Latest

Hot

At least nine members of Congress sold banking stocks before and during market turmoil last month, including a member of the House financial services committee who sold Silicon Valley Bank stock before it failed.

![]() New Jersey Democrat and financial services committee member Josh Gottheimer disclosed the sale of shares in Silicon Valley Bank (SVB) on March 9.

New Jersey Democrat and financial services committee member Josh Gottheimer disclosed the sale of shares in Silicon Valley Bank (SVB) on March 9.

![]() The sale, valued between $1,000 and $15,000, was made just before...

The sale, valued between $1,000 and $15,000, was made just before...

+1

16

15

Columns Q&A about FRC delisting

Why I can't buy FRC?

FRC recently changed its trading symbol to FRCB on May 3rd. If you're interested in buying or closing your positions for FRCB, you can do so now. However, it's important to note that opening new short positions is currently not supported. Also, be sure to choose Regular Trading Hours when placing your orders. One thing to keep in mind is that buy-to-open positions only support limited orders.

Why FRC was delisted?

First Republic Bank collapsed and was ...

FRC recently changed its trading symbol to FRCB on May 3rd. If you're interested in buying or closing your positions for FRCB, you can do so now. However, it's important to note that opening new short positions is currently not supported. Also, be sure to choose Regular Trading Hours when placing your orders. One thing to keep in mind is that buy-to-open positions only support limited orders.

Why FRC was delisted?

First Republic Bank collapsed and was ...

15

2

Reasons why I think $First Republic Bank (FRC.US)$ is a trap:

They postponed their initial earnings. It was supposed to be this week. Generally companies don't do this for good reasons.

While other regional banks have shown that their net deposit loss was rather small and that the bleeding has stopped, FRC is on the extreme end. They had to be rescued. This makes me think their net deposit loss is much greater but obviously the market has priced that in to some extent. Bu...

They postponed their initial earnings. It was supposed to be this week. Generally companies don't do this for good reasons.

While other regional banks have shown that their net deposit loss was rather small and that the bleeding has stopped, FRC is on the extreme end. They had to be rescued. This makes me think their net deposit loss is much greater but obviously the market has priced that in to some extent. Bu...

7

4

On Monday after the US stock market closed, First Republic Bank ( $First Republic Bank (FRC.US)$ ) released its first-quarter results. Due to a sharp decline in deposits overshadowing the bank's better-than-expected profits, the stock tumbled more than 22% in after-hours trading.

Highlights

![]() First-quarter 2023 revenues were $1.2 billion, which is down 13.4% year-...

First-quarter 2023 revenues were $1.2 billion, which is down 13.4% year-...

Highlights

12

2022 year end assets: $212B

2022 year end receivables: $158B

2022 year end cash position: $54B

(guess) 03-2023 cash position before crisis: $60B (approximate)

(Source somewhere present) 03-16-2023 bank run: $24B (source present somewhere)

(FRC) As of March 15, 2023, the Bank had a cash position of approximately $34 billion, not including the $30 billion of uninsured deposits from Bank of America, Citigroup, etc.

=> so, $60B(cash position before crisis, approximate) - $24B(with...

2022 year end receivables: $158B

2022 year end cash position: $54B

(guess) 03-2023 cash position before crisis: $60B (approximate)

(Source somewhere present) 03-16-2023 bank run: $24B (source present somewhere)

(FRC) As of March 15, 2023, the Bank had a cash position of approximately $34 billion, not including the $30 billion of uninsured deposits from Bank of America, Citigroup, etc.

=> so, $60B(cash position before crisis, approximate) - $24B(with...

7

1

This article provides comprehensive information on the timeline of $First Republic Bank (FRCB.US)$FRC's delisting and its impact, as well as how investors can proceed. Welcome to read it.![]()

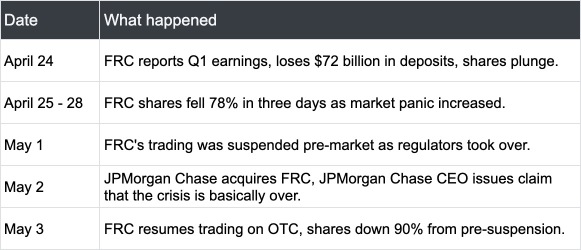

I. Event Review EST

II. Event Impacts

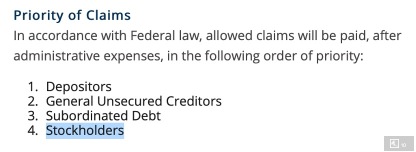

In just one week, FRC was sold to JPMorgan Chase $JPMorgan (JPM.US)$. JPMorgan Chase emerged as the big winner with an estimated one-time after-tax gain of about $2.6 bi...

I. Event Review EST

II. Event Impacts

In just one week, FRC was sold to JPMorgan Chase $JPMorgan (JPM.US)$. JPMorgan Chase emerged as the big winner with an estimated one-time after-tax gain of about $2.6 bi...

5

1

First Republic Bank’s shaky deposit footing and dismal earnings report won’t trigger the chain reaction that investors fear, Jim Cramer said on Tuesday.

“There’s one big difference between now and 2008: This time there is no systemic contagion,” Cramer said on Tuesday.

First Republic tumbled over 49% on Tuesday, reaching a new 52-week low. $First Republic Bank (FRC.US)$

“There’s one big difference between now and 2008: This time there is no systemic contagion,” Cramer said on Tuesday.

First Republic tumbled over 49% on Tuesday, reaching a new 52-week low. $First Republic Bank (FRC.US)$

3

seems that short sellers are still stronger than recovery and buys added, esp after hours further plunge. I bought more at that point, with firm believe the FED will not take over like SVB or Signature, and their management will have creative solutions worked out with likes of JPM. FED cannot be killing these regional banks with continued rate hikes.

1

1

A few more crisis please. Do we have a event calendar on moomoo!

Can’t wait for debt limit crisis![]()

Long time no see! How have you been CiCi![]()

Can’t wait for debt limit crisis

Long time no see! How have you been CiCi

1

1

Earlyretire : Jail! There's no much insider trading on the daily. It's disgusting

The Brown Knight : Id say under a certain limit of say… 10,000$ (total) it wouldn’t bother me. But if there are dumping more than that, then yes!

Expendabiggles : Whats going to be done about it?? Not a damn thing.

Biff : They're insiders on everything. They should not be allowed to own stocks

razo2 : do you know why our economic data is in a mess now? you can thank these people for it. utter chaos before the system collapse. for all you know they probably already switched to a safer asset laughing at bull and bears as they feed shit to your guys to eat daily on news and YouTube.

View more comments...