdaq. While the Dow is up just 2% for the year, the broad-based S&P 500 is up 12%, the tech-focused Nasdaq is higher by 27%.

So why that b...

The Dow Jones Industrial Average eked out a tiny 0.1% gain on Friday to cap a week of thin trading. Wall Street’s blue-chip index has been massively outperformed by its two peers – the S&P 500 and the Nasdaq. While the Dow is up just 2% for the year, the broad-based S&P 500 is up 12%, the tech-focused Nasdaq is higher by 27%.

So why that b...

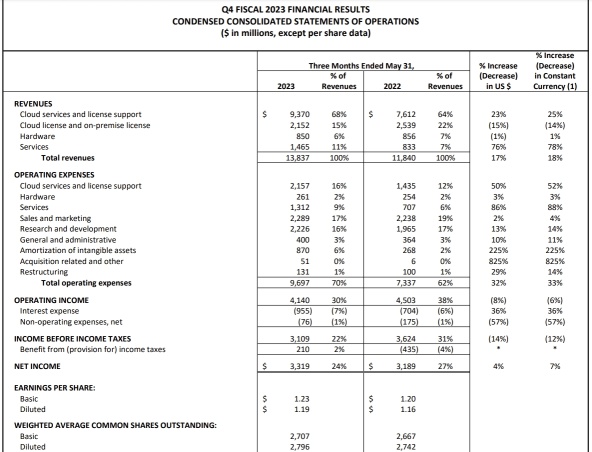

As of June 12, Oracle has risen 44% year-to-date. After the company released its latest financial report exceeding expectations, it rose another 3.64% after hours. So how is the company's financial report performance this time, and is there room for the stock price to rise in the future?

1. Oracle's overall performance exceeded expectations, and the leverage ratio is still surprisingly high

In FY2023, the company's total revenue is US$50 billion, YoY+18%. In FY23...

1. Oracle's overall performance exceeded expectations, and the leverage ratio is still surprisingly high

In FY2023, the company's total revenue is US$50 billion, YoY+18%. In FY23...

8

Most big Wall Street banks expect the Federal Reserve to keep interest rates unchanged on Wednesday, while sticking to its hawkish tone due to a strong job market and elevated inflation.

Several economists say that it is a toss-up between a skip and a hike in the June meeting. Most banks expect the central bank to prepare markets for a hike in July.

Money markets are currently pricing in a more than 70% chance of a pause this month, with r...

Several economists say that it is a toss-up between a skip and a hike in the June meeting. Most banks expect the central bank to prepare markets for a hike in July.

Money markets are currently pricing in a more than 70% chance of a pause this month, with r...

OIL prices declined on Monday ahead of a U.S. Federal Reserve meeting as investors tried to gauge the central bank's appetite for further rate hikes, while concerns about China's fuel demand growth and rising Russian crude supply weighed on the market.

Brent crude futures fell 70 cents, or 0.94%, to $74.09 a barrel by 0647 GMT. U.S. West Texas Intermediate (WTI) crude was at $69.53, down 0.91%.

Both benchmarks posted their second straight weekly de...

Brent crude futures fell 70 cents, or 0.94%, to $74.09 a barrel by 0647 GMT. U.S. West Texas Intermediate (WTI) crude was at $69.53, down 0.91%.

Both benchmarks posted their second straight weekly de...

Futures for Canada's main resource-heavy stock index edged lower on Monday, tracking weakness in commodity prices, while investors awaited U.S. Federal Reserve's interest rate decision due later in the week.

June futures on the S&P/TSX index (SXFc1) were down 0.1% at 7:39 a.m. ET (1139 GMT).

Economists and traders widely expect the U.S. central bank to halt its market-punishing interest rate hikes for the first time in over a year at...

June futures on the S&P/TSX index (SXFc1) were down 0.1% at 7:39 a.m. ET (1139 GMT).

Economists and traders widely expect the U.S. central bank to halt its market-punishing interest rate hikes for the first time in over a year at...

- Last Thursday’s release of initial jobless claims data for week of Jun 3rd soared to 261k, higher than both prior period and survey estimates of 232k and 235k respectively, and also the highest since October 2021.

- May’s CPI print will be out one day ahead of the FOMC rate decision, with survey estimates at 0.2% m/m, which is lower than prior period’s 0.4% m/m, increasing the likelihood of the start of an extended hawkish rate pause.

- Consequently, i...

- May’s CPI print will be out one day ahead of the FOMC rate decision, with survey estimates at 0.2% m/m, which is lower than prior period’s 0.4% m/m, increasing the likelihood of the start of an extended hawkish rate pause.

- Consequently, i...

6

2