Latest

Hot

$ON Semiconductor (ON.US)$

$ON Semiconductor (ON.US)$

ON Semiconductor Corporation is a global provider of intelligent sensing and power solutions. The company operates through three segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group. Its intelligent power technologies play a crucial role in electrifying the automotive industry, enabling the development of lighter and longer-range electric vehicles, fast-charging systems, and sustainable ...

$ON Semiconductor (ON.US)$

ON Semiconductor Corporation is a global provider of intelligent sensing and power solutions. The company operates through three segments: Power Solutions Group, Advanced Solutions Group, and Intelligent Sensing Group. Its intelligent power technologies play a crucial role in electrifying the automotive industry, enabling the development of lighter and longer-range electric vehicles, fast-charging systems, and sustainable ...

2

asking the question whether Fundamental Analysis (FA) or Technical Analysis (TA) is better, is like asking someone whether orange or apple is better..

why? coz tho' both are categorised as fruits, we know that oranges and apples are different -- orange packs more vitamins whereas apples contain more fiber and both are good for our health..

in a similar rein, though both FA and TA are used for stock analysis, we need to recognise how they are different and use them cor...

why? coz tho' both are categorised as fruits, we know that oranges and apples are different -- orange packs more vitamins whereas apples contain more fiber and both are good for our health..

in a similar rein, though both FA and TA are used for stock analysis, we need to recognise how they are different and use them cor...

3

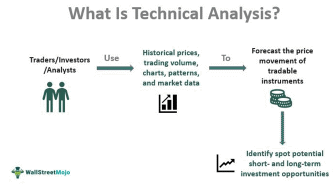

Technical Analysis (TA)

TA is about analyzing statistical trends of a security using historical data. Technical analysis involves looking at the past trading activity and price variations of a security, with the goal of understanding how the supply and demand of a security might influence its future price changes. By using charts to evaluate price trends and patterns, it's often been possible to find profitable trading opportunities.

TA is usu...

TA is about analyzing statistical trends of a security using historical data. Technical analysis involves looking at the past trading activity and price variations of a security, with the goal of understanding how the supply and demand of a security might influence its future price changes. By using charts to evaluate price trends and patterns, it's often been possible to find profitable trading opportunities.

TA is usu...

27

21

Qs- Are you buying for the short or long term? TA or FA are 2 different analysis tools but have the same common goal which is to make our monies work hard for us.

FA study a company inside out via financial data and economic outlook. But lack the precision needed for investors to enter the market. Also assumption are made to project future growth. Suitable for long term investment.

TA look into price charts and time entry into the market by analyzing previous p...

FA study a company inside out via financial data and economic outlook. But lack the precision needed for investors to enter the market. Also assumption are made to project future growth. Suitable for long term investment.

TA look into price charts and time entry into the market by analyzing previous p...

+1

7

technical analysis is definitely for trading and I would use it for an entry point (or exit point if a stock ran up an unbelievable amount and I was trading)

fundamental analysis is the first step I would use to even determine whether or not to get into a stock in the first place. if the profit to earnings ratio is too high I would be hesitant to start a position in the first place as the price per share may fall

both methods have their place and time. however I would never put mo...

fundamental analysis is the first step I would use to even determine whether or not to get into a stock in the first place. if the profit to earnings ratio is too high I would be hesitant to start a position in the first place as the price per share may fall

both methods have their place and time. however I would never put mo...

2

Should rely more on Fundamental Analysis, because numbers don't lie...people do.![]()

1

1

Fundamental analysis is most often used when determining the quality of long-term investments in a wide array of securities and markets, while technical analysis is used more in the review of short-term investment decisions such as the active trading of stocks.

For myself, I often look at the fundamental and overall macroeconomic landscape as the market outlook, and use chart to decide which stocks to buy or sell, and when to enter or exit.

I don't hesitate too long befor...

For myself, I often look at the fundamental and overall macroeconomic landscape as the market outlook, and use chart to decide which stocks to buy or sell, and when to enter or exit.

I don't hesitate too long befor...

If you're thinking about investing in a technology company, consider the following analysis:

To evaluate the company's financial health, you would examine its financial statements using fundamental analysis. Revenue growth, earnings per share (EPS), cash flow and debt status are all factors to consider. This fundamental analysis provides a more comprehensive understanding of a company's growth potential and market competitiveness. If you review that this techno...

To evaluate the company's financial health, you would examine its financial statements using fundamental analysis. Revenue growth, earnings per share (EPS), cash flow and debt status are all factors to consider. This fundamental analysis provides a more comprehensive understanding of a company's growth potential and market competitiveness. If you review that this techno...

13

Some may say it doesn't have to be mutually exclusive. Can we have both?

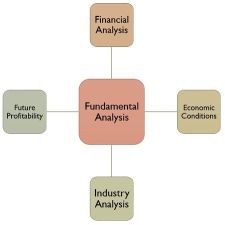

The goal of fundamental analysis (FA) is to come up with a fair value of a company by evaluating all aspects of the business, along with the industry, the market as a whole, and the domestic and global environment.

The goal of technical analysis (TA) is to evaluate data—such as historical returns and price changes—to chart patterns that can be used to estimate future price movement f...

The goal of fundamental analysis (FA) is to come up with a fair value of a company by evaluating all aspects of the business, along with the industry, the market as a whole, and the domestic and global environment.

The goal of technical analysis (TA) is to evaluate data—such as historical returns and price changes—to chart patterns that can be used to estimate future price movement f...

7