Latest

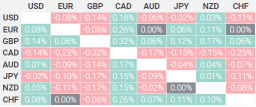

Hot

Today’s payroll report was mixed, with strong and weak signs for the economy alike. Overall though, this is another net-strong report that shows that rate cuts are increasingly unlikely in 2024

As expected

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Invesco QQQ Trust (QQQ.US)$ $INVESCO ESG NASDAQ 100 ETF (QQMG.US)$ $Meta Platforms (META.US)$ $Alpha Metaverse Technologies Inc (ALPA.CA)$ $Tesla (TSLA.US)$ $Broadcom (AVGO.US)$ $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Amazon (AMZN.US)$ $Salesforce (CRM.US)$ $Taiwan Semiconductor (TSM.US)$ $Super Micro Computer (SMCI.US)$

As expected

$Vanguard S&P 500 ETF (VOO.US)$ $SPDR S&P 500 ETF (SPY.US)$ $iShares Core S&P 500 ETF (IVV.US)$ $Invesco QQQ Trust (QQQ.US)$ $INVESCO ESG NASDAQ 100 ETF (QQMG.US)$ $Meta Platforms (META.US)$ $Alpha Metaverse Technologies Inc (ALPA.CA)$ $Tesla (TSLA.US)$ $Broadcom (AVGO.US)$ $NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$ $Amazon (AMZN.US)$ $Salesforce (CRM.US)$ $Taiwan Semiconductor (TSM.US)$ $Super Micro Computer (SMCI.US)$

3

4

Jerome Powell, Chairman of the Federal Reserve System (Fed), said that they are prepared to raise rates further if appropriate in his opening remarks at the annual Jackson Hole Economic Symposium.

Key takeaways from Jerome Powell's speech at the Jackson Hole Symposium

![]() "We intend to hold rates at restrictive level until confident inflation is moving sustainably down to 2%."

"We intend to hold rates at restrictive level until confident inflation is moving sustainably down to 2%."

![]() "Fed will proceed carefully when deciding t...

"Fed will proceed carefully when deciding t...

Key takeaways from Jerome Powell's speech at the Jackson Hole Symposium

4

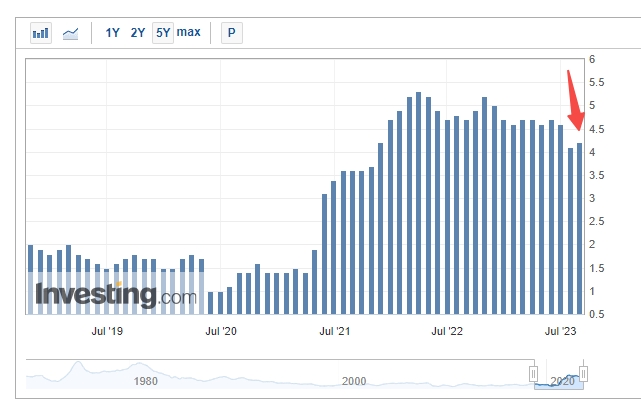

U.S. job openings dropped to their lowest level in more than two years in July, but remain relatively elevated, potentially prompting Federal Reserve officials to keep interest rates higher for longer to help loosen a tight labor market.

Highlighting the resilient market conditions, layoffs were little changed at 1.6 million during the month, suggesting that employers are continuing to hold on to workers following troubles finding labor...

Highlighting the resilient market conditions, layoffs were little changed at 1.6 million during the month, suggesting that employers are continuing to hold on to workers following troubles finding labor...

2

This week, look out for the Personal Consumption Expenditure report coming out Thursday, and the August jobs report releasing Friday. Those two pieces of data will give a sign of whether the Fed will indeed continue raising rates, as Powell cautioned at Jackson Hole, or if inflation and the jobs market are cooling down enough for the central bank to keep rates unchanged. $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

1

Silverbat : No matter what, FED will surprise with a rate cut this year to stimulate the economy

Brianjh OP Silverbat : I certainly do hope so

razo2 Brianjh OP : not when inflation is still above the 2% target. they can cut rates, but oil will fly back to the sky just like 2008. 2008 you have steady oil supply. 2024 you do not have that privilege.

Brianjh OP razo2 : yes. completely agree