Latest

Hot

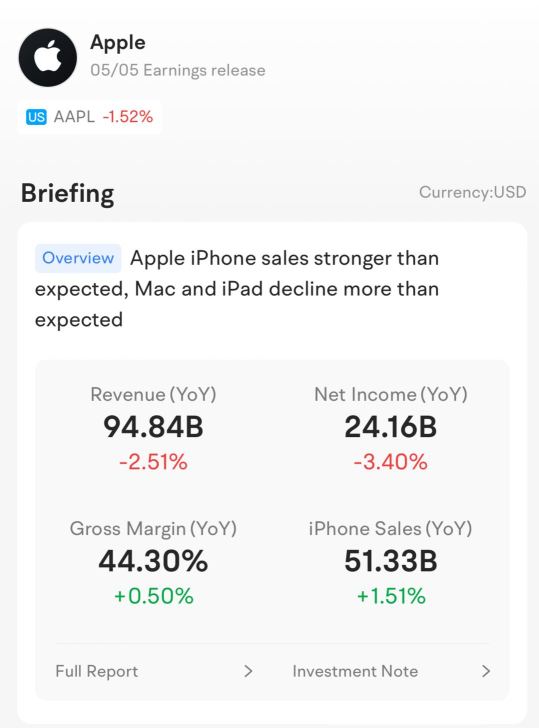

It seems the Q1 2023 earnings season has come to a close. As a novice investor, with an overwhelming amount of information flooding in, it can be quite daunting to navigate the volatile market and make informed decisions during the earnings season. Thankfully, I came to the moomoo community and met you guys-a group of kind and experienced investors who have shared so many invaluable insights. Big thanks to all the investors here!![]()

![]()

![]()

Let me briefl...

Let me briefl...

4

1

Volatility is good for traders.

Don’t follow the earnings and think that a good earnings report means that the price will fly to the moon.

Watch what the traders are doing and where is the price is going on the day and decide the direction of trade.

With the same ticker, you can go long one day and short the other.

Case in point, if you went long the day $Palantir (PLTR.US)$ released the report and short the next few days, and then long again yesterda...

Don’t follow the earnings and think that a good earnings report means that the price will fly to the moon.

Watch what the traders are doing and where is the price is going on the day and decide the direction of trade.

With the same ticker, you can go long one day and short the other.

Case in point, if you went long the day $Palantir (PLTR.US)$ released the report and short the next few days, and then long again yesterda...

22

8

Hey, mooers!![]()

The earnings season tends to bring unanticipated opportunities for investors, and it can also lead to significant fluctuations in the stock market. Positive results from a company's financial report may cause a rapid increase in its stock price, while disappointing results may result in sharp declines. As a result, investors must be careful during this period, as unexpected market swings may lead to financial losses.

Until now, big tech...

The earnings season tends to bring unanticipated opportunities for investors, and it can also lead to significant fluctuations in the stock market. Positive results from a company's financial report may cause a rapid increase in its stock price, while disappointing results may result in sharp declines. As a result, investors must be careful during this period, as unexpected market swings may lead to financial losses.

Until now, big tech...

24

6

Earnings season can be a roller coaster, with stock prices spiking up or down just before and after earnings announcements. It’s tempting to look at financial media to predict what will happen or make sense of things, but often, this only confuses us more. Cognitive biases like availability bias, confirmation bias, and overconfidence bias kick into high gear, leading us to make emotional investing decisions.

Take m...

Take m...

14

Enjoy $Tesla (TSLA.US)$?

This is the missing play in AI stocks!

Don't FOMO on $Palantir (PLTR.US)$ or $NVIDIA (NVDA.US)$

This is the missing play in AI stocks!

Don't FOMO on $Palantir (PLTR.US)$ or $NVIDIA (NVDA.US)$

8

4

1. Company that I’m paying attention would be $Banyan Tree (B58.SG)$ . Stock performance is slowly recovering with an upward trajectory. Travelling, tourism and hospitality has been on a positive note so far. It is one of the top watchlist to note.

2. One of the trading plan would be deploy cost averaging during the period of market downturn. Some stocks has reached a new 3-months low and their valuations are getting even more attractive.

3. Don’t oppose the opportunity when market presents itsel...

2. One of the trading plan would be deploy cost averaging during the period of market downturn. Some stocks has reached a new 3-months low and their valuations are getting even more attractive.

3. Don’t oppose the opportunity when market presents itsel...

7

1

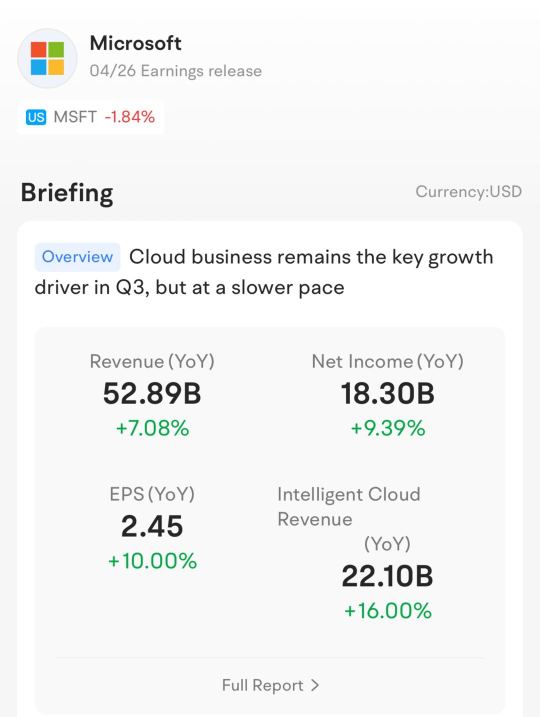

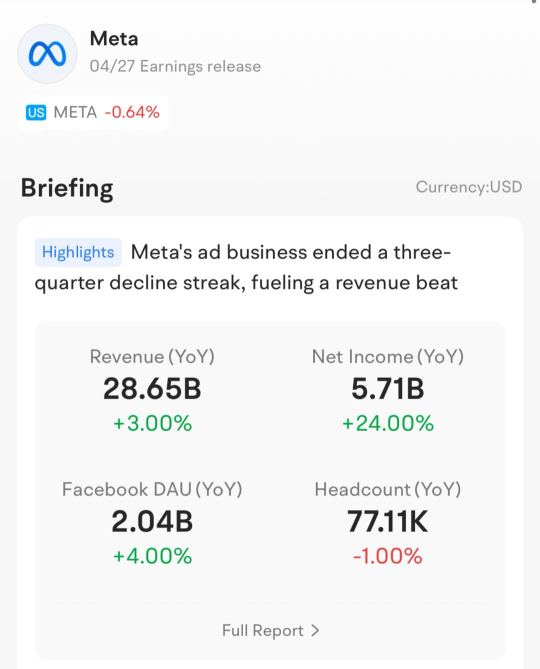

When watching earning season I like to pay attention to top market cap companies and leading businesses in their field. Watching how the gaints performed like Apple, Mircosoft, and Meta gives me a good indication on how smaller companies might perform. It is a good sign for me to see which direction the market is moving. One stock I constantly look at is Telsa, but this is mainly due to my interest in electric vehicles.

It is often said that volatility is the life blood of the mar...

It is often said that volatility is the life blood of the mar...

8

Will you delay trading because of the market volatility? Personally, I think not![]() , of course not! Earnings reports come out as the best time for us to get information about the company, and market volatility is part of the trade.

, of course not! Earnings reports come out as the best time for us to get information about the company, and market volatility is part of the trade.

If we miss good opportunities because of volatility, then we may miss the reaction of the company's stock price after the earnings announcement, limiting our chances of taking profits. After all, we invest to make long-term gains, and brief market fluctuations cannot s...

If we miss good opportunities because of volatility, then we may miss the reaction of the company's stock price after the earnings announcement, limiting our chances of taking profits. After all, we invest to make long-term gains, and brief market fluctuations cannot s...

8

Which company's earnings report do you pay the most attention to? And how's their stock performance?

US: Tesla, Microsoft, Meta, Google Apple etc

Singapore: DBS, SIA, OCBC, UOB etc

China & HK: Alibaba, Tencent, Baidu, BYD etc

I also monitor ETF like S&P500.

Do you have a specific trading plan for the earnings season? Will you stick to your plan?

I invest based on FA and take long position. I'm learning TA for options tr...

US: Tesla, Microsoft, Meta, Google Apple etc

Singapore: DBS, SIA, OCBC, UOB etc

China & HK: Alibaba, Tencent, Baidu, BYD etc

I also monitor ETF like S&P500.

Do you have a specific trading plan for the earnings season? Will you stick to your plan?

I invest based on FA and take long position. I'm learning TA for options tr...

6

productivity : @RJBoy @Wee Loon Ng @Rizzu @Don_Obet76 @Chomel @Echophi @Jemar Quiro love your posts![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) thanks for sharing your thoughts so generously

thanks for sharing your thoughts so generously![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)