Latest

Hot

Alright, folks, let’s talk about the latest episode of "Succession: The Arnault Edition." Yes, you heard it right. Bernard Arnault, the man who practically owns your luxury dreams, has appointed his 29-year-old son, Frederic, as the head honcho of the family holding company controlling LVMH. Because, you know, when you're worth billions, what’s nepotism but a fancy French word?

Frederic, who is the fourth out of five of Arnault’s protégés, is s...

Frederic, who is the fourth out of five of Arnault’s protégés, is s...

1

The truth about price increases

1. Declining consumption growth and intensifying class differentiation

Compared with the relatively sluggish overall consumption, China's luxury goods market has been rising against the trend. Predominantly driven by changes in the wealth structure.

"M-Type Society: The Crisis and Business Opportunities of the Disappearing Middle Class" When the wealthy end of the M-type society continues to expand, the middle class ...

1. Declining consumption growth and intensifying class differentiation

Compared with the relatively sluggish overall consumption, China's luxury goods market has been rising against the trend. Predominantly driven by changes in the wealth structure.

"M-Type Society: The Crisis and Business Opportunities of the Disappearing Middle Class" When the wealthy end of the M-type society continues to expand, the middle class ...

+1

4

3

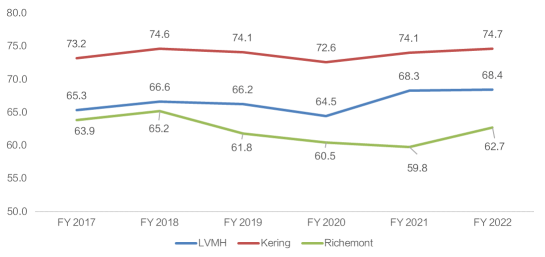

The market seems to partially agree thay LVMH should be trading at a discount compared to other pure-play operational luxury companies like Hermès.

The market is worried that excessive expenses will eat up the group's profits and reduce its profitability. However, the regular disadvantages of a holdings company are non-existent in LVMH. The group is extremely profitable, and the synergies it has between all its operations are more than offsetting any "unnecessary costs...

The market is worried that excessive expenses will eat up the group's profits and reduce its profitability. However, the regular disadvantages of a holdings company are non-existent in LVMH. The group is extremely profitable, and the synergies it has between all its operations are more than offsetting any "unnecessary costs...

3

Columns LVMH still has investment value!

1.The brands are the embodiment of prestige and class.

2.The company's pricing power is almost unparalleled, as its customers are high-net-worth men and women

3.LVMH is one of the least sensitive companies to macroeconomics, thanks to Multi-business and multi-regional business ecology.

Wines & Spirits at a glance:

Fashion & Leather Goods at a glance...

+8

5

3

2

People who can afford luxury goods are usually less affected by recession and keep buying stuff anyway??

$LVMH Moet Hennessy Louis Vuitton (LVMHF.US)$ $KERING UNSPON ADR EA REPR 0.1 ORD EUR0.00 (PPRUY.US)$ $COMPAGNIE FINANCIERE RICHEMONT SA. (CFRHF.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

$LVMH Moet Hennessy Louis Vuitton (LVMHF.US)$ $KERING UNSPON ADR EA REPR 0.1 ORD EUR0.00 (PPRUY.US)$ $COMPAGNIE FINANCIERE RICHEMONT SA. (CFRHF.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

LVMH, the world's largest luxury firm, saw a 4.5% rise in stock prices to €874.40 in early European trade on Thursday after reporting a surge in Q1 sales, particularly in China, where growth of 14% drove the increase. LVMH's shares are up almost 30% so far this year, with market capitalization reaching €438bn, over twice the level seen three years ago. The French company owns several luxury brands, including Louis Vuitton, Dior, Tiffany, and Hennessy cognac...

1

LVMH $Moelis & Co (MC.US)$ released its Q1 earnings report last night, beating expectations across the board.

Revenue up 17% yoy![]()

![]()

![]()

Selective Retailing showed the strongest growth in % 📈

$LVMH Moet Hennessy Louis Vuitton (LVMHF.US)$ $KERING UNSPON ADR EA REPR 0.1 ORD EUR0.00 (PPRUY.US)$ $COMPAGNIE FINANCIERE RICHEMONT SA. (CFRHF.US)$

Revenue up 17% yoy

Selective Retailing showed the strongest growth in % 📈

$LVMH Moet Hennessy Louis Vuitton (LVMHF.US)$ $KERING UNSPON ADR EA REPR 0.1 ORD EUR0.00 (PPRUY.US)$ $COMPAGNIE FINANCIERE RICHEMONT SA. (CFRHF.US)$

zoharrr : wow~~

zoharrr :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

开门见山 : Are these all US stocks?