Latest

Hot

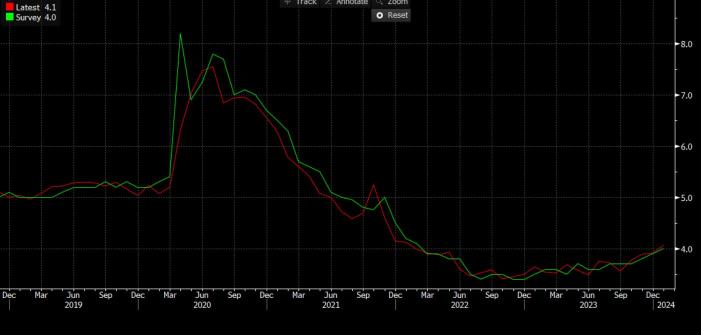

Australia's unemployment rate is rising a litter faster than the RBA thought and now bets have dropped of a rate hike in Australia in May.

Today's data release showed the jobless rate (unemployment rate) in Australia rose to 4.1% in January, up from 3.9%, (vs 4.0% read expected).

The biggest weight on the data was that most economists didn't expected a drop-in part-...

Today's data release showed the jobless rate (unemployment rate) in Australia rose to 4.1% in January, up from 3.9%, (vs 4.0% read expected).

The biggest weight on the data was that most economists didn't expected a drop-in part-...

5

1

Any thoughts on ECB decision tonight?

The prices are rising at more than twice its 2% target, even after 9 consecutive rate hikes.

Feel free to vote! 👇🏻

The prices are rising at more than twice its 2% target, even after 9 consecutive rate hikes.

Feel free to vote! 👇🏻

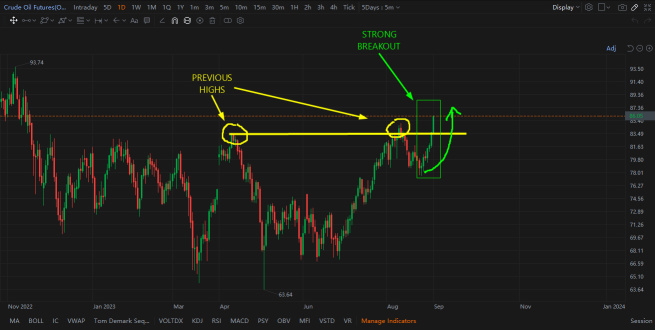

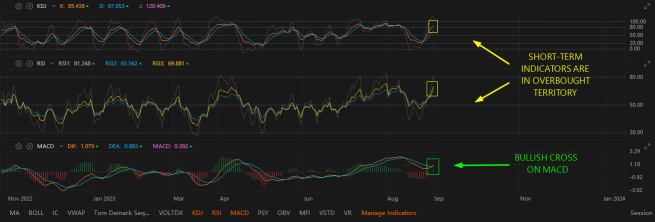

Last week’s rally in oil prices and encouraging US economic data, such as solid jobless claims had also supported the case for elevated rates.

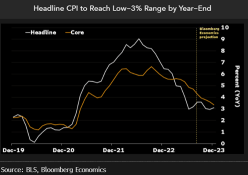

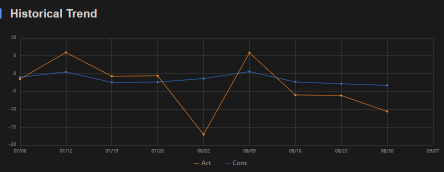

However, the upcoming Aug’s CPI report scheduled for Sep 13, is expected to present a mixed picture. Bloomberg Economics predicts headline CPI to accelerate to 0.6% MoM / 3.6% YoY (vs. 0.2% MoM / 3.2% MoM in Jul) on higher gasoline prices, while core CPI to accelerate 0.2% MoM / 4.3% YoY (vs 0.2% MoM / 4.7% YoY i...

However, the upcoming Aug’s CPI report scheduled for Sep 13, is expected to present a mixed picture. Bloomberg Economics predicts headline CPI to accelerate to 0.6% MoM / 3.6% YoY (vs. 0.2% MoM / 3.2% MoM in Jul) on higher gasoline prices, while core CPI to accelerate 0.2% MoM / 4.3% YoY (vs 0.2% MoM / 4.7% YoY i...

8

1

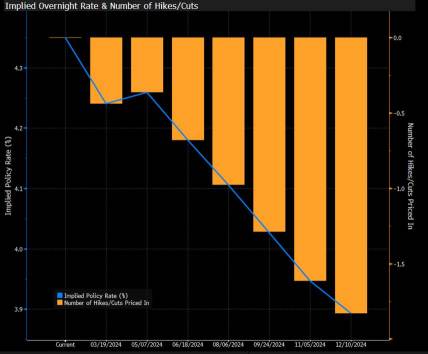

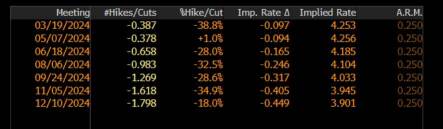

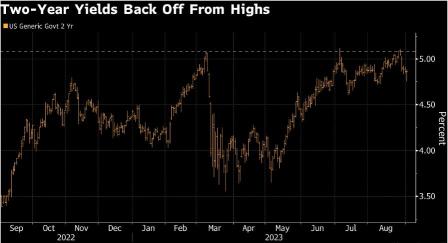

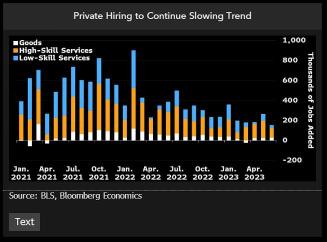

- For the 1sttime since the Fed began raising interest rates nearly 18 months ago, the labor marketis exhibiting significant weaknesses, whichhas encouraged major global bond investors to speculate that the tightening cycle is ultimately drawing to a close.

- A series of declining employment indicators this week, culminating in Friday's August payrolls report, has caused market sentiment to favor the ownership of policy-sensitive two-year treasuries.

- H...

- A series of declining employment indicators this week, culminating in Friday's August payrolls report, has caused market sentiment to favor the ownership of policy-sensitive two-year treasuries.

- H...

10

1

$Crude Oil Futures(MAY5) (CLmain.US)$

Energy investors have had a very profitable few months. Oil prices have been on a sharp incline recently. How high can the price of oil go? Nobody knows for sure, but there are a few factors you can watch out for.

Laws of Demand

What causes oil prices to move? The laws of supply and demand dictate oil prices. It sounds simple, but with all of the geopolitical issues around the world, oil prices can be quite volatile and hard to ...

Energy investors have had a very profitable few months. Oil prices have been on a sharp incline recently. How high can the price of oil go? Nobody knows for sure, but there are a few factors you can watch out for.

Laws of Demand

What causes oil prices to move? The laws of supply and demand dictate oil prices. It sounds simple, but with all of the geopolitical issues around the world, oil prices can be quite volatile and hard to ...

+5

6

7

3

- Last Wednesday (Aug 17), Fed's July meeting minuteswere released, and thehawkish signalsheightened concerns that the Fed wouldcontinue to raise interest rates to combat inflation. Consequently, yields on two-year notes, sensitive to monetary policy, rose close to 5. This came following last Tuesday’s (Aug 16) data release showingheadline retail sales rise 0.7% MoM, surpassing expectations of 0.4% MoM,further supported the case for the Fed to maintain h...

4

- Last Tuesday (Aug 1),Fitch downgraded the US government rating one notch from AAA to AA+, aligning with S&P Global Ratings previous downgrade following the 2011 debt-ceiling standoff. This follows a mid-year Treasury statement that highlighted how quickly the US deficit had widened – something usually associated with a worsening economic outlook.

- It is anticipated that US nonfarm payrolls increase by around 200k jobs in July, primarily driven by job ...

- It is anticipated that US nonfarm payrolls increase by around 200k jobs in July, primarily driven by job ...

4

Join event more interest rates rise to a 22 hight.