Latest

Hot

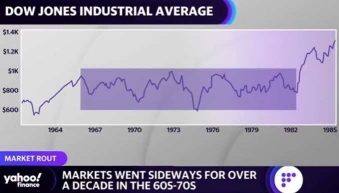

In 2022: The market has sold off so much. 4 out of 5 analysts were calling for a recession in Europe and America. The Chinese economy was locked down due to virus restrictions causing supply chain issues. Russian war supply chain issues were apparent as well. Inflation was skyrocketing and there was no end in sight. This sent Treasury yields and the Dollar Index skyrocketing as the Fed was fighting inflation. Basically everything looked very bearish for equities last year. A lo...

24

24

Wedge Pattern Candlestick Formation

With a wedge formation this big you should expect a big price move once the market picks which direction the market wants to go. And this should happen very soon as the price is coiled up about as tight as it can be at the tip of the wedge. A breakout is imminent.

$Invesco QQQ Trust (QQQ.US)$ $iShares Russell 2000 ETF (IWM.US)$ $VIX Index Futures(DEC4) (VXmain.US)$ $SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Gold Futures(FEB5) (GCmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $E-mini S&P MidCap 400 Futures(DEC4) (EMDmain.US)$ $E-mini Russell 2000 Index Futures(DEC4) (RTYmain.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $VIX Index Futures(DEC4) (VXmain.US)$

���������...

With a wedge formation this big you should expect a big price move once the market picks which direction the market wants to go. And this should happen very soon as the price is coiled up about as tight as it can be at the tip of the wedge. A breakout is imminent.

$Invesco QQQ Trust (QQQ.US)$ $iShares Russell 2000 ETF (IWM.US)$ $VIX Index Futures(DEC4) (VXmain.US)$ $SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Gold Futures(FEB5) (GCmain.US)$ $E-mini Dow Futures(DEC4) (YMmain.US)$ $E-mini S&P 500 Futures(DEC4) (ESmain.US)$ $E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ $E-mini S&P MidCap 400 Futures(DEC4) (EMDmain.US)$ $E-mini Russell 2000 Index Futures(DEC4) (RTYmain.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $VIX Index Futures(DEC4) (VXmain.US)$

���������...

19

14

Looks like 2023 will be the year for Chinese stock market after they had been crashing down for 2 years straight. According to PwC, more than 100 new listings are expected to raise around HK$200 billion (US$25.6 billion) in HK market in 2023.

The top 6 IPO that investor could see are $Alibaba (BABA.US)$'s Ant Group, ByteDance, Syngenta, Amer Sports, $FWD GROUP HOLDINGS LIMITED (810347.HK)$ and $DiDi Global Inc (DIDIY.US)$ among t...

The top 6 IPO that investor could see are $Alibaba (BABA.US)$'s Ant Group, ByteDance, Syngenta, Amer Sports, $FWD GROUP HOLDINGS LIMITED (810347.HK)$ and $DiDi Global Inc (DIDIY.US)$ among t...

loading...

20

4

This is the one million dollars question that is frequently asked by all investors. Unfortunately no one can time the market. You're responsible for own investment so do your own due diligence (DYODD). Be assimilated (sell) or be hopeful (hold or buy the dip) is entirely UP TO YOU.

$Tesla (TSLA.US)$ $Apple (AAPL.US)$ $DBS Group Holdings (D05.SG)$ 😎

$Tesla (TSLA.US)$ $Apple (AAPL.US)$ $DBS Group Holdings (D05.SG)$ 😎

6

4

FOMO or fear of missing out is when a stock has risen strongly in price and then you buy because you fear that it will continue rising. This is driven by greed. Usually, the stock is overbought and due for a fall by that time.

FOLO or fear of losing out is when you own a stock and should probably sell it but you are afraid to because you're sure it will immediately start to increase as soon as you do. This is driven by fear. Usually, the stock is overso...

FOLO or fear of losing out is when you own a stock and should probably sell it but you are afraid to because you're sure it will immediately start to increase as soon as you do. This is driven by fear. Usually, the stock is overso...

+2

9

Dow Jones Industrial Average has been rallying in Jan 2023. From Fig. 1 above, it is above the MA200 and looks bullish. But it is still rejected at Downtrend line 2. Is it going to break out of the resistance?

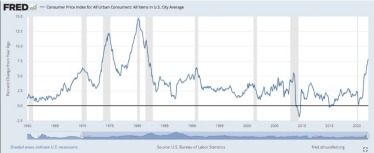

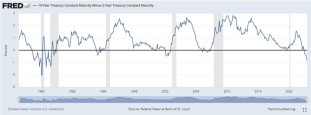

Analysts are expecting a recession later this year. Inflation appeared to have peaked in Jul 2022 with the CPI peaking at 9.1%. Inflation have risen at a slower rate and was 6.5% in Dec. They expect the Fed to stop hiking rates as soon as 1Q2023 wi...

Analysts are expecting a recession later this year. Inflation appeared to have peaked in Jul 2022 with the CPI peaking at 9.1%. Inflation have risen at a slower rate and was 6.5% in Dec. They expect the Fed to stop hiking rates as soon as 1Q2023 wi...

4

3

2022 was quite the different year than 2021. Going into 2022 everyone thought the bull run would not end, but due to record inflation and interest rate hikes the SP500 is down ~19.85% year to date. Based on the Fed we know we will still see some interest rate hikes, but not too the extent of what they were in 2022. So what is your prediction for 2023?

What stocks will perform the best (excluding penny stocks)?

What is your prediction for where the SP500 will e...

What stocks will perform the best (excluding penny stocks)?

What is your prediction for where the SP500 will e...

2

2

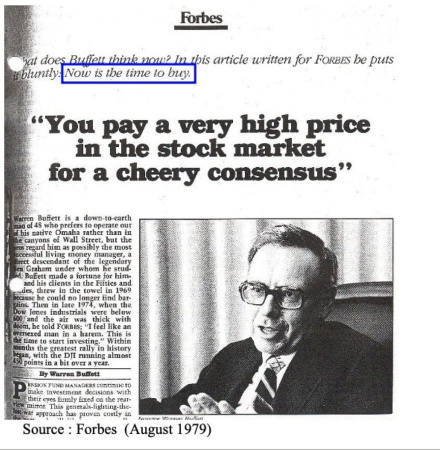

"I feel like an oversexed man in a harem."

Bear markets are opportunities.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tesla (TSLA.US)$

Bear markets are opportunities.

$Warren Buffett Portfolio (LIST2999.US)$ $Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $Tesla (TSLA.US)$

2

1

I realise too late I've invested way toouch I to utilities so with them taking such a dive I have lost quite a bit. Should I just take the L and sell everything or are they likely to go up, or at least be not in the worst spot ever?$# $Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$

1

1

The Nasdaq composite went on to post a 29.8% gain in 1975 and would not see another down year until 1981, but that was only after it lost a combined 55% in 1974 and 1973.

The view and opinions of the author do not reflect the views of Moomoo Financial Inc. or any of its affiliates. The views and opinions of the author are provided for informational purposes only, do not constitute a recommendation of an investment strategy or to buy, sell, or hold any i...

The view and opinions of the author do not reflect the views of Moomoo Financial Inc. or any of its affiliates. The views and opinions of the author are provided for informational purposes only, do not constitute a recommendation of an investment strategy or to buy, sell, or hold any i...

2

Violets : I put down earnings because I think people truly have pulled back on using quite a bit of software and definitely spending money. but I know many people that think that we actually are going into a bull market and the economy is just fine. they think the recession talk is globalist creating a recession and that the economy is much stronger than anyone is letting on. I think that interest rates are going to increase and therefore I think that's what will bring us down in 2023 for us extended amount of time. however I don't think it will be the entire year. also people think that the FED is going to introduce a federal digital currency and that that will be one of the reasons that the market will be forced to crash so that that can be introduced. just what I'm hearing

SpyderCall OP Violets : i haven't heard much about the Feds digital currency and it potential impact. Its interesting that somebody said the market needs to crash for this to happen because China introduce their digital currency. and they did this when their market crashed for almost two years straight.

as for US markets. I'm feeling bullish but not as bullish as a complete bull market in 2023. not yet at least. Based off of history earnings should be effected by rising yields. but the lag affect of interest rate increases can take a year or more to impact an economy or earnings. That is why a lot analyst are thinking only half of the year will be good. but who knows.

until i see some bad data or earnings im just going to ride the trends

Violets : Do you know of the trader called Spud?

he posted something interesting today and I'm going to post it here for you. I'm not as good of a technical trader as you are but I think you will find this interesting

Violets SpyderCall OP : this is what he said.... the guy has been trading for about 4 years but he made like a million his first year. but then he went all cash at some point in 2022. I think he trades mostly penny stocks and sometimes calls on spy and other s&p stocks.

Violets SpyderCall OP : you know it would be great if even half the year was bullish but I am so bearish it's hard for me to buy calls but I know I'm missing out. I think if I keep buying puts though I'm going to get burned even more. I thought the second half of 2023 would be bullish don't the first half but so far I am spot on wrong LOL. can't help but think the said might bring this down on February 1st or 2nd

View more comments...