Latest

Hot

1. Avoid 0DTE

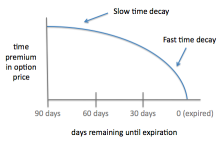

0DTE (Zero days to expiration), as the name suggests, are options close to their expiration dates, such as opening an option expiring on March 27th when it's already March 25th.

For 0DTE, the primary factor influencing them is the stock price. By this time, time value has essentially eroded, and even if some remains, it will rapidly diminish in the coming days until it re...

0DTE (Zero days to expiration), as the name suggests, are options close to their expiration dates, such as opening an option expiring on March 27th when it's already March 25th.

For 0DTE, the primary factor influencing them is the stock price. By this time, time value has essentially eroded, and even if some remains, it will rapidly diminish in the coming days until it re...

25

7

11

Currently, my account is slightly in the red. In the early stage, I faced a floating loss of 50%, but in the latter, I managed to achieve a 30% gain. Here are some insights into my growth process:

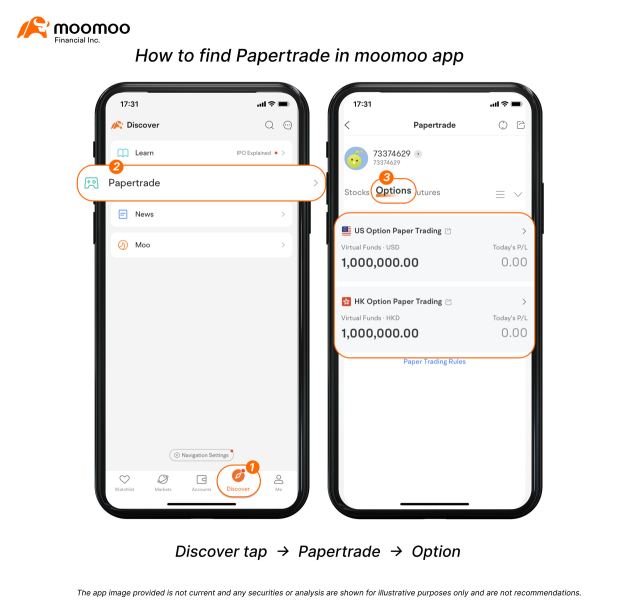

1. Rapid Learning of Options Knowledge:

I've been diligently studying options through resources like moomoo, which provides comprehensive educational articles. These resources a...

1. Rapid Learning of Options Knowledge:

I've been diligently studying options through resources like moomoo, which provides comprehensive educational articles. These resources a...

130

15

10

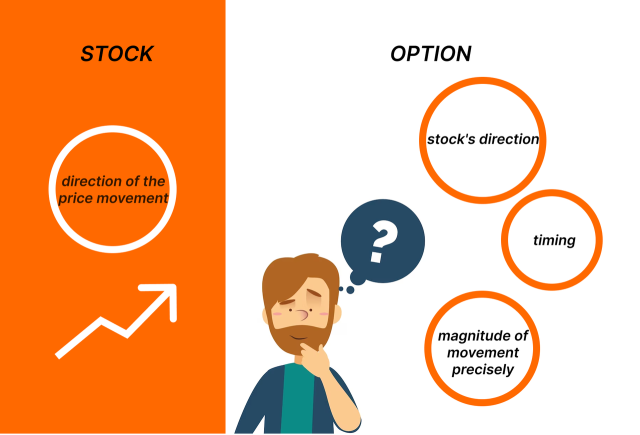

When starting out in options trading, it can be tempting to use similar strategies from stock trading. However, this could potentially lead to significant losses.

In this article, we'll explore why options trading requires a different approach and discuss techniques that may be more appropriate to this style of trading.

Options are not stocks

The first and most important thing to understand about options is that they are not stocks....

In this article, we'll explore why options trading requires a different approach and discuss techniques that may be more appropriate to this style of trading.

Options are not stocks

The first and most important thing to understand about options is that they are not stocks....

+2

44

18

15

Hello everyone and welcome back to moomoo. I'm options explorer. In today's [Options ABC], we're diving into the concept of Triple-Witching Day.

There’s a myth surrounding Triple Witching Days - that they bring a 'curse' of plunging stock prices.

But does data support this notion? And how does it affect options trading?

Let's explore together today whether there's any reality to this belief and how it cou...

There’s a myth surrounding Triple Witching Days - that they bring a 'curse' of plunging stock prices.

But does data support this notion? And how does it affect options trading?

Let's explore together today whether there's any reality to this belief and how it cou...

![[Options ABC] Triple Witching Day: The Essential Survival Guide for Today's Options Trading](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240315/1710494449679-f555542b43.png/thumb?area=100&is_public=true)

![[Options ABC] Triple Witching Day: The Essential Survival Guide for Today's Options Trading](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240315/1710492919965-a8d3078d5b.png/thumb?area=100&is_public=true)

![[Options ABC] Triple Witching Day: The Essential Survival Guide for Today's Options Trading](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240315/1710492920260-4affff2e43.png/thumb?area=100&is_public=true)

48

3

53

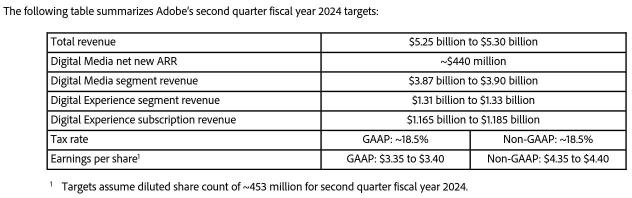

The blood bath that has engulfed $Adobe (ADBE.US)$'s stock is boosting demand for a hedge against the share slump.

About halfway through the trading day, more than 200,000 Adobe options were traded, putting them among the top 10 heavily-traded stock options. The most-active contracts are put options that give the holders the right to sell Adobe shares at $480 each before the trading day, which can help cushion the blow should losses deepen.

Th...

About halfway through the trading day, more than 200,000 Adobe options were traded, putting them among the top 10 heavily-traded stock options. The most-active contracts are put options that give the holders the right to sell Adobe shares at $480 each before the trading day, which can help cushion the blow should losses deepen.

Th...

+1

44

3

5

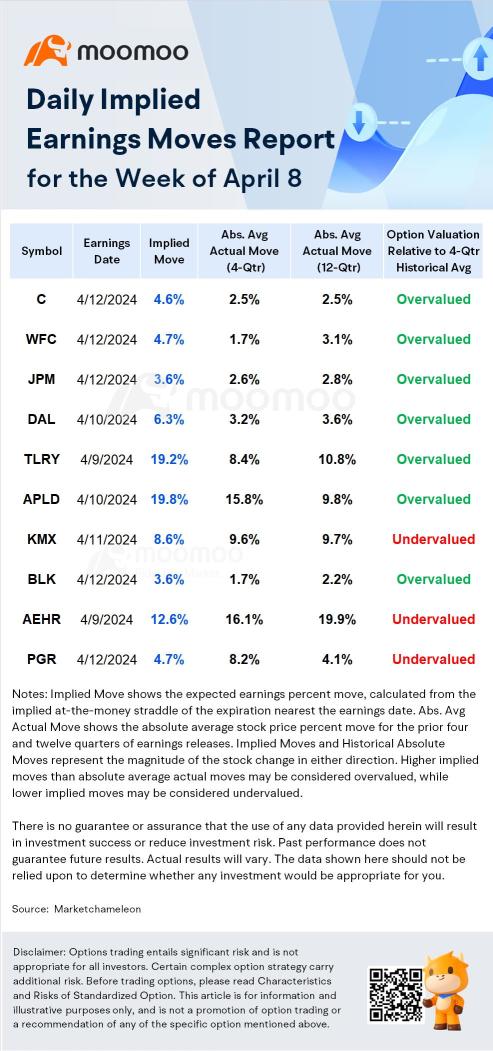

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Stock: $Citigroup (C.US)$

-Earnings Date: 4/12 After Market Close

-Implied Move: 4.6%

-Abso...

-Stock: $Citigroup (C.US)$

-Earnings Date: 4/12 After Market Close

-Implied Move: 4.6%

-Abso...

+3

25

2

13

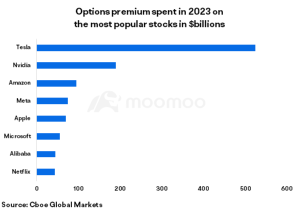

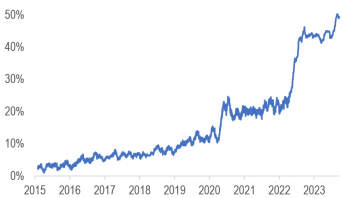

The options market is experiencing an unprecedented boom with an average of 44 million contracts changing hands every day in 2023. This figure has doubled compared to five years ago and is on track to set an annual record, according to Options Clearing Corp's data.

The surge in activity indicates that many traders are willing to take significant risks in the market for bigger payouts than traditional buy-and-hold investments.

$Tesla (TSLA.US)$ remains a...

The surge in activity indicates that many traders are willing to take significant risks in the market for bigger payouts than traditional buy-and-hold investments.

$Tesla (TSLA.US)$ remains a...

24

1

11

Before and after the release of financial reports, implied volatility (IV) often experiences a sharp decline, a phenomenon referred to as IV Crush.

This article is divided into three parts: one, introducing the concepts of IV and IV Crush; two, sharing option trading strategies related to IV Crush; three, discussing my own views on NVIDIA.

I. Concepts of IV and IV Crush

What is IV?

IV, or Implied Volatility, is a critical parameter in option pricing model...

This article is divided into three parts: one, introducing the concepts of IV and IV Crush; two, sharing option trading strategies related to IV Crush; three, discussing my own views on NVIDIA.

I. Concepts of IV and IV Crush

What is IV?

IV, or Implied Volatility, is a critical parameter in option pricing model...

13

1

1

$SoundHound AI (SOUN.US)$ here's an option play for the bulls. rather than by the common stock here at $8.30 you can buy a March 15th $7 call for a 1.30 contract.. if tomorrow 4:00 the stock stays here does nothing you got to play you got all your money back zero risk if the stock today goes back up to $9 you're going to get $3.50 back.. if it goes any higher it's tick for tick because you're in the money. if the stock collapses and goes to five if you were to bought the common stock a thousand s...

7

9

is this how I join a moo community option discussion?

3

7

EnjoyTheProcess : Thanks for the clear explanation. Do u know the step by step of selling a covered call on moomoo? assuming u already have the 100 shares in ur portfolio, do u sell option as "single option" or "covered stock" option?

Still-Learning : Thank you soo much for this detailed explanation. I haven’t yet ventured into options. I found ur article very helpful to understand the basics of options. Thanks a ton![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

lucky333 : thanks for clear explanation![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Harrison Wells : Good topic

悠悠37 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

View more comments...